- Automatic enrolment into workplace pensions will become mandatory for employers starting from October 2012, with requirements being phased in over 4 years.

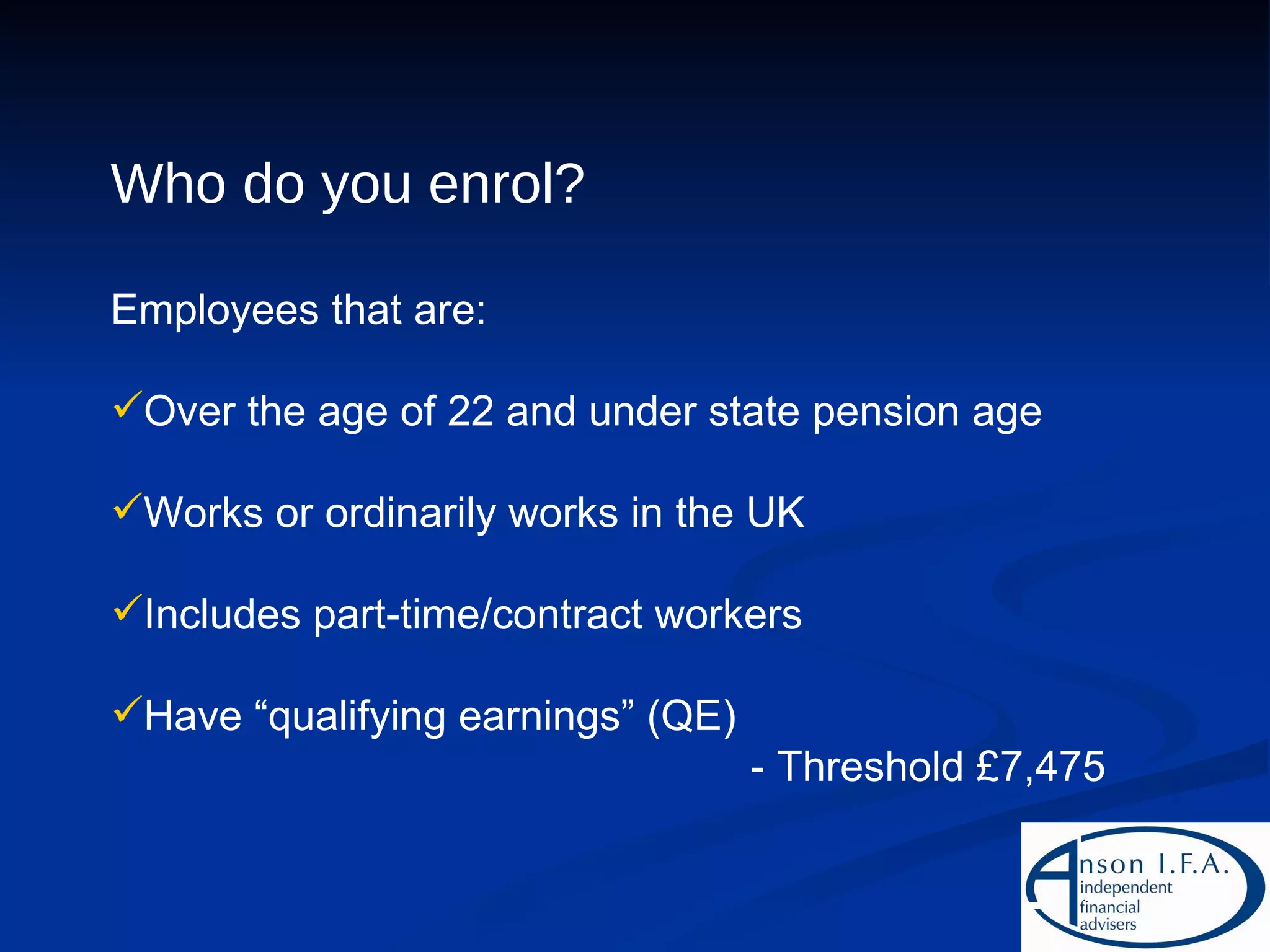

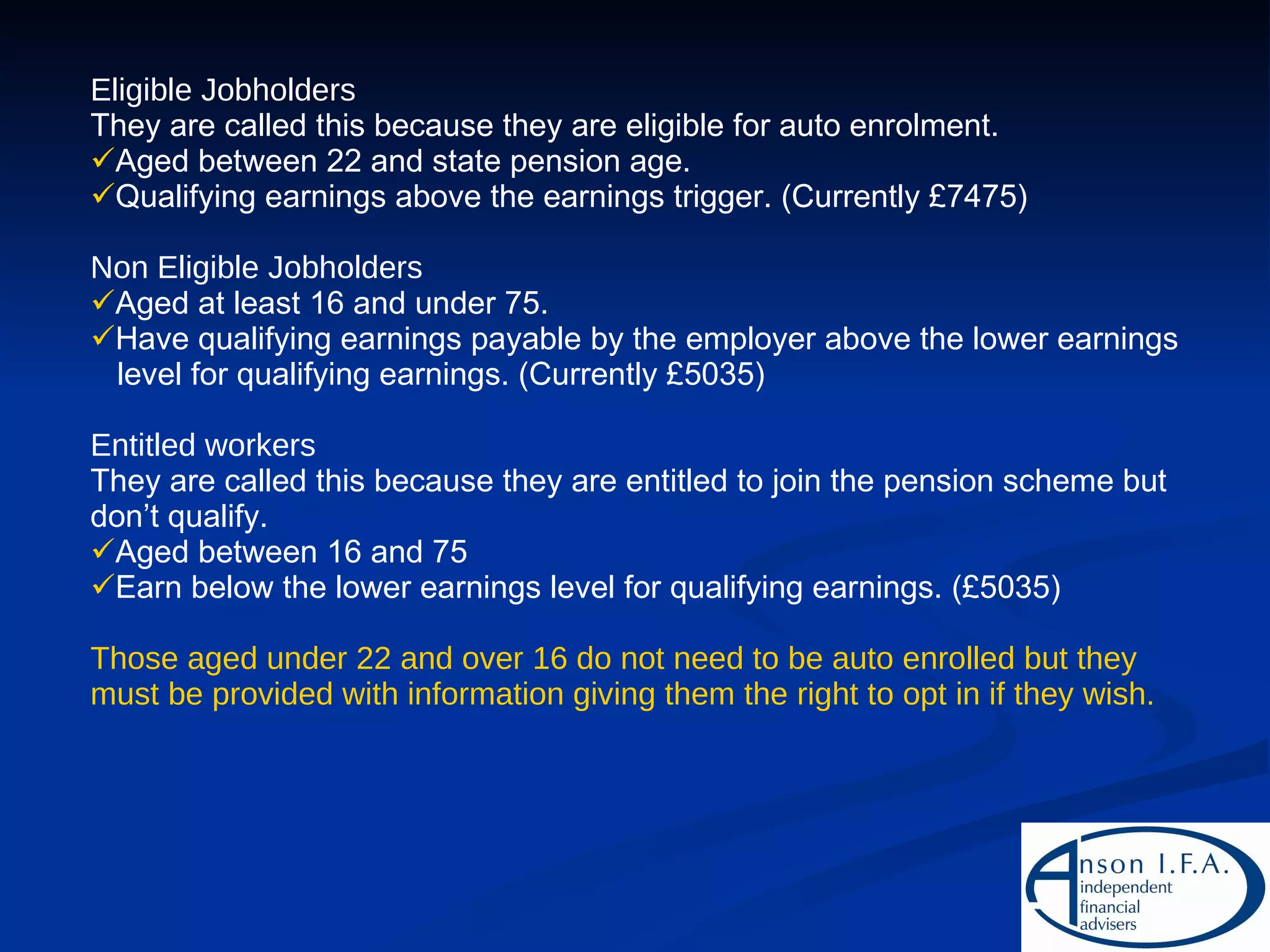

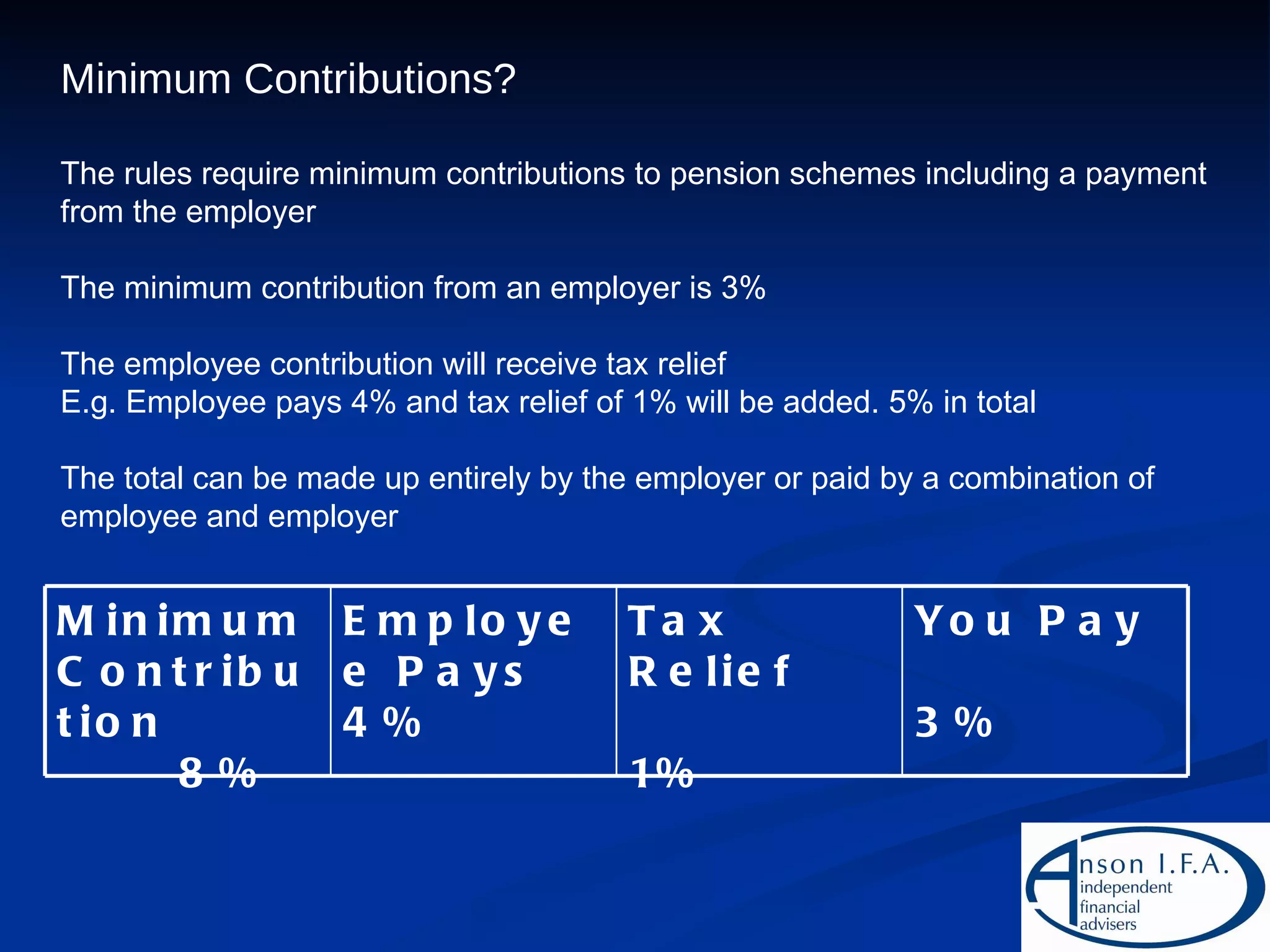

- Eligible employees who must be enrolled are aged between 22 and state pension age, earning above £7,475 annually. Employers must pay a minimum 3% contribution on qualifying earnings between £5,035 - £33,540.

- Employers can use the National Employment Savings Trust (NEST) pension scheme or their existing occupational schemes to meet these requirements. Non-compliance will result in fines for employers.

![Thank you Further information is available on request Contact: Julie Roche Cert PFS, Cert CII(MP) [email_address] Suite 26, Century Building Tower Street Brunswick Business Park Liverpool L3 4BJ 0151 707 8848](https://image.slidesharecdn.com/automaticenrolment-13088347592419-phpapp01-110623083109-phpapp01/75/Automatic-Enrolment-21-2048.jpg)