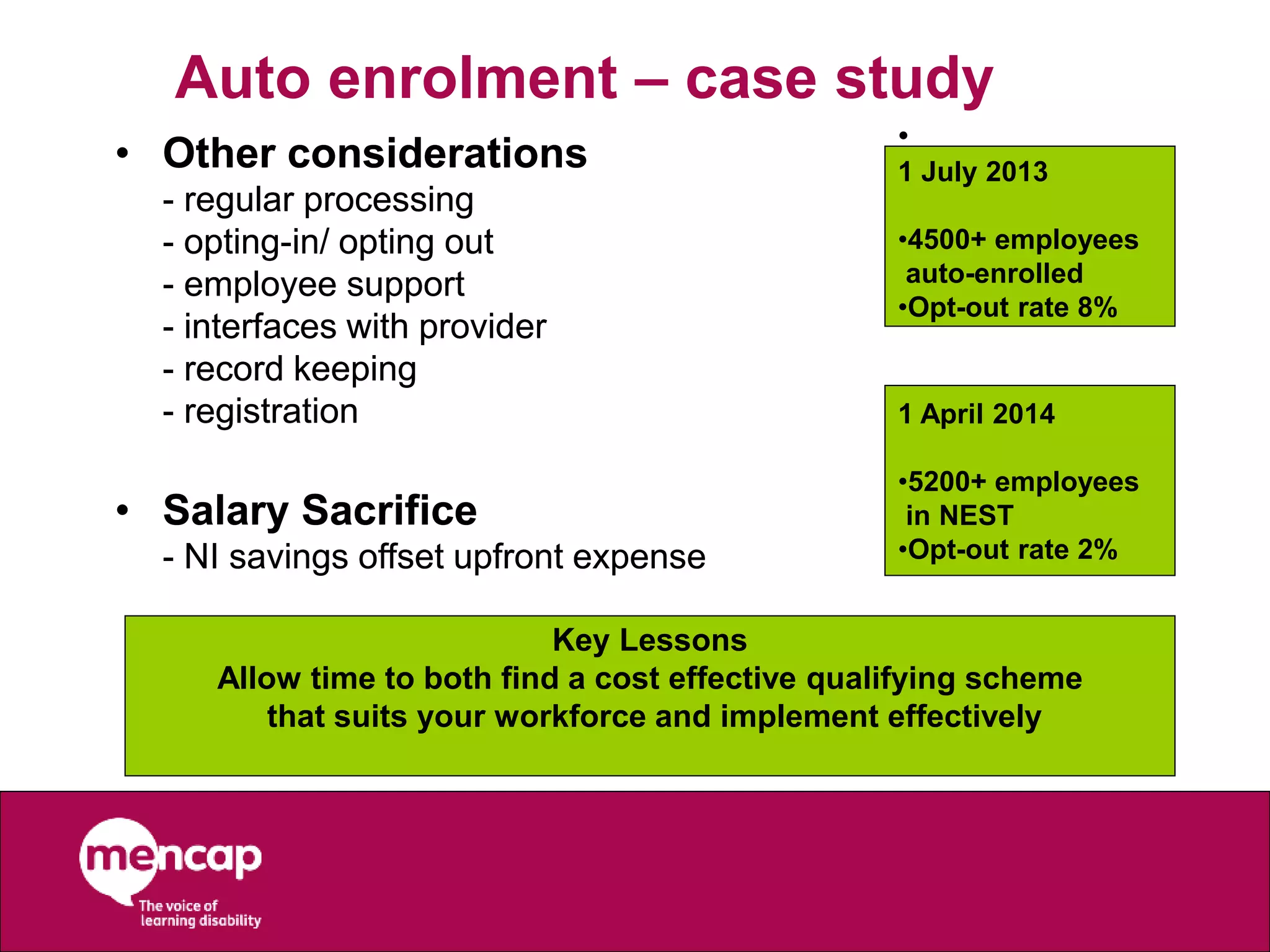

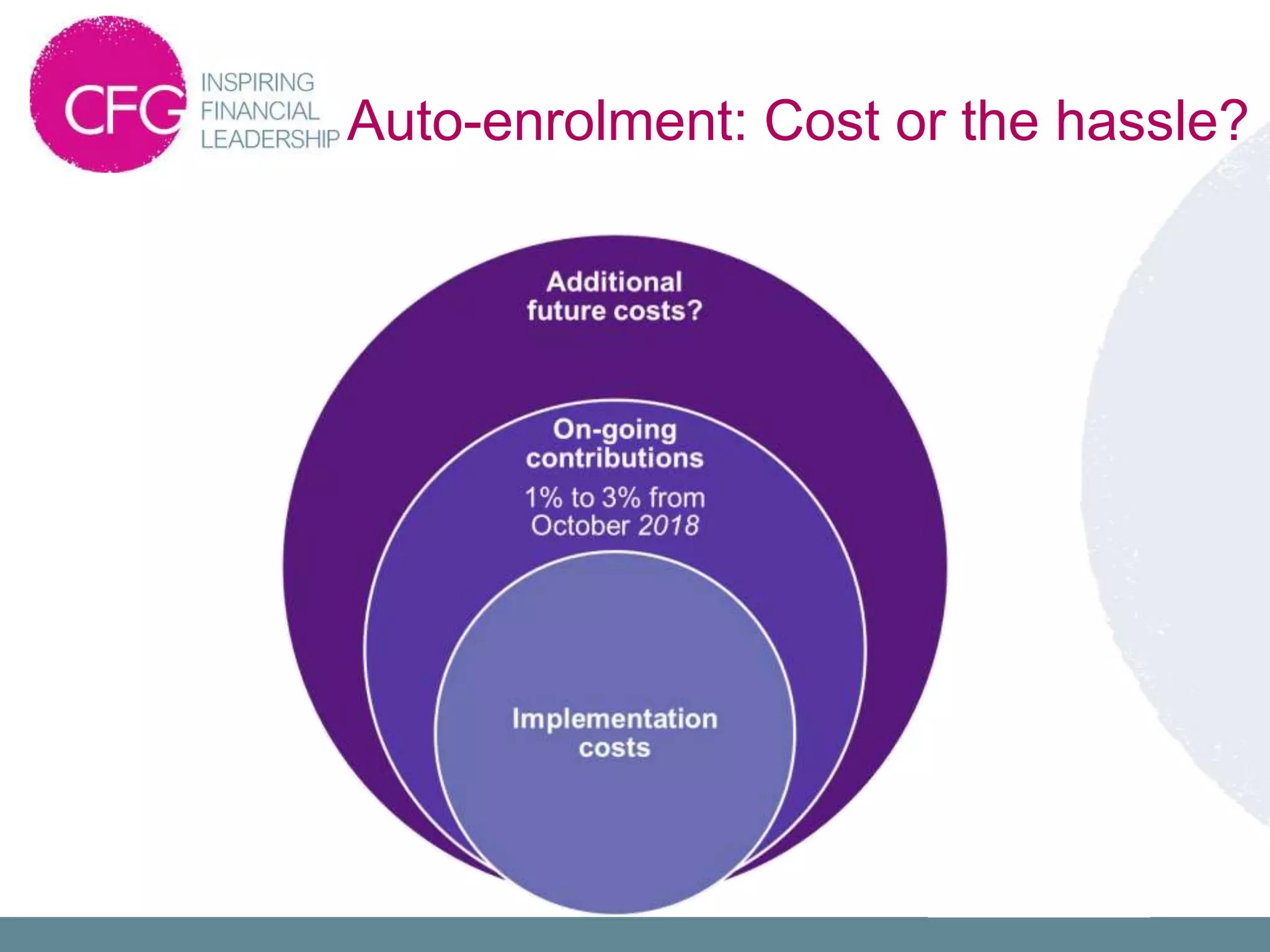

The document discusses auto-enrollment in pension plans in the UK. It summarizes the experiences and lessons learned by Mencap, a charity that supports people with learning disabilities, in implementing auto-enrollment for its over 10,000 employees. Key lessons included allowing sufficient time to choose a qualifying pension scheme and implement enrollment effectively, and keeping opt-out rates low through early planning and clear communication. The document also briefly discusses potential future changes to auto-enrollment in the UK such as increasing employer contribution rates over time and guidance for individuals after auto-enrollment ends.