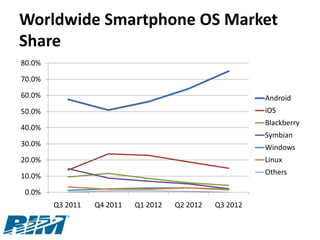

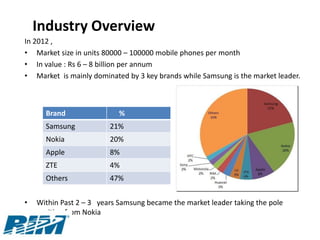

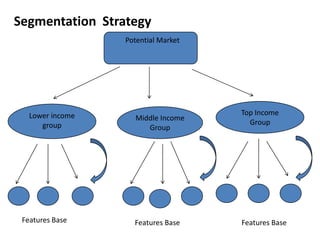

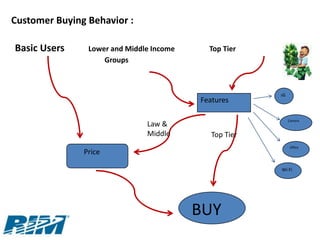

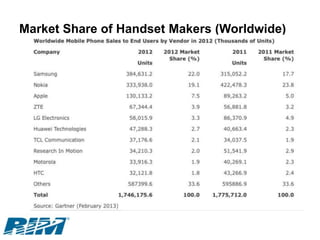

The mobile phone industry is a $1.18 trillion global industry dominated by smartphones, with the smartphone market expected to grow 46.4% annually and Android accounting for 75% of smartphones sold; the mobile phone market in India is led by Samsung and is worth $6-8 billion annually, with lower income groups making up 70% of sales.