5 November Daily market report

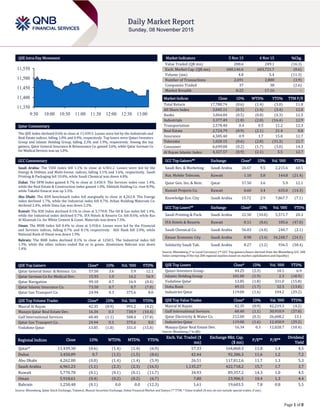

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.6% to close at 11,439.3. Losses were led by the Industrials and Real Estate indices, falling 1.0% and 0.9%, respectively. Top losers were Qatari Investors Group and Islamic Holding Group, falling 2.3% and 1.9%, respectively. Among the top gainers, Qatar General Insurance & Reinsurance Co. gained 3.6%, while Qatar German Co for Medical Devices was up 1.0%. GCC Commentary Saudi Arabia: The TASI Index fell 1.1% to close at 6,961.2. Losses were led by the Energy & Utilities and Multi-Invest. indices, falling 3.1% and 1.6%, respectively. Saudi Printing & Packaging fell 10.0%, while Saudi Chemical was down 4.0%. Dubai: The DFM Index gained 0.7% to close at 3,450.9. The Services index rose 1.4%, while the Real Estate & Construction index gained 1.0%. Ekttitab Holding Co. rose 8.9%, while Takaful Emarat was up 5.5%. Abu Dhabi: The ADX benchmark index fell marginally to close at 4,262.8. The Energy index declined 1.7%, while the Industrial index fell 0.7%. Arkan Building Materials Co. declined 2.4%, while Dana Gas was down 2.2%. Kuwait: The KSE Index declined 0.1% to close at 5,770.8. The Oil & Gas index fell 1.4%, while the Industrial index declined 0.7%. IFA Hotels & Resorts Co. fell 8.6%, while Ras Al Khaimah Co. for White Cement & Const. Materials was down 7.3%. Oman: The MSM Index fell 0.4% to close at 5,918.6. Losses were led by the Financial and Services indices, falling 0.7% and 0.1% respectively. Ahli Bank fell 2.0%, while National Bank of Oman was down 1.9%. Bahrain: The BHB Index declined 0.1% to close at 1250.5. The Industrial index fell 1.3%, while the other indices ended flat or in green. Aluminium Bahrain was down 1.4%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar General Insur. & Reinsur. Co. 57.50 3.6 5.9 12.1 Qatar German Co for Medical Dev. 15.93 1.0 16.2 56.9 Qatar Navigation 99.10 0.7 16.9 (0.4) Qatar Islamic Insurance Co. 73.50 0.7 0.7 (7.0) Qatar Gas Transport Co. 24.94 0.3 375.6 8.0 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Masraf Al Rayan 42.35 (0.9) 991.2 (4.2) Mazaya Qatar Real Estate Dev. 16.34 0.3 738.9 (10.4) Gulf International Services 60.40 (1.1) 508.4 (37.8) Qatar Gas Transport Co. 24.94 0.3 375.6 8.0 Vodafone Qatar 13.85 (1.8) 331.0 (15.8) Market Indicators 5 Nov 15 4 Nov 15 %Chg. Value Traded (QR mn) 208.6 249.1 (16.3) Exch. Market Cap. (QR mn) 600,146.6 603,721.7 (0.6) Volume (mn) 4.8 5.4 (11.3) Number of Transactions 2,691 2,800 (3.9) Companies Traded 37 38 (2.6) Market Breadth 8:25 17:16 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,780.74 (0.6) (1.4) (3.0) 11.8 All Share Index 3,045.11 (0.5) (1.4) (3.4) 12.0 Banks 3,064.84 (0.5) (0.8) (4.3) 12.5 Industrials 3,377.49 (1.0) (2.8) (16.4) 12.9 Transportation 2,578.40 0.4 0.5 11.2 12.3 Real Estate 2,724.79 (0.9) (2.1) 21.4 8.8 Insurance 4,585.40 0.9 1.7 15.8 12.7 Telecoms 1,020.15 (0.6) (2.8) (31.3) 21.7 Consumer 6,699.00 (0.2) (1.7) (3.0) 14.3 Al Rayan Islamic Index 4,327.57 (0.9) (2.1) 5.5 12.7 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Res. & Marketing Saudi Arabia 26.67 9.5 2,215.6 60.5 Nat. Mobile Telecom. Kuwait 1.10 5.8 144.8 (21.4) Qatar Gen. Ins. & Rein. Qatar 57.50 3.6 5.9 12.1 Kuwait Projects Co. Kuwait 0.60 3.4 635.0 (14.3) Knowledge Eco. City Saudi Arabia 15.72 2.9 7,867.7 (7.1) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Printing & Pack. Saudi Arabia 22.50 (10.0) 5,571.7 20.3 IFA Hotels & Resorts Kuwait 0.11 (8.6) 185.6 (47.0) Saudi Chemical Co. Saudi Arabia 56.03 (4.0) 240.7 (2.1) Emaar Economic City Saudi Arabia 8.98 (3.4) 34,248.7 (24.5) Solidarity Saudi Tak. Saudi Arabia 8.27 (3.2) 936.5 (58.4) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatari Investors Group 44.25 (2.3) 18.1 6.9 Islamic Holding Group 101.00 (1.9) 2.3 (18.9) Vodafone Qatar 13.85 (1.8) 331.0 (15.8) Doha Bank 49.15 (1.7) 32.5 (13.8) Industries Qatar 119.00 (1.6) 104.2 (29.2) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Masraf Al Rayan 42.35 (0.9) 42,219.3 (4.2) Gulf International Services 60.40 (1.1) 30,910.9 (37.8) Qatar Electricity & Water Co. 212.00 (0.3) 26,608.2 13.1 Industries Qatar 119.00 (1.6) 12,450.9 (29.2) Mazaya Qatar Real Estate Dev. 16.34 0.3 12,028.7 (10.4) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 11,439.30 (0.6) (1.4) (1.4) (6.9) 57.33 164,860.3 11.8 1.4 4.5 Dubai 3,450.89 0.7 (1.5) (1.5) (8.6) 42.44 92,386.3 11.6 1.2 7.2 Abu Dhabi 4,262.80 (0.0) (1.4) (1.4) (5.9) 26.51 117,812.6 11.7 1.3 5.3 Saudi Arabia 6,961.23 (1.1) (2.3) (2.3) (16.5) 1,135.27 422,718.2 15.7 1.7 3.7 Kuwait 5,770.78 (0.1) (0.1) (0.1) (11.7) 34.93 89,357.2 14.3 1.0 4.5 Oman 5,918.61 (0.4) (0.2) (0.2) (6.7) 7.80 23,906.5 10.4 1.3 4.4 Bahrain 1,250.48 (0.1) 0.0 0.0 (12.3) 1.61 19,603.5 7.8 0.8 5.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,350 11,400 11,450 11,500 11,550 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index declined 0.6% to close at 11,439.3. The Industrials and Real Estate indices led the losses. The index fell on the back of selling pressure from non-Qatari and GCC shareholders despite buying support from Qatari shareholders. Qatari Investors Group and Islamic Holding Group were the top losers, falling 2.3% and 1.9%, respectively. Among the top gainers, Qatar General Insurance & Reinsurance Co. gained 3.6%, while Qatar German Co for Medical Devices was up 1.0%. Volume of shares traded on Thursday fell by 11.3% to 4.8mn from 5.4mn on Wednesday. Further, as compared to the 30-day moving average of 7.3mn, volume for the day was 34.2% lower. Masraf Al Rayan and Mazaya Qatar Real Estate Development were the most active stocks, contributing 20.7% and 15.4% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings Releases, Global Economic Data and Earnings Calendar Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change Saudi British Bank (SABB) S&P Saudi Arabia LT CCR/ST CCR A/A-1 A/A-1 – Negative Saudi Investment Bank (SAIB) S&P Saudi Arabia LT CR/ST CR A-/A-2 BBB+/A-2 Negative – Samba Financial Group (SFG) S&P Saudi Arabia LT CCR/ST CCR A+/A-1 A/A-1 Negative – Riyad Bank S&P Saudi Arabia LT CCR/ST CCR A+/A-1 A/A-1 Negative – National Commercial Bank (NCB) S&P Saudi Arabia LT CCR/ST CCR A+/A-1 A/A-1 Negative – Arab National Bank (ANB) S&P Saudi Arabia LT CCR/ST CCR A/A-1 A/A-1 – Negative Al Rajhi Bank (ARB) S&P Saudi Arabia LT CCR/ST CCR A+/A-1 A/A-1 Negative – Banque Saudi Fransi (BSF) S&P Saudi Arabia LT CCR/ST CCR A/A-1 A/A-1 – Negative Source: News reports (* LT – Long Term, ST – Short Term, FSR- Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, CCR – Counterparty Credit Rating, CR – Credit Rating) Earnings Releases Company Market Currency Revenue (mn) 3Q2015 % Change YoY Operating Profit (mn) 3Q2015 % Change YoY Net Profit (mn) 3Q2015 % Change YoY Unikai Foods Dubai AED 80.5 -1.1% 4.3 NA 4.2 NA Air Arabia Dubai AED – – – – 235.0 -6.4% Abu Dhabi National Takaful Co. (ADNTC) Abu Dhabi AED – – 18.7 54.2% 11.6 18.6% United Gulf Industries Corporation (UGIC) Bahrain BHD – – – – -1.4 NA Bahrain Flour Mills Co. Bahrain BHD 1.3 -4.4% -0.1 NA 0.0 NA Source: Company data, DFM, ADX, MSM Overall Activity Buy %* Sell %* Net (QR) Qatari 74.34% 72.20% 4,456,900.29 GCC 2.72% 4.34% (3,400,097.84) Non-Qatari 22.95% 23.45% (1,056,802.45)

- 3. Page 3 of 8 Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 11/05 US Department of Labor Initial Jobless Claims 31-October 276k 262k 260k 11/05 US Department of Labor Continuing Claims 24-October 2,163k 2,140k 2,146k 11/05 US Bloomberg Bloomberg Consumer Comfort 1-November 41.1 – 42.8 11/06 US Bureau of Labor Statistics Unemployment Rate October 5.00% 5.00% 5.10% 11/06 US Bureau of Labor Statistics Average Hourly Earnings MoM October 0.40% 0.20% 0.00% 11/06 US Bureau of Labor Statistics Average Hourly Earnings YoY October 2.50% 2.30% 2.30% 11/05 EU Markit Markit Eurozone Retail PMI October 51.3 – 51.9 11/05 EU Eurostat Retail Sales MoM September -0.10% 0.20% 0.00% 11/05 EU Eurostat Retail Sales YoY September 2.90% 3.00% 2.20% 11/05 France Markit Markit France Retail PMI October 51.9 – 49.6 11/06 France Ministry of the Economy Budget Balance YTD September -74.5bn – -89.7bn 11/06 France Ministry of the Economy Trade Balance September -3,384mn -3,050mn -2,978mn 11/05 Germany Markit Markit Germany Construction PMI October 51.8 – 52.4 11/05 Germany Markit Markit Germany Retail PMI October 52.4 – 54.0 11/06 Germany Deutsche Bundesbank Industrial Production SA MoM September -1.10% 0.50% -0.60% 11/06 Germany Bundesministerium fur Wirtscha Industrial Production WDA YoY September 0.20% 1.30% 2.70% 11/06 UK National Institute of Economic NIESR GDP Estimate October 0.60% – 0.50% 11/06 UK ONS Industrial Production MoM September -0.20% -0.10% 0.90% 11/06 UK ONS Industrial Production YoY September 1.10% 1.30% 1.80% 11/06 UK ONS Manufacturing Production MoM September 0.80% 0.60% 0.40% 11/06 UK ONS Manufacturing Production YoY September -0.60% -0.70% -0.90% 11/06 UK ONS Visible Trade Balance GBP/Mn September -£9,351.0 -£10,600.0 -£10,786.0 11/06 UK ONS Trade Balance Non EU GBP/Mn September -£2,076.0 -£3,100.0 -£3,842.0 11/06 UK ONS Trade Balance September -£1,353.0 -£3,000.0 -£2,905.0 11/05 UK Bank of England BOE Asset Purchase Target November £375bn £375bn £375bn 11/05 UK Bank of England Bank of England Bank Rate 5-November 0.0 0.0 0.0 11/06 Spain INE Industrial Output NSA YoY September 0.0 – 0.1 11/06 Spain INE Industrial Output SA YoY September 0.0 0.0 0.0 11/06 Spain INE House transactions YoY September 0.1 – 0.2 11/06 Spain INE Industrial Production MoM September 0.0 0.0 -0.0 11/05 Italy Markit Markit Italy Retail PMI October 48.8 – 51.7 11/07 China National Bureau of Statistics Foreign Reserves October $3,525.5bn $3,465.0bn $3,514.1bn Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 2Q2016 results No. of days remaining Status VFQS Vodafone Qatar 12-Nov-15 4 Due Source: QSE

- 4. Page 4 of 8 News Qatar QNBK: Qatar real estate prices to continue strong growth – According to a report released by QNB Group (QNBK), Qatar’s real estate prices are expected to continue strong growth although at a more moderate pace on rapid population growth and higher per capita GDP. QNBK in its Monthly Monitor report said that the Qatar Central Bank real estate index had risen by 18.2% YoY in September 2015, slowing down from 20.2% in August 2015. The real estate price index had reached its highest point in September 2015 since its introduction four years ago. QNBK expects Qatar’s ongoing investment program to continue attracting expatriates, resulting in an overall population growth of 9% in 2015. The report said the YoY growth in Qatar’s bank deposits had fallen marginally to 7.1% in September 2015 from 7.2% in August 2015. Public sector deposits contracted by 13.9% and private sector deposits grew by 12.0%, while non-resident deposits doubled, growing by 120.2%. QNBK is expecting deposit growth to reach 9.5% in 2015 reflecting strong population growth. As per the report, bank asset growth fell to 8.7% in September from 11.8% in August. Growth in bank loans had slowed to 12% YoY in September 2015 from 17.3% in August 2015, the monthly monitor showed. Loans to the public sector contracted by 6.6% YoY, while lending to the private and foreign sectors grew strongly by 23.1% and 24.5%, respectively. QNBK forecasted that bank lending will grow by 10.5% in 2015, increasingly driven by project lending and the expanding population. (Gulftimes.com) ORDS offers lowest-ever calling rate for all calls to any network in Qatar – Ooredoo (ORDS) has announced one of its most significant pricing revamps for call costs in Qatar’s history, offering the lowest-ever local calling rate of 10Dhs per minute for all calls to any network in Qatar. The new campaign, “One Qatar, One Call Rate,” means that Hala customers using the International Saver Key or Egypt Key will always be able to pay the same rate whether they are calling local Ooredoo lines, or calling numbers provided by other operators in Qatar. (Gulf-Times.com) ABQK launches MasterCard CashBack credit card – Ahlibank (ABQK) has launched the MasterCard CashBack credit card, a market leading credit card offering up to 2% cashback on all purchases and cash withdrawals made inside and outside Qatar, to ensure customers benefit every time they use the card. In addition, the cashback earned is automatically credited every month to the customer’s credit card account up to a maximum of QR500 per month. (Gulf-Times.com) GWCS complies with QFMA to establish new pricing mechanism – Gulf Warehousing Company (GWCS) has complied with the directives of the Qatar Financial Market Authority (QFMA) issued on October 26, 2015 and November 4, 2015 to establish a new pricing mechanism specific to subscribers, who request excess shares during the company’s ongoing rights issue. As per the directive, the shareholders subscribing for excess shares shall pay the subscription value (QR38.50) in addition to the rights issues value, which has been priced in accordance with the rights issue pricing mechanism in effect during the rights issue trading period. This is the closing price of the share on the previous day of the subscription with the value of the price of the rights issue subtracted. The period for subscribing the rights issue will commence from November 8 and end on November 25, 2015. (QSE) Austria’s Porr wins third major tender in Qatar – Austria’s Porr has won a third major tender in Qatar and has been entrusted with the responsibility of laying the Slab Track Austria System in Qatar. The contract has been awarded by Mitsubishi Heavy Industries Limited led consortium, which has been charged with implementing the system technology by the Qatar Railway Company. The works, on a manufacture, supply and install basis, comprise the track slabs for the green, red and gold lines of the Doha Metro. The project will be realized by PORR Bau GmbH in cooperation with its local subsidiary PORR Qatar Construction W.L.L. The track will be laid in total as part of the Doha project for the individual metro lines. The contract works will be executed in two main stages, the preparation & production of the slab track elements and the installation of the track bed. (Bloomberg) PM to open Ministerial Energy meet – Prime Minister and Interior Minister HE Sheikh Abdullah bin Nasser bin Khalifa Al Thani will open the 6th Asian Ministerial Energy Roundtable (AMER6) in Doha today. The three-day roundtable is being organized by the Ministry of Energy & Industry in coordination with the International Energy Forum (IEF). The meet will be attended by ministers and representatives from 30 largest producers and consumers of energy in Asia. It will focus on the importance of dialogue in the convergence of views to create a balance in the energy markets, and in securing global energy needs to ensure continued development in the participating countries. AMER6 will bring views of producers and consumers of energy in Asia closer in light of the new reality in energy markets. (Peninsula Qatar) Chestertons sees Qatari portfolios expanding in London property market – International real estate agency, Chestertons’ Global Director of International Residential Developments, Samuel Warren said the Qatari portfolios in the London property market have expanded to include investments not only from owning residential homes but also a keen interest in capital growth from lower value properties. Warren said while there is still growth in Qatari investors eyeing property in key locations in the UK, there is also a “massive increase” in interest on lower value or smaller properties in other parts of London, which they could sell in fast growing areas in terms of capital growth. (Gulf-Times.com) Bani Hajer to get new health center – Primary Health Care Corporation (PHCC) Managing Director Dr. Mariam Ali Abdulmalik said that a new health center will be established in Bani Hajer. She said that PHCC is coordinating with the Public Works Authority (Ashghal) to design and build the center and work is expected to be completed in 2018. (Peninsula Qatar) International US records solid job growth in October, bolster bets for December rate hike – US job growth surged in October and the unemployment rate hit a 7-1/2-year low of 5.0% in a show of economic strength that makes it much more likely the Federal Reserve will raise interest rates in December 2015. The Labor Department said nonfarm payrolls increased 271,000 last month, the largest rise since December 2014. The payrolls jump followed modest gains in August and September. The unemployment rate now stands at its lowest level since April 2008 and is in a range many Fed officials see as consistent with full employment. In addition to the unexpectedly stronger job gains in October, data for August and September were revised to show 12,000 more jobs created than previously reported. The report added to strong services sector and automobile sales data in painting an upbeat picture of the economy at the start of 4Q2015. (Reuters) Eurozone retail sales slipped in September for first time in six months – Eurozone retail sales slipped for the first time in six months in September, against expectations of a slight increase, as spending on food and drinks declined sharply during the month. The European Union’s statistics office, Eurostat said retail sales in the 19 countries sharing the euro were 0.1% lower in September, but up 2.9% YoY. Sales were unchanged MoM and up a revised 2.2% YoY in August 2015. In the 28 countries of the European

- 5. Page 5 of 8 Union, sales were up 0.3% in September and 3.7% higher YoY. Retail sales were flat MoM in the Eurozone’s biggest economy Germany and declined by 0.4% in the second largest, France. Sentiment in the retail sector has risen steadily since June, with a pick-up in the views of both present and future sales. However, consumer confidence, as measured by the European Commission’s monthly economic sentiment survey, has weakened over that time. (Reuters) BoE shies away from early 2016 rate rise – The Bank of England (BoE) made no move towards an early interest rate rise on November 5, saying Britain’s near-zero inflation would pick up only slowly, even if borrowing costs stay on hold throughout 2016. Only one BoE policymaker, Ian McCafferty, voted to raise interest rates this month. The other Monetary Policy Committee members opted to keep them at a record-low 0.5%, where they have been since March 2009. The BoE said that even though Britain’s domestic economy was strong, risks from emerging markets had grown and lower prices for fuel, food and other imported goods would keep inflation below 1% until at least the middle of 2016. (Reuters) BoJ Governor: China slowdown biggest threat to Japan – Bank of Japan (BoJ) Governor Haruhiko Kuroda warned on Friday a prolonged, deeper-than-expected slowdown in China and other emerging economies was the biggest risk facing Japan’s economic outlook. Kuroda warned there was uncertainty on how much an expected rebound in China would boost growth in neighboring Asian economies, as China now produces more parts domestically instead of importing them from other countries. He also said Japanese firms have been disappointingly slow in boosting wages, a sign they have yet to dispel the “deflationary mindset” that beset Japan during 15 years of grinding price falls. Kuroda added that Japan can hit the BoJ’s 2% inflation target without additional stimulus for now on strength in domestic demand. But he stressed the BoJ would not hesitate to ease policy if risks, such as sluggish overseas demand, threaten to derail Japan’s moderate economic recovery. (Reuters) MOFCOM: China to achieve steady trade growth in 2016 despite weak global demand – China’s Ministry of Commerce (MOFCOM) said combined exports and imports are expected to post steady growth in 2016, as government policy measures to support trade gain traction, but global demand was likely to stay weak. The ministry said consumers in developed countries remained cautious alongside volatility in emerging-market economies. MOFCOM said the value of exports in 2015 is likely to be similar to the 2014 level, while imports may fall sharply. The value of China’s services trade is expected to grow more than 10% in 2016. China’s combined exports and imports have fallen 8.1% YoY in 9M2014, highlighting persistent weakness in demand at home and abroad while remaining well below the full-year official target of 6% growth. (Reuters) FAO: World food prices jump in October hit by El Nino – According to a report released by the United Nations Food & Agriculture Organization (FAO), global food prices rose the most in over three years in October 2015 on supply concerns. An index of 73 food prices increased 3.9% to 162 in October, the biggest jump since July 2012. The return of the El Nino weather phenomenon is changing weather conditions around the world, damaging crops with too much rain in some areas and not enough in others. The increase in prices is a reversal of the trend from earlier in 2015, when the FAO index steadily declined to a six-year low amid a worldwide oversupply of grain. However, the gauge remains below July’s level. FAO reported that the price of sugar increased more than that of any other commodity, soaring 17%, the most since September 2010. Vegetable oil prices jumped 6.2%, the most since 2010 while dairy costs rose 9.4%, the biggest gain in two years. The FAO Senior Economist, Abdolreza Abbassian said the October jump does not affect the FAO’s outlook for the 2015 world food- import bill to drop by $261bn to a five-year low of $1.09tn. (Bloomberg) Regional AMC: MENA healthcare spending expected to reach $144bn by 2020 – According to estimates by Al Masah Capital (AMC), healthcare spending in the Middle East and North Africa (MENA) region is expected to reach $144bn by 2020, following enormous development witnessed over the last 10 years. Crossing $95.8bn in 2013, government spending in healthcare across the region tripled from just $30.4bn in 2003. The company also noted that Gulf Cooperation Council (GCC) nations, which account for around 52% of the healthcare expenditure of the region, kept pace, reported healthcare spending of $49.8bn in 2013 versus $15.5bn in 2003, and economic indicators point toward even brighter prospects for the sector. AMC said that healthcare in MENA has emerged as one of the most promising sectors supported by strong demand and supply factors. A robust healthcare sector would help the region’s efforts at economic diversification by creating new employment opportunities and will also arrest outbound medical tourism, which is currently a significant burden on the state. Despite this steep rise, healthcare spending in MENA is below par considering the global average. The region spends only 4% of its GDP on healthcare as compared to 12% in high-income nations and a world average of 10%. On a per capita basis, the GCC spending on healthcare was $1,022, comparable with the world average of $1,062. However, the MENA region has a much lower per capita spending of $415. (GulfBase.com) PKF-TCH: Per capita GDP driving GCC retail market – PKF The Consulting House (PKF-TCH) in its ‘GCC Retail Growth’ report has said that Gulf Cooperation Council (GCC) countries enjoy some of the highest GDP per capita levels in the world and this general wealth enables the retail market to achieve growth rates typically not found in mature markets such as the US or the UK. As per the report, the gross leasable area (GLA) per capita in UAE cities and Jeddah ranges from a minimum of 0.23 square meters (sqm) to a maximum of 1.16 sqm and Dubai is the regional leader and most mature market. This shows that several major GCC cities offer significant growth potential when compared to Dubai or other global counterparts. Dubai, despite having retail GLA per capita 4.5 times higher than the UK average, could still accommodate an additional GLA of 2mn sqm to reach comparable US levels. This is particularly true as tourists are a major end-user segment for retail in the Emirate. When considering the cumulative resident and tourist shoppers, Dubai's retail GLA per capita would actually equate to a low 0.35 sqm, thus indicating a solid demand potential for additional retail space in the Emirate. Demand is further supported by a high level of expatriates (85%) in the population and a high spending power among white-collar workers. (GulfBase.com) LuLu plans US expansion – LuLu Group is planning to foray into the US market by setting up a logistics facility for initiating procurement, consolidation and export of food, non-food, chilled and frozen products of the US origin. The company has recently identified a few projects in New Jersey and Houston and the necessary spadework is underway. The facility is expected to be operational within a couple of months. The facility will also initiate necessary value addition by date coding and labeling for different countries, translation of labels, halal & other relevant certifications and export on a regular basis to its supermarkets and hypermarkets across the GCC countries. (Gulftimes.com) IATA: International travel on Middle East airlines rose 9.9% YoY in September 2015 – The International Air Transport Association

- 6. Page 6 of 8 (IATA) in its latest passenger market analysis has said that international air travel on Middle Eastern carriers had risen 9.9% YoY in September 2015. IATA said that major economies in the Middle East, including Saudi Arabia and the UAE, have seen slowdowns in non-oil sectors in 2Q2015, but the rates of growth remain robust and this should help sustain solid expansion in air passenger demand for local carriers. As per the report, global air travel had risen 7.3% YoY in September 2015 as compared to September 2014. (Gulftimes.com) GUCIC appoints financial advisor to manage rights offering – Gulf Union Cooperative Insurance Company (GUCIC) has appointed Aljazira Capital as financial advisor to manage the offering rights issue. (Tadawul) SACO renews banking facilities agreement with SABB – Saudi Company for Hardware (SACO) has announced the renewal of its Islamic banking facilities agreement with Saudi British Bank (SABB). The loan was signed on November 5, 2015 for a total amount of SR104.45mn. The company will use the short-term loan to finance the working capital. (Tadawul) Sipchem may not pay dividends in 2H2015 – Saudi International Petrochemical Company (Sipchem) CEO Ahmed Al-Ohali has said that Sipchem might not pay dividends for 2H2015, despite seeing results from a restructuring intended to cope with low oil prices. He said that the quarter was tough on the sector and on Sipchem, but added that cost-cutting and investments in strategic initiatives would put the company in a position to rebound once product prices stabilize. Ahmed foresaw no major maintenance shutdowns for the next two years, following a six-week scheduled shutdown at one of its methanol plants starting on November 1, 2015. (GulfBase.com) Saudi Khurais oilfield expansion delayed – According to industry sources, Saudi Arabia is moving ahead with the expansion of its giant Khurais oilfield but the project would move slower than originally planned because of budgetary reasons. However, since global oil prices started to fall sharply in 2014, Saudi Arabian Oil Company (Saudi Aramco) has slowed some projects, shelving less important ones and asking for discounts on some contracts which it had awarded. The project plans to raise Khurais' output by 300,000 barrels per day (bpd) to 1.5mn bpd, and allow it to produce 143mn standard cu ft per day of associated gas and 34,000 bpd of natural gas liquids. The original time frame to complete the expansion was 2017. Reportedly, the expansion of the Khurais oilfield is still on but will take longer than expected, with possible completion in 2018. (GulfBase.com) S&P affirms Sharjah’s A/A-1 rating, outlook stable – Standard & Poor's (S&P) has affirmed the Sharjah’s A/A-1' long-and short- term foreign and local currency sovereign credit ratings, on the basis of Sharjah's continued growth and low government debt burden. The outlook is stable. S&P said Sharjah's economic growth projections are lower than its previous expectations because of slower regional demand following the decline in oil prices. The rating agency expects Sharjah's government to maintain a conservative fiscal stance and retain substantial revenue and expenditure flexibility. S&P believes that the general government deficit will narrow toward 1% of GDP in 2018, from a peak of 2.7% of GDP in 2014. In its base-case scenario, S&P expects government borrowing to be limited to only what is required for capital spending, and potentially, for a small proportion of deficit financing. S&P estimates that net general government debt will average 8% of GDP in 2015-2018, after standing at 2.6% of GDP in 2013. S&P estimated that the UAE's gross external financing needs will average about 100% of usable reserves of the Central Bank of the UAE and CARs over the same period. The credit rating agency expects the UAE's current account to show an overall surplus of about 6.6% of GDP in 2015-2018, significantly lower than the average of 17% of GDP in 2011-2014. The stable outlook reflects S&P’s view that Sharjah's public finances will remain strong during a period of slower nominal GDP growth. (Bloomberg) RAKBANK signs partnership deal with Dubai Properties – The National Bank of Ras Al Khaimah (RAKBANK) has signed a partnership agreement with Dubai Properties to provide home finance solutions for some complete and off-plan properties in Dubai Properties’ portfolio of projects. Under the partnership, the bank will offer financing for properties such as Mudon, and completed projects including JBR (Jumeirah Beach Residence), Executive Towers, Bay Square, The Villa, and Remraam. (GulfBase.com) CBI launches Islamic banking window – Commercial Bank International (CBI), a Dubai-based conventional lender, has launched its Islamic Banking window – Al Islami – which offers a wide range of Shari’ah-compliant financial solutions and banking services aimed at the corporate financial world. The initiative is supported by its strategic partnership with QNB Group (QNBK), which owns 40% of CBI. Guided by leading international Shari’ah adviser, the Shari’ah Review Bureau — which will provide consultancy and audit support to CBI – Al Islami will offer a suite of corporate banking products catering to the financial needs and requirements of its customers. (Peninsula Qatar) Investments in DSOA at AED3.28bn – Dubai Silicon Oasis Authority (DSOA) Chairman Sheikh Ahmed Bin Saeed Al Maktoum said that DSOA is currently implementing investment projects at a cost of AED1.42bn. The hi-tech free zone has also attracted foreign investments worth AED1.86bn, thus taking the total investments to AED3.29bn. Saeed also revealed that the DSOA’s positive results recorded across all areas of operations in 1H2015, registering AED245.4mn in revenue by mid-2015, representing a 16% increase as compared with the same period of 2014. DSOA also earned AED93.8mn in net profit while achieving a 14.6% growth in recurring revenues as compared to 1H2014. (GulfBase.com) Emirates first half profit jumps 65% as fuel costs plunge – Dubai’s flagship airline Emirates posted a 65% surge in 1H2015 net profit after its decision not to hedge against changes in fuel costs paid off when oil prices plunged. The airline posted a profit of AED3.1bn for the six months ending September 30, 2015, up from AED1.9bn a year earlier. Emirates said fuel costs dropped to 28% of operating costs from 38% as fuel prices fell 41% YoY. The lower fuel costs and increase in passengers offset pressures from foreign exchange moves as a stronger dollar hurt revenue, which fell 4% to AED42.3bn. Emirates said half-year profit for the wider group, which includes airline services arm Dnata, rose to AED3.7bn from AED2.2bn a year ago. The group’s cash position as of September 30, 2015 was at AED14.8bn as compared to AED20bn as of March 31, 2015. This is due to the ongoing investments mainly into new aircraft, airline related infrastructure projects and business acquisitions. (Qatar Tribune, Emirates 24/7) Warburg Pincus and General Atlantic in talks to buy Abraaj Group’s 49% stake in Network International – According to sources, Warburg Pincus and General Atlantic are in talks to buy Abraaj Group’s 49% stake in Network International, a leading payment solutions provider in the Middle East. Abraaj may announce the sale of its holding in Network International as early as this week. The transaction could value Network International at about $1.5bn to $2bn. Separately, sources reported that Network International is in talks to buy Actis LLP’s payment services firm Emerging Markets Payments Group. The transaction would be valued at $400mn. (Bloomberg) Limitless said to hold $517mn payment after pledge – According to sources, Limitless has not paid banks about $517mn it made from

- 7. Page 7 of 8 a land sale in Saudi Arabia, more than four months after promising to do so as part of talks to restructure its debts. The Dubai-based developer is refusing to pay creditors until they agree to a restructuring proposal for an additional $648mn of debt. Reportedly, banks do not agree with the terms of the new offer and are refusing to approve the deal, leading negotiations to stall. The company began talks to restructure a $1.2bn Islamic loan for a second time in 2014. Earlier, in 2015, Limitless’ Chairman Ali Rashid Lootah said that the company hopes to be debt-free by 2018 and return to profitability before then. (Bloomberg) Warba Bank reports KD1.25mn net profit in 3Q2015 – Kuwait’s Warba Bank reported a net profit of KD1.25mn in 3Q2015 as compared to KD0.32mn in 3Q2014. The bank’s operational revenue grew by 34% to reach KD13.28mn as of 3Q2015-end as compared to KD9.89mn as of 3Q2014-end. Warba Bank’s total assets grew by 34% reaching KD682.76mn at the end of September 30, 2015 as compared to KD507.14mn on September 30, 2014. The bank’s financing portfolio grew by 42% reaching KD492.39mn by 3Q2015-end as compared to KD346.75mn as of 3Q2014-end. Customers deposits increased by 42.2% and stood at KD585.3mn in 3Q2015 as compared to KD411.61mn in 3Q2014. (GulfBase.com) Kuwait will see oil glut for as long as five years on increasing supply – According to Mohammed Al-Shatti, Kuwait’s representative to the Organization of Petroleum Exporting Countries (OPEC), oil markets will continue to be oversupplied for as long as five years as producers in the Middle East ramp up output. He said many countries are expected to increase production. Iranian crude is expected to return and that means an increase in production. Al- Shatti said demand is not expected to absorb the extra capacity and it will take shifts in supply to affect prices. He further added that the geopolitical disruptions or reduced future output because of the 30% fall in capital expenditure by oil companies could cause an increase. (Bloomberg) Al Madina Investment forays into healthcare sector – Al Madina Investment has revealed details of an OMR72mn integrated healthcare complex to be constructed in Hail Al Seeb, Oman. The investment firm has unveiled plans to launch a 225-bed tertiary care hospital, 120 keys three-star hotel apartments, 300 residential apartments, a fitness center and retail space. The multi- use healthcare complex will be known as Al Madina International Hospital and is expected to be opened in 2018. Al Madina Real Estate will carry out the development of the project. (MSM, Zawya) Oman confident of winning US anti-dumping case – Oman is confident of winning an anti-dumping case against a local steel pipeline manufacturer in the US. An anti-dumping lawsuit was filed by the US against Oman and four other countries for selling steel pipes below its fair price. The lawsuit, filed by the US Department of Commerce, follows allegations on dumping against these countries by US steel manufacturing firms. (GulfBase.com) KHCB reports BHD6mn net profit in 9M2015 – Khaleeji Commercial Bank (KHCB) reported a net profit of BHD6.04mn in 9M2015 as compared to BHD2.25mn in 9M2014. Total net income reached BHD15.06mn in 9M2015 as compared to BHD9.87mn in 9M2014. The bank’s total assets stood at BHD663.58mn at the end of September 30, 2015 as compared to BHD596.65mn on December 31, 2014. Financing assets reached BHD311.7mn, while customers’ current accounts stood at BHD60.61mn. KHCB’s financial position remain strong with a liquid asset ratio of 25.3% and capital adequacy ratio of 20.3%, which is well above the regulatory minimum of 12.5%. EPS amounted to BHD6.254 in 9M2015 versus BHD2.319 in 9M2014. (Bahrain Bourse) EFTS launched in Bahrain – The BENEFIT Company, in coordination with Central Bank of Bahrain (CBB) and all commercial banks, has launched the electronic fund transfer system (EFTS) in Bahrain. BENEFIT CEO Abdulwahid Janahi said that the system is an integrated electronic system linking all commercial banks and large institutions from the public and the private sector. He said it will reduce the time of the process of electronic transfers and payments to no more than 30 seconds. (GulfBase.com)

- 8. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Oct-11 Oct-12 Oct-13 Oct-14 Oct-15 QSE Inde x S&P Pa n Ara b S&P GCC (1.1%) (0.6%) (0.1%) (0.1%) (0.4%) (0.0%) 0.7% (1.6%) (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,089.80 (1.3) (4.6) (8.0) MSCI World Index 1,704.39 (0.4) (0.1) (0.3) Silver/Ounce 14.78 (1.4) (4.9) (5.9) DJ Industrial 17,910.33 0.3 1.4 0.5 Crude Oil (Brent)/Barrel (FM Future) 47.42 (1.2) (4.3) (17.3) S&P 500 2,099.20 (0.0) 1.0 2.0 Crude Oil (WTI)/Barrel (FM Future) 44.29 (2.0) (4.9) (16.9) NASDAQ 100 5,147.12 0.4 1.8 8.7 Natural Gas (Henry Hub)/MMBtu 2.17 3.7 12.1 (27.4) STOXX 600 379.95 (0.9) (1.4) (1.6) LPG Propane (Arab Gulf)/Ton 44.25 (2.7) (1.7) (9.7) DAX 10,988.03 (0.3) (1.3) (1.0) LPG Butane (Arab Gulf)/Ton 63.75 (4.9) 2.0 (2.7) FTSE 100 6,353.83 (1.3) (2.8) (6.6) Euro 1.07 (1.3) (2.4) (11.2) CAC 40 4,984.15 (1.1) (0.8) 3.5 Yen 123.13 1.1 2.1 2.8 Nikkei 19,265.60 (0.3) (1.1) 7.1 GBP 1.51 (1.0) (2.4) (3.4) MSCI EM 852.47 (1.4) 0.5 (10.9) CHF 0.99 (1.0) (1.7) (1.1) SHANGHAI SE Composite 3,590.03 1.8 5.6 8.5 AUD 0.70 (1.4) (1.3) (13.8) HANG SENG 22,867.33 (0.8) 1.0 (3.1) USD Index 99.17 1.3 2.3 9.9 BSE SENSEX 26,265.24 (0.5) (2.5) (8.6) RUB 64.51 1.8 0.9 6.2 Bovespa 46,918.52 (2.5) 4.8 (34.2) BRL 0.27 0.2 2.3 (29.7) RTS 854.34 (2.6) 1.0 8.0 136.3 109.6 107.3