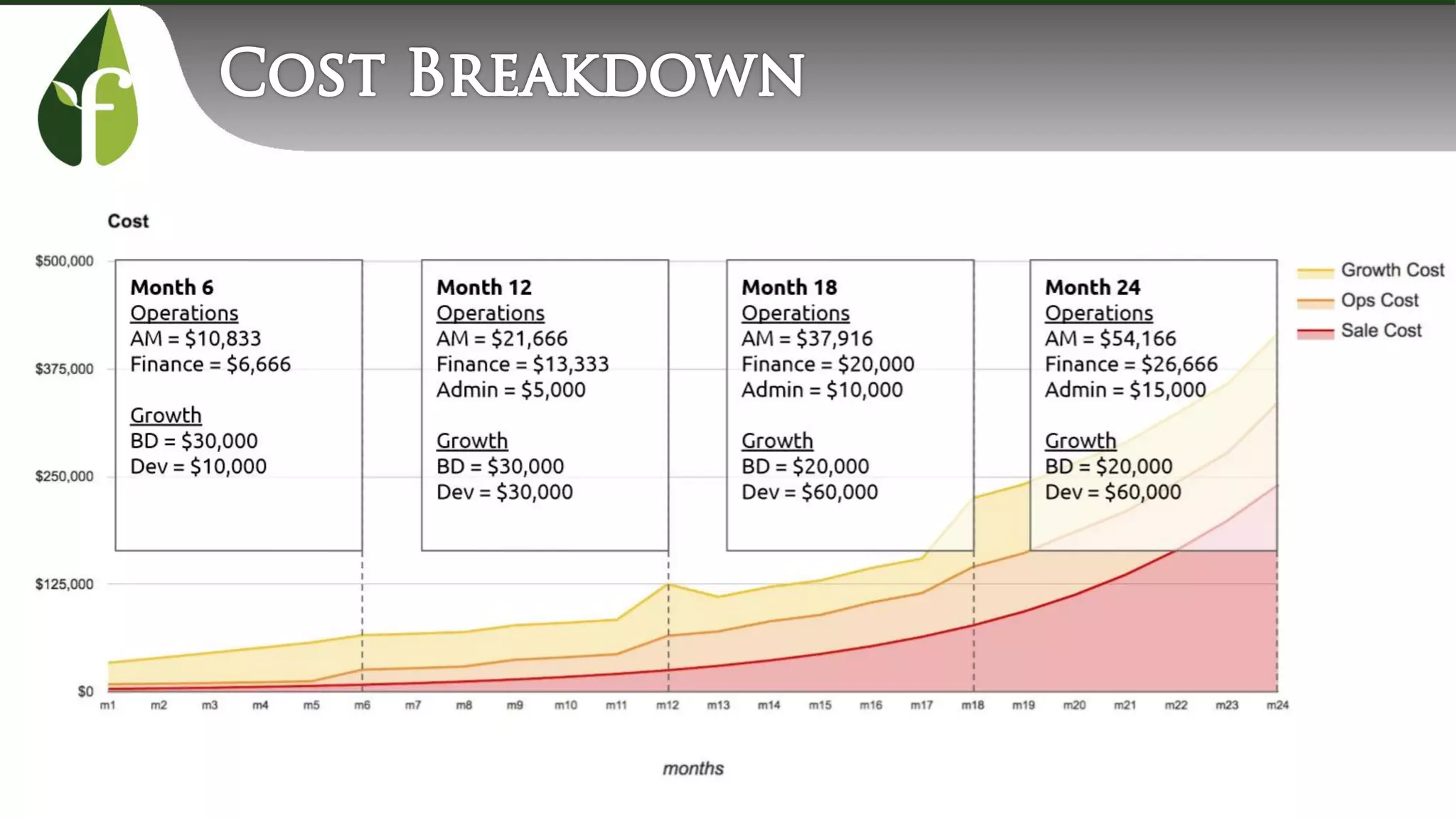

- It is important for early stage startups to monitor their monthly burn rate as running out of cash is a major cause of failure. Burn rate is calculated as the cash balance at the beginning of the period minus the end balance divided by the number of months.

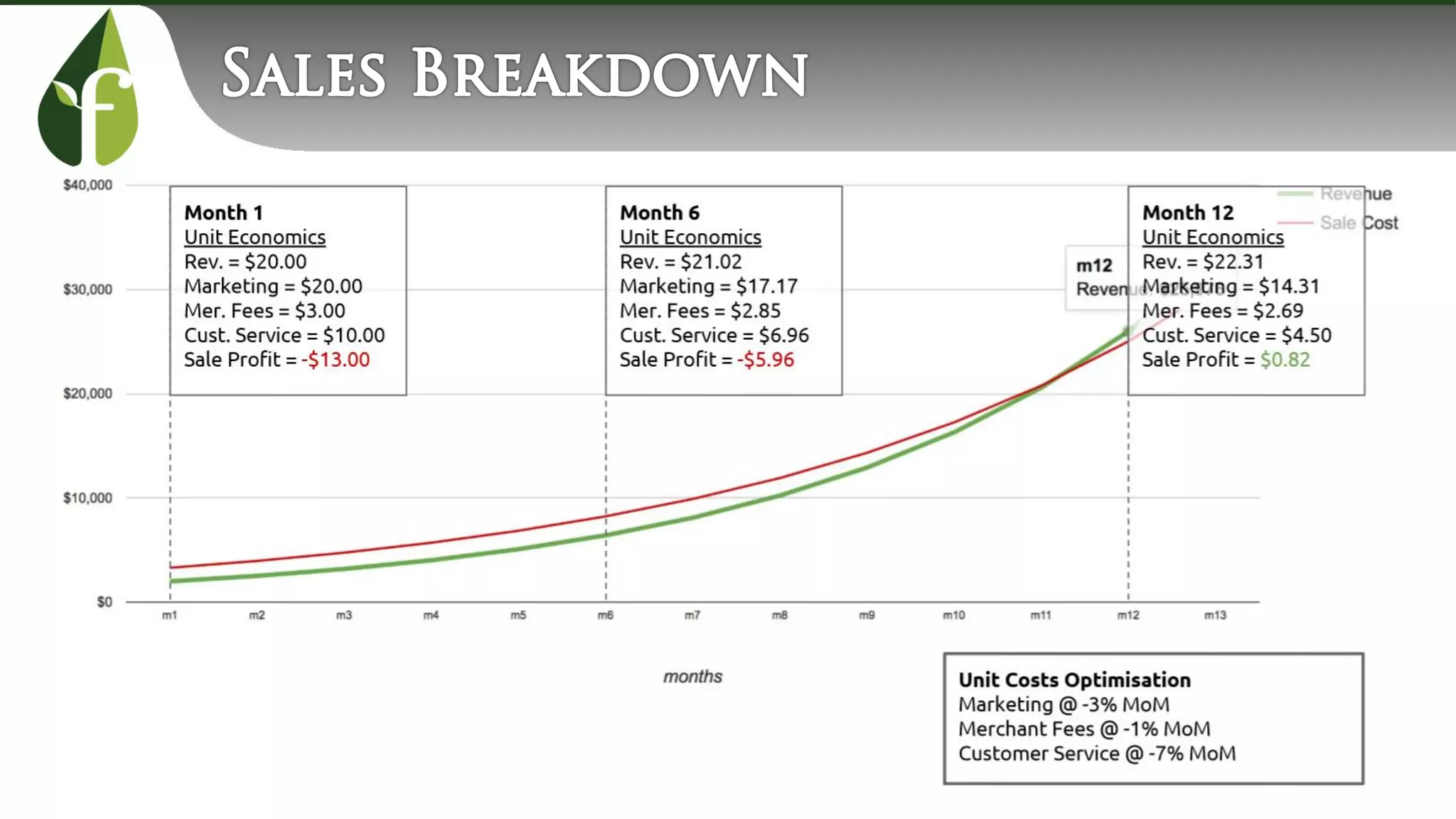

- Understanding unit economics, including revenues, customer acquisition costs, operational costs, and lifetime value is essential for evaluating the viability and profitability of a business model. Realistic forecasts are needed around these metrics.

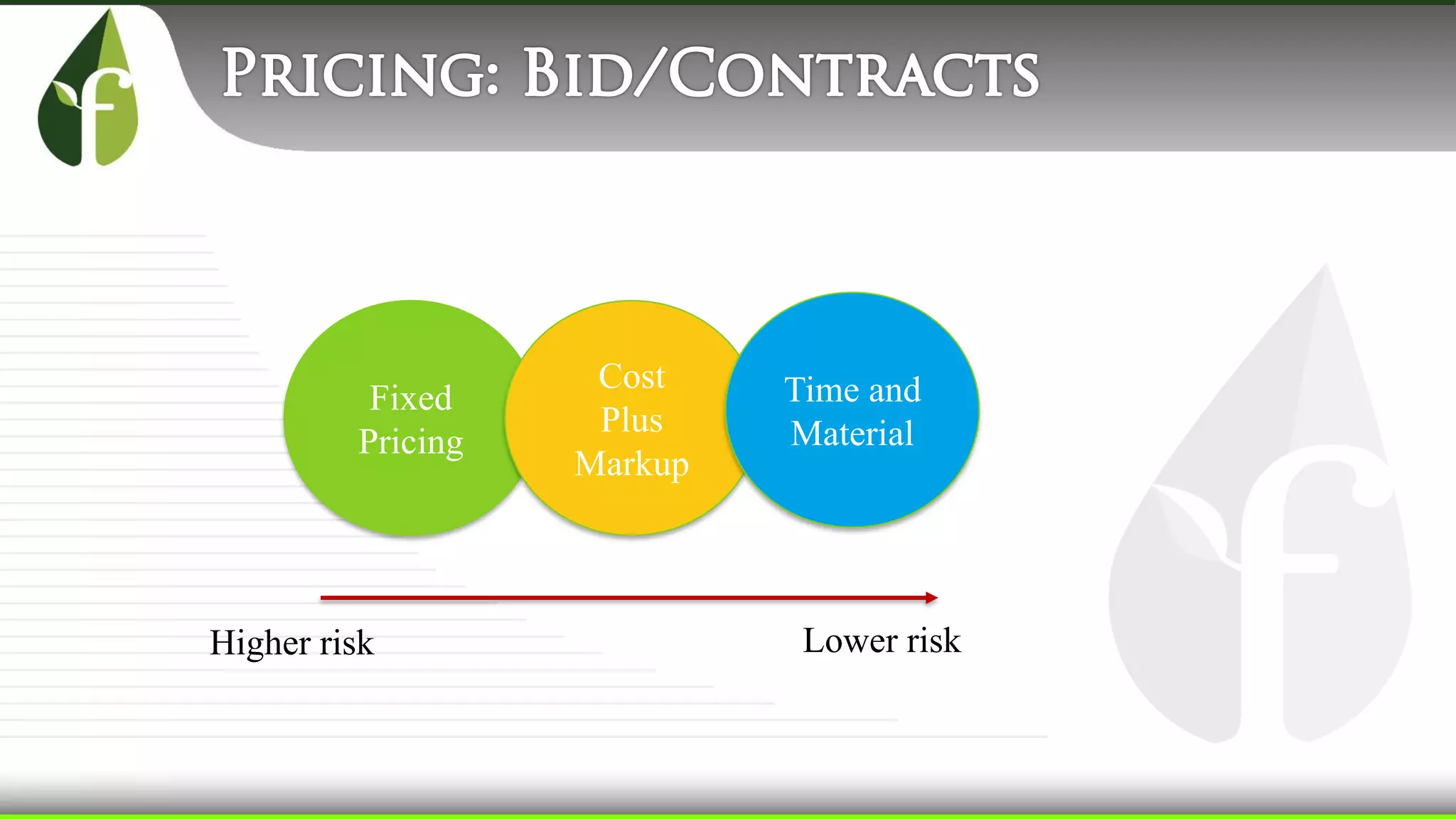

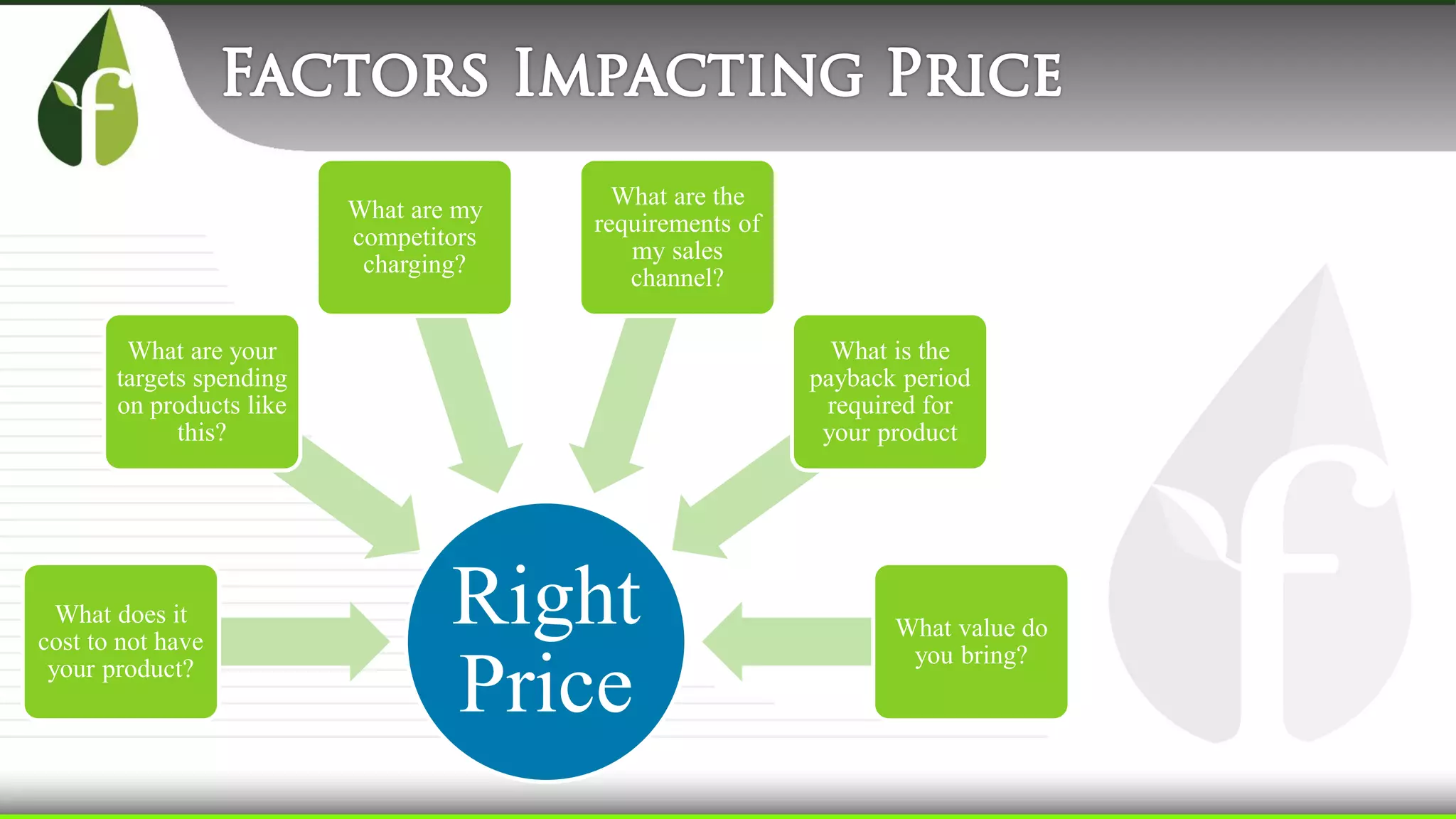

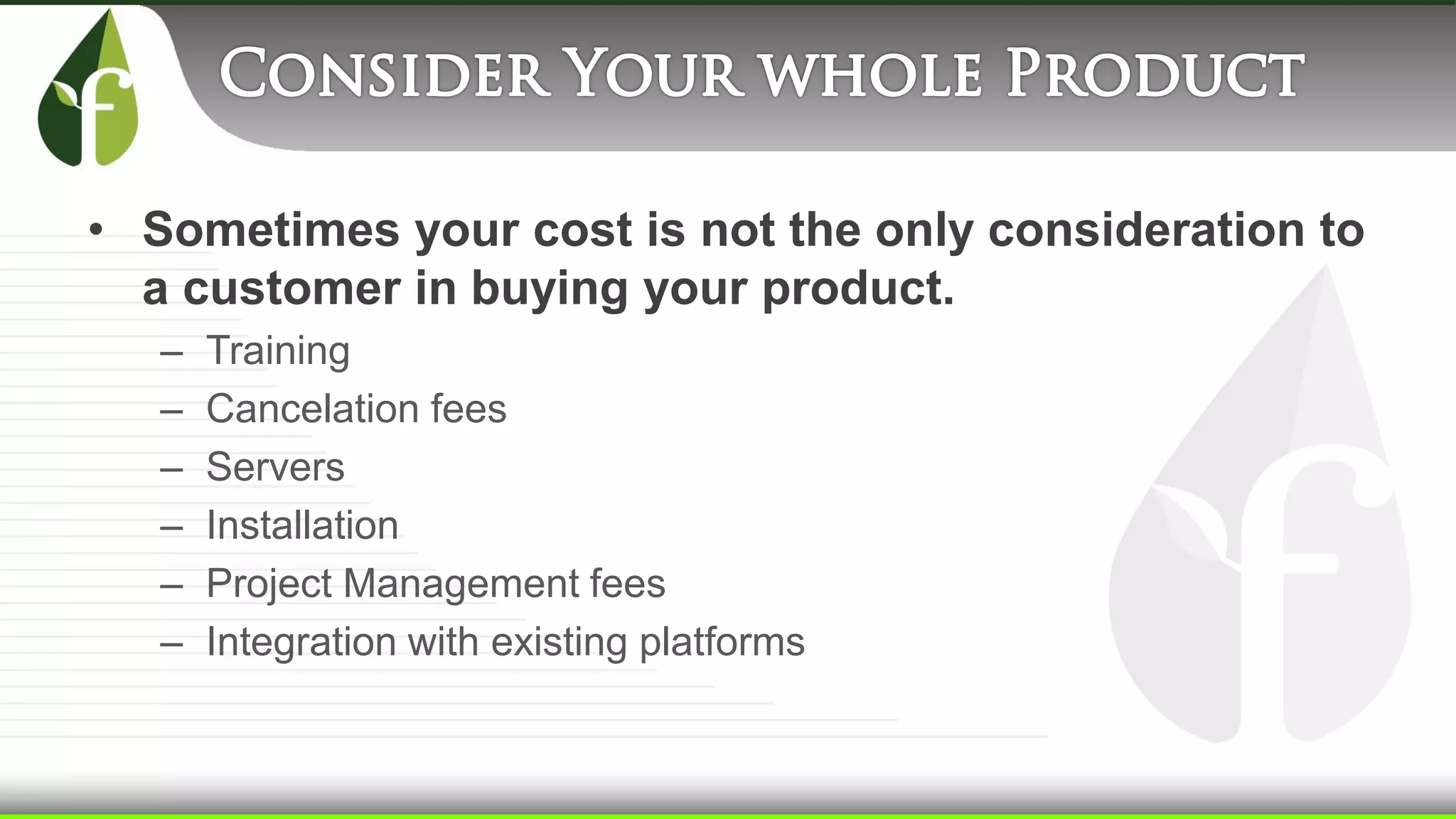

- There are many factors to consider when determining the right price for a product or service, including costs, value provided, competitors' prices, and requirements of sales channels among others. Pricing strategies also require consideration around discounts, promotions, and maxim