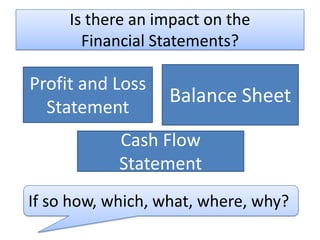

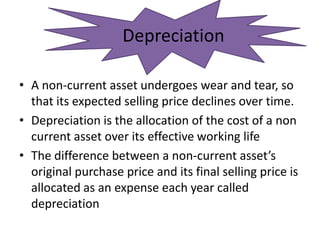

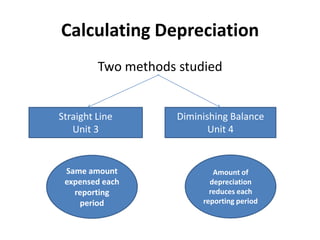

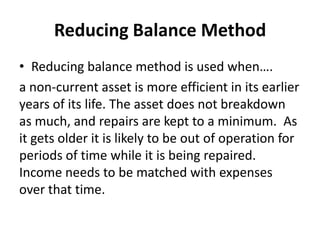

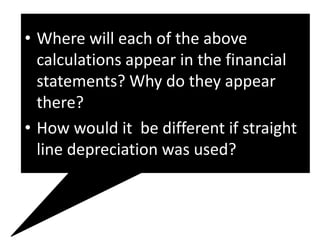

The document discusses the financial impact of purchasing a forklift over a five-year period, focusing on how depreciation affects financial statements such as profit and loss, balance sheet, and cash flow. It highlights the methods of calculating depreciation, including straight-line and diminishing balance, using a tractor purchase by Farmer Fred as a practical example. The text aims to illustrate the allocation of costs and the reporting of depreciation in financial documentation, also encouraging further engagement and reflection on the topic.