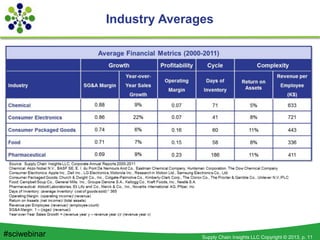

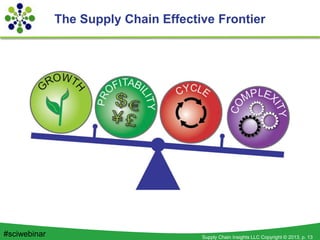

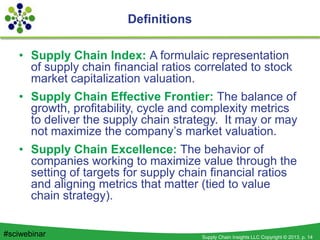

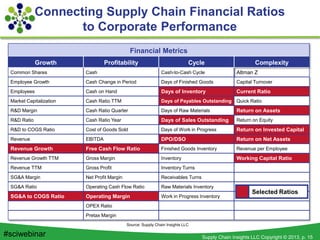

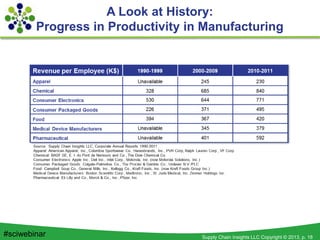

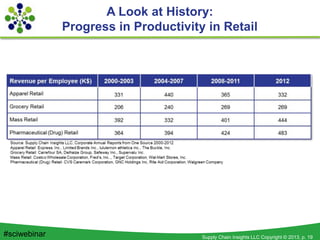

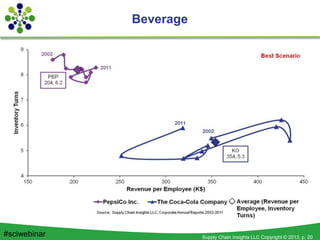

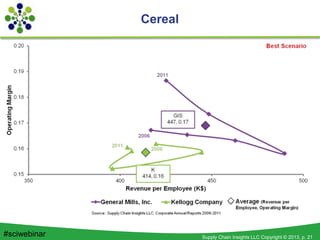

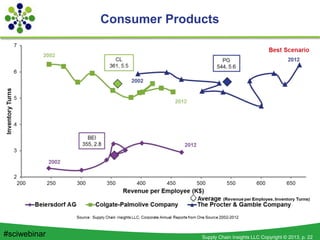

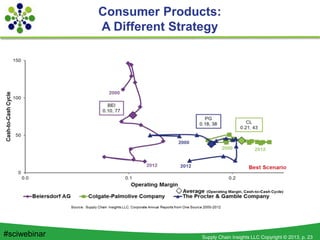

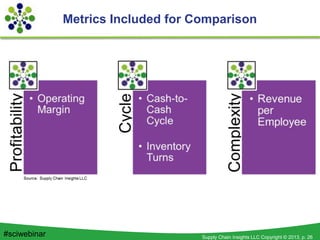

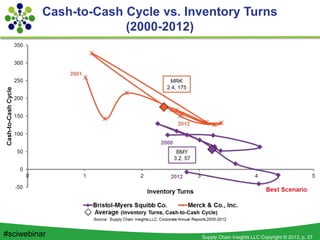

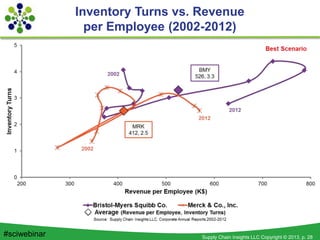

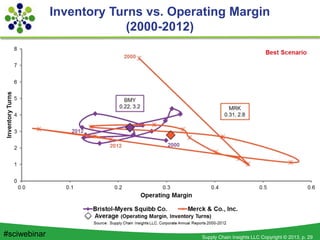

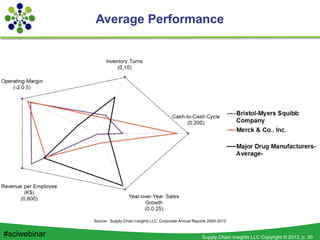

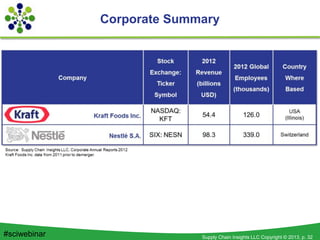

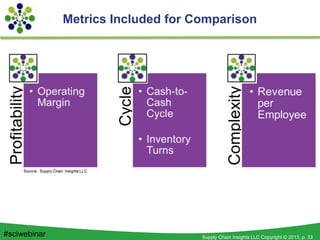

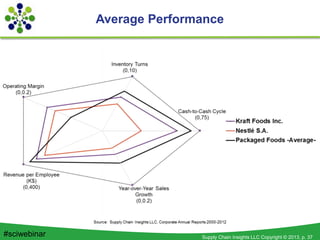

The document discusses the significant relationship between supply chain management and corporate performance, emphasizing the need for strategic alignment and metrics that matter for enhancing company value. It introduces the concept of a 'supply chain index' to evaluate financial ratios against market valuation and highlights best practices for achieving supply chain excellence. Additionally, it outlines upcoming training programs and webinars by Supply Chain Insights to further educate on these topics.