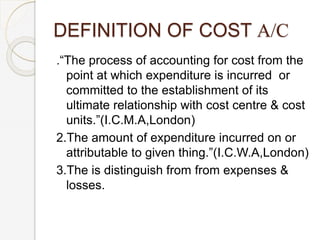

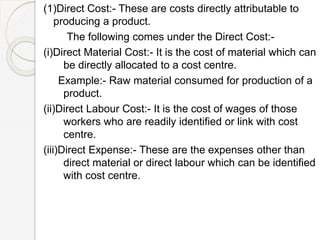

The document provides an overview of cost accounting, emphasizing its significance in measuring and controlling costs to enhance business efficiency. It covers definitions, classifications of costs, the role of cost accounting in decision-making, and its relationship with management accounting. Additionally, it discusses various techniques and terms related to cost analysis, including break-even points and cost control methods.