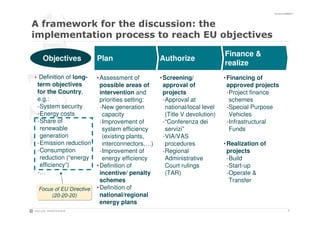

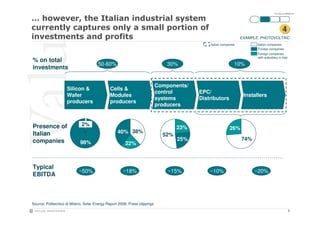

This 3-page document discusses objectives and plans for Italy's energy sector to meet 2020 targets for renewable energy generation, emission reduction, and energy efficiency.

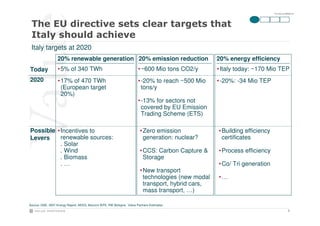

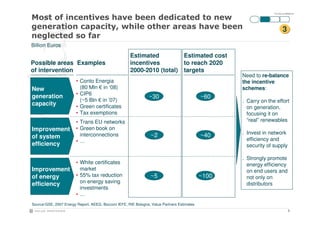

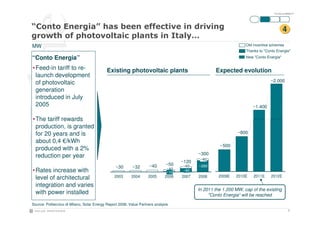

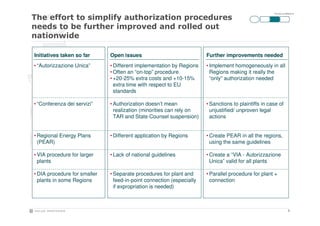

It outlines Italy's targets of achieving 20% renewable energy generation, a 20% reduction in emissions, and 20% improved energy efficiency by 2020 based on EU directives. Potential levers are identified such as incentives for renewable sources, carbon capture and storage, and initiatives to improve building and industrial efficiency.

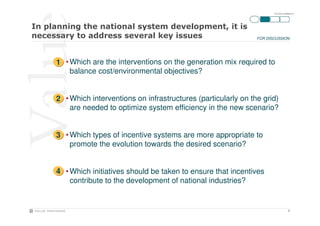

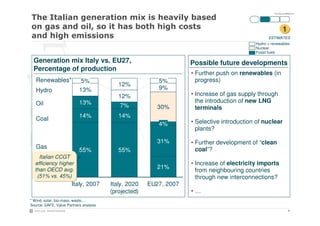

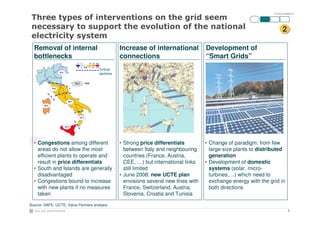

Projected generation mixes for Italy and the EU in 2020 are presented, indicating an expected increase in renewable sources like solar and wind power. Open discussion points are posed around interventions needed in the generation mix, grid infrastructure improvements, and appropriate incentive systems.