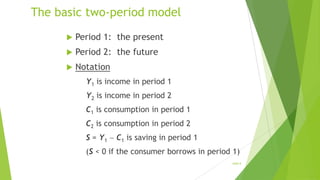

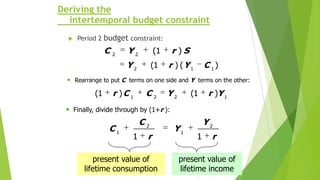

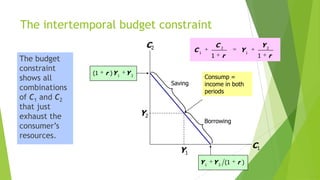

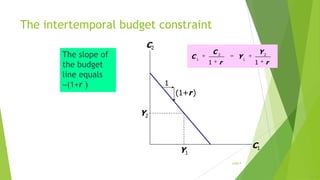

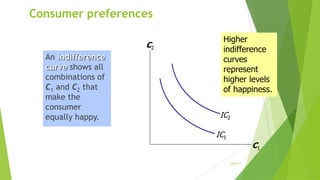

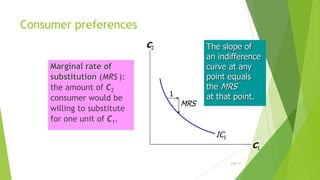

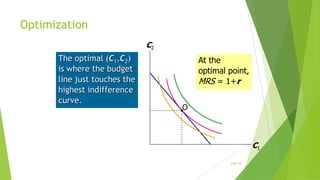

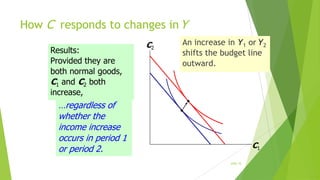

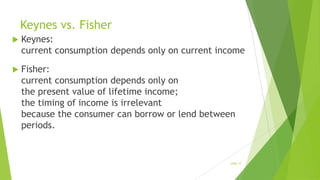

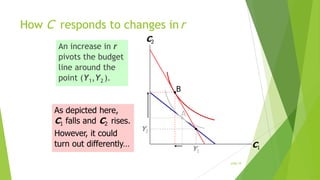

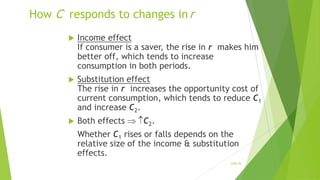

The document summarizes Irving Fisher's work on intertemporal choice theory and consumption. It discusses (1) Fisher's assumption that consumers maximize lifetime satisfaction subject to an intertemporal budget constraint, (2) a basic two-period model where consumption in period 1 (C1) and period 2 (C2) exhaust lifetime income, (3) how the intertemporal budget constraint relates C1 and C2 to present values of lifetime income and consumption, (4) indifference curves representing consumer preferences between C1 and C2, and (5) how consumption responds to changes in income and interest rates according to the model.