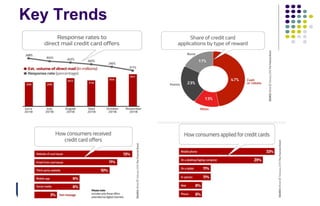

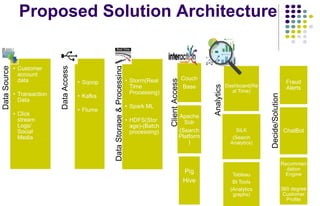

The document outlines key challenges and trends in the banking industry's credit card sector, emphasizing the importance of big data analytics for customer engagement and retention. It proposes solutions such as personalized offerings, intelligent chatbots, and fraud detection to enhance customer satisfaction and streamline marketing strategies. The document concludes that leveraging big data can improve decision-making, reduce costs, and increase revenue in banking operations.