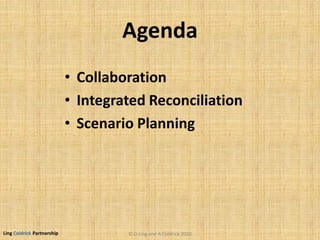

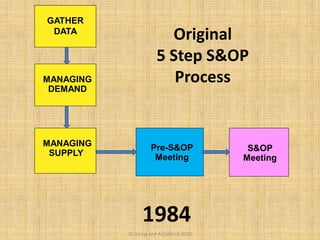

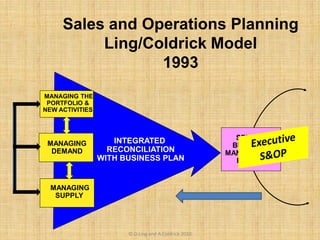

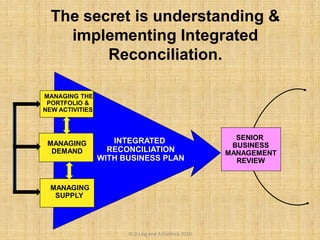

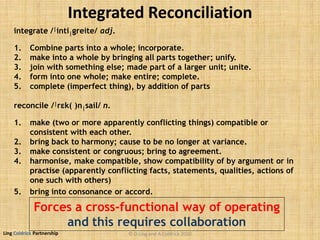

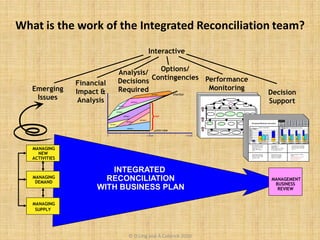

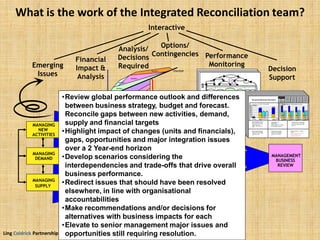

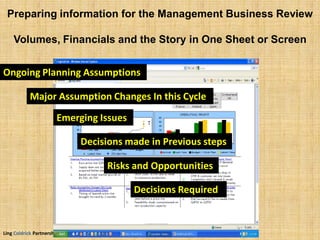

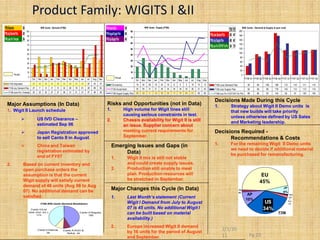

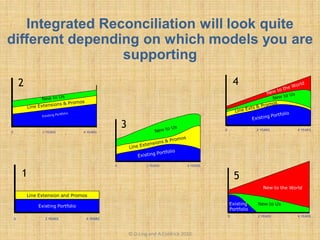

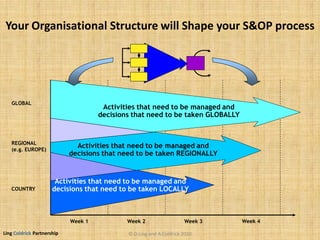

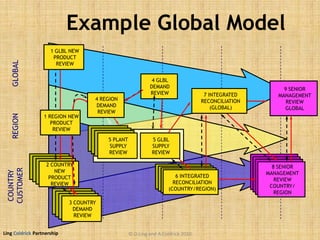

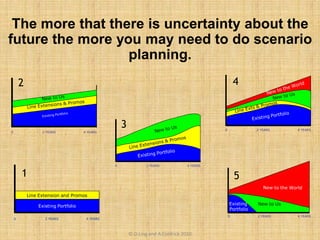

The document discusses improving the sales and operations planning (S&OP) process through collaboration. It provides context on the history of S&OP, emphasizing early focus on leadership and aggregate management rather than collaboration. More recently, the authors have come to see collaboration as important. An effective S&OP requires integrating demand and supply reconciliations in a collaborative, cross-functional way.