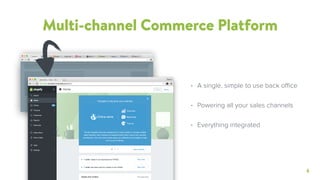

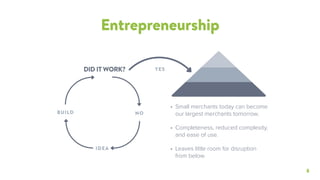

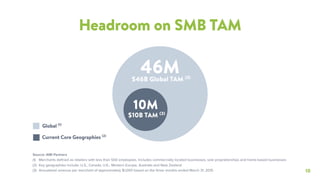

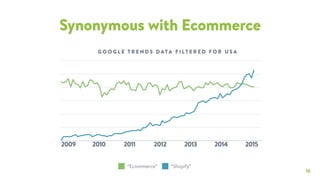

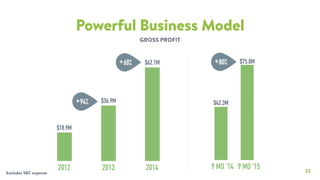

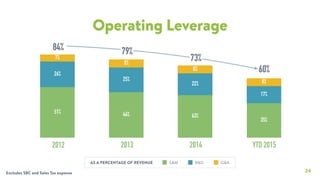

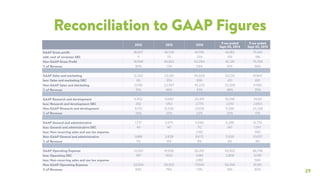

Shopify is an e-commerce platform that powers over 200,000 active merchants with $1.9 billion in GMV in Q3 2015. The document discusses Shopify's multi-channel commerce platform that allows merchants to manage sales across all channels through a single integrated back office. It highlights Shopify's growing merchant base and financials including strong and consistent growth in revenue, monthly recurring revenue, and GMV driven by new merchants and solutions.