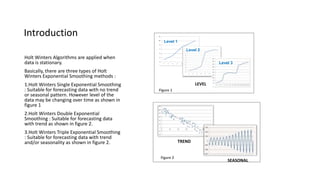

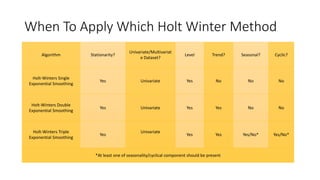

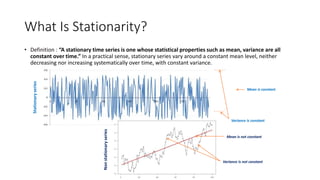

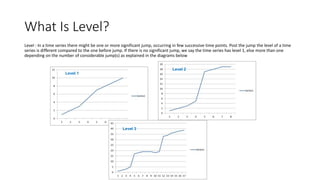

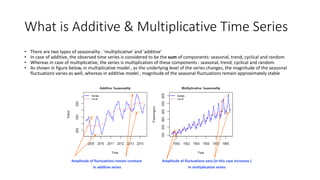

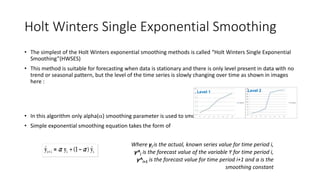

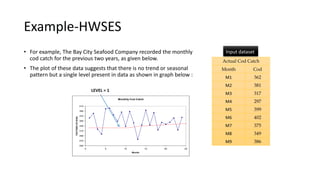

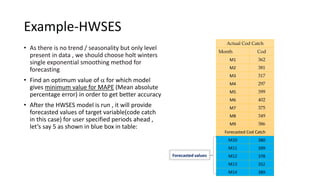

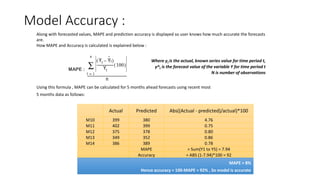

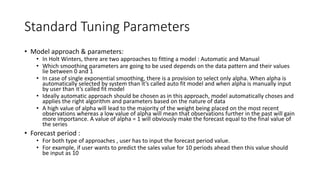

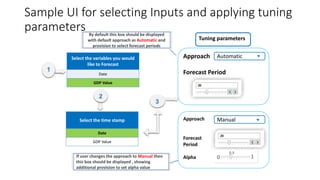

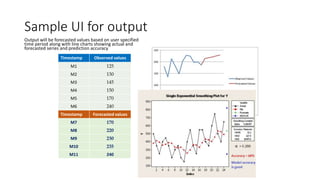

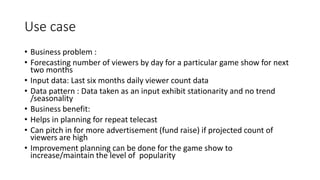

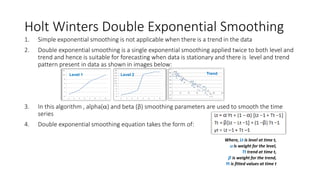

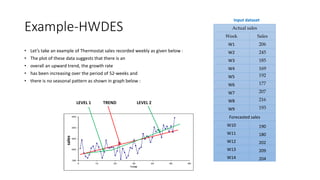

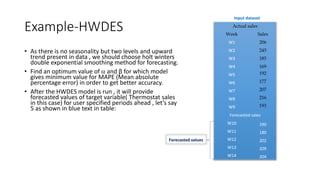

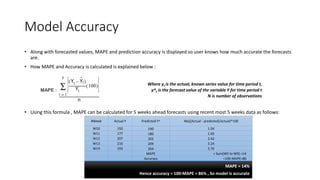

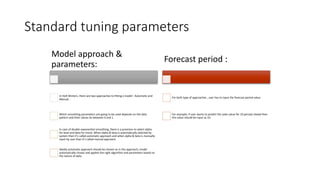

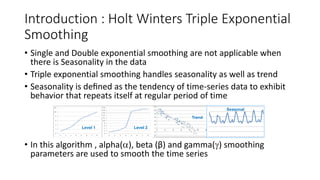

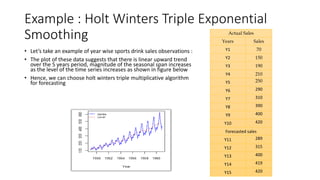

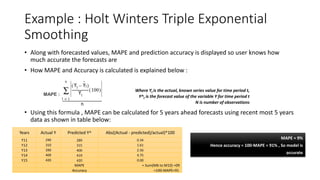

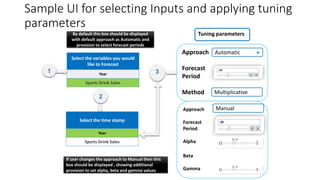

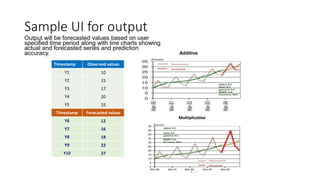

The document provides an overview of Holt-Winters exponential smoothing methods for time series forecasting, categorizing them into three types: single, double, and triple exponential smoothing, each suitable for different data patterns like trend and seasonality. It explains key concepts such as stationarity, level, and the distinction between additive and multiplicative time series components. Furthermore, it highlights the importance of selecting appropriate smoothing parameters to improve forecast accuracy, using examples to demonstrate the application of each method.