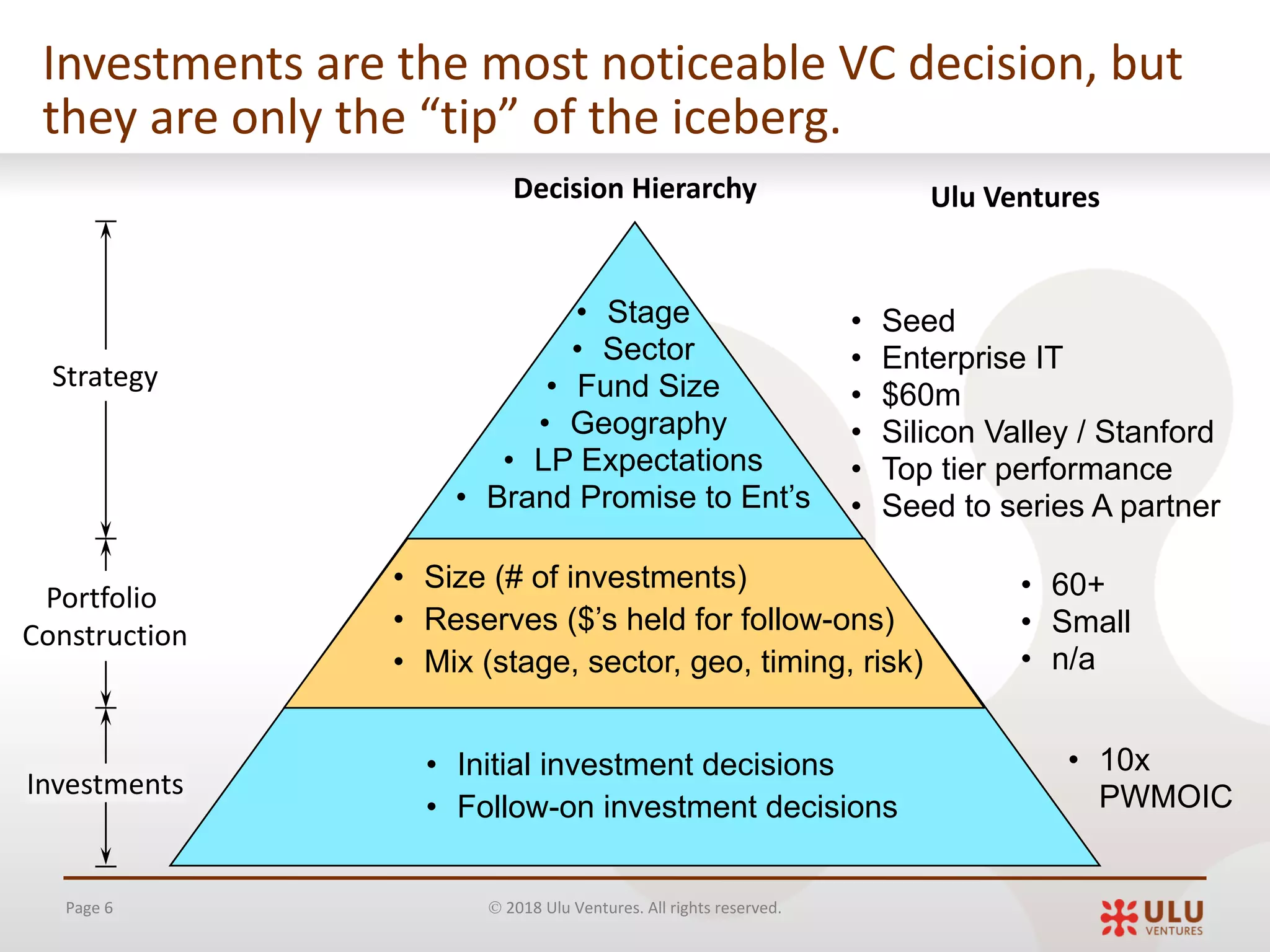

The document outlines Ulu Ventures' approach to venture capital decision-making, emphasizing a disciplined process for evaluating investments that includes qualitative sorting, risk assessment, and sensitivity analysis. It highlights the importance of portfolio construction, leveraging a larger number of investments to mitigate risks and enhance returns. Ulu Ventures also discusses their unique filtering criteria and the significance of early-stage investment success probabilities, aiming for outlier returns through a diversified investment strategy.