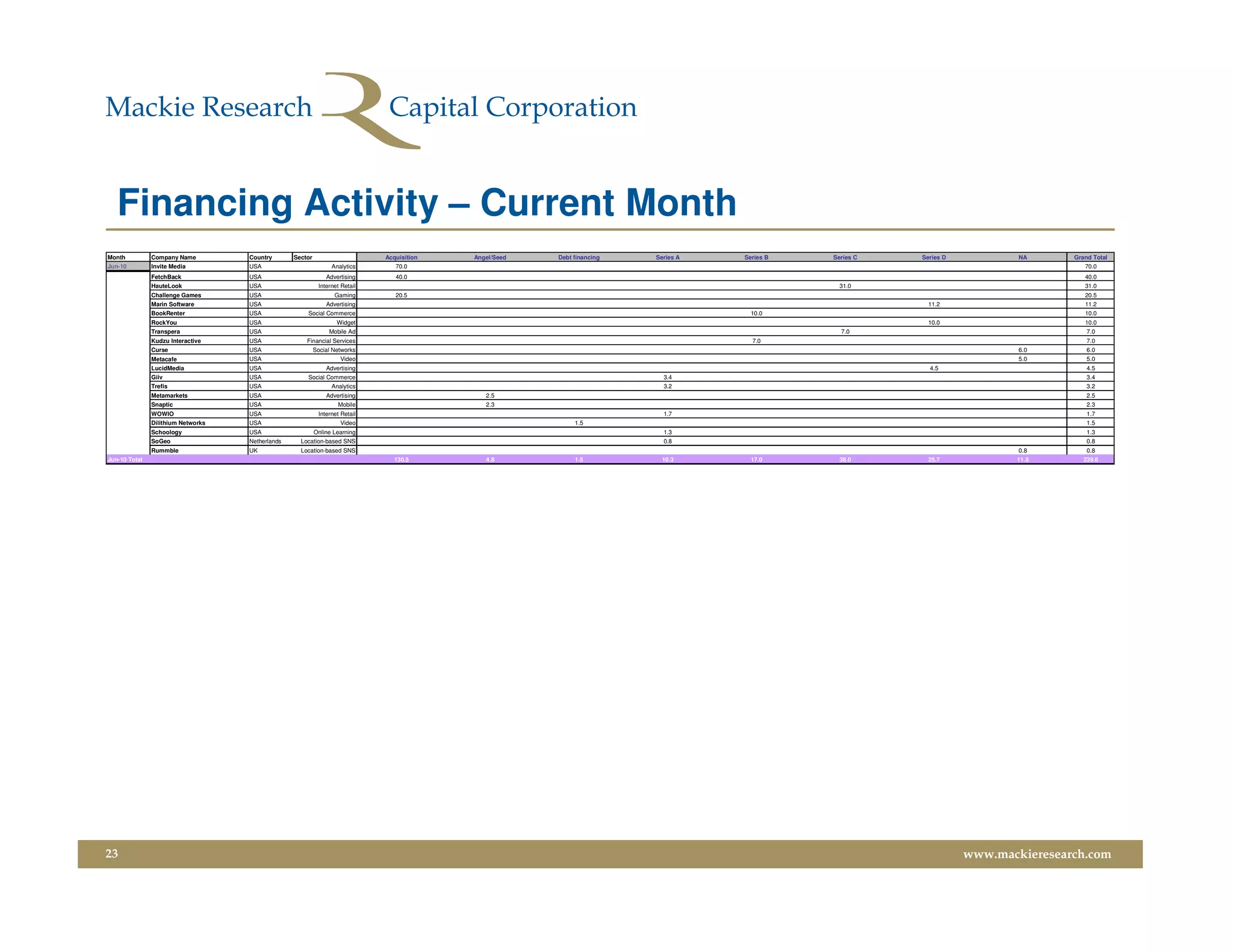

Google acquired advertising analytics firm Invite Media for $70 million. Zynga acquired virtual goods game maker Challenge Games for $20.5 million. FetchBack, a post-customer interaction advertising platform, was acquired by GSI Commerce for $40 million. Shanda Interactive reported a 16% year-over-year revenue decline to $1.1 billion as the company's gaming revenues registered a decline.