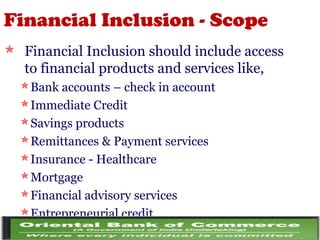

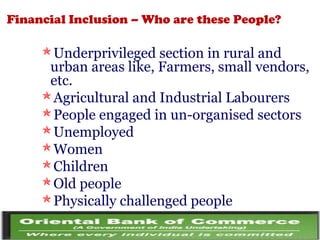

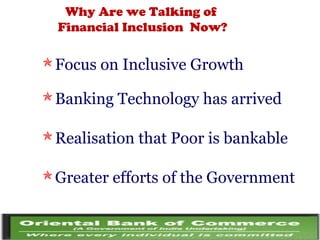

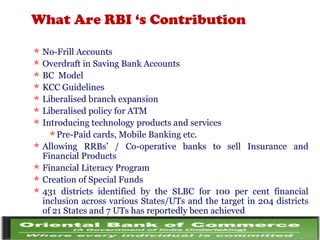

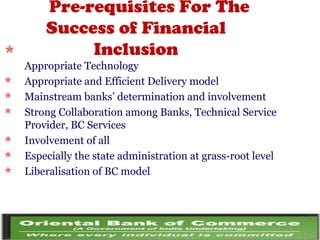

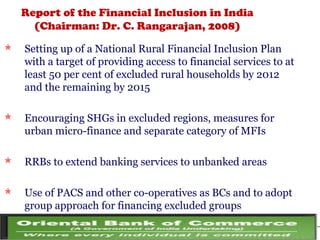

Financial inclusion aims to ensure access to affordable financial services for vulnerable groups like low-income individuals. It involves access to products like bank accounts, credit, insurance, remittances, and financial advice. The document outlines steps taken in India to promote financial inclusion, such as cooperative banking, nationalizing banks, and microfinance institutions. However, lack of technology, literacy, and appropriate business models have hindered progress. Recent efforts by the government and RBI, including no-frills accounts, business correspondent models, and financial literacy programs, aim to leverage technology and collaboration to make the poor bankable and further the goal of inclusive growth.