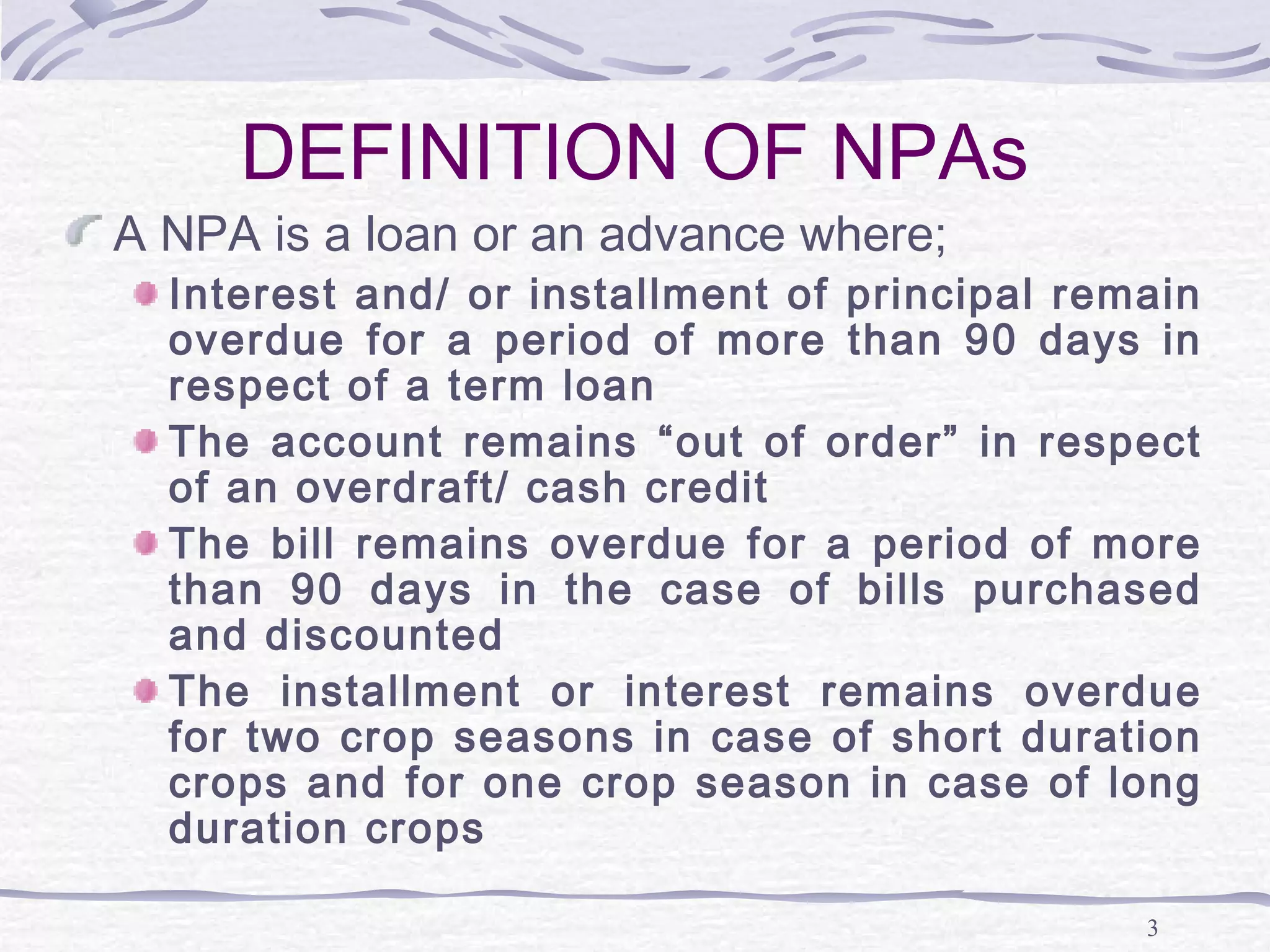

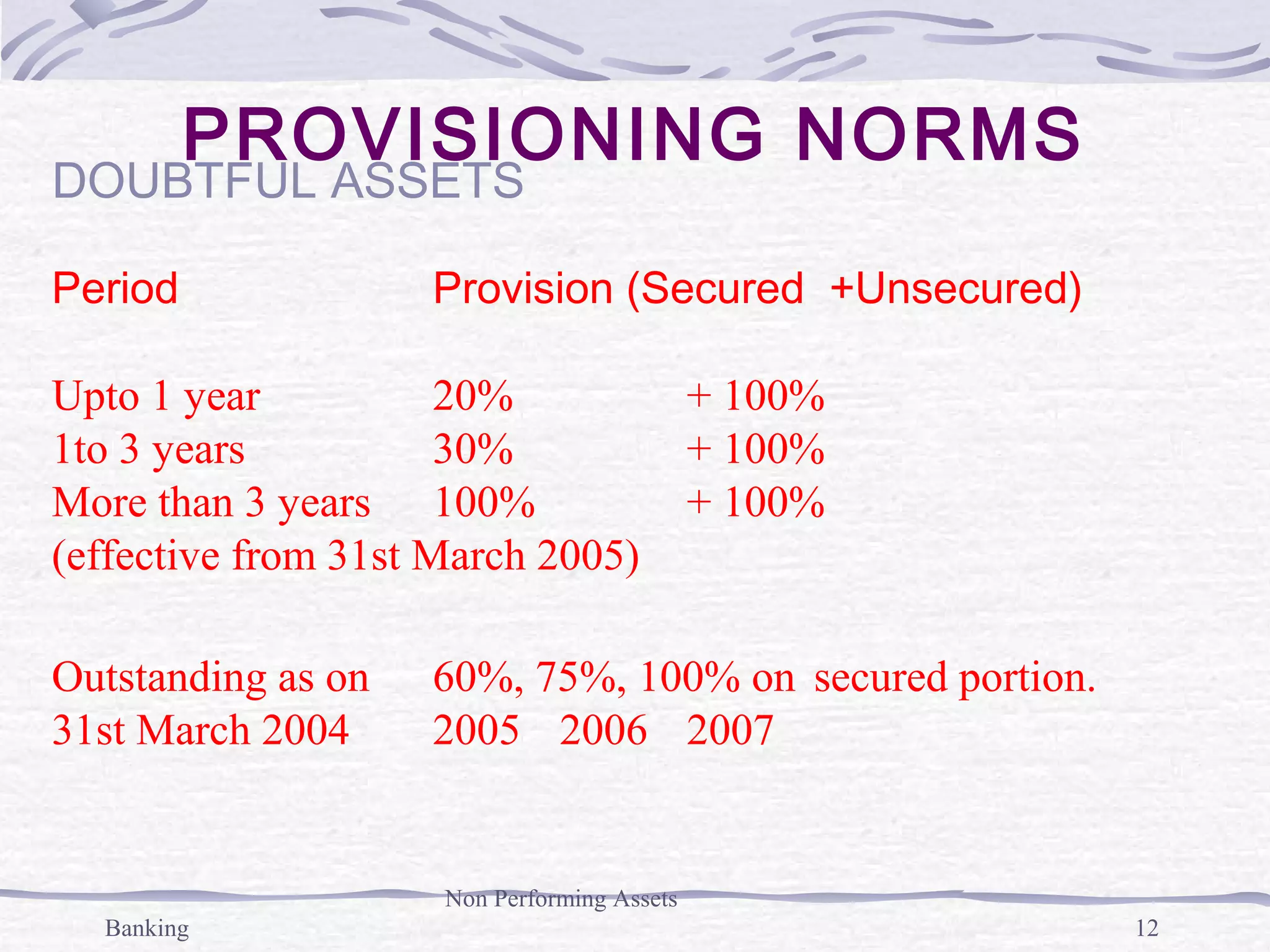

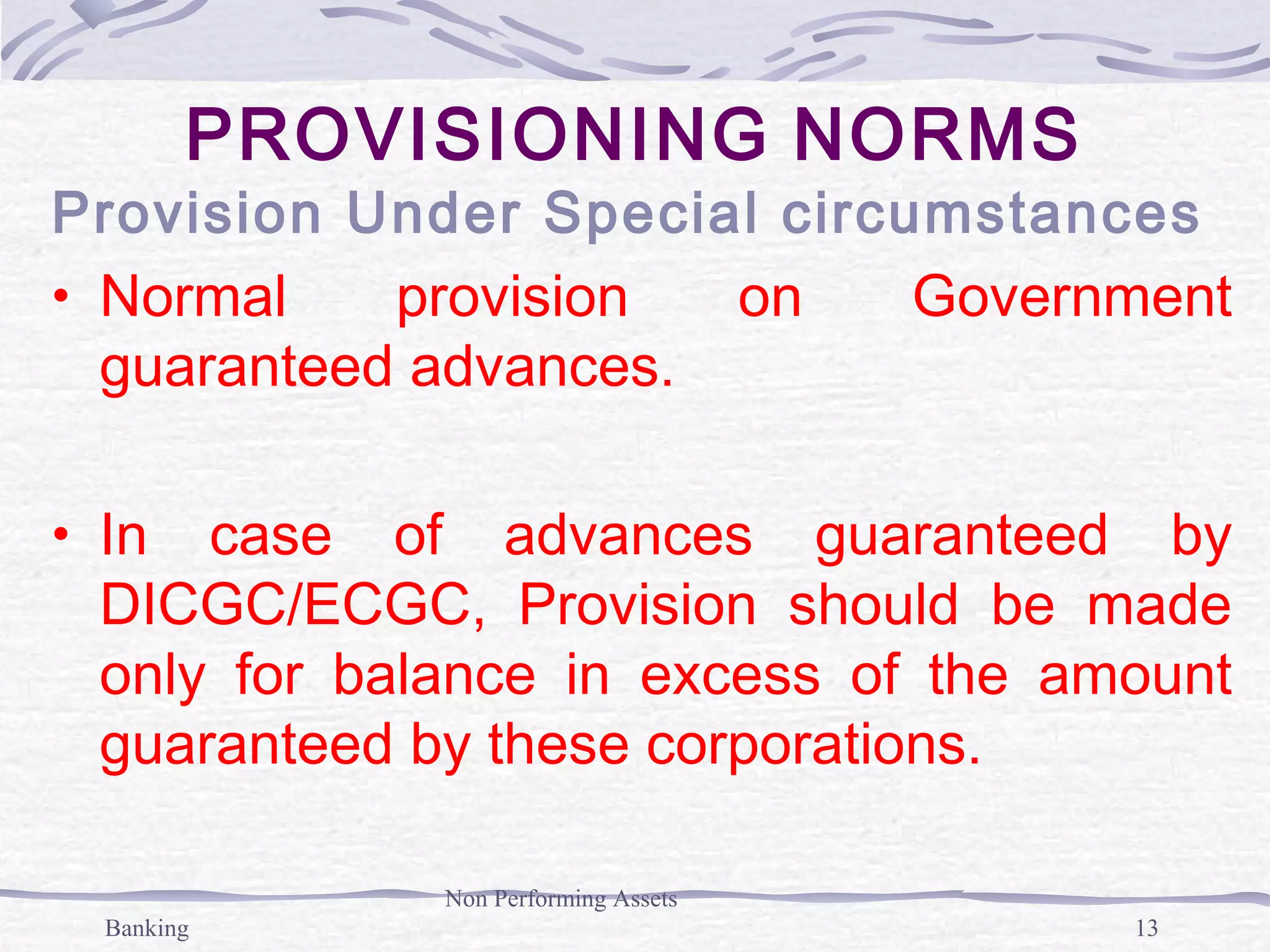

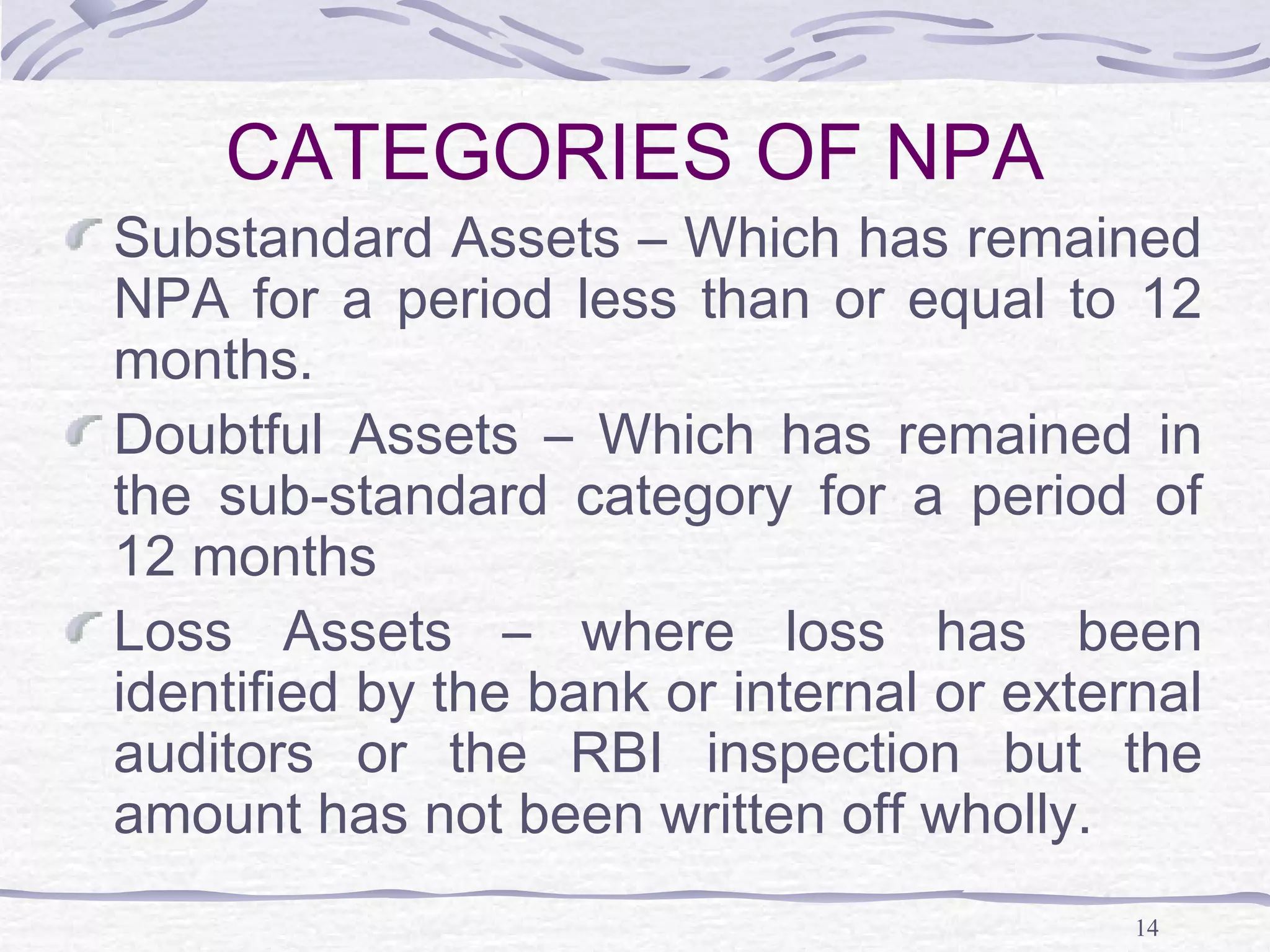

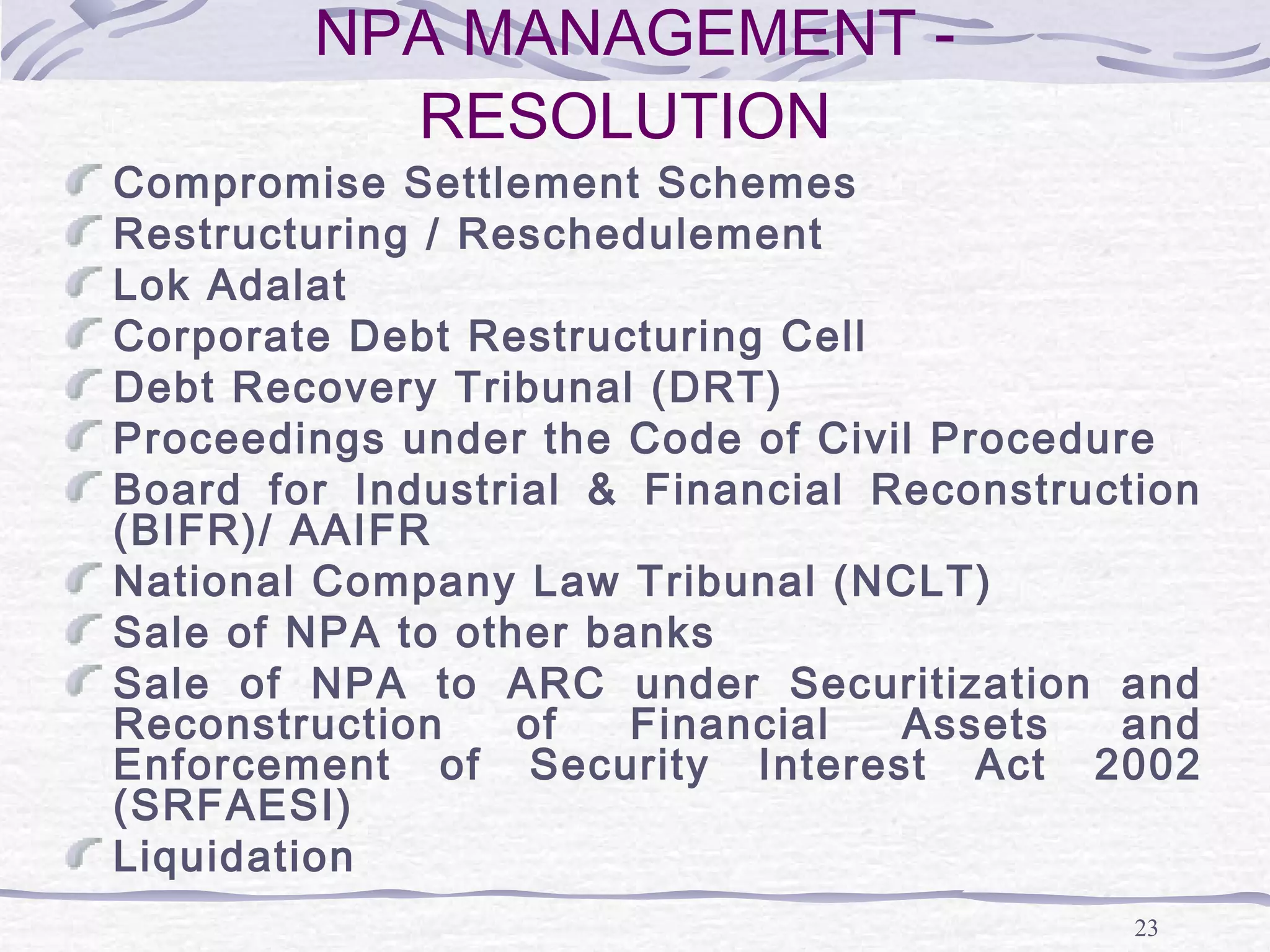

This document discusses the management of non-performing assets (NPAs) in banks. It defines NPAs as loans or advances where interest or principal payments are overdue by 90 days or more. It outlines the classification of assets as standard, sub-standard, doubtful or loss based on delinquency period. The document also discusses provisioning norms required against different asset classifications and factors contributing to rising NPAs. It examines the impact of NPAs on bank operations and various methods used for prevention and resolution of NPAs.