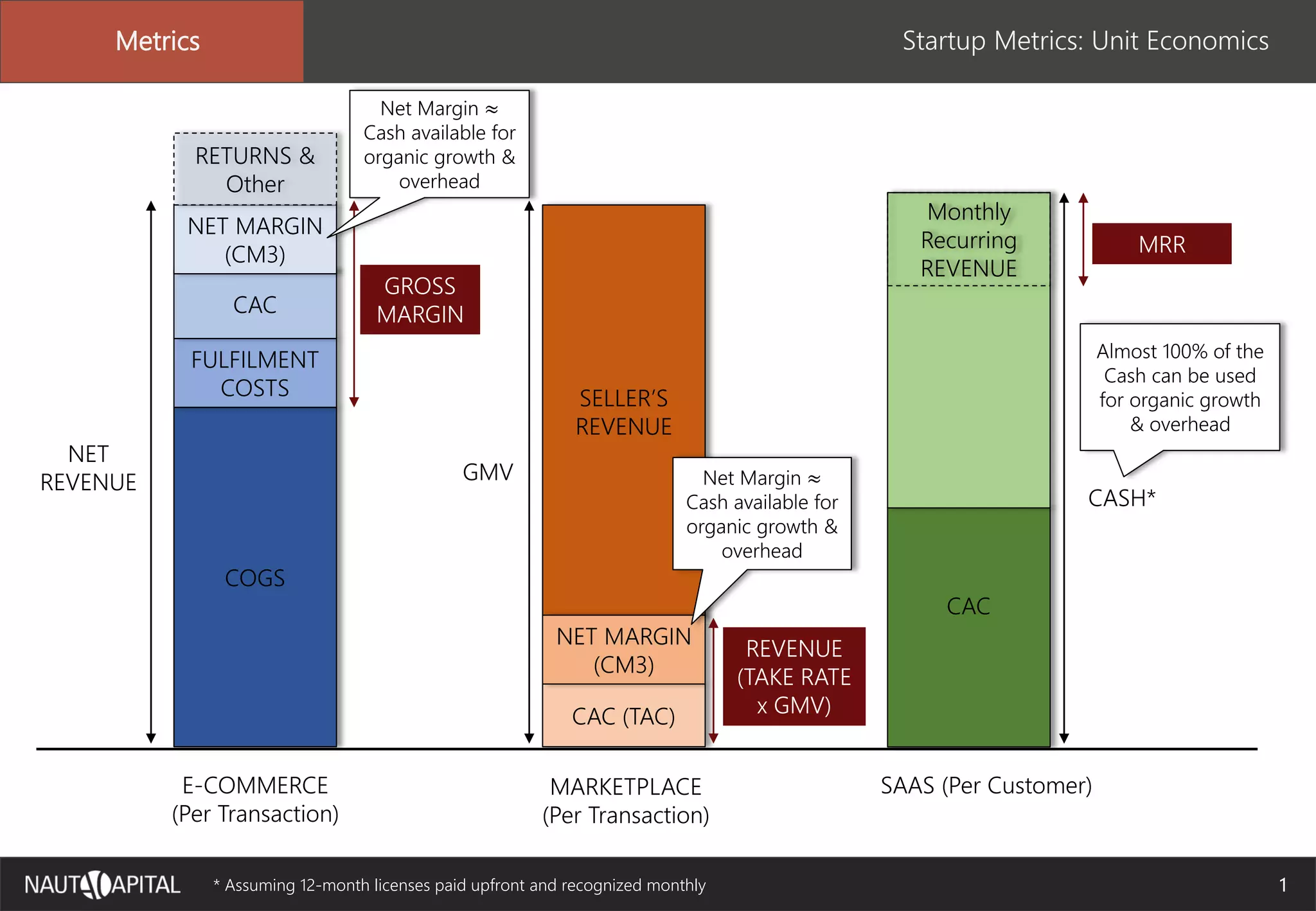

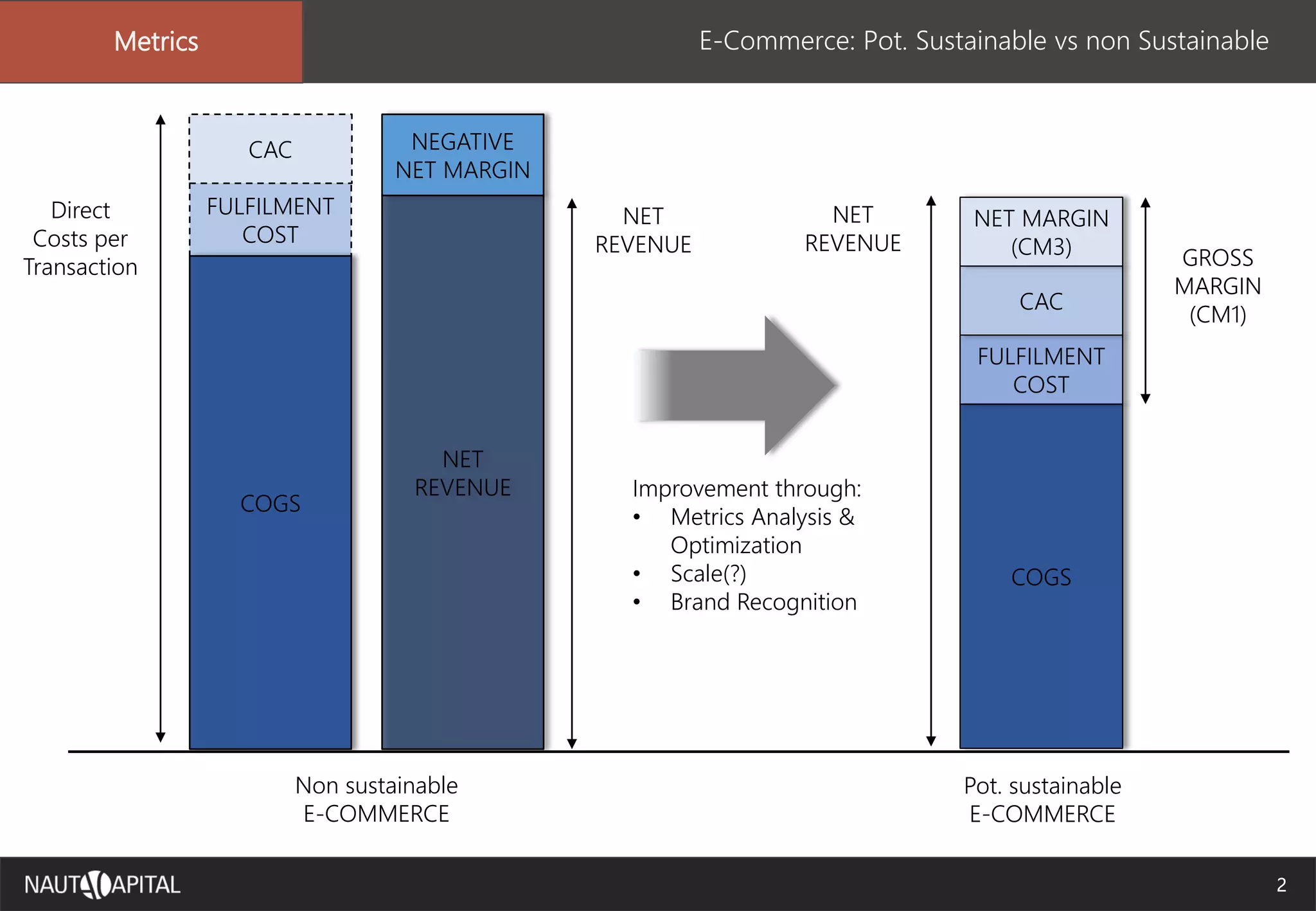

This document discusses key metrics for evaluating the unit economics of different business models including e-commerce, marketplaces, and SaaS. For e-commerce and marketplaces, it distinguishes between potentially sustainable and non-sustainable scenarios based on whether net margins are positive or negative after accounting for costs like fulfillment, COGS, and customer acquisition costs. For SaaS, it introduces metrics like customer lifetime value (CLTV), churn, monthly recurring revenue (MRR), and cash-on-cash return to assess sustainability. Examples are provided for analyzing churn rates and using cohort analysis to understand net MRR churn. The document also provides a framework for evaluating SaaS businesses as good, okay, or non-