1 September Daily market report

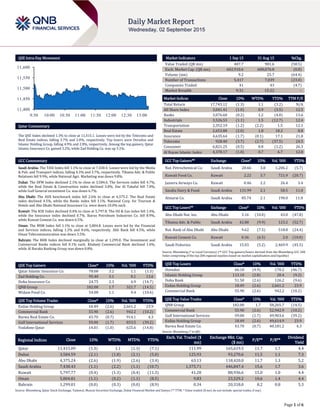

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 1.3% to close at 11,415.1. Losses were led by the Telecoms and Real Estate indices, falling 3.7% and 2.0%, respectively. Top losers were Ooredoo and Islamic Holding Group, falling 4.9% and 2.8%, respectively. Among the top gainers, Qatar Islamic Insurance Co. gained 3.2%, while Zad Holding Co. was up 3.1%. GCC Commentary Saudi Arabia: The TASI Index fell 1.1% to close at 7,438.4. Losses were led by the Media & Pub. and Transport indices, falling 4.3% and 3.7%, respectively. Tihama Adv. & Public Relations fell 9.9%, while National Agri. Marketing was down 9.8%. Dubai: The DFM Index declined 2.1% to close at 3,584.6. The Services index fell 4.7%, while the Real Estate & Construction index declined 3.0%. Dar Al Takaful fell 7.0%, while Gulf General investment Co. was down 6.7%. Abu Dhabi: The ADX benchmark index fell 2.6% to close at 4,375.2. The Real Estate index declined 4.5%, while the Banks index fell 3.1%. National Corp. for Tourism & Hotels and Abu Dhabi National Insurance Co. were down 10.0% each. Kuwait: The KSE Index declined 0.4% to close at 5,797.8. The Oil & Gas index fell 1.4%, while the Insurance index declined 0.7%. Ikarus Petroleum Industries Co. fell 8.9%, while Kuwait Cement Co. was down 6.5%. Oman: The MSM Index fell 1.1% to close at 5,804.8. Losses were led by the Financial and Services indices, falling 1.2% and 0.6%, respectively. Ahli Bank fell 4.5%, while Oman Telecommunication was down 3.5%. Bahrain: The BHB Index declined marginally to close at 1,299.0. The Investment and Commercial Banks indices fell 0.1% each. Khaleeji Commercial Bank declined 1.6%, while Al Baraka Banking Group was down 0.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Islamic Insurance Co. 78.00 3.2 1.1 (1.3) Zad Holding Co. 95.40 3.1 0.1 13.6 Doha Insurance Co. 24.75 2.3 4.9 (14.7) QNB Group 182.00 1.7 321.7 (14.5) Widam Food Co. 54.00 1.1 4.4 (10.6) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Ezdan Holding Group 18.49 (2.6) 2,661.2 23.9 Commercial Bank 55.90 (2.6) 942.2 (10.2) Barwa Real Estate Co. 43.70 (0.7) 914.1 4.3 Gulf International Services 59.00 (1.7) 833.5 (39.2) Vodafone Qatar 14.01 (1.0) 625.6 (14.8) Market Indicators 1 Sep 15 31 Aug 15 %Chg. Value Traded (QR mn) 407.7 981.6 (58.5) Exch. Market Cap. (QR mn) 602,910.6 608,076.8 (0.8) Volume (mn) 9.2 25.7 (64.4) Number of Transactions 5,417 7,039 (23.0) Companies Traded 41 43 (4.7) Market Breadth 9:31 15:22 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 17,743.12 (1.3) 1.1 (3.2) N/A All Share Index 3,041.41 (1.0) 0.9 (3.5) 12.5 Banks 3,076.60 (0.2) 1.2 (4.0) 13.6 Industrials 3,526.53 (1.1) 1.5 (12.7) 12.4 Transportation 2,352.19 (1.2) (2.2) 1.5 12.1 Real Estate 2,653.88 (2.0) 1.8 18.2 8.8 Insurance 4,635.64 (1.7) (0.1) 17.1 21.8 Telecoms 928.40 (3.7) (2.7) (37.5) 24.5 Consumer 6,821.25 (0.5) 0.8 (1.2) 26.3 Al Rayan Islamic Index 4,378.17 (1.0) 0.7 6.7 12.8 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Petrochemical Co. Saudi Arabia 20.66 3.8 1,206.2 (5.7) Kuwait Food Co. Kuwait 2.22 3.7 721.9 (20.7) Jazeera Airways Co. Kuwait 0.46 2.2 26.4 3.4 Saudia Dairy & Food. Saudi Arabia 131.99 2.1 58.5 11.0 Almarai Co. Saudi Arabia 85.74 2.1 190.0 11.8 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi Nat. Ins. Abu Dhabi 3.16 (10.0) 43.0 (47.8) Tihama Adv. & Public Saudi Arabia 42.80 (9.9) 123.2 (52.7) Nat. Bank of Abu Dhabi Abu Dhabi 9.62 (7.5) 518.8 (24.4) Kuwait Cement Co. Kuwait 0.36 (6.5) 2.0 (10.0) Saudi Fisheries Saudi Arabia 15.03 (5.2) 2,469.9 (45.5) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Ooredoo 66.10 (4.9) 170.2 (46.7) Islamic Holding Group 113.10 (2.8) 20.4 (9.2) Doha Bank 51.50 (2.6) 126.2 (9.6) Ezdan Holding Group 18.49 (2.6) 2,661.2 23.9 Commercial Bank 55.90 (2.6) 942.2 (10.2) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 182.00 1.7 58,265.7 (14.5) Commercial Bank 55.90 (2.6) 52,942.9 (10.2) Gulf International Services 59.00 (1.7) 49,903.6 (39.2) Ezdan Holding Group 18.49 (2.6) 49,614.9 23.9 Barwa Real Estate Co. 43.70 (0.7) 40,181.2 4.3 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,415.09 (1.3) 1.1 (1.3) (7.1) 111.99 165,619.5 11.7 1.7 4.4 Dubai 3,584.59 (2.1) (1.8) (2.1) (5.0) 125.93 93,270.6 11.5 1.1 7.3 Abu Dhabi 4,375.24 (2.6) (1.9) (2.6) (3.4) 63.13 118,420.0 11.7 1.3 5.2 Saudi Arabia 7,438.43 (1.1) (2.2) (1.1) (10.7) 1,375.71 446,847.4 15.6 1.7 3.6 Kuwait 5,797.77 (0.4) (1.3) (0.4) (11.3) 41.28 88,936.6 15.0 1.0 4.4 Oman 5,804.81 (1.1) (0.2) (1.1) (8.5) 9.83 23,529.2 10.6 1.4 4.4 Bahrain 1,299.01 (0.0) (0.3) (0.0) (8.9) 0.34 20,318.0 8.2 0.8 5.3 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,400 11,450 11,500 11,550 11,600 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 1.3% to close at 11,415.1. The Telecoms and Real Estate indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Ooredoo and Islamic Holding Group were the top losers, falling 4.9% and 2.8%, respectively. Among the top gainers, Qatar Islamic Insurance Co. gained 3.2%, while Zad Holding Co. was up 3.1%. Volume of shares traded on Tuesday fell by 64.4% to 9.2mn from 25.7mn on Monday. However, as compared to the 30-day moving average of 6.0mn, volume for the day was 52.2% higher. Ezdan Holding Group and Commercial Bank were the most active stocks, contributing 29.0% and 10.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09/01 US Census Bureau Construction Spending MoM July 0.70% 0.60% 0.70% 09/01 US Bloomberg IBD/TIPP Economic Optimism September 42.0 47.1 46.9 09/01 EU Eurostat Unemployment Rate July 10.90% 11.10% 11.10% 09/01 Germany Deutsche Bundesbank Unemployment Change (000's) August -7K -4K 9K 09/01 Germany Deutsche Bundesbank Unemployment Claims Rate SA August 6.40% 6.40% 6.40% 09/01 UK Bank of England Net Consumer Credit Jul 1.2B 1.2B 1.2B 09/01 UK Bank of England Net Lending Sec. on Dwellings July 2.7B 2.7B 2.6B 09/01 UK Bank of England Mortgage Approvals July 68.8K 68.1K 67.1K 09/01 UK Bank of England Money Supply M4 MoM July 1.00% – -0.50% 09/01 UK Bank of England M4 Money Supply YoY July 0.60% – -0.30% 09/01 UK Bank of England M4 Ex IOFCs 3M Annualized July 3.70% – 3.90% 09/01 UK Markit Markit UK PMI Manufacturing SA August 51.5 52.0 51.9 09/01 Spain Markit Markit Spain Manufacturing PMI August 53.2 53.6 53.6 09/01 Italy Markit Markit/ADACI Italy Manufacturing PMI August 53.8 55.0 55.3 09/01 Italy ISTAT Unemployment Rate Quarterly 2Q2015 12.40% 12.50% 12.30% 09/01 Italy Italian Treasury Budget Balance August -7.8B – -2.2B 09/01 China China Federation of Logistics Manufacturing PMI August 49.7 49.7 50.0 09/01 China China Federation of Logistics Non-manufacturing PMI August 53.4 – 53.9 09/01 China Markit Caixin China PMI Composite August 48.8 – 50.2 09/01 China Markit Caixin China PMI Services August 51.5 – 53.8 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 42.50% 48.33% (23,765,892.18) GCC 5.16% 14.28% (37,191,875.43) Non-Qatari 52.35% 37.40% 60,957,767.61

- 3. Page 3 of 6 News Qatar QCB auctions T-bills worth QR4bn on September 1 – The Qatar Central Bank (QCB) has auctioned treasury bills worth QR4bn on September 1, 2015 for which it received bids totaling QR7.05bn. T- bills worth QR2bn with a three-month maturity period were auctioned at a yield of 0.85%. T-bills worth QR1bn with a six- month maturity period were sold at a yield of 0.87%, while T-bills worth QR1bn with a nine-month maturity period were auctioned at a yield of 0.96%. (QCB) QSE suspends trading of QGTS shares on September 2 – The Qatar Stock Exchange (QSE) has announced trading suspension of Qatar Gas Transport Company’s (QGTS) shares on September 2, 2015 due to the company’s EGM being held during the day. (QSE) Qatar to finish work on first World Cup venue by 2016 – According to the Project Manager, Mansoor Saleh Al-Muhannadi, Qatar will complete work on the first venue for the 2022 FIFA World Cup by 2016. It is also the venue for the 2019 World Athletics Championships, the first time that the games will be held in the Middle East. The 40,000-seater Khalifa International Stadium is scheduled to host group stage, round of 16 and quarter-final matches during the 2022 FIFA World Cup. The Khalifa Stadium, located in the west of Doha, was originally built in 1976 as a 20,000-seater Stadium but is undergoing major renovation for 2022. (Gulf-Times.com) QDB: Innovation key to diversifying Qatar economy – Qatar Development Bank’s (QDB) Capability Development Manager, Ibrahim Abdulaziz al-Mannai said as falling oil prices continue to impact global economies, innovative non-hydrocarbon businesses play a significant role in diversifying Qatar’s economy. Al-Mannai said developing a culture of entrepreneurship and expanding Qatar’s small and medium-sized enterprise (SME) sector could help lessen the country’s dependence on the oil & gas industry. Al- Mannai further added that due to the recent drop in oil prices, anything innovative in the fields of IT, ICT, environment, renewable energies could become successful businesses and will help diversify the country’s economy. These sectors are grounds for entrepreneurs to build their businesses in Qatar. Meanwhile, QDB has launched the fourth edition of the “Al-Fikra” competition for start-ups, in collaboration with a host of sponsors and partners. The competition aims at nurturing Qatari entrepreneurs’ talent by mentoring their innovative businesses, which will contribute to the QDB’s economic diversification targets. The competition will take place for three months, from September till the third week of November 2015. (Gulf-Times.com, Peninsula Qatar) MEC, Manateq sign QR856mn deal with Galfar Al Misnad for Wakrah Logistic Services Area works – The Logistic Committee at the Ministry of Economy & Commerce (MEC) and the Economic Zones Company (Manateq) have signed a contract worth QR856mn with Galfar Al Misnad Engineering & Contracting to implement infrastructure works associated with the Al Wakrah Logistic Services Area. The project covers a total area of 6.6 square kilometers (sq km) and currently the first phase is being developed on 3.5 sq km, to be leased to investors. MEC said that the infrastructure works are scheduled to be completed within 24 months of signing the contract. (Gulf-Times.com) MEC to exempt some commercial shops from civil defense certificate – Al Sharq has reported that the Ministry of Economy & Commerce (MEC) has signed an agreement with the Civil Defense Department to exempt some commercial shops which have license from the civil defense certificate. Around 55 commercial activities will be exempted from issuing civil defense certificates. The list includes sun & medical glasses shops, building material shops, sweets shops, cafeterias, livestock sale barns and men's & women's salons. (Peninsula Qatar) Ministry sets November 3 deadline to implement online wage system – The Ministry of Labor and Social Affairs, responsible for implementing and supervising the new payment mode, has given private companies time until November 3 to comply with the mandatory online payment system for low-paid workers. The Ministry has urged all private companies to abide. Any failure by companies to abide by the rule would make them liable for punishment, including denial of work visas and refusal to endorse worker’s job contracts. The Ministry said it will stop all transactions with non-complying entities unless they mend their ways and rectify their situation. The new system, called the Wage Protection System (WPS), will apply to all private companies—as all of them are covered by the labor law, number 14 of 2004. The Ministry said it would closely monitor the WPS in coordination with the banking regulator, Qatar Central Bank (QCB). (Peninsula Qatar) International US manufacturing expands at slowest pace in August since May 2013 – Manufacturing in the US expanded in August at the slowest pace since May 2013 as anemic demand from emerging markets such as China translated into leaner factory order books. The Institute for Supply Management’s index fell to 51.1 from 52.7 in July. The dollar’s ascent, which has accelerated since the middle of last year, is making it tougher for US producers to drum up overseas sales, prompting plants to slow hiring and production. A measure of exports matched the weakest reading since April 2009. The ISM group’s new orders gauge dropped to a more than two- year low of 51.7 from 56.5 in July. The report also showed the slowest rate of production growth since February 2014 as factories work off inventories, which shrank for a second month. The weak data surface ahead of the Federal Reserve’s September policy meeting in which they will debate whether the US is strong enough to withstand an increase in interest rates in the face of fragile overseas economies. (Bloomberg) QNBK: GCC growth to remain strong despite lower commodity prices – QNB Group (QNBK), in its “economic outlook,” said that growth in the GCC region is expected to remain strong despite lower commodity prices. QNBK maintains its “overall positive outlook” for the region, with a growth forecast of 4-4.5% for 2015- 16. QNBK said the US economy looked very much on track. The 2Q2015 GDP is expected to be revised up to 3.2% and activity data were indicating above-trend growth in 3Q2015. The 2Q2015 GDP in the Eurozone was slightly weaker than expected (0.3% QoQ), but composite Purchasing Managers’ Index (PMI) was still showing expansions in July and August 2015. QNBK expects the Eurozone to grow by 1-1.5% in 2015-16. China has slowed down significantly in July and August 2015. Growth in retail sales (10.5%) and industrial production (6%) fell in July 2015. Exports dropped by a much larger than expected 8.3% in July 2015. On emerging markets, QNBK said lower commodity prices and financial market turmoil are rattling EMs. China’s surprise devaluation resulted in capital flight into safe havens. This led to the depreciation of the currencies of commodity-rich countries such as Indonesia, South Africa and Latin American nations, and countries with large trade exposure to China such as Taiwan, Thailand and South Korea. Vietnam followed China’s steps by devaluing its currency, and lower oil prices forced Kazakhstan to abandon its peg to the US dollar. Overall, QNBK expect EMs to grow by 3.5-4% in 2015-16. (Gulf-Times.com) JP Morgan/Markit: Global factory growth weakens in August – According to a business survey conducted by JP Morgan/Markit,

- 4. Page 4 of 6 the global factory activity expanded at its weakest pace in just over two years in August, even though discounted prices did drive a modest upturn in new orders. JPMorgan's Global Manufacturing purchasing managers’ index (PMI), produced with Markit, sank in August to its lowest reading since July 2013, coming in at 50.7 as compared to 51.0 in July 2015. August was the 33rd month the index has been above the 50 level that separates growth from contraction. But a sub-index measuring prices charged held below 50, registering 49.7, only slightly above July’s 49.5. The global PMI combines survey data from countries including the US, Japan, Germany, France, Britain, China and Russia. (Reuters) Canada contracts in 2Q2015 on oil shock – Canada’s economy shrank again in 2Q2015 as plunging oil prices triggered a drop in investment, with fresh debate about a recession dealing a blow to Prime Minister Stephen Harper’s bid for re-election. Statistics Canada reported that the GDP declined at a 0.5% annualized pace from April to June. The agency revised the 1Q2015 contraction to 0.8% from 0.6%. On a monthly basis, Canada’s GDP rose 0.5% in June, the fastest since May 2014, led by the mining, quarrying and oil & gas extraction category. Economists predicted an expansion of 0.2%. Business investments fell by 7.9% in 2Q2015 after a 10.9% decline in 1Q2015, partly because of a drop in mineral exploration. The GDP was also curbed as companies slowed their investment in inventories to C$7.1bn from C$12bn. The consecutive output declines, a so-called technical recession, are expected to shift into a slow expansion over the rest of the year, giving the Bank of Canada Governor Stephen Poloz scope to avoid cutting rates on September 9. (Bloomberg) Eurozone factory growth eases in August, unemployment drops in July – Eurozone manufacturing growth eased in August, despite factories barely raising prices, adding to the European Central Bank's woes as it battles to spur expansion and inflation. Markit’s final manufacturing purchasing managers’ index stood at 52.3 in August, below an earlier flash reading that suggested it had held steady at July’s 52.4. An index measuring output rose to 53.9 from 53.6, above the preliminary reading of 53.8. Meanwhile, unemployment in the Eurozone unexpectedly declined to its lowest level in more than 3 years, signaling the region’s recovery is gaining pace even as dark clouds from China draw on the horizon. The European Union’s statistics office said the seasonally adjusted unemployment rate for the 19-nation region dropped to 10.9% in July from 11.1% in June, the lowest since February 2012. While the drop in unemployment adds to signs that the Eurozone is on the mend, China’s economic slowdown and downside risks to inflation due to a slump in the oil price may dampen the outlook. (Reuters, Bloomberg) China to relax requirements for fixed-asset investments – China’s cabinet, in a statement published on its website, said it will relax requirements for fixed-asset investments, including lowering minimum capital requirements, as the economy showed further signs of weakness. China would also establish a $9.4bn national small and medium-enterprise development fund. The cabinet said the minimum capital ratio requirements for airports, ports, and coastal and water transport will be cut to 25% from 30%. Requirements for railways, highways and urban rail will drop to 20% from 25%. Corn deep processing requirements will fall to 20% from 30%. Industries with excess capacity, such as steel, cement, electrolytic aluminum and coke, will continue to stick to existing requirements of 30% to 40%. The move comes as China’s economy sputters after decades of double-digit growth and stock markets remain volatile after routs this summer. Meanwhile, the China Securities Journal reported that nine Chinese brokerages have pledged additional funds worth over $4.71bn to buy shares, answering fresh government calls to support a wobbly stock market. The announcements followed a joint statement issued late on Monday by China’s major institutions charged with supervising financial markets which encouraged listed firms to merge, offer cash dividends, and buy back shares to support the market. (Reuters) Regional ANB Insurance receives SAMA’s approval for capital increase – The Saudi Arabian Monetary Agency (SAMA) has approved Metlife AIG ANB Cooperative Insurance Company’s (ANB Insurance) request of $175mn capital increase through rights issue. The company will comply and complete requested legal processes from other sources. (Tadawul) STC to spend $1bn to cope with data traffic – Saudi Telecom Company (STC) expects to spend another $1bn in 2H2015 on enhancing its networks as it tries to meet surging demand for web- based services. The SR3.9bn outlay repeats STC's capital expenditure in 1H2015 and lifts 2015 spend to a four-year peak. (Bloomberg) Al Tayyar founder to maintain stake despite resignation – The founder of Saudi-based Al Tayyar Travel Group, Nasser Bin Aqeel Al-Tayyar, will retain his stake in the company despite his resignation. He has resigned from his position on September 1, 2015. He owns 14.57% of the company. This is the second-largest shareholding following Al Tayyar Real Estate & Tourism Development Co., which owns 23.3%. (GulfBase.com) Arab News: KSA inks key construction contracts – Arab News reported that Saudi Arabia is planning to construct nine buildings and various centers for Islamic organizations across the Kingdom at an estimated cost of SR35mn. As per the deal, new buildings will be constructed in the south of Badr province, Yadma province and in Fahd, in addition to a new main building in the Sharourah governorate. New buildings will also come up in Hawtat Bani Tamim, Dawadmi, Majmaah, and Abu Bakr in Zulfi. (GulfBase.com) Saudi emerges as leading exporter of agriculture & dairy products – Saudi Arabia has witnessed significant agricultural development over the last three decades, successfully turning large areas of desert into agricultural fields. Currently, Saudi is a leading exporter of a variety of agricultural products including organic products and olives & oil as well as dairy products, eggs, fish, poultry, fruits, vegetables, and flowers to markets around the world. (GulfBase.com) CCHI renews GGI license – Gulf General Cooperative Insurance Company (GGI) has received approval from the Secretary General of the Council of Cooperative Health Insurance (CCHI) regarding renewal of its CCHI license, starting from September 1, 2015 for one year. (Tadawul) Commerzbank: UAE banks face risk from weakening liquidity – Commerzbank has continued to perceive the UAE bank credit risk as a ‘safe haven’ asset class relative to the broader emerging markets (EM) banking universe. Safe haven assets are an investment, which is expected to retain its value or even increase its value in times of market turbulence. Commerzbank said main risks for the UAE banks stem from weakening liquidity, rise in funding costs because of lower oil prices, softening of Dubai’s real estate market and estimated US Fed rate increase. Commerzbank added that the UAE banks would be looking to print more AT1 perpetual instruments to shore up their capital bases prior to the implementation of Basel III standards. (Bloomberg) Mubadala Aerospace’s unit Strata expects 15% revenue growth in 2015 – Mubadala Aerospace’s manufacturing unit, Strata Manufacturing is expecting revenue to grow over 15% in 2015 and aims to break even in two years’ time. Strata CEO Badr al-Olama said the company’s revenue will cross AED400mn in 2015. He said Strata generated revenue of AED346mn in 2014 and has a target of

- 5. Page 5 of 6 AED1bn by 2020. The company is planning to build a second plant close to the current Al Ain facility in 2017. (Reuters) DSC: Dubai’s non-oil sector stays vibrant – According to the Dubai Statistics Centre (DSC), Dubai’s economy grew 3.9% with its GDP rising to AED88.7bn during 1Q2015, spurred by vibrant logistics and trading activities. DSC Executive Director Arif Obaid Al Muhairi said that logistics activities played a key role in supporting the overall growth of Dubai, along with a 3% surge recorded by the wholesale and retail trade that contributes 26.9% to the GDP. The number of hotels grew 7.7%, while real estate and business services posted a 4.4% surge. Dubai’s corporate earnings expanded 3.7% YoY to $4.1bn in 1H2015, on the back of a strong banking sector growth. (GulfBase.com) DLD: Real estate sales decline in August – According to the Dubai Land Department (DLD), real estate sales totaled AED4.18bn in August as compared to AED4.3bn in July 2015, down 6.3% YoY. During January-August 2015, real estate sales declined 26.7% YTD to AED40.3bn. On the other hand, mortgage deals rose 9.4% YoY in August to reach AED5.5bn. (Bloomberg) OCL in bid to acquire EPC contract for Egypt’s wind farm along Gulf of Suez – Orascom Construction Limited (OCL) CEO Osama Bishai has said that Egyptian Ministry of Electricity is in talks with OCL, Engie and the Toyota group to build a 250-megawatt wind farm along Gulf of Suez. He said OCL is a low bidder and is in talks to be the engineering, procurement and constructor (EPC) contractor, while Engie is the lowest bidder for another part of the project on the northern part of the Red Sea. (Bloomberg) Ompet signs licensing agreement with BP – Oman International Petrochemical Industries Company (Ompet) has signed a licensing agreement with BP. Under the terms of agreement, Ompet will own a license for BP’s latest purified terephthalic acid (PTA) technology to build a 1.1mn tons per annum (tpa)-capacity project in Sohar. The planned facility will produce PTA, the primary feedstock for polyesters used in the textile and packaging industry. Ompet is a joint venture of Oman Oil Company, LG International Corporation and Takamul Investment Company. (GulfBase.com) Marubeni, Mitsui & Engie in race for Oman’s mega power project – Japanese firms Marubeni and Mitsui and France-based Engie have submitted bids for developing Oman’s biggest gas-fired power plant, coming up in Ibri and Sohar, with a combined generation capacity of 2,600 megawatts. The proposed project will have a combined capital expenditure of $1.5bn. Oman Power and Water Procurement Company (OPWP) floated a request for the proposal earlier, seeking potential developers to submit their bids up to August 2015 for developing the mega power plant within the main interconnected system (MIS) region, following a pre-qualification process. According to earlier reports, part of the capacity would go on stream by 2017, while the full project would be ready by 2018. (GulfBase.com) Zain Bahrain appoints new Marketing Director – Zain Bahrain has appointed Mr. Roland Lotscher as its new Marketing Director, effective from September 1, 2015. (Bahrain Bourse) Moody’s holds first banking & Islamic finance workshop in Bahrain – Moody’s Investors Service will hold its first banking and Islamic finance workshop in Bahrain on September 2, 2015. The workshop will focus on Bahrain’s banking sector amid low oil prices and global headwinds. The workshop will also provide Moody’s assessment of the local operating environment and the credit- worthiness of banks in Bahrain and the rest of the region. Moreover, the workshop will further discuss the latest developments in the Islamic finance sector as well as growth trends and liquidity management challenges. (GulfBase.com)

- 6. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Index S&P Pan Arab S&P GCC (1.1%) (1.3%) (0.4%) (0.0%) (1.1%) (2.6%) (2.1%) (3.0%) (2.5%) (2.0%) (1.5%) (1.0%) (0.5%) 0.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,140.28 0.5 0.6 (3.8) MSCI World Index 1,600.71 (2.7) (3.5) (6.4) Silver/Ounce 14.62 (0.1) 0.1 (6.9) DJ Industrial 16,058.35 (2.8) (3.5) (9.9) Crude Oil (Brent)/Barrel (FM Future) 49.56 (8.5) (1.0) (13.6) S&P 500 1,913.85 (3.0) (3.8) (7.0) Crude Oil (WTI)/Barrel (FM Future) 45.41 (7.7) 0.4 (14.8) NASDAQ 100 4,636.11 (2.9) (4.0) (2.1) Natural Gas (Henry Hub)/MMBtu 2.75 2.5 3.4 (8.3) STOXX 600 352.89 (2.1) (2.1) (4.0) LPG Propane (Arab Gulf)/Ton 41.75 (3.7) 3.1 (14.8) DAX 10,015.57 (1.8) (2.0) (5.3) LPG Butane (Arab Gulf)/Ton 53.00 (4.5) 2.7 (15.5) FTSE 100 6,058.54 (3.5) (3.5) (9.3) Euro 1.13 0.9 1.2 (6.5) CAC 40 4,541.16 (1.8) (2.1) (1.0) Yen 119.37 (1.5) (1.9) (0.3) Nikkei 18,165.69 (2.7) (3.8) 3.8 GBP 1.53 (0.3) (0.6) (1.8) MSCI EM 801.11 (2.2) (2.3) (16.2) CHF 1.04 0.9 0.4 3.7 SHANGHAI SE Composite 3,166.62 (1.0) (1.7) (4.6) AUD 0.70 (1.3) (2.1) (14.1) HANG SENG 21,185.43 (2.2) (2.0) (10.2) USD Index 95.45 (0.4) (0.7) 5.7 BSE SENSEX 25,696.44 (2.2) (2.9) (11.0) RUB 66.67 3.8 2.2 9.8 Bovespa 45,477.06 (3.6) (5.9) (34.5) BRL 0.27 (2.2) (3.3) (28.4) RTS 805.06 (3.4) (3.0) 1.8 136.7 115.4 111.0