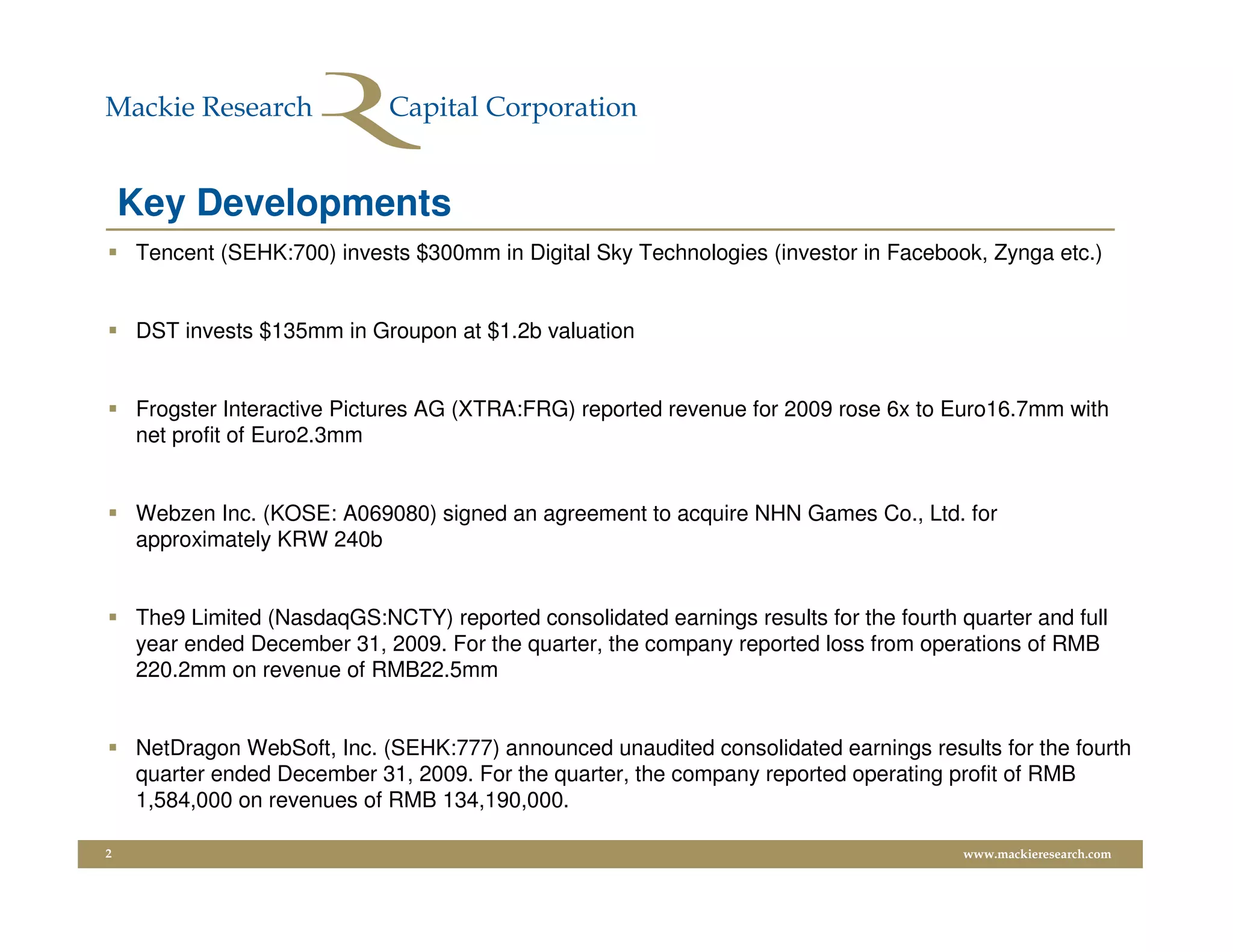

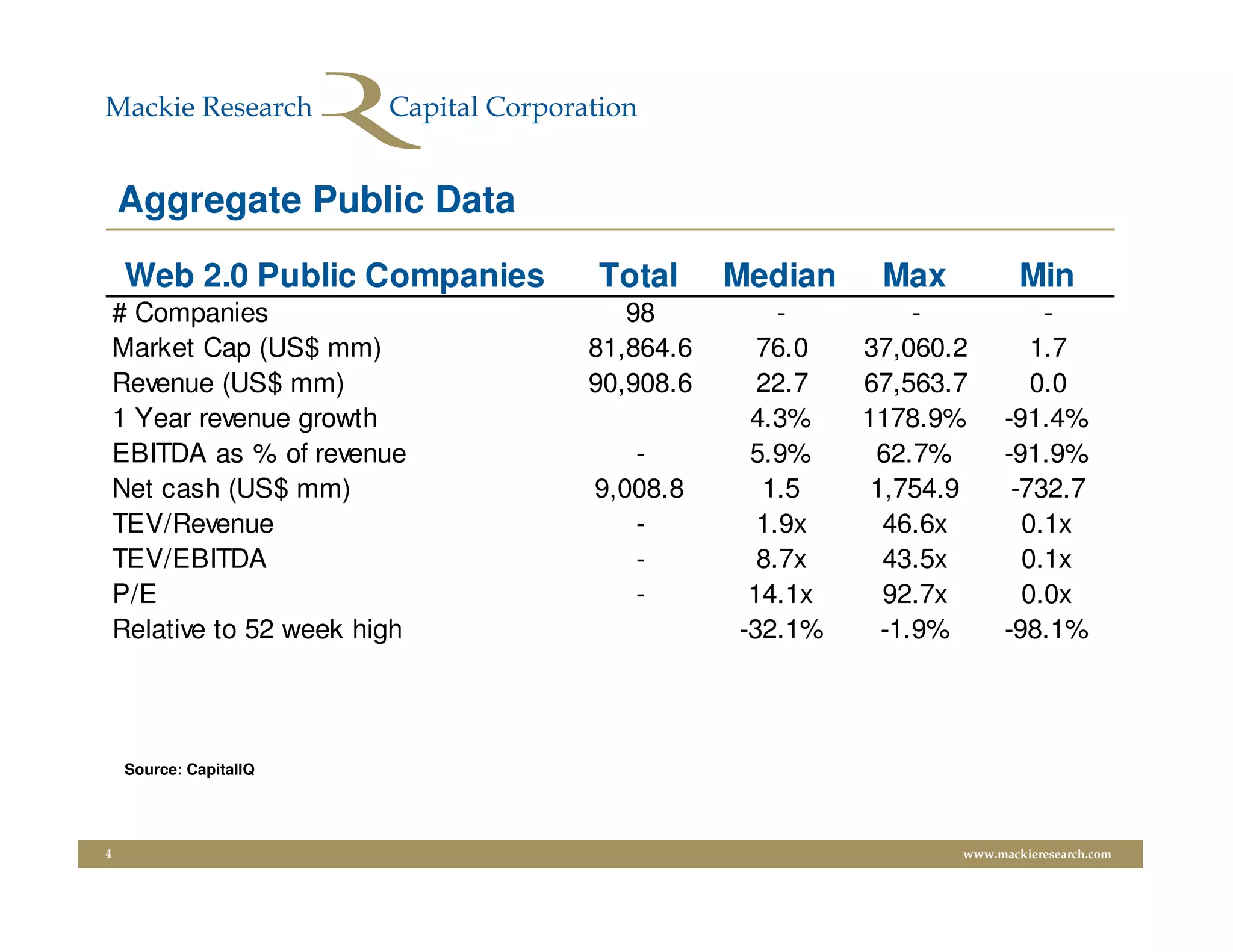

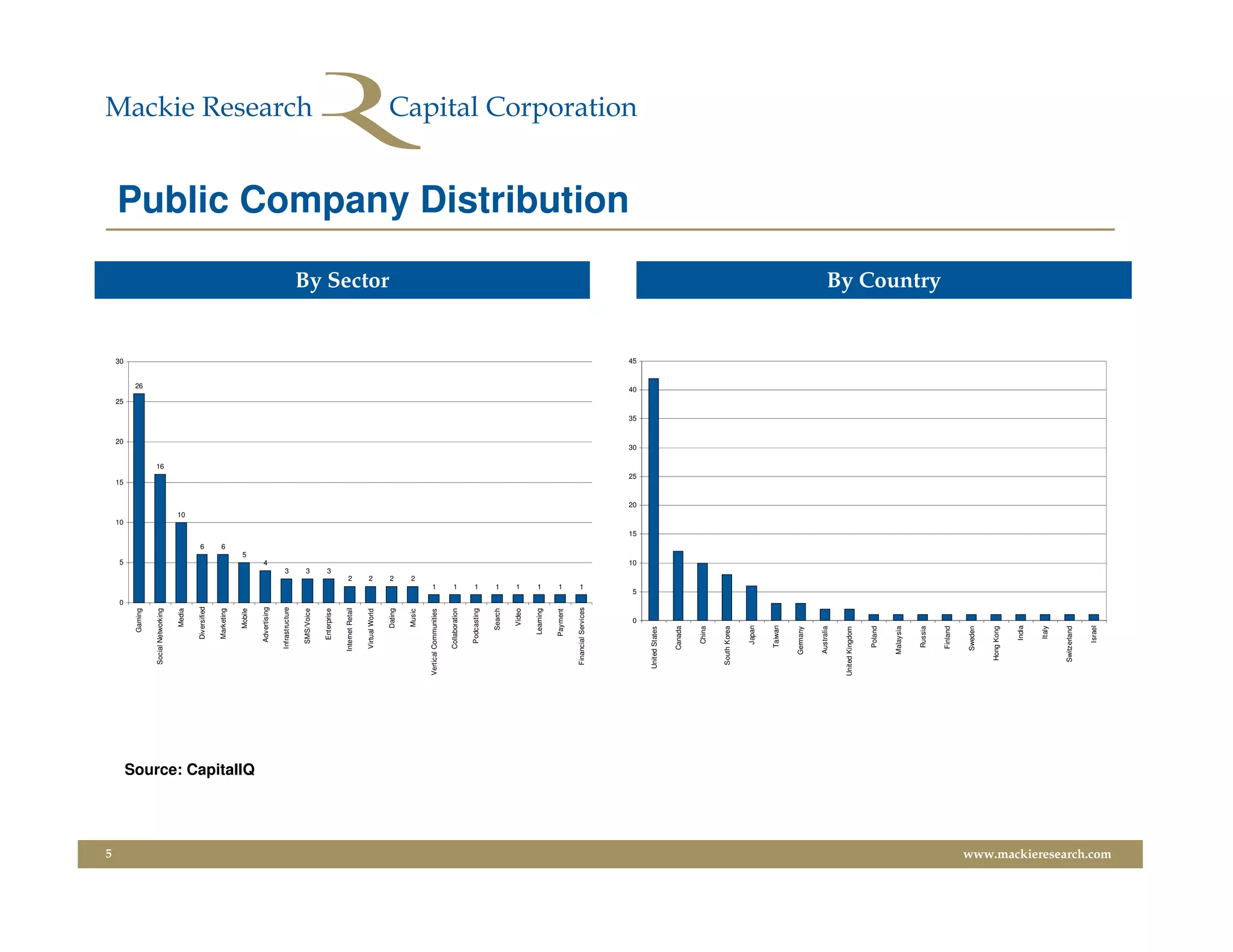

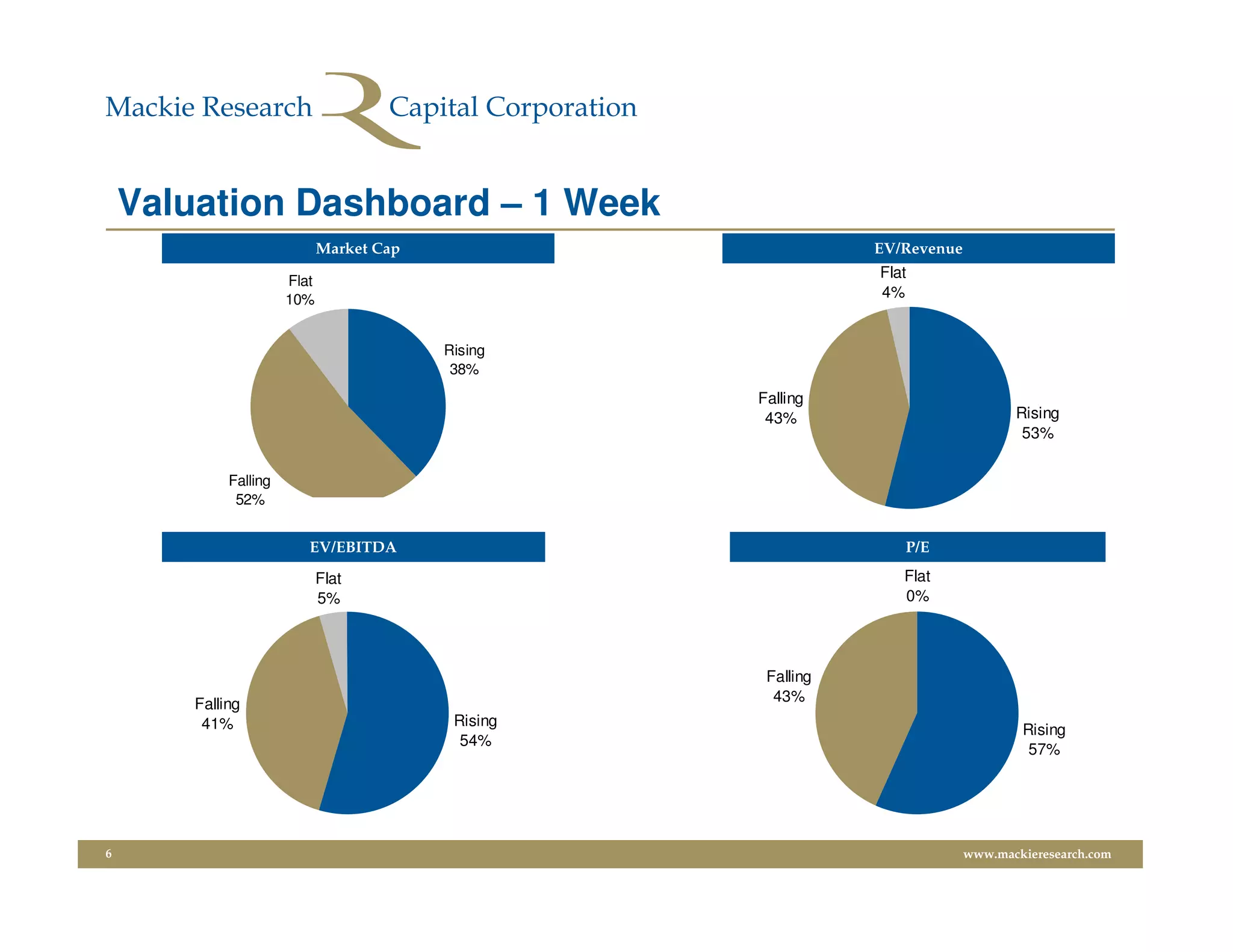

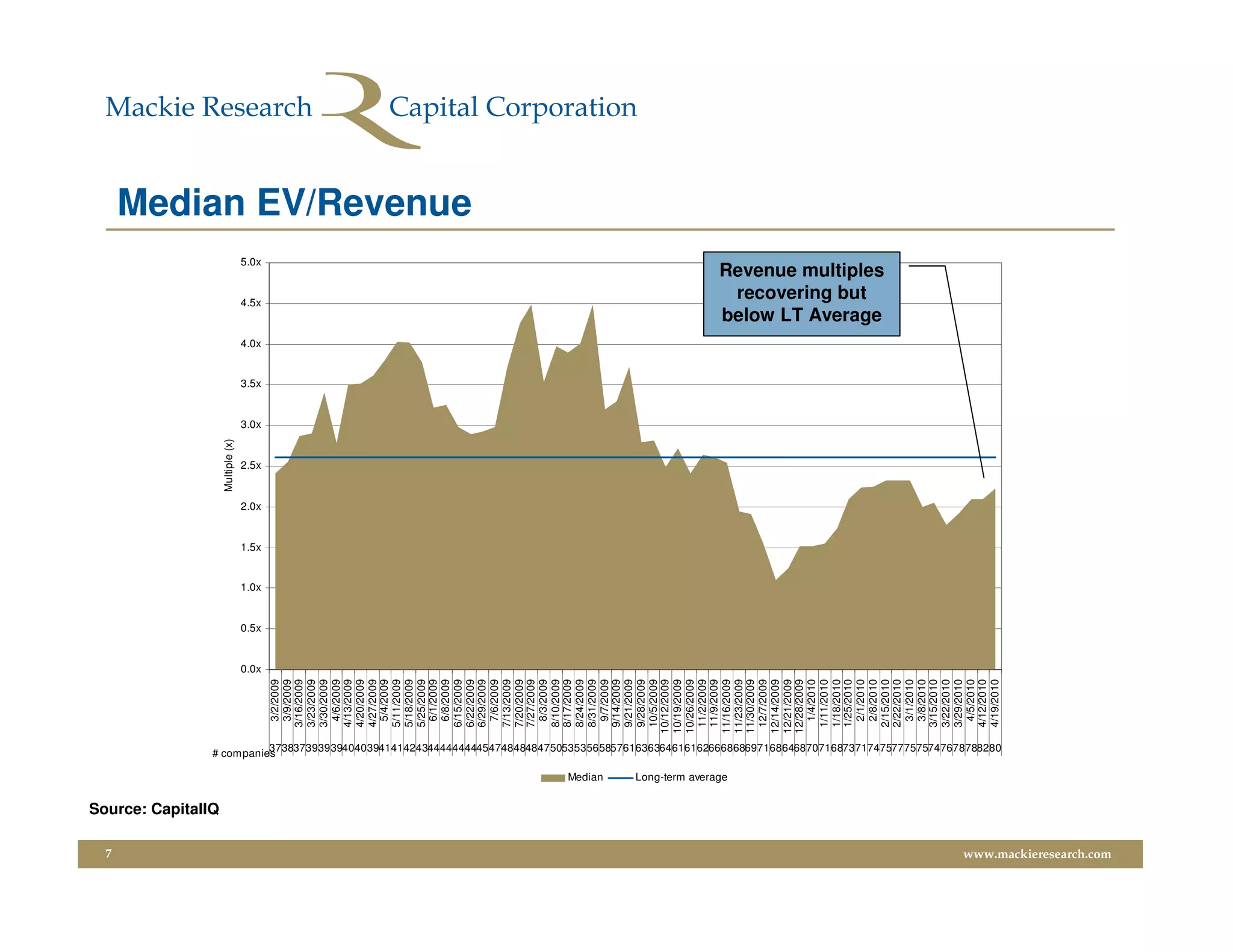

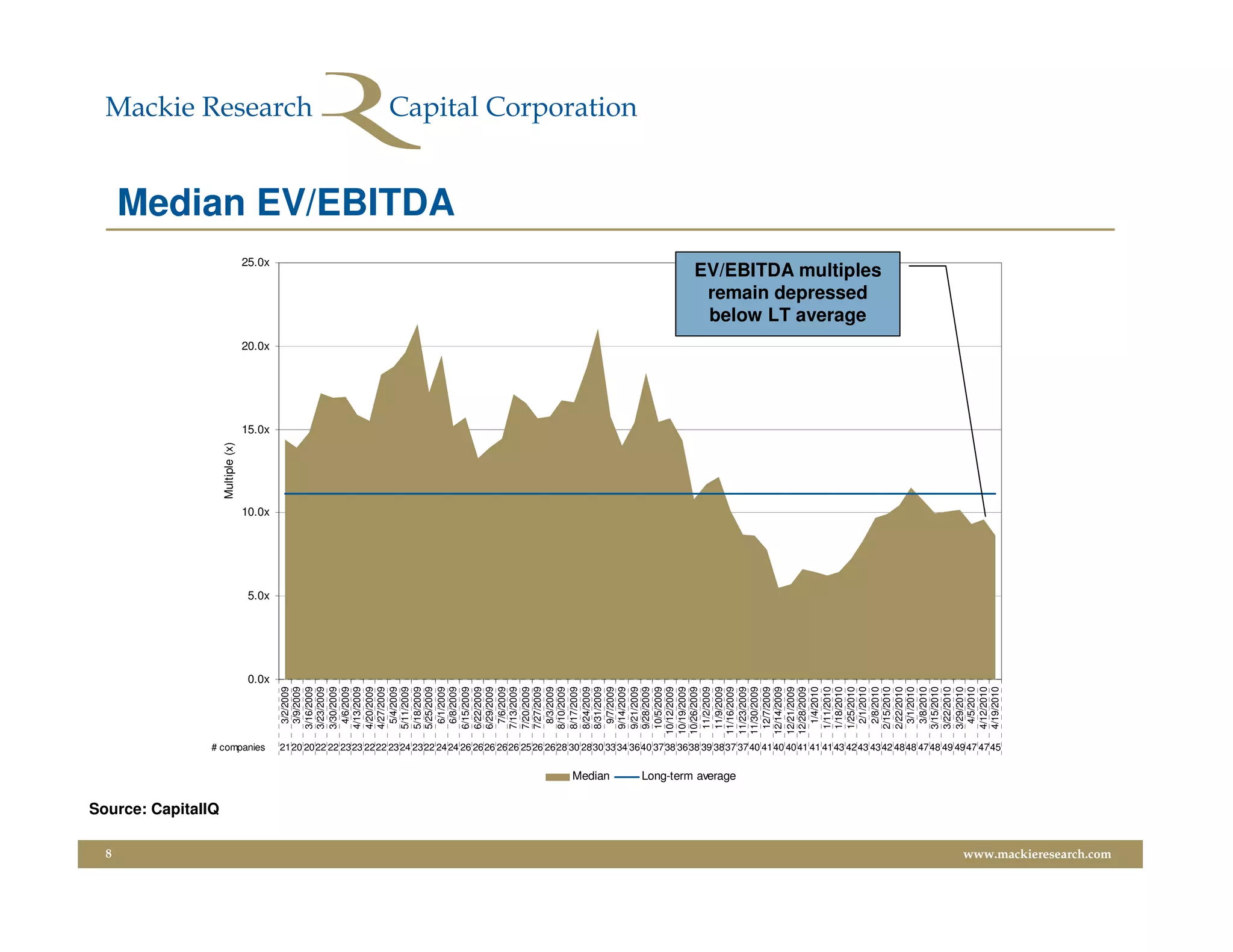

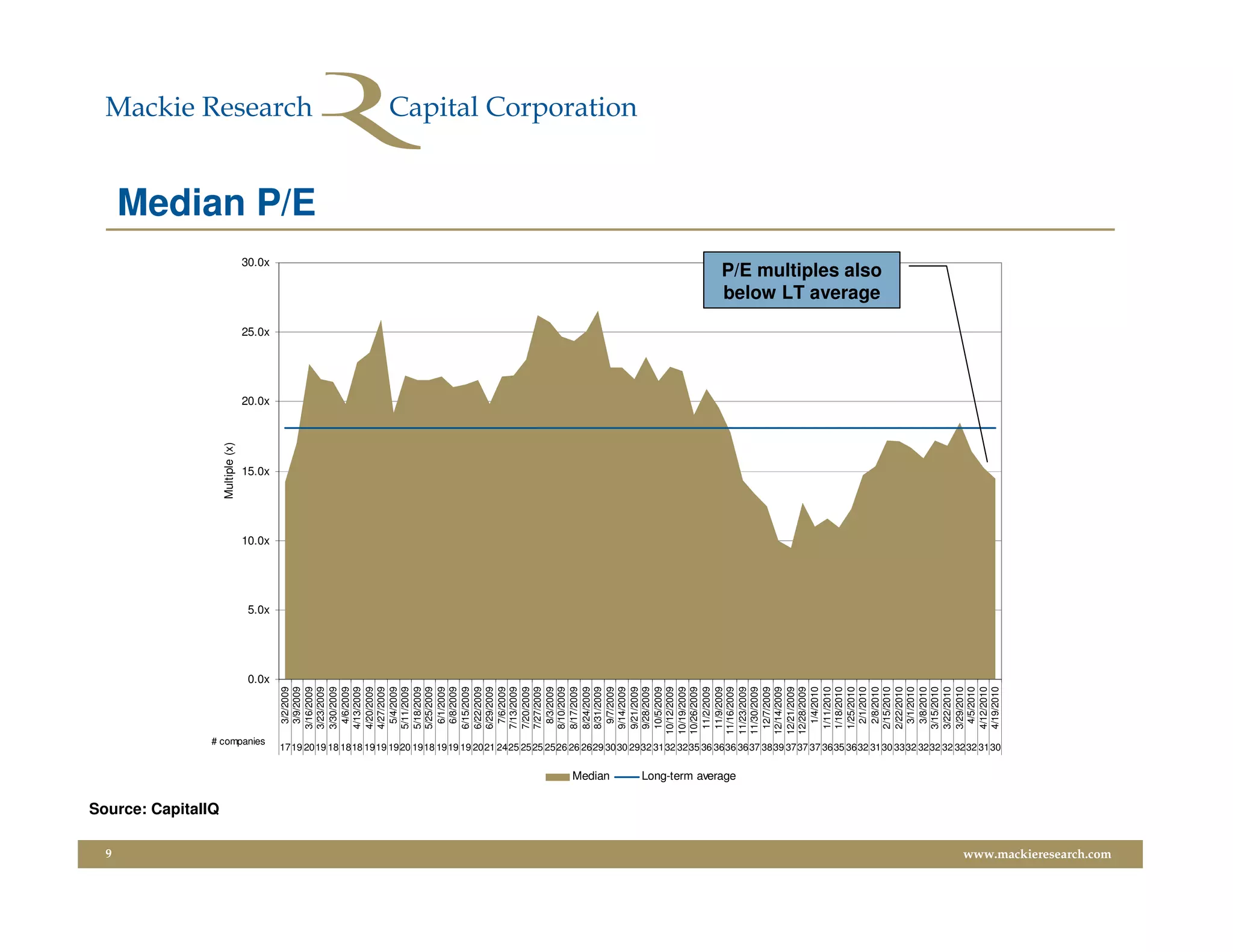

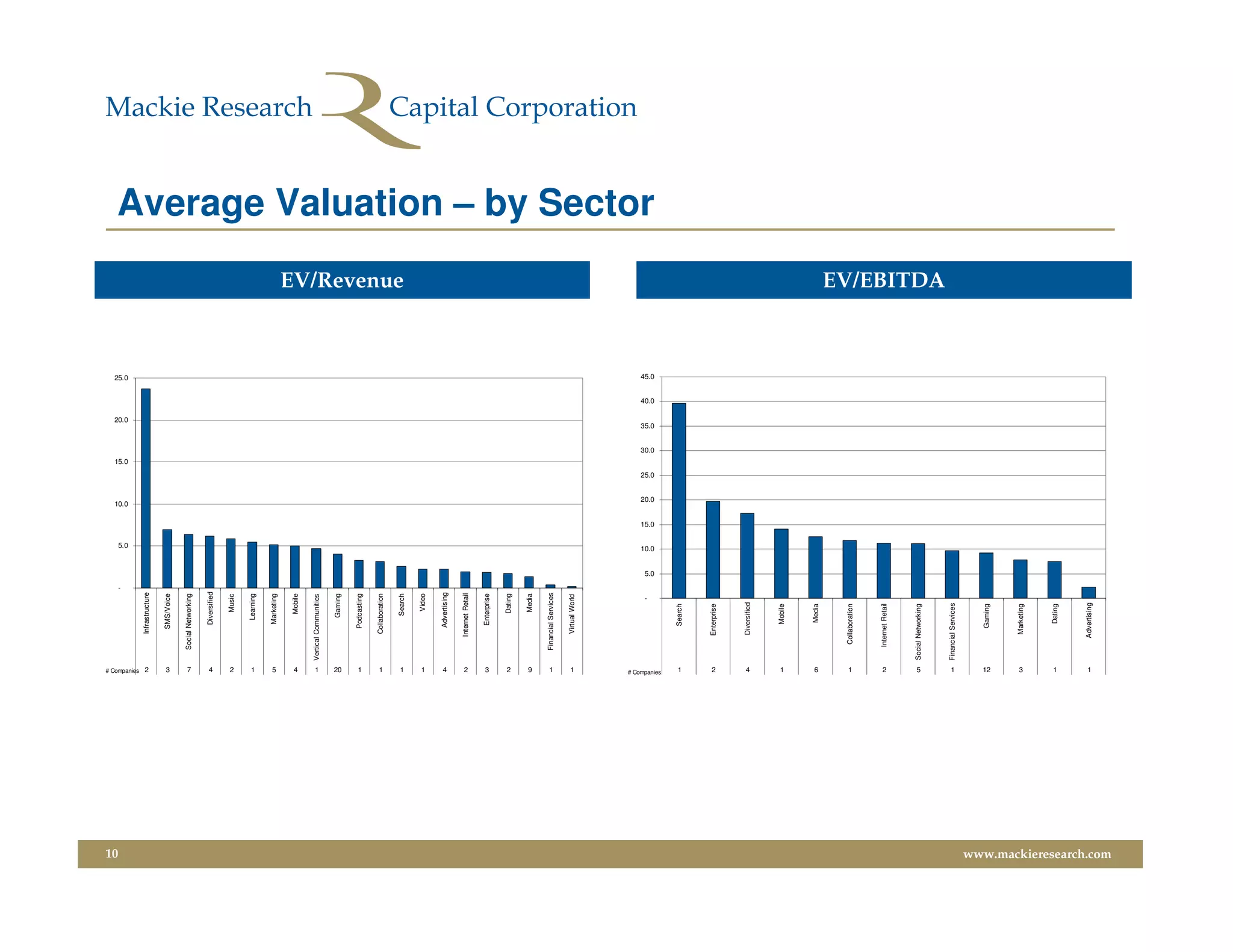

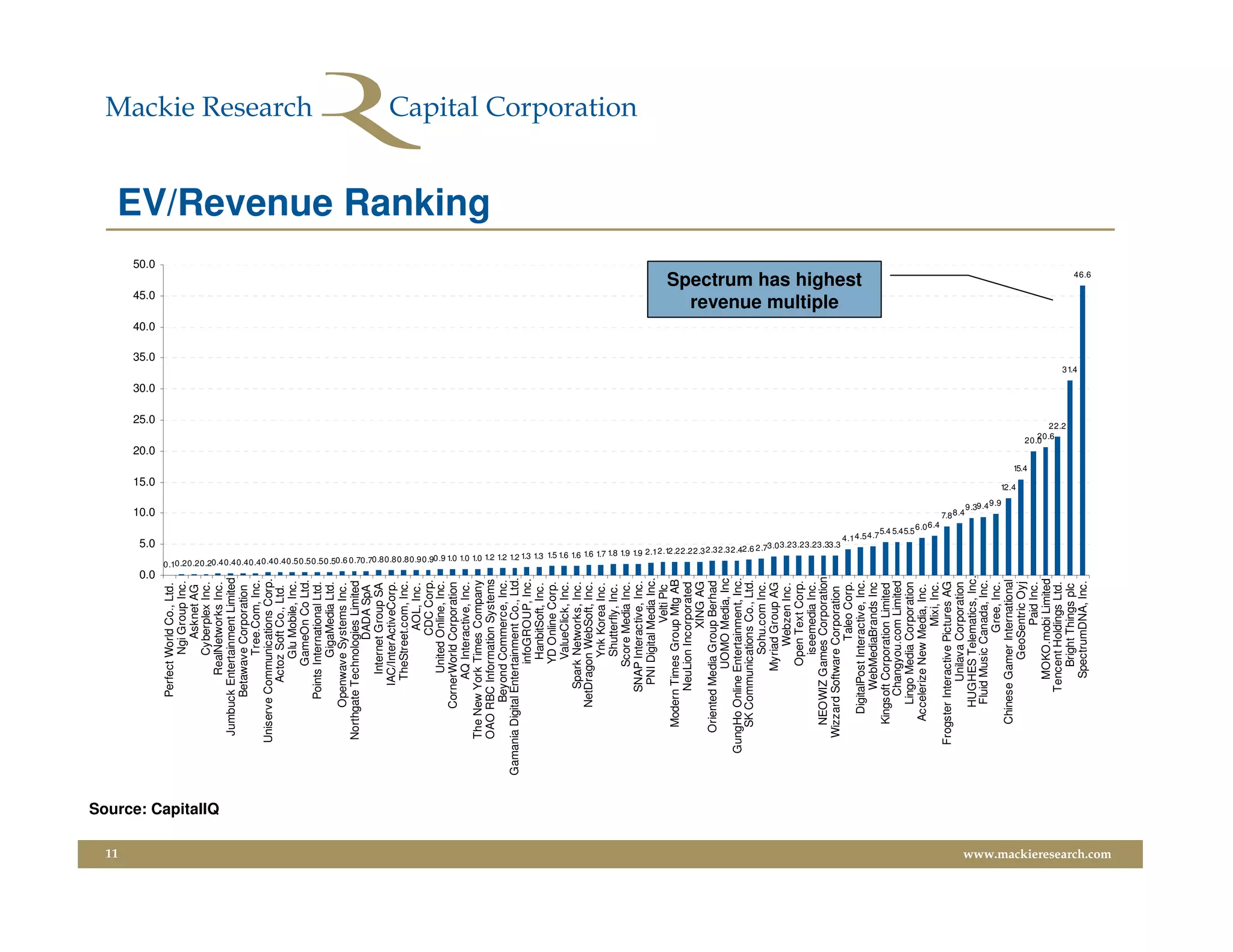

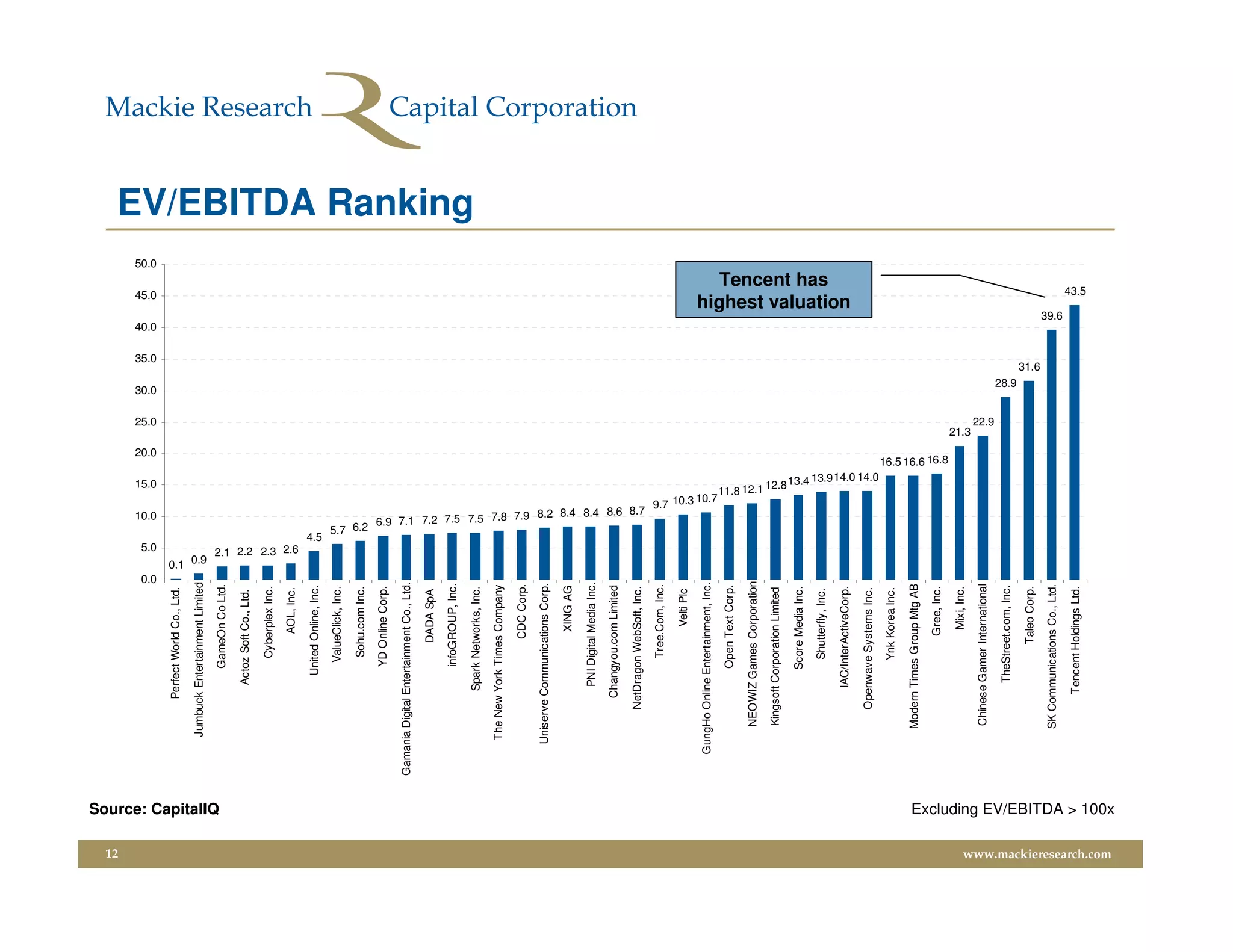

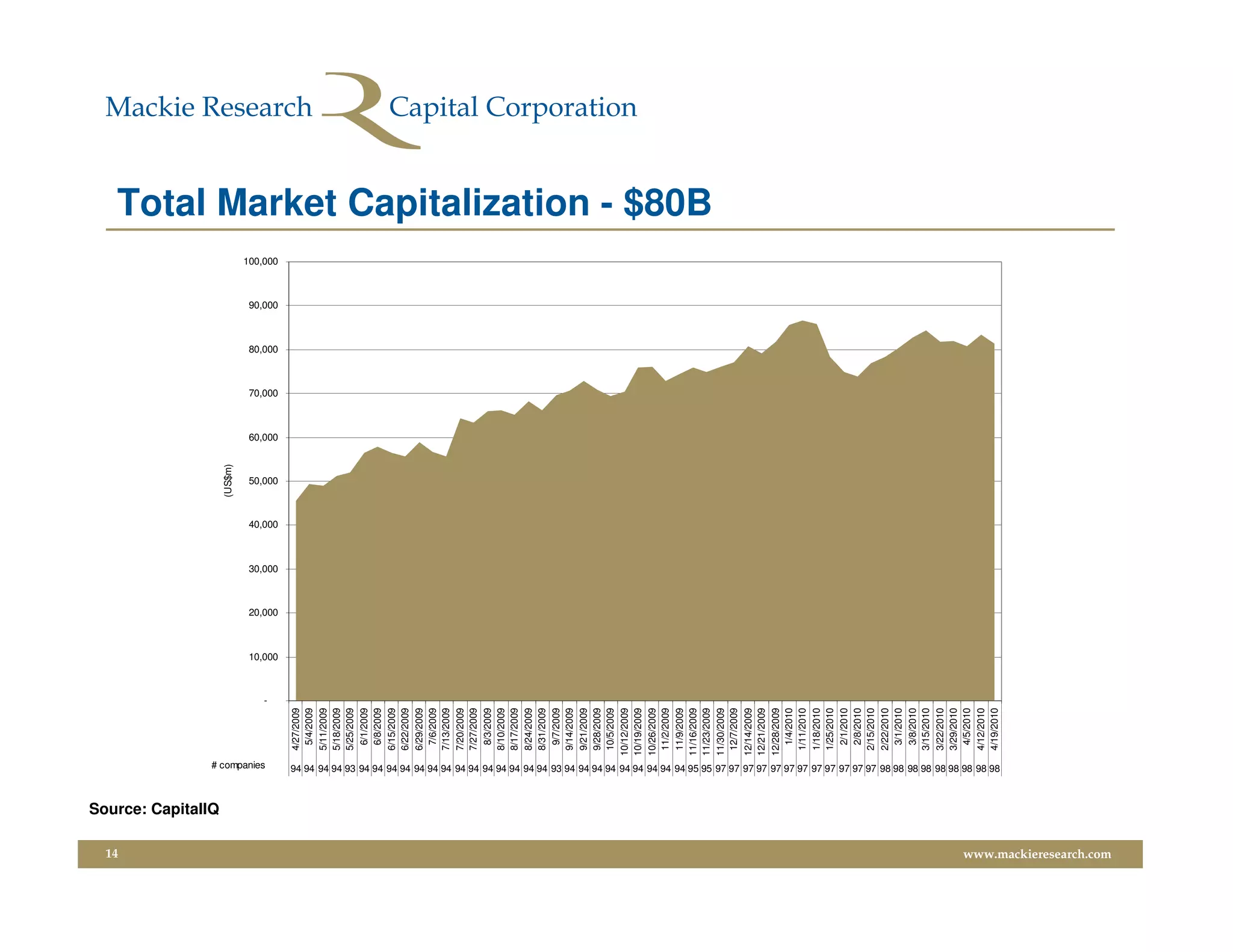

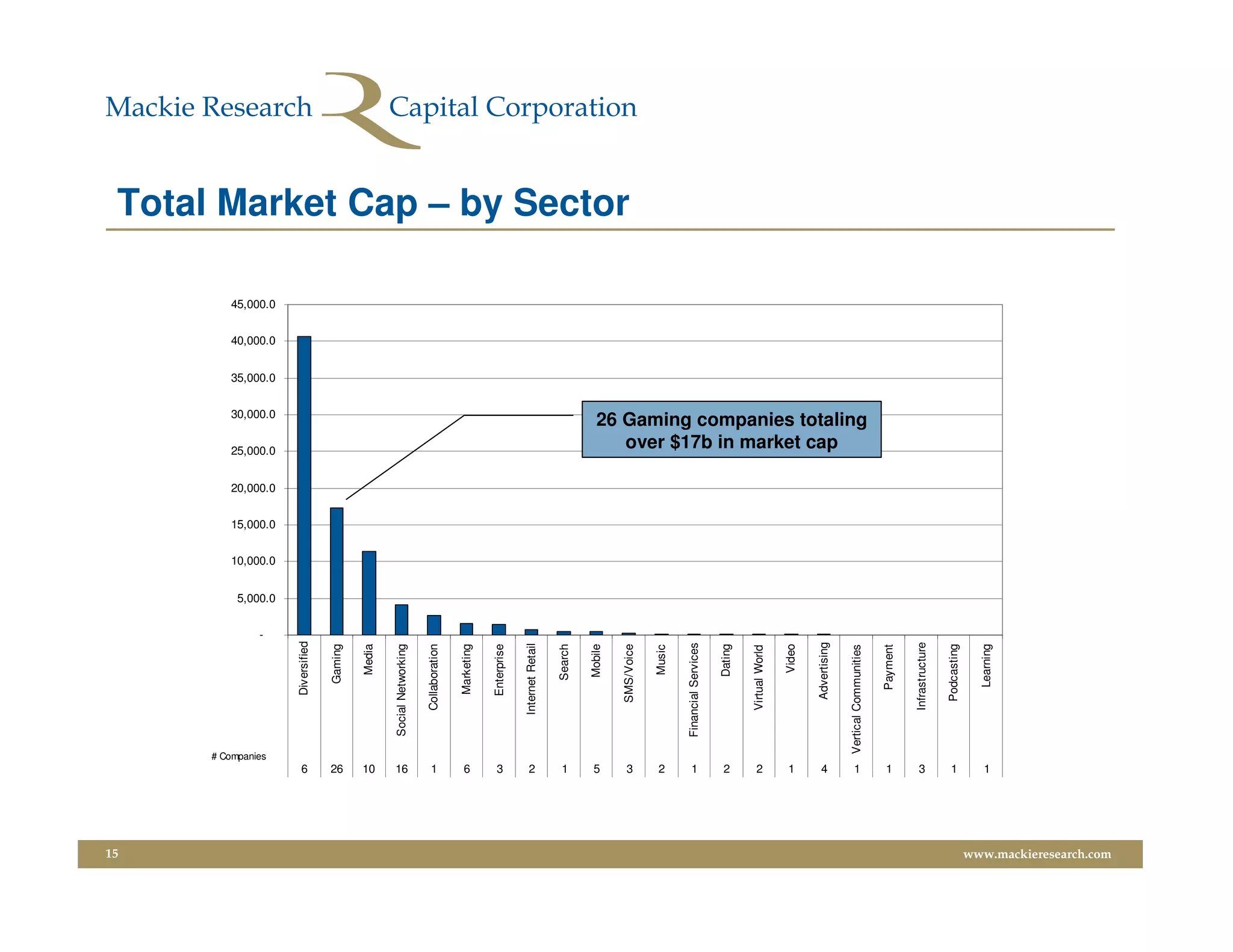

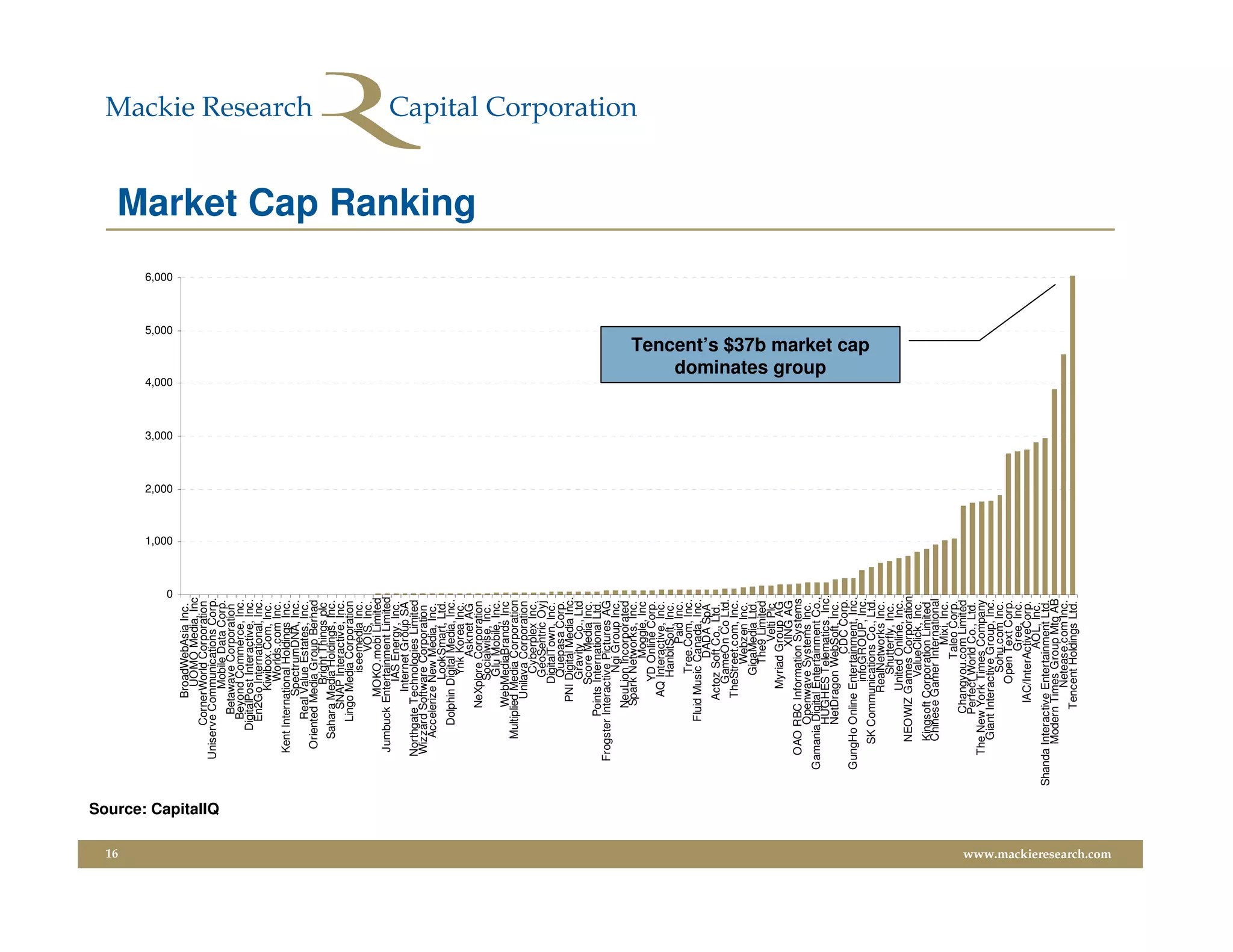

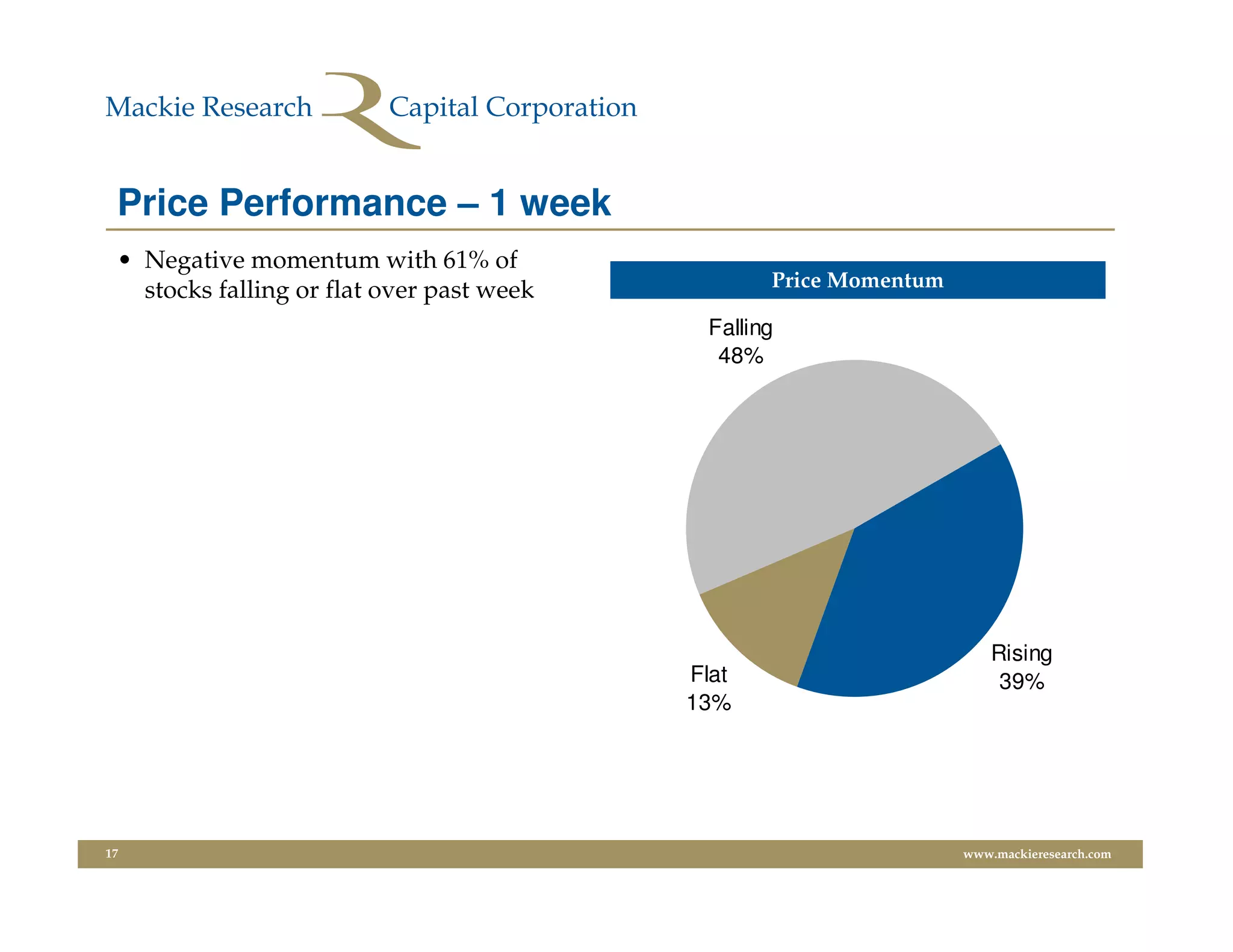

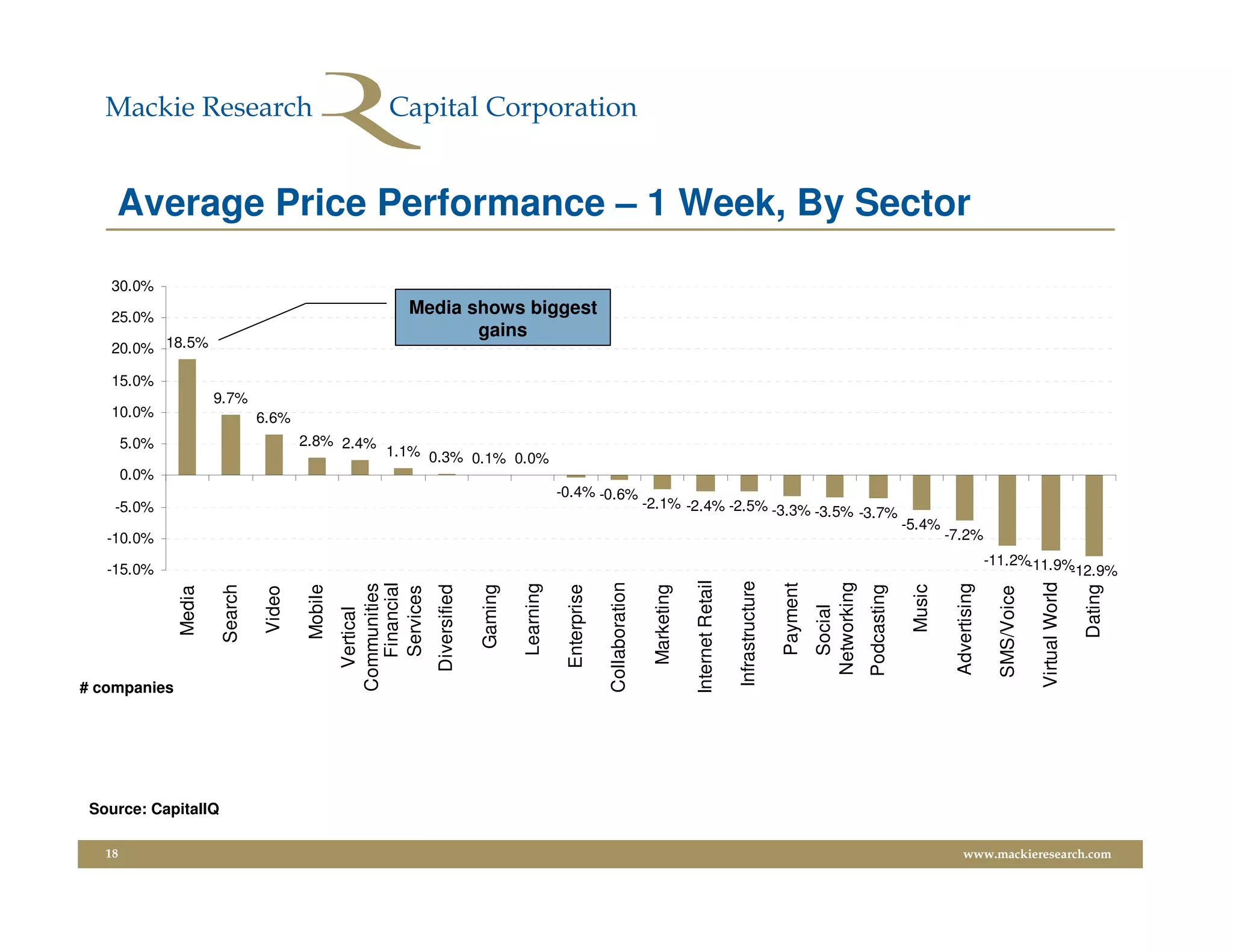

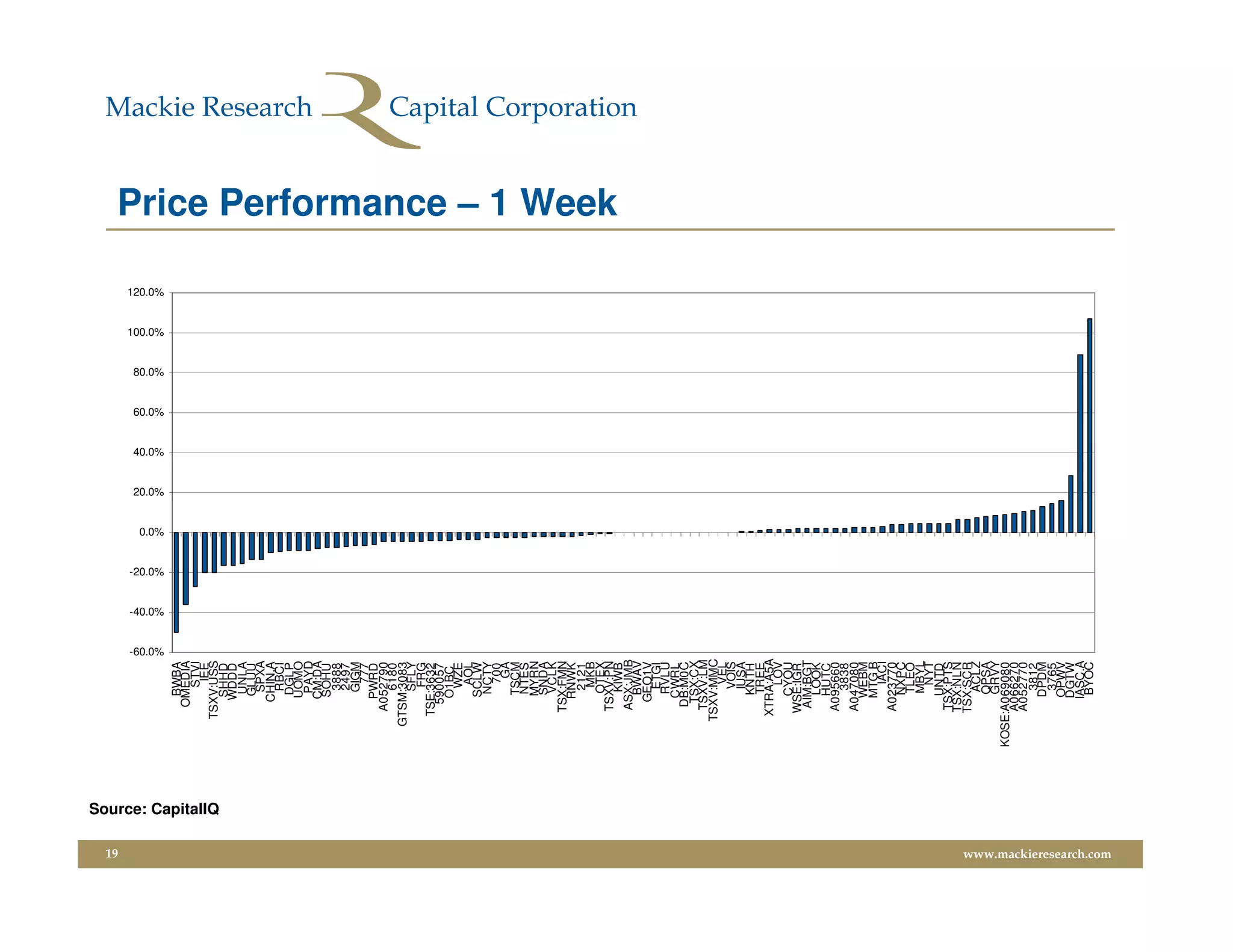

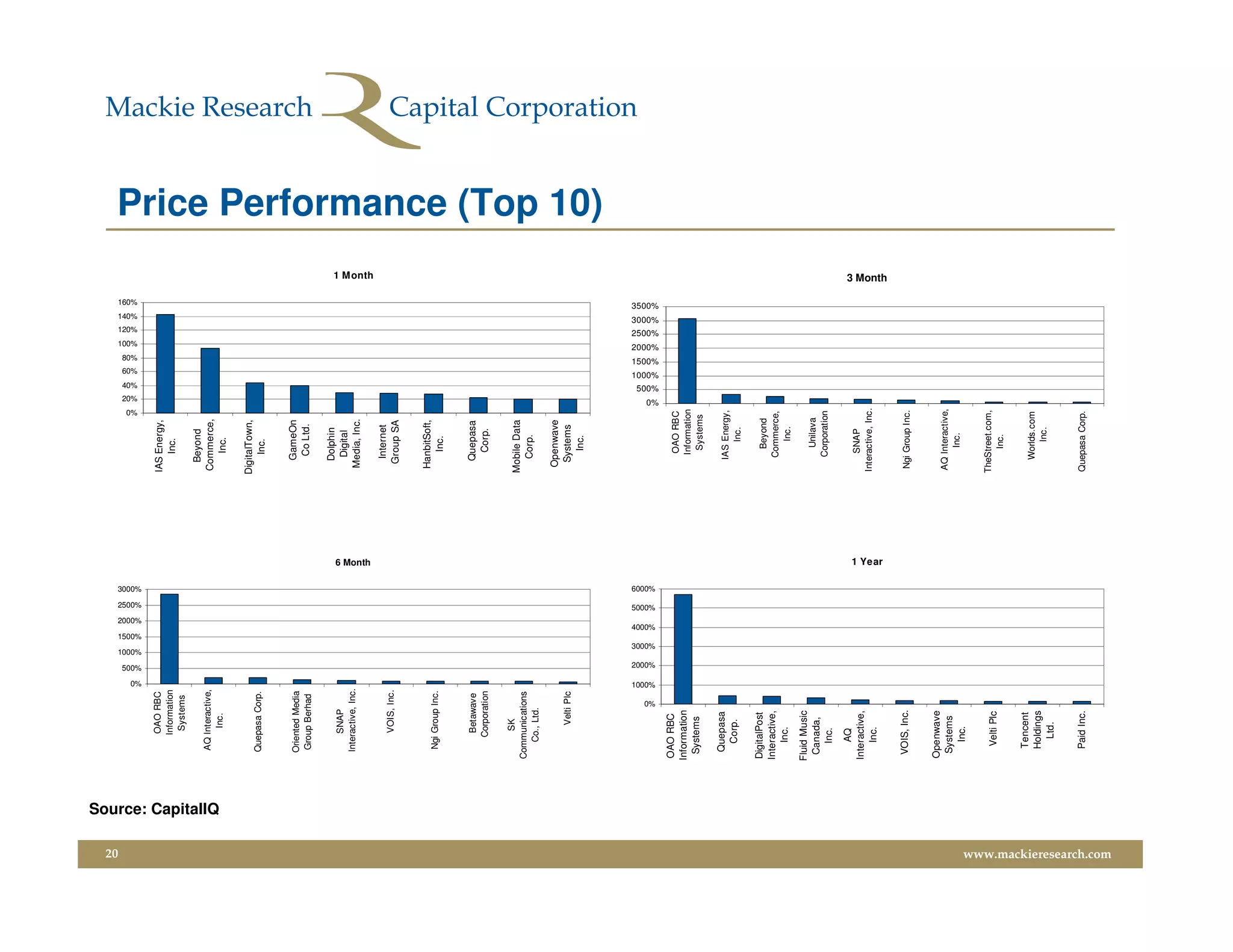

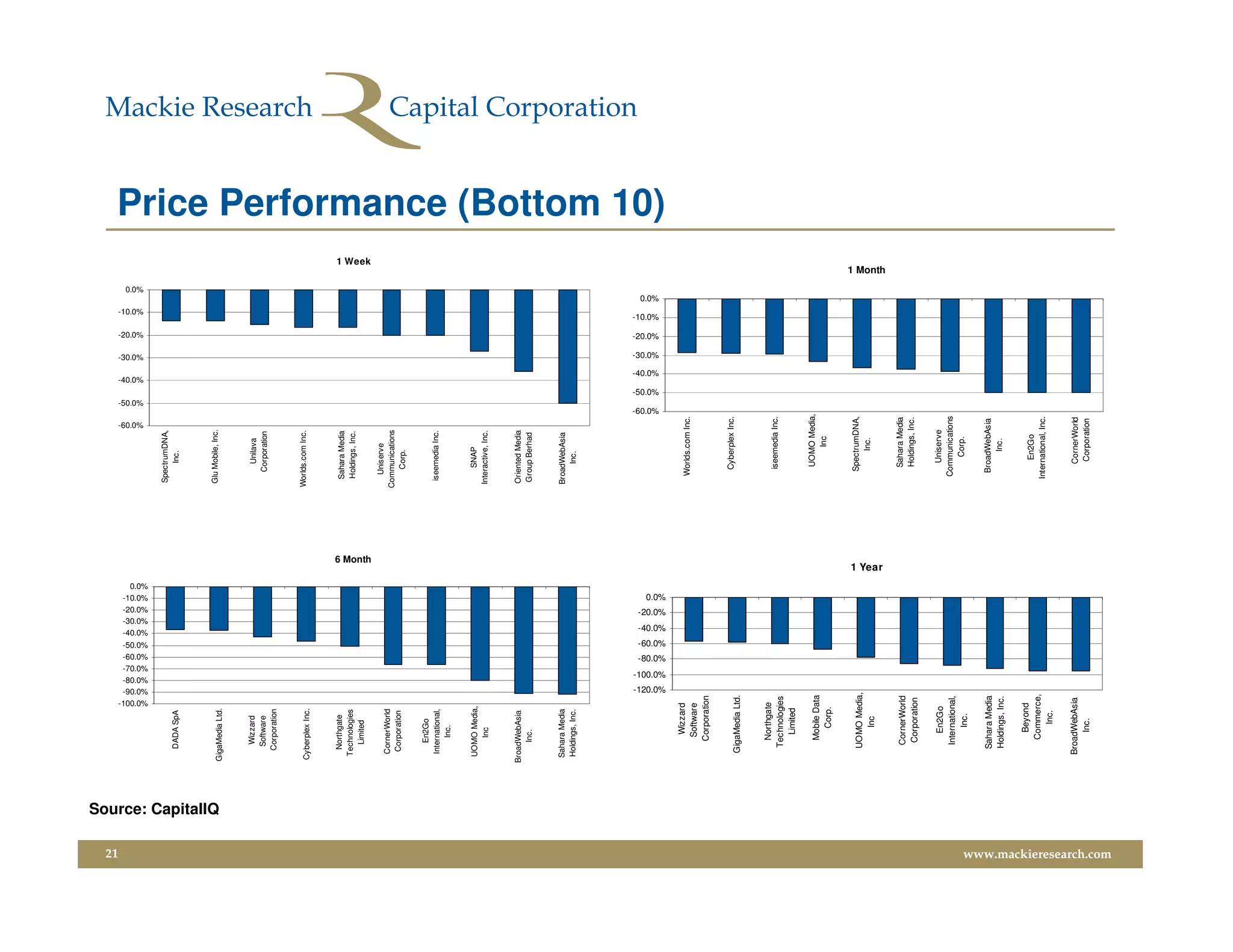

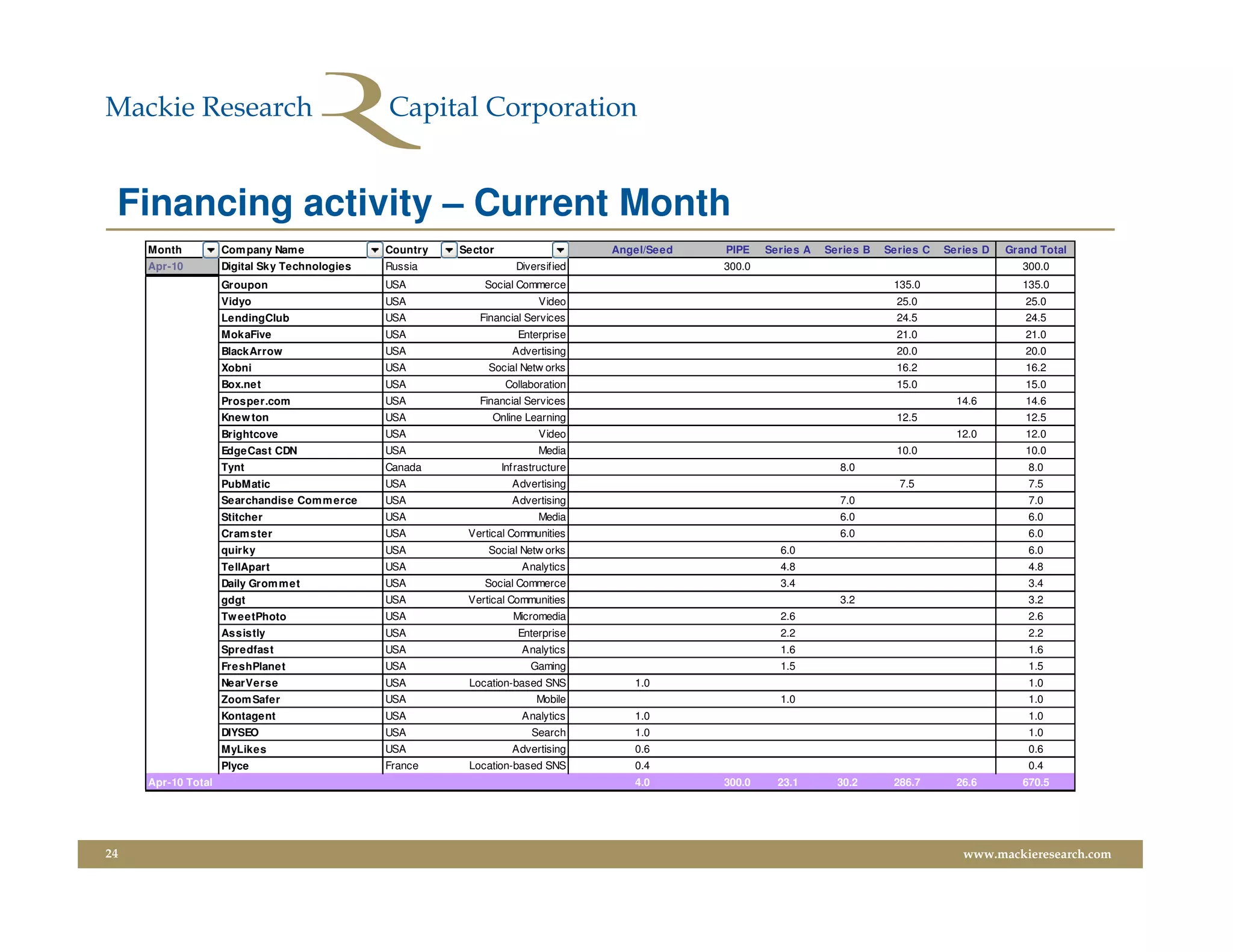

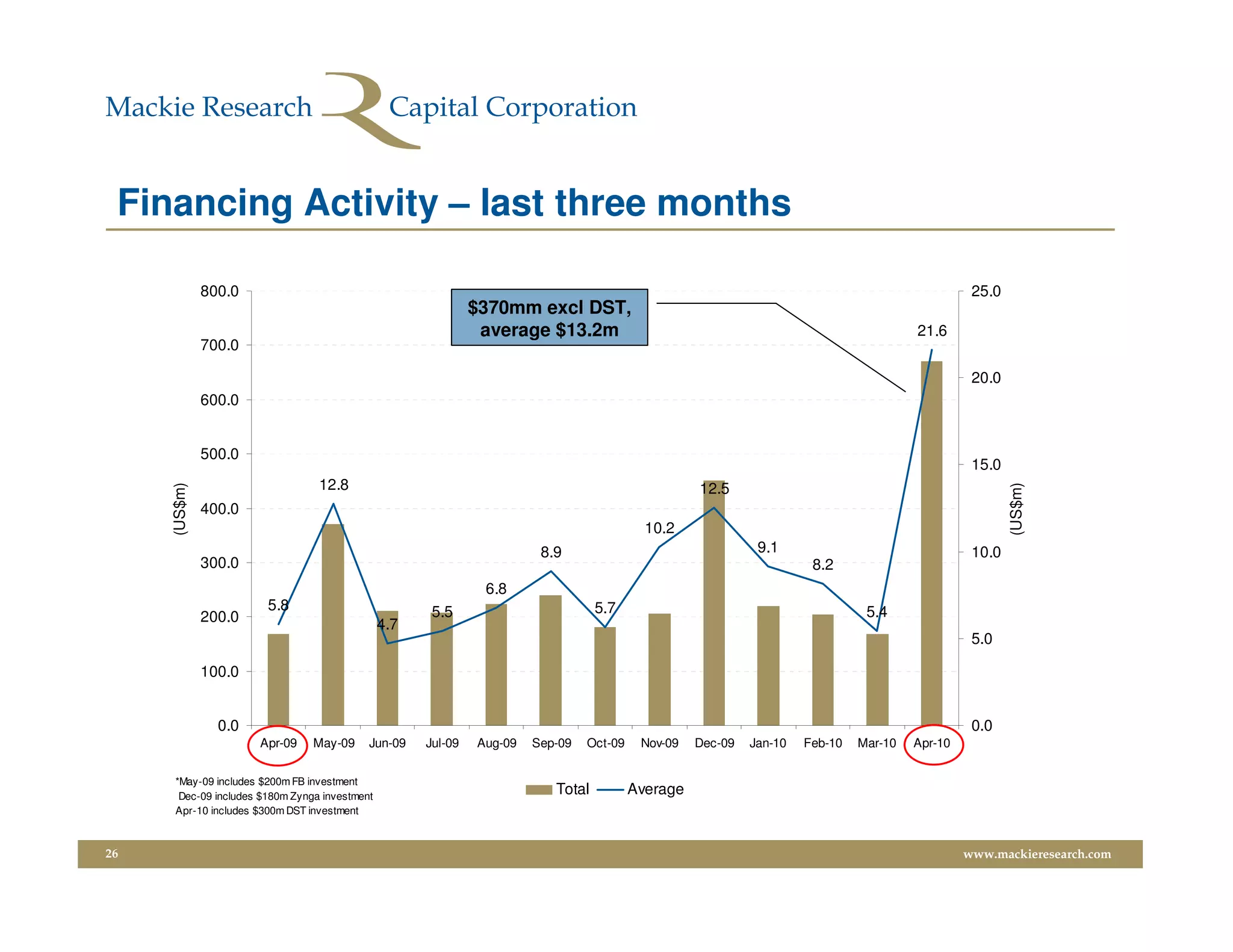

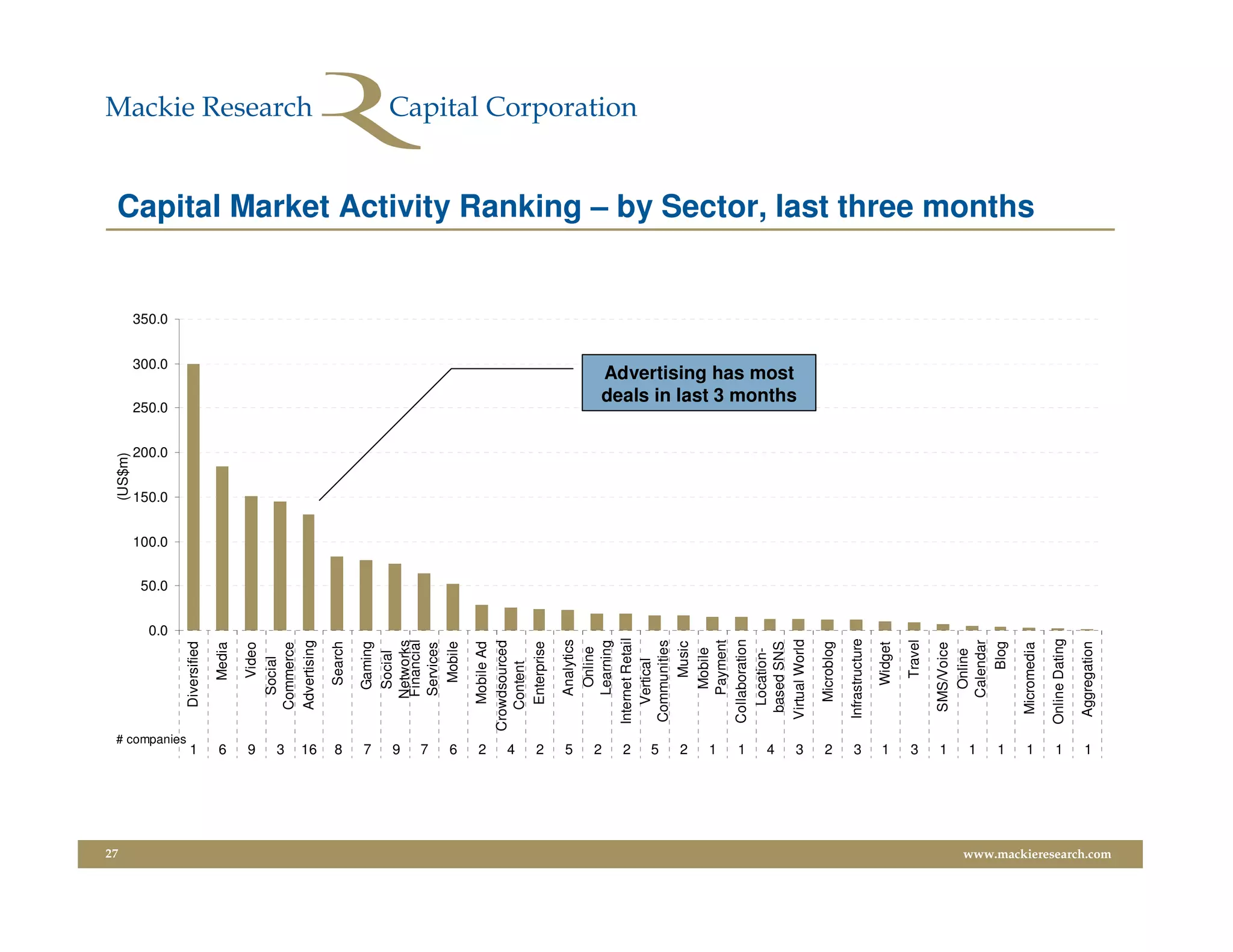

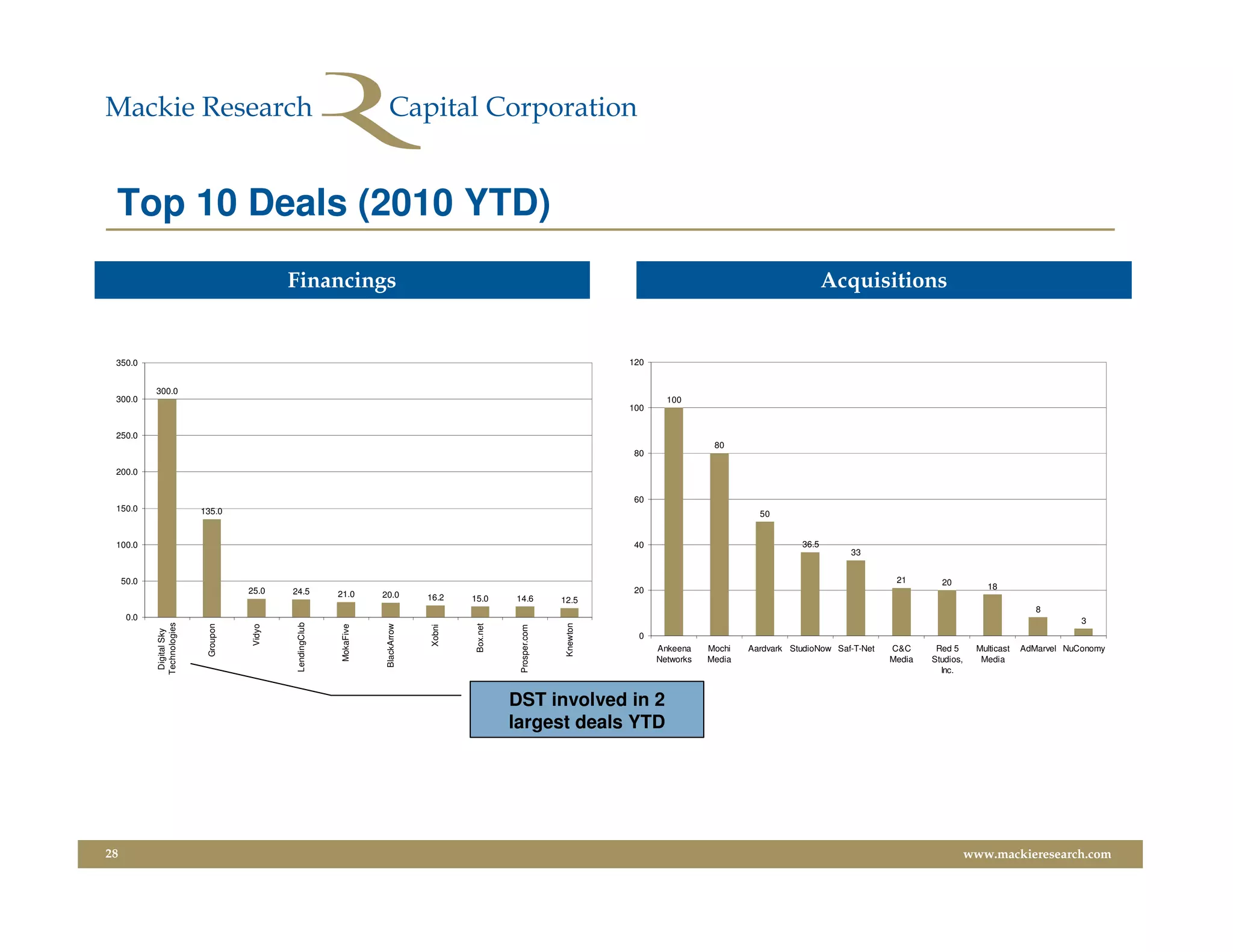

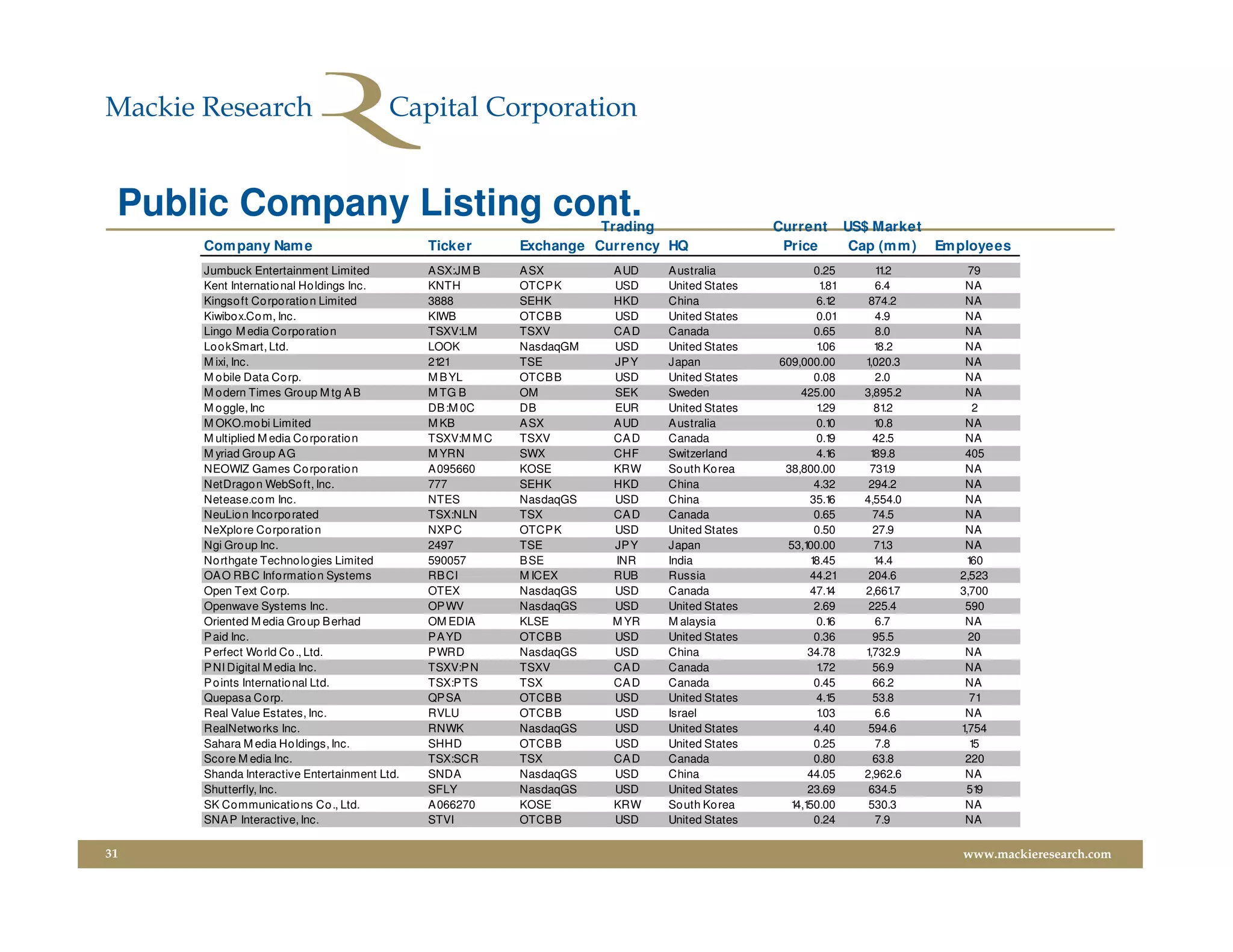

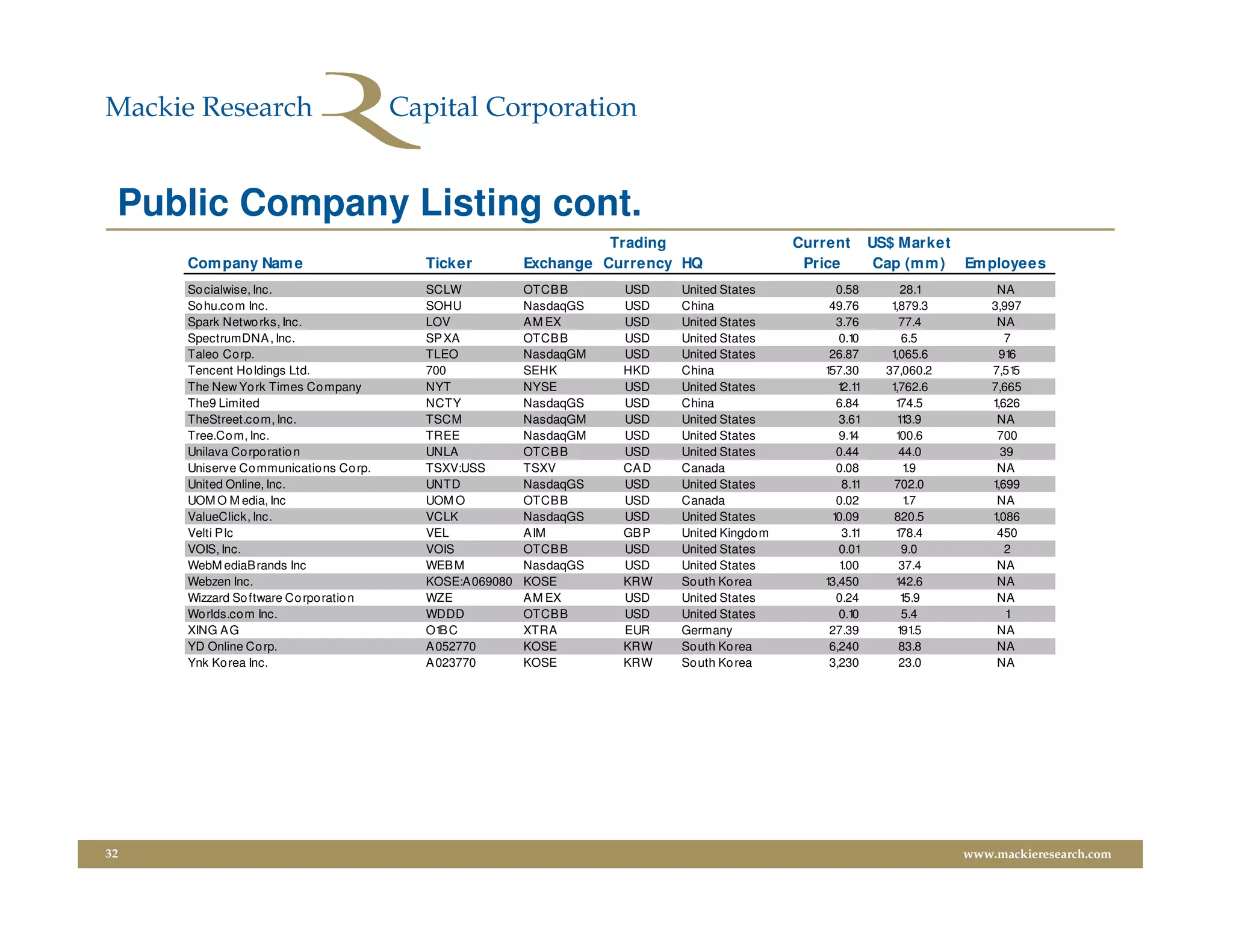

The report discusses recent investments and performance metrics in the digital technology sector, highlighting Tencent's $300 million investment in Digital Sky Technologies and DST's $135 million investment in Groupon. It provides financial results for multiple companies, indicating varied revenue growth and profitability in 2009, along with detailed public company data including market capitalization and revenue. Additionally, the valuation metrics for web 2.0 public companies are presented, showcasing trends in market performance.