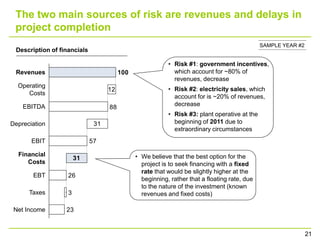

1. SunShare is building a 1 MWp photovoltaic power plant in Italy and offering small shares to individuals ranging from €2,500 to €100,000, rewarding them with an annual 12% return.

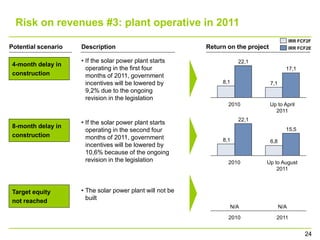

2. The Italian solar energy market is a robust investment opportunity due to attractive regulatory frameworks that guarantee incentives fixed for 20 years.

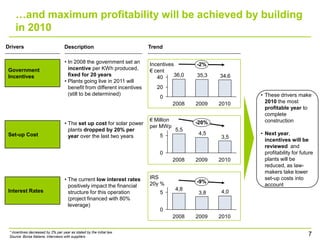

3. Maximum profitability will be achieved by building the plant in 2010 due to high government incentives that year and decreasing set-up costs for solar power plants.