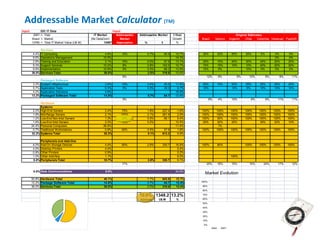

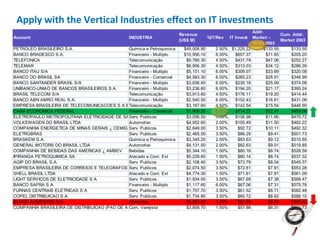

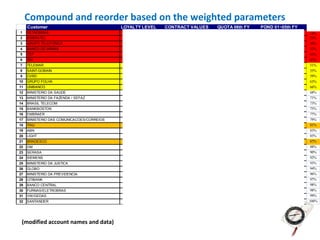

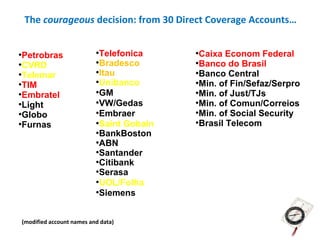

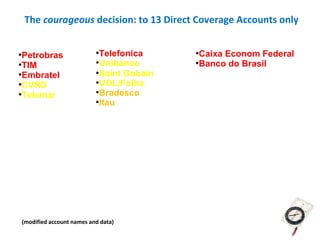

Here are the top 3 accounts based on the weighted parameters:

1. PETROBRAS - Highest loyalty level and largest contract values and historical spending. Clear top priority account.

2. EMBRATEL - Second highest loyalty level and above average contract values and historical spending. A core priority account.

3. GRUPO TELEFONICA - Second highest contract values and spending but lower loyalty level than top two. Still a priority account but perhaps slightly lower focus than the top two.