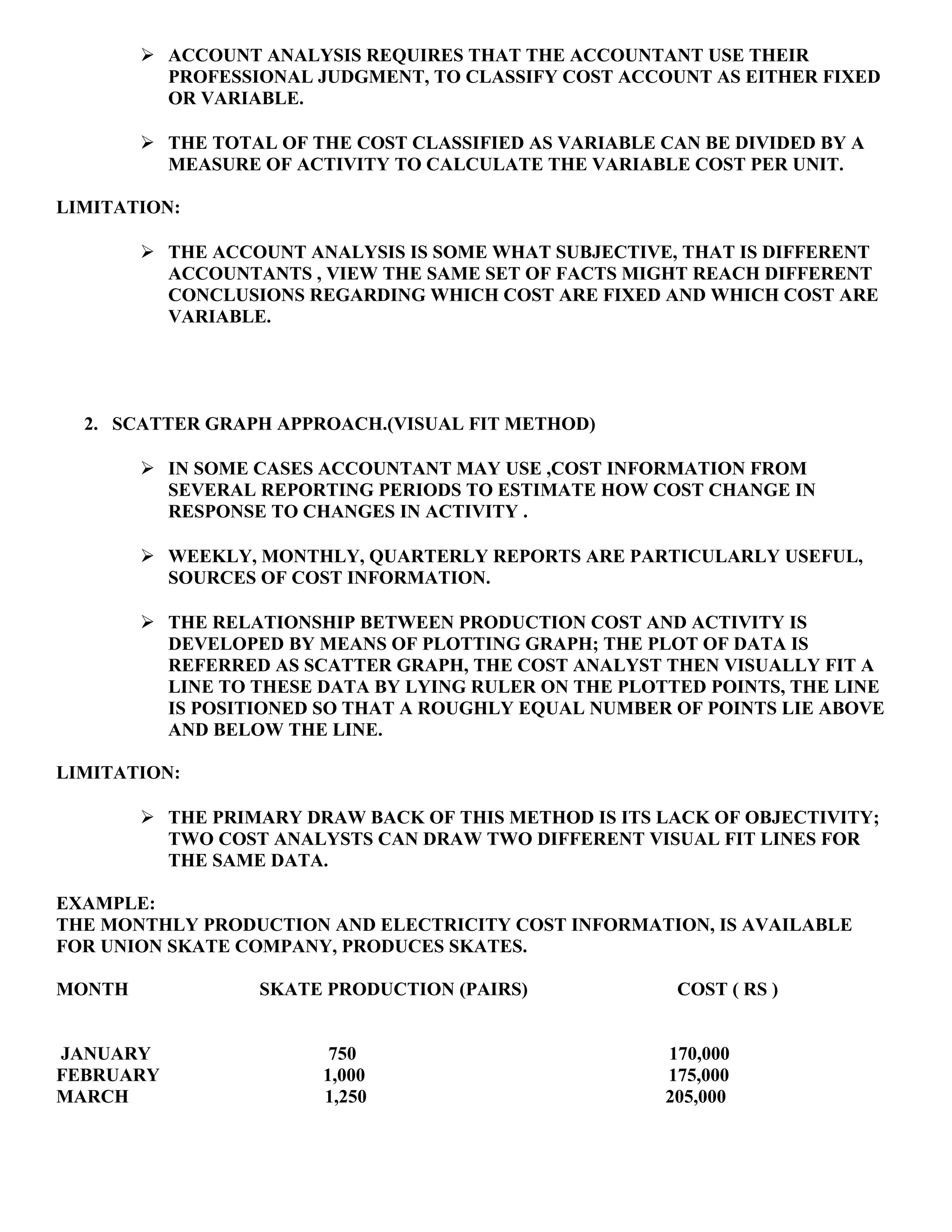

This document discusses cost classification concepts in managerial accounting. It defines cost as a sacrifice of resources measured monetarily. Management accountants pay attention to costs for planning, evaluation, and decision making. Costs can be classified in various ways depending on their intended use, including by manufacturing vs. non-manufacturing, traceability, behavior, and controllability. Common classifications include direct/indirect materials, direct/indirect labor, variable/fixed, and controllable/uncontrollable costs. Techniques for estimating the fixed and variable components of mixed costs include account analysis, scatter graph, high-low method, and regression analysis. Cost behavior is only valid within a relevant range of activity levels.