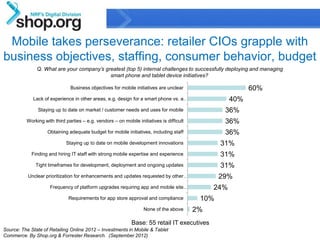

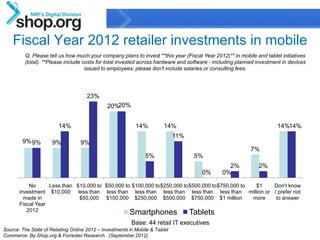

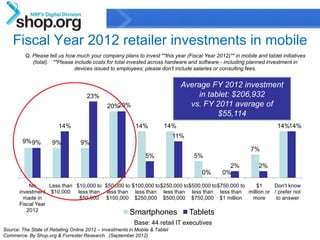

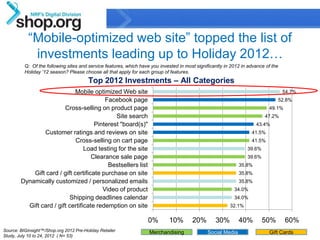

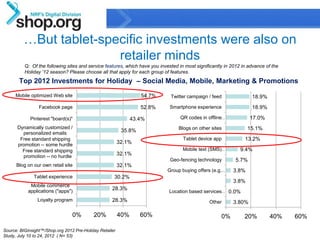

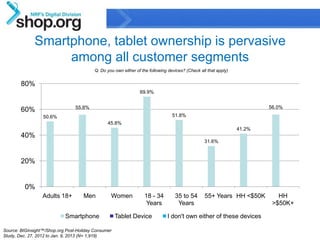

This document discusses retailers' tablet investments and challenges in 2012. It finds that the average planned investment in tablets for fiscal year 2012 was $206,932, up from $55,114 in 2011. The top internal challenges for mobile initiatives were unclear business objectives and lack of mobile experience. A mobile-optimized website was the most common investment made by retailers in 2012 in preparation for the holiday season.

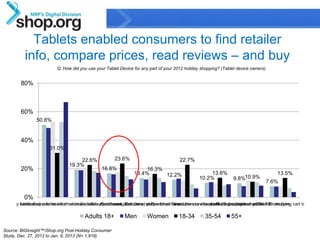

![Millennials led in tapping tablets for coupons, using /

buying gift cards, watching product videos

Q: How did you use your Tablet Device for any part of your 2012 holiday shopping? (Tablet device owners) (cont.) [For additional

answers, please see Appendix Slide 70.]

80%

60%

40%

20% 17.6%

14.9%

10.5% 8.3% 8.6%

6.7% 6.3% 5.6% 5.2% 7.2%

4.5% 3.7% 5.0% 3.5%

0%

Searched for Redeemed Redeemed a gift Looked up a gift Bought a gift card Used apps to Watched a

coupons or coupons card registry or wish list research or product video

discounts purchase products

specifically when I

was in the store

Adults 18+ Men Women 18-34 35-54 55+

Source: BIGinsight™/Shop.org Post-Holiday Consumer

16

Study, Dec. 27, 2012 to Jan. 9, 2013 (N= 1,919) Confidential & Proprietary](https://image.slidesharecdn.com/businsiderfeb2013-fswerdlowtablets-130206082555-phpapp01/85/Business-Insider-Social-Commerce-Summit-Fiona-Swerdlow-16-320.jpg)