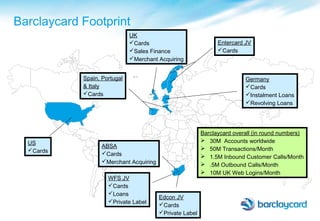

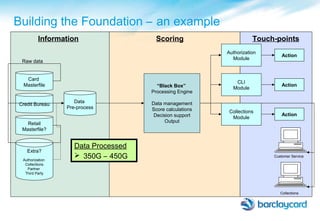

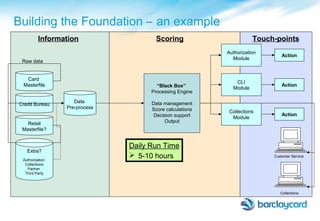

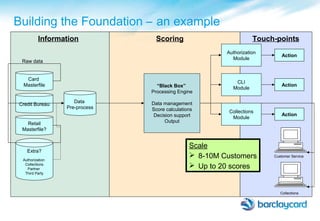

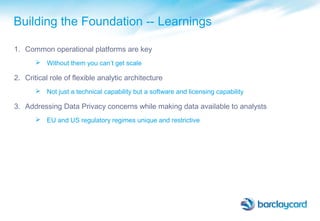

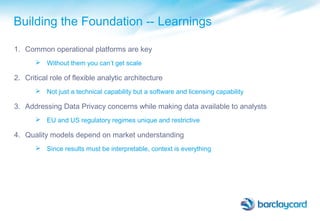

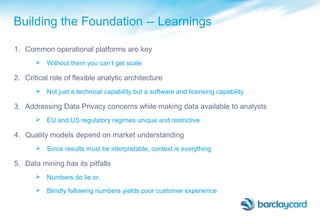

The document discusses the evolution and significance of big data in credit card management, highlighting Barclaycard's multi-pronged approach over the last 5 years to utilize data-driven tools for better customer interactions. It emphasizes the need for a seamless customer experience and adaptability in the face of changing market dynamics and regulatory pressures. Ultimately, it envisions Barclaycard as a 'go-to' bank through enhanced products and services tailored to customers' needs.