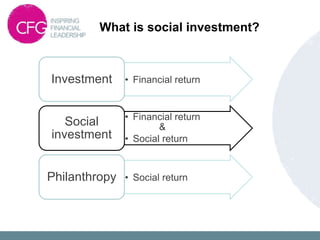

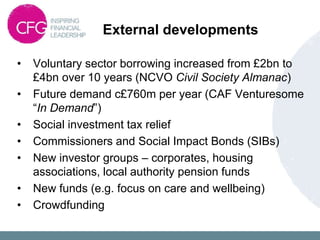

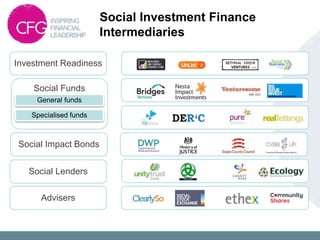

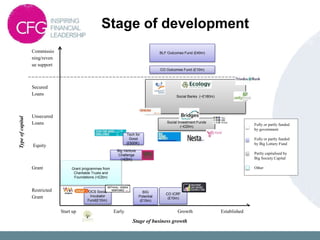

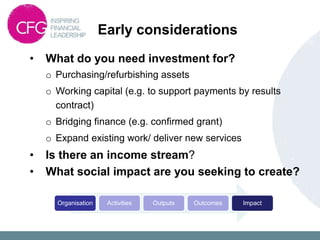

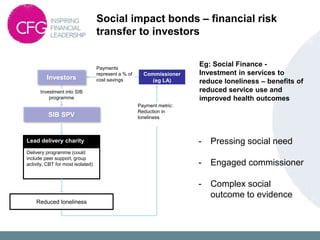

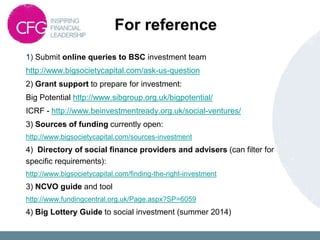

This document discusses social investment, which provides both financial return and social return. It outlines external developments growing social investment, including increased borrowing by the voluntary sector. It describes Big Society Capital's vision to improve access to finance for charities and build participation in social investment. BSC plays a role as a wholesaler and market champion. The document then provides guidance for organizations on engaging with social investors, including things to consider around investment needs, impact, and opportunities social investment provides beyond financing. It also briefly outlines social impact bonds and gives an example.