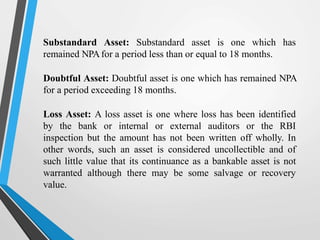

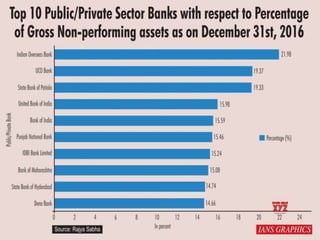

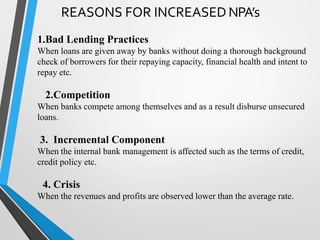

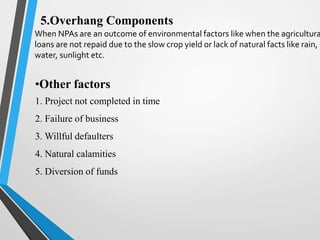

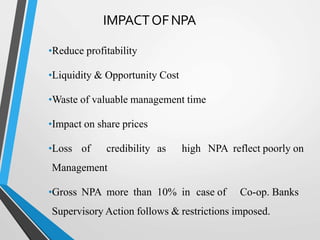

A non-performing asset (NPA) refers to a loan or advance that is in default or in which scheduled payments have not been made for over 90 days. NPAs are classified as substandard, doubtful, or loss assets depending on how long they have been non-performing. Rising NPAs are a major threat to the banking sector and are caused by factors like bad lending practices, competition, internal management issues, economic crises, and external environmental conditions. High NPAs reduce bank profitability and liquidity. Tools used to recover NPAs include lok adalats, debt recovery tribunals, the SARFAESI Act of 2002, compromise settlements, and credit information bureaus. The Indian government