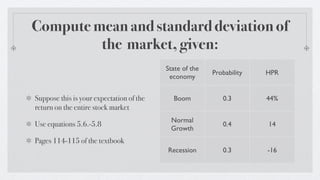

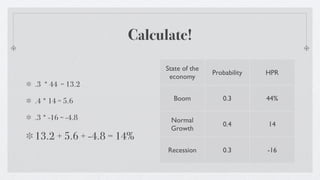

The document provides information to calculate the mean and standard deviation of historical percentage returns (HPR) for the stock market given different economic states and their probabilities.

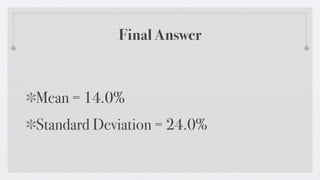

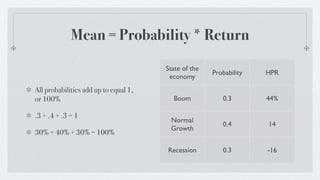

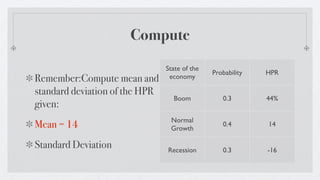

[1] The mean HPR is calculated as the weighted average of returns based on probabilities, which equals 14%.

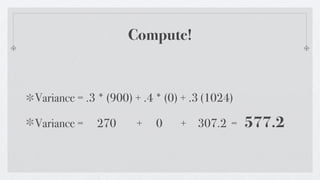

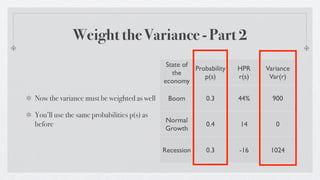

[2] Variance is calculated by taking the difference of each return from the mean, squaring it, and weighting it by the probabilities.

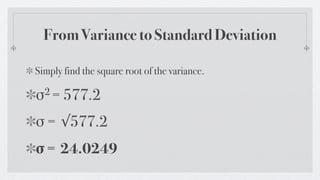

[3] Standard deviation is the square root of variance, which equals 24.0249% or approximately 24.0% rounded.

![Finding variance - Part 1

State of the Probability HPR

economy p(s) r(s)

Simply subtract the expected return from

the HPR for each row, and square that value Boom 0.3 44%

[r(s) - E(r)]2

Normal

0.4 14

Growth

Remember: We calculated E(r) = 14

Recession 0.3 -16](https://image.slidesharecdn.com/05-05variance-120317001302-phpapp02/85/Risk-and-Return-Problem-Chapter-5-11-320.jpg)

![Compute!

HPR

r(s) - E(r) [r(s) - E(r)]2

r(s)

Subtract E(r) from each HPR to find 44 44-14 = 30 30 2 =900

the difference.

Then, square this number. 14 14-14 = 0 0 2 =0

-16 -16 - 14 = -32 -32 2 =1024](https://image.slidesharecdn.com/05-05variance-120317001302-phpapp02/85/Risk-and-Return-Problem-Chapter-5-12-320.jpg)

![Equation for Variance

σ 2 = ∑ p(s) [r(s) - E(r)]2](https://image.slidesharecdn.com/05-05variance-120317001302-phpapp02/85/Risk-and-Return-Problem-Chapter-5-14-320.jpg)