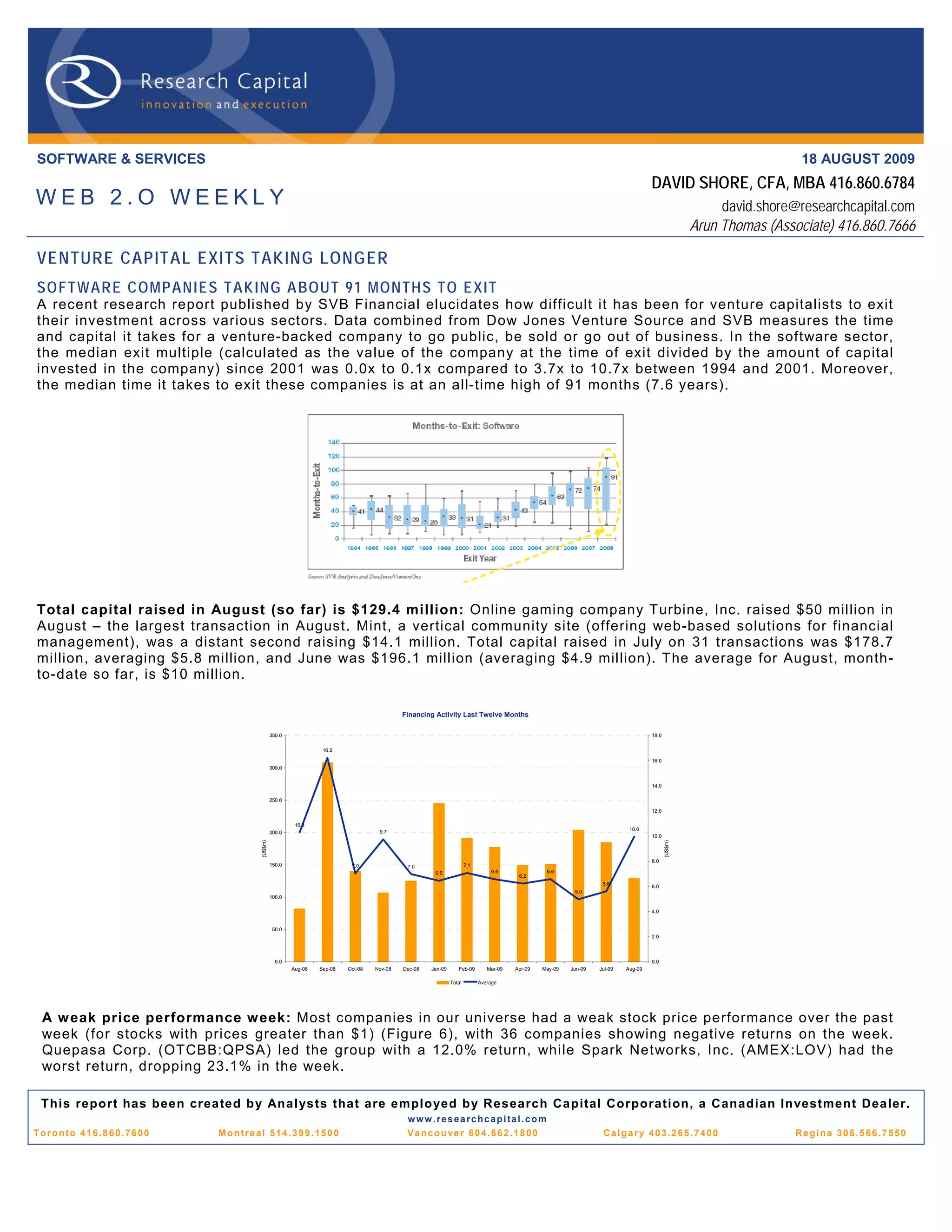

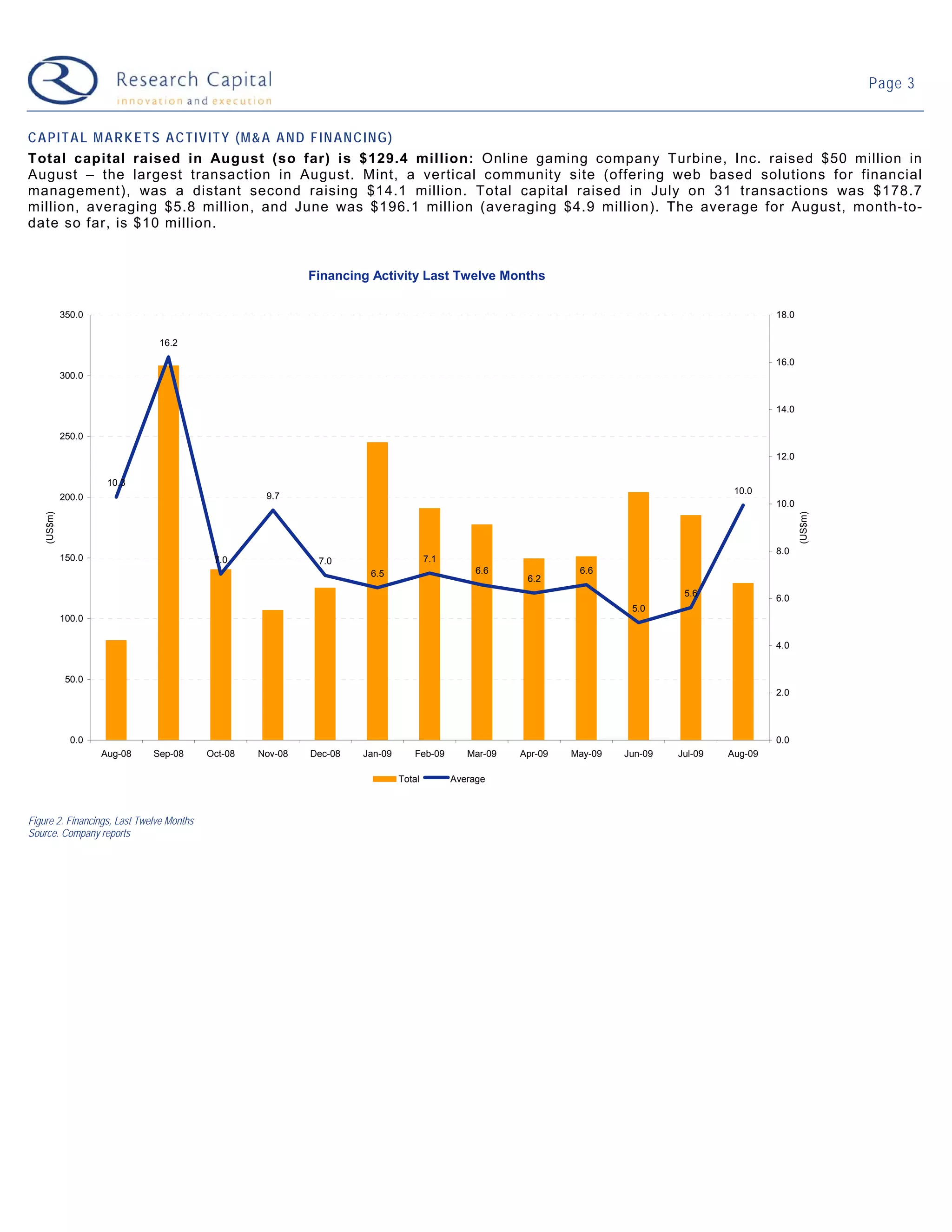

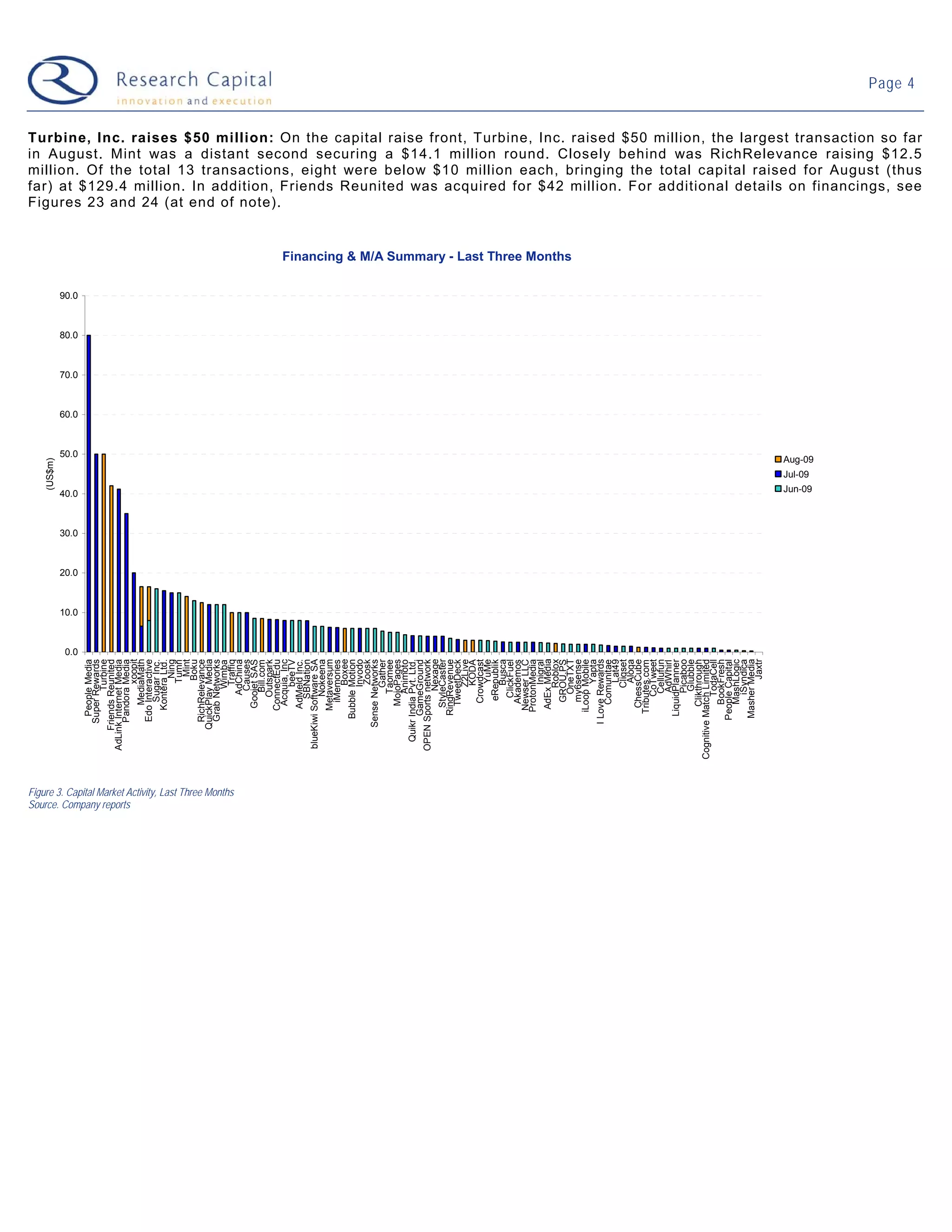

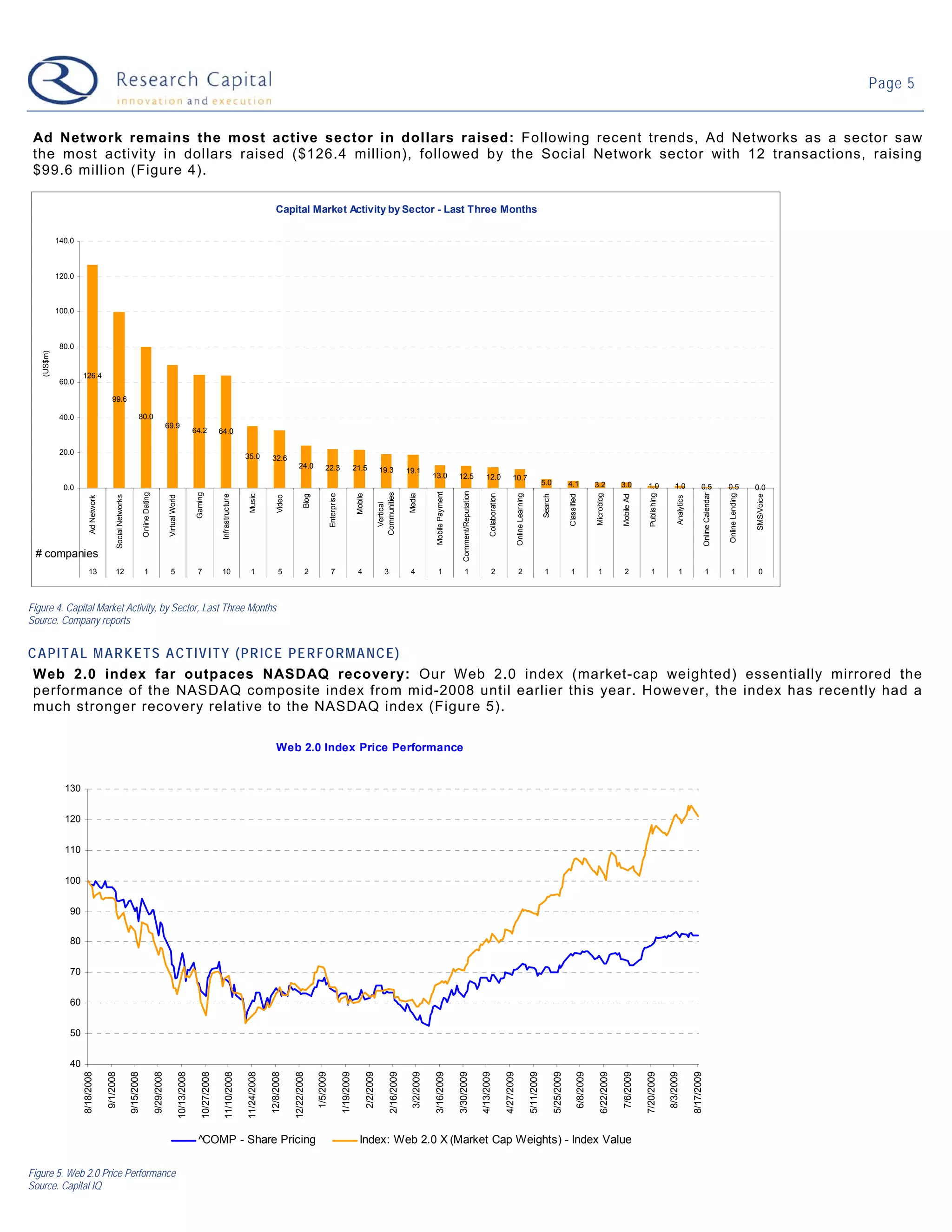

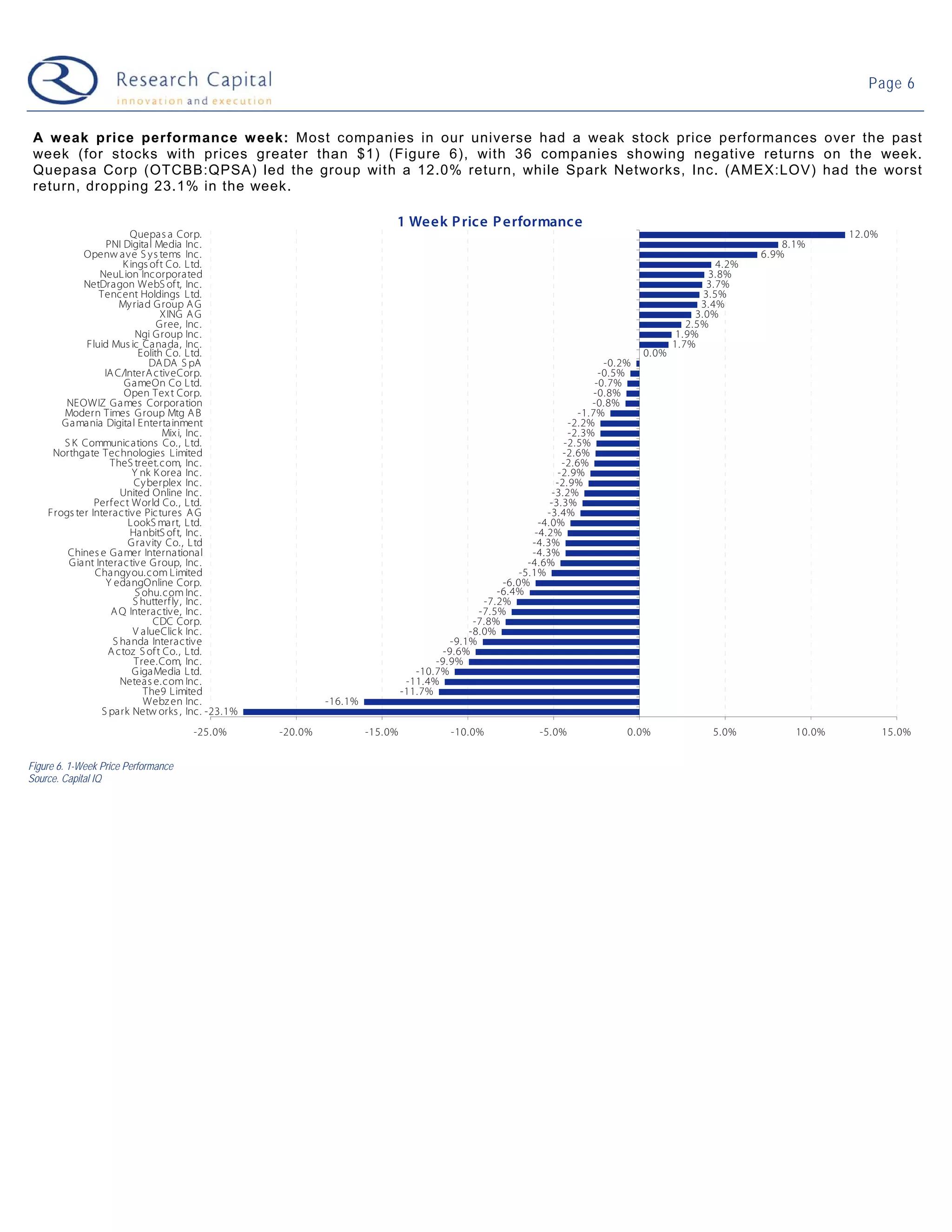

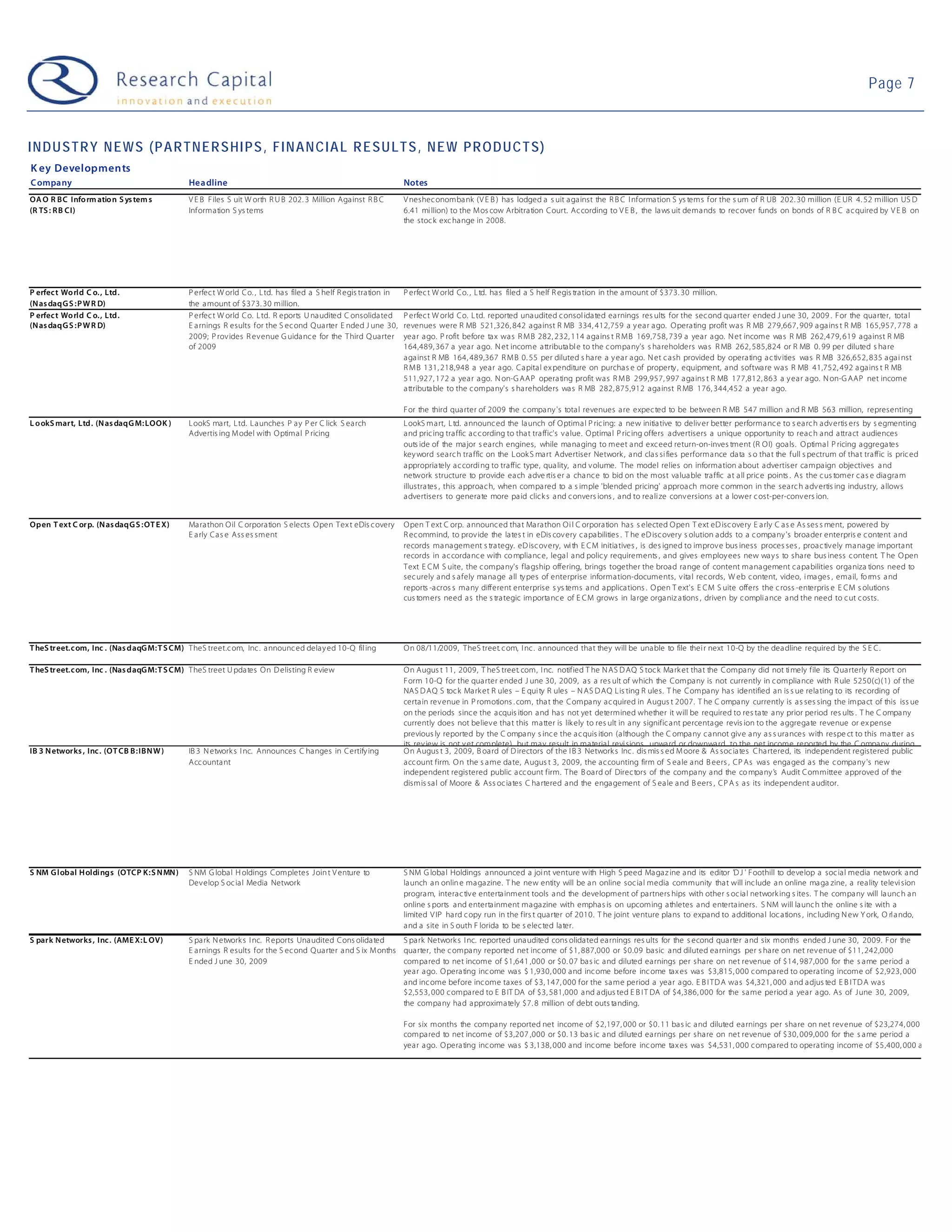

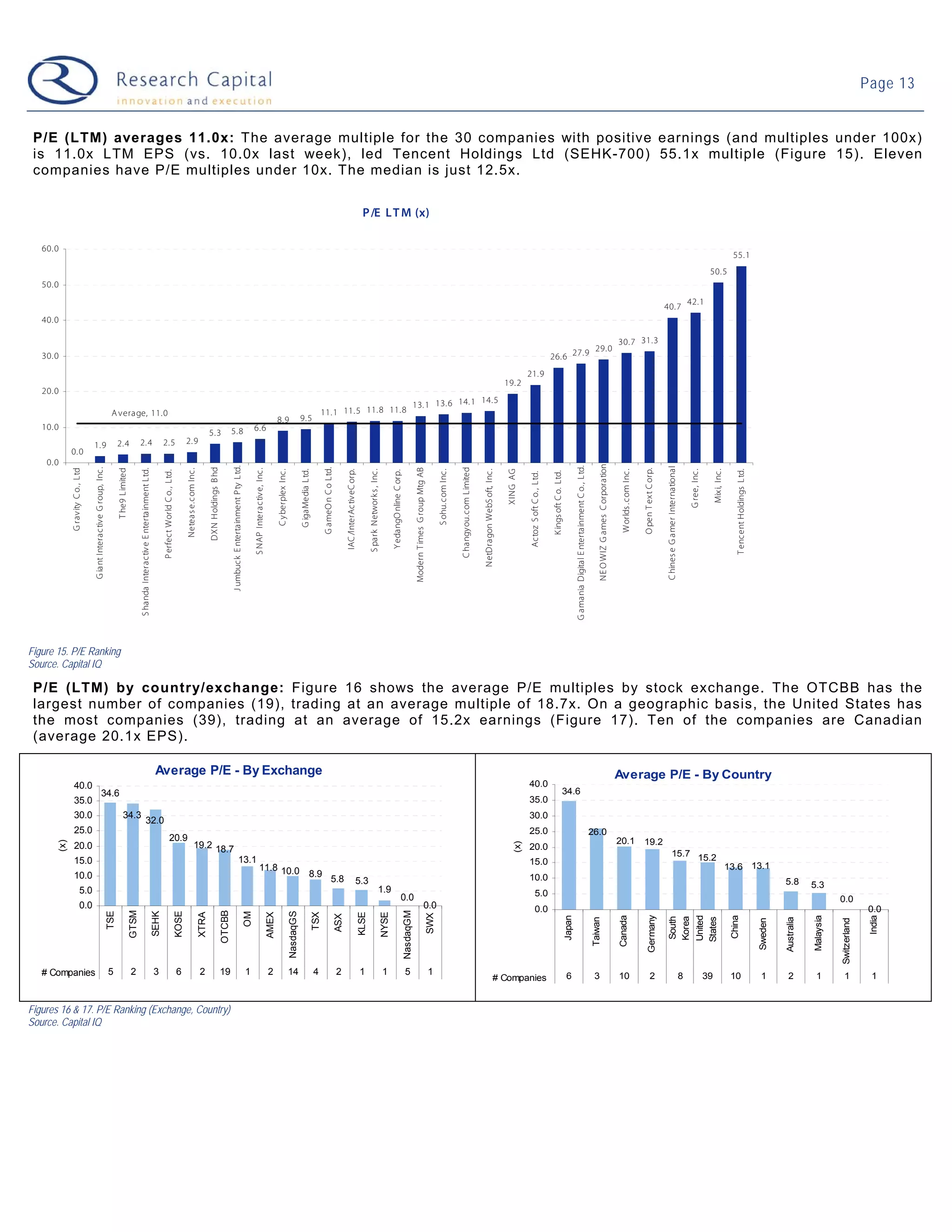

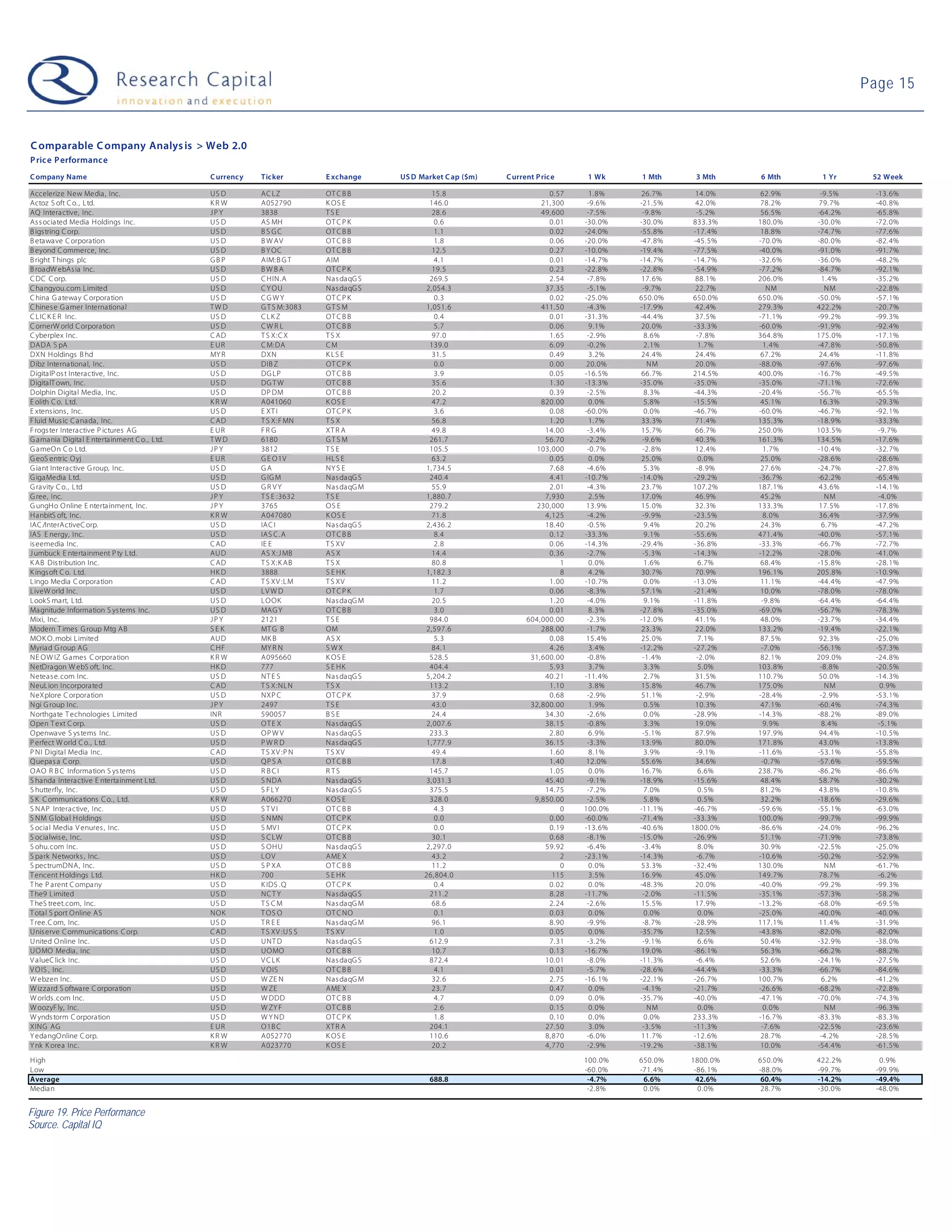

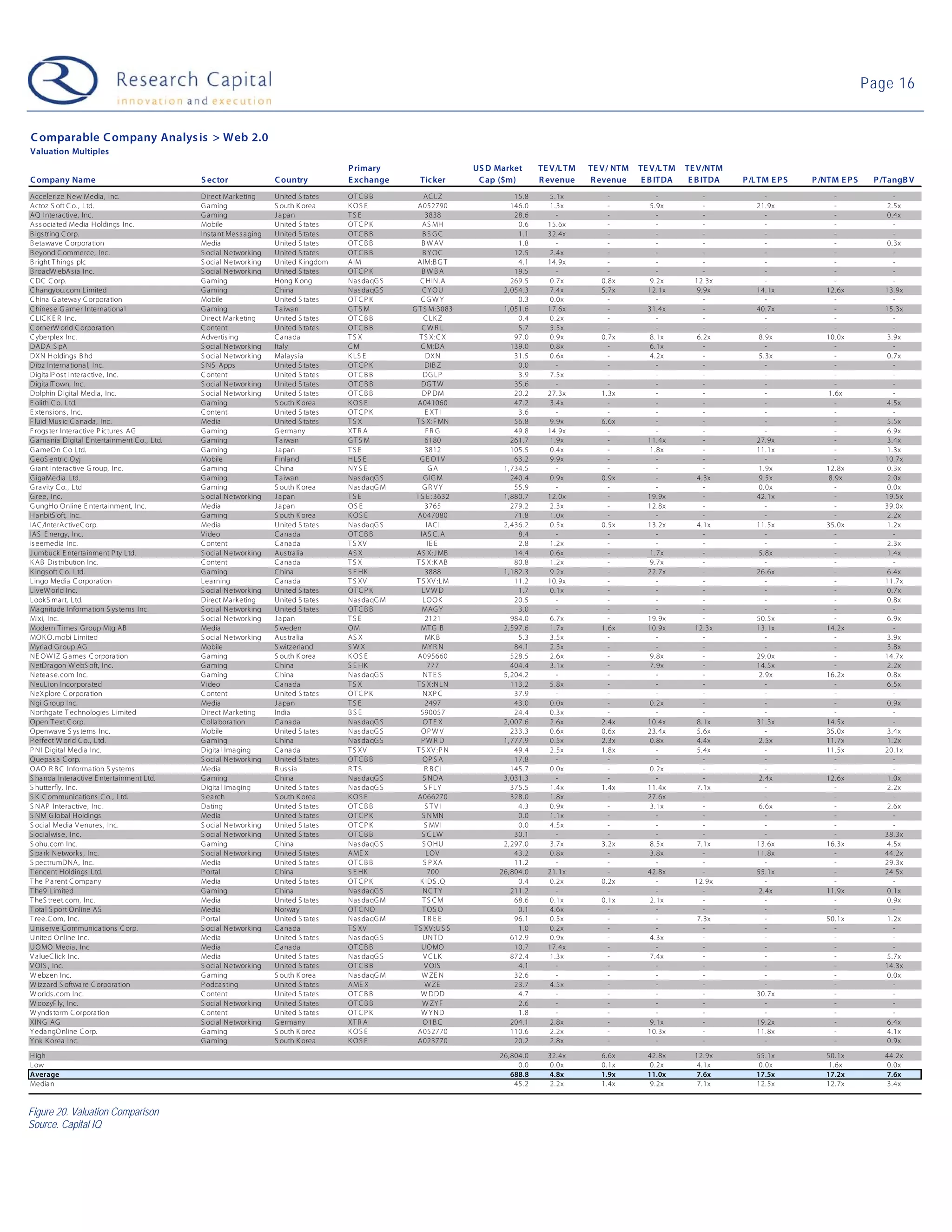

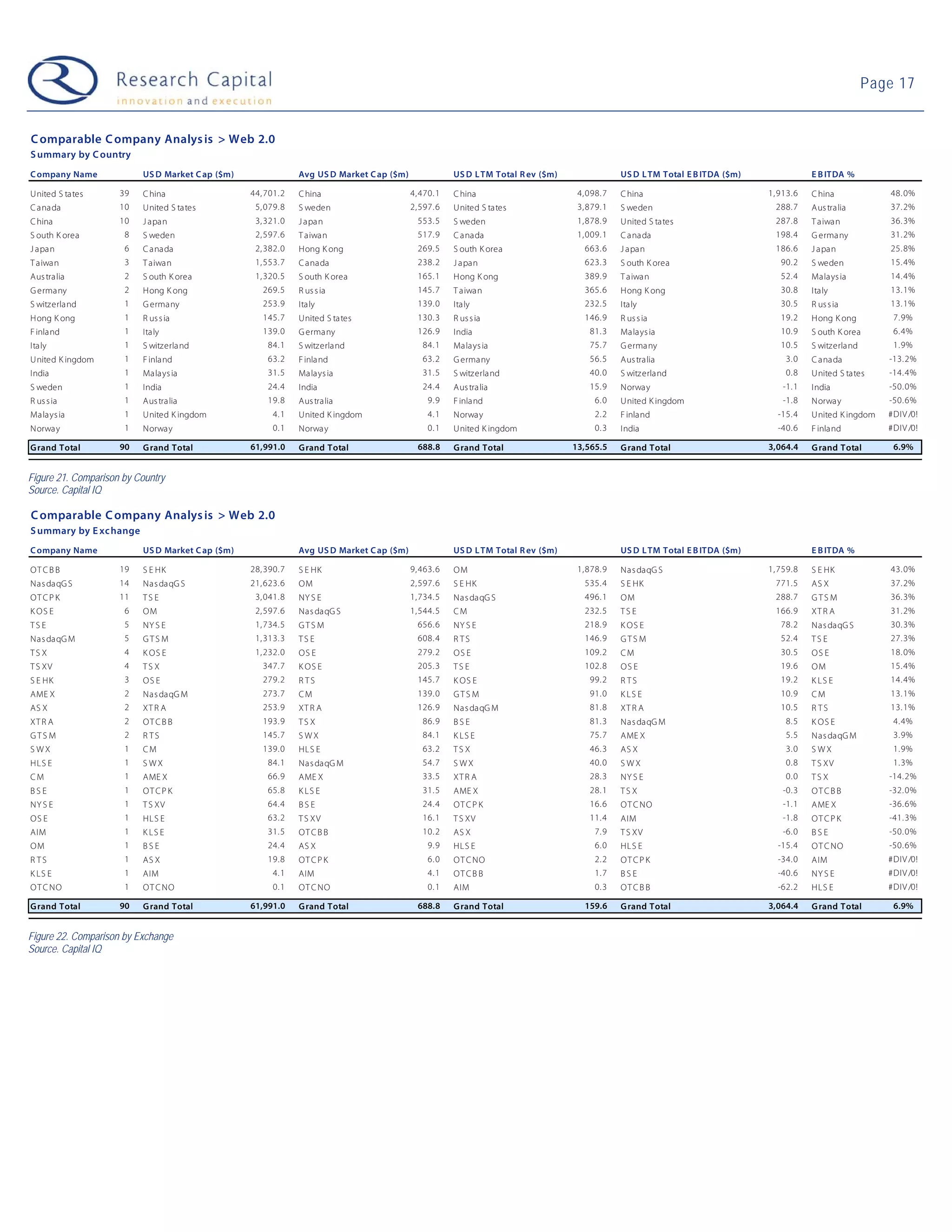

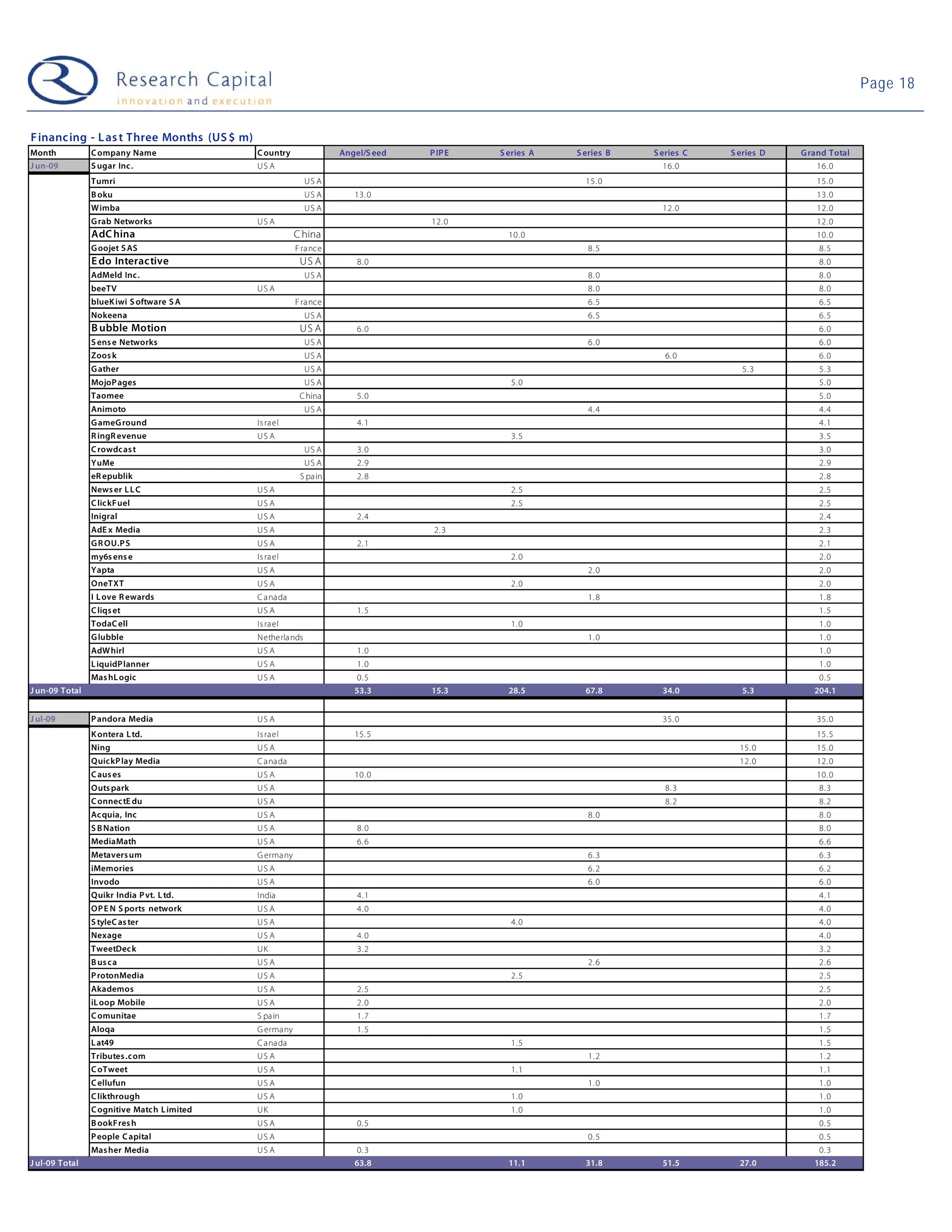

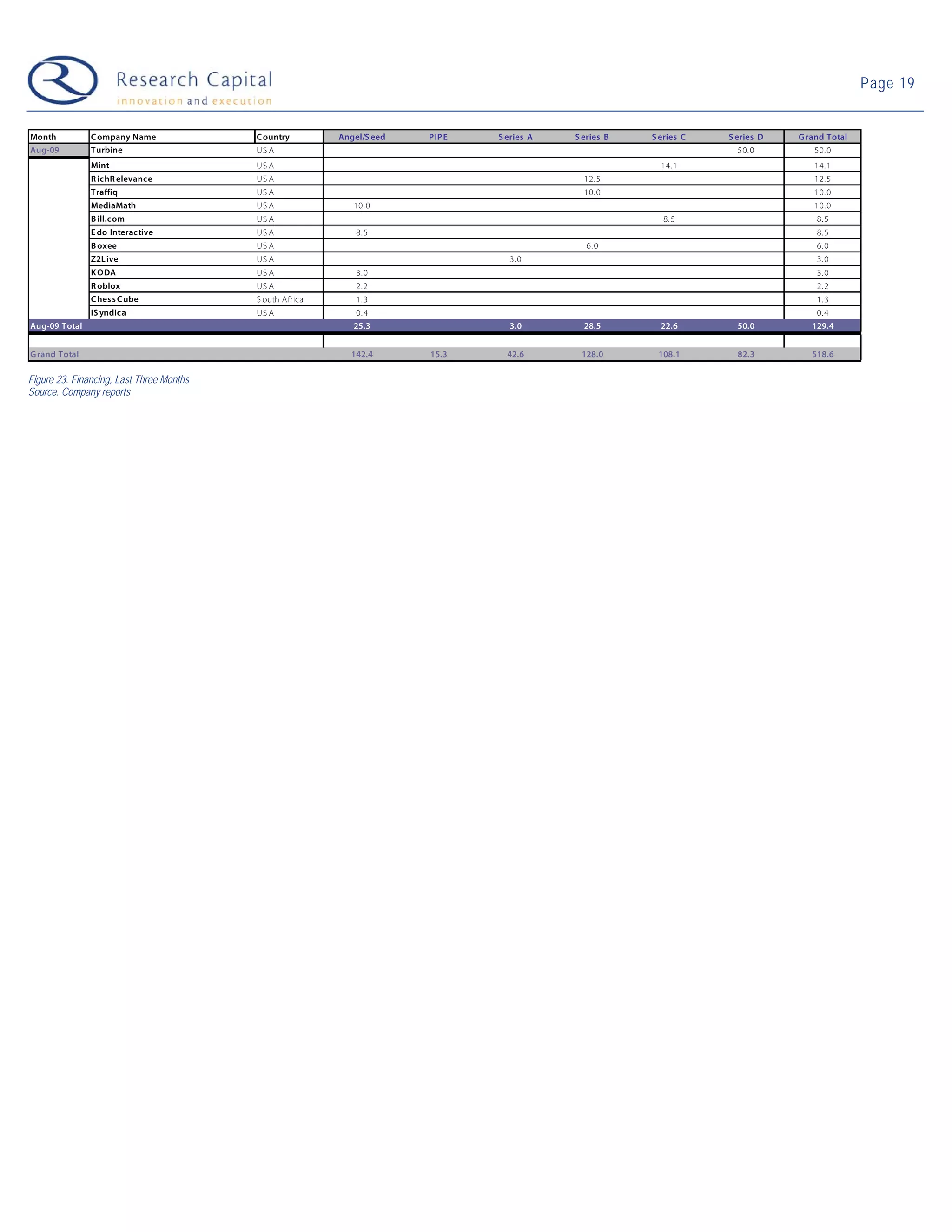

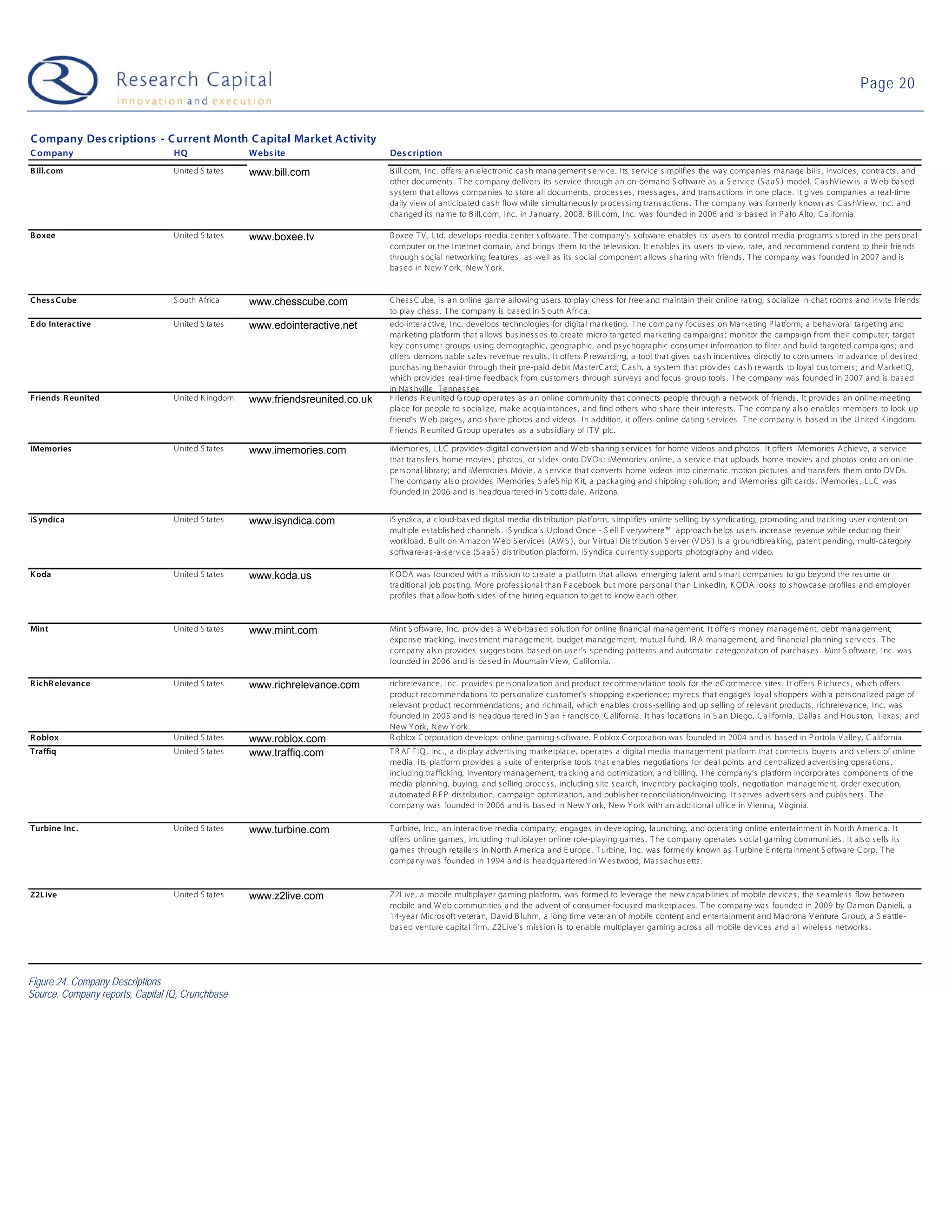

The document summarizes a research report that found software companies are taking longer on average to exit investments through IPO, acquisition, or failure. Specifically, the median time for exit is now 91 months (7.6 years) for software companies, compared to 3.7-10.7 years previously. Additionally, median exit valuations for software companies since 2001 have been very low at 0.0-0.1x compared to 3.7-10.7x from 1994-2001. The document also provides an overview of financing activity and performance of publicly traded web 2.0 companies.