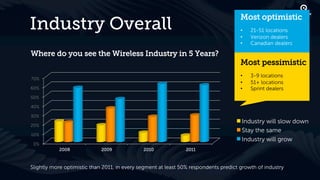

The document summarizes the findings of the 2011 State of Wireless Industry Survey, which received 158 responses. Key highlights include:

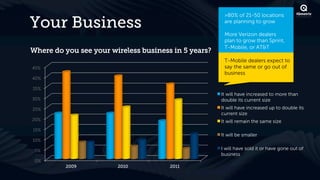

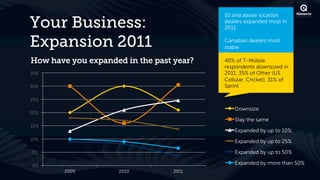

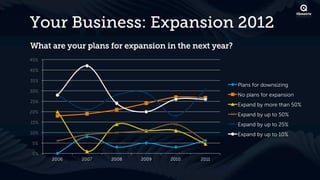

- Respondents were optimistic about industry growth but less optimistic about their own businesses. Expansion plans have decreased.

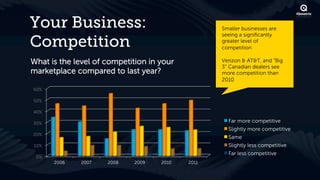

- Carriers remain the biggest competition. The pending AT&T acquisition of T-Mobile is seen as an increasing threat.

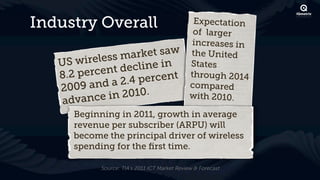

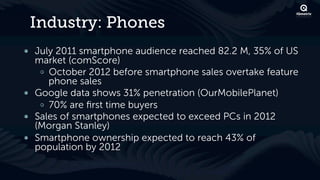

- Optimism is driven by growth in diverse devices and increased data usage on new applications.

- Over half of respondents expect their wireless businesses to grow in the next 5 years, with larger dealers and Verizon dealers being most optimistic.