QSE Intra-Day Movement

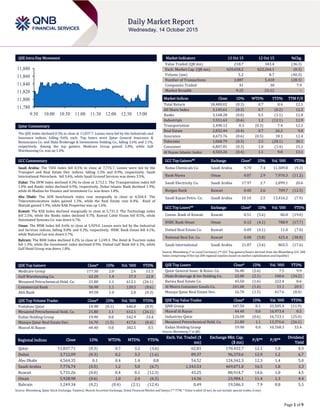

- 1. Page 1 of 9 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.3% to close at 11,837.7. Losses were led by the Industrials and Insurance indices, falling 0.6% each. Top losers were Qatar General Insurance & Reinsurance Co. and Dlala Brokerage & Investments Holding Co., falling 2.6% and 2.1%, respectively. Among the top gainers, Medicare Group gained 2.0%, while Gulf Warehousing Co. was up 1.4%. GCC Commentary Saudi Arabia: The TASI Index fell 0.5% to close at 7,776.7. Losses were led by the Transport and Real Estate Dev. indices, falling 1.3% and 0.9%, respectively. Saudi International Petrochem. fell 3.6%, while Saudi Ground Services was down 3.5%. Dubai: The DFM Index declined 0.3% to close at 3,712.1. The Transportation index fell 1.0% and Banks index declined 0.9%, respectively. Dubai Islamic Bank declined 1.9%, while Al-Madina for Finance and Investment Co. was down 1.8%. Abu Dhabi: The ADX benchmark index rose marginally to close at 4,564.4. The Telecommunication index gained 1.3%, while the Real Estate rose 0.4%. Bank of Sharjah gained 1.9%, while RAK Properties was up 1.6%. Kuwait: The KSE Index declined marginally to close at 5,731.3. The Technology index fell 2.5%, while the Banks index declined 0.7%. Kuwait Cable Vision fell 8.5%, while Automated Systems Co. was down 6.7%. Oman: The MSM Index fell 0.6% to close at 5,929.0. Losses were led by the Industrial and Services indices, falling 0.8% and 0.3%, respectively. HSBC Bank Oman fell 4.1%, while National Gas was down 3.7%. Bahrain: The BHB Index declined 0.2% to close at 1,249.3. The Hotel & Tourism index fell 1.3%, while the Investment index declined 0.9%. United Gulf Bank fell 6.3%, while Gulf Hotel Group was down 1.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Medicare Group 177.30 2.0 2.6 51.5 Gulf Warehousing Co. 63.20 1.4 37.3 22.8 Mesaieed Petrochemical Hold. Co. 21.80 1.1 612.1 (26.1) Commercial Bank 56.90 1.1 120.5 (8.6) Ahli Bank 49.50 1.0 2.0 (0.3) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 14.98 (0.1) 646.0 (8.9) Mesaieed Petrochemical Hold. Co. 21.80 1.1 612.1 (26.1) Ezdan Holding Group 19.90 0.0 542.9 33.4 Mazaya Qatar Real Estate Dev. 16.70 (1.5) 417.6 (8.4) Masraf Al Rayan 44.40 0.0 382.5 0.5 Market Indicators 13 Oct 15 12 Oct 15 %Chg. Value Traded (QR mn) 218.7 343.4 (36.3) Exch. Market Cap. (QR mn) 620,658.2 622,264.1 (0.3) Volume (mn) 5.2 8.7 (40.3) Number of Transactions 3,887 5,418 (28.3) Companies Traded 41 38 7.9 Market Breadth 9:25 23:12 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,400.02 (0.3) 0.7 0.4 12.1 All Share Index 3,145.61 (0.3) 0.7 (0.2) 12.2 Banks 3,168.28 (0.0) 0.5 (1.1) 12.8 Industrials 3,551.63 (0.6) 1.2 (12.1) 12.9 Transportation 2,490.12 0.3 (0.3) 7.4 12.1 Real Estate 2,832.44 (0.4) 0.7 26.2 9.0 Insurance 4,673.76 (0.6) (0.5) 18.1 12.4 Telecoms 1,068.79 (0.3) 2.5 (28.1) 30.1 Consumer 6,807.81 (0.3) 1.0 (1.4) 15.1 Al Rayan Islamic Index 4,503.26 (0.4) 1.1 9.8 13.1 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Nama Chemicals Co. Saudi Arabia 9.70 7.4 11,589.8 (9.3) Bank Nizwa Oman 0.07 2.9 7,970.3 (11.2) Saudi Electricity Co. Saudi Arabia 17.97 2.7 2,899.1 20.6 Burgan Bank Kuwait 0.40 2.6 709.7 (12.5) Saudi Kayan Petro. Co. Saudi Arabia 10.10 2.5 13,416.2 (7.9) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Comm. Bank of Kuwait Kuwait 0.51 (5.6) 86.8 (19.0) HSBC Bank Oman Oman 0.12 (4.1) 788.9 (17.7) United Real Estate Co. Kuwait 0.09 (4.1) 11.0 (7.0) National Real Est. Co. Kuwait 0.08 (3.8) 425.4 (38.8) Saudi International Saudi Arabia 21.87 (3.6) 865.5 (17.6) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar General Insur. & Reins. Co. 56.40 (2.6) 7.5 9.9 Dlala Brokerage & Inv Holding Co. 22.00 (2.1) 100.6 (34.2) Barwa Real Estate Co. 45.50 (1.6) 222.4 8.6 Al Meera Consumer Goods Co. 241.00 (1.6) 11.1 20.5 Mazaya Qatar Real Estate Dev. 16.70 (1.5) 417.6 (8.4) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 187.50 0.1 33,505.4 (11.9) Masraf Al Rayan 44.40 0.0 16,973.4 0.5 Industries Qatar 126.00 (0.6) 16,723.1 (25.0) Mesaieed Petrochemical Hold. Co. 21.80 1.1 13,376.6 (26.1) Ezdan Holding Group 19.90 0.0 10,768.3 33.4 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,837.71 (0.3) 0.7 3.2 (3.6) 62.81 170,432.7 12.1 1.8 4.3 Dubai 3,712.09 (0.3) 0.2 3.3 (1.6) 89.37 96,370.6 12.9 1.2 6.7 Abu Dhabi 4,564.35 0.1 0.4 1.4 0.8 54.52 124,342.3 12.3 1.4 5.0 Saudi Arabia 7,776.74 (0.5) 1.2 5.0 (6.7) 1,343.53 469,071.0 16.5 1.8 3.3 Kuwait 5,731.26 (0.0) 0.4 0.1 (12.3) 43.25 88,914.7 14.6 1.0 4.5 Oman 5,928.98 (0.6) 1.0 2.4 (6.5) 14.36 23,984.1 11.4 1.3 4.4 Bahrain 1,249.34 (0.2) (0.4) (2.1) (12.4) 0.49 19,586.3 7.9 0.8 5.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,780 11,800 11,820 11,840 11,860 11,880 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 9 Qatar Market Commentary The QSE Index declined 0.3% to close at 11,837.7. The Industrials and Insurance indices led the losses. The index fell on the back of selling pressure from Qatari and GCC shareholders despite buying support from non-Qatari shareholders. Qatar General Insurance & Reinsurance Co. and Dlala Brokerage & Investments Holding Co. were the top losers, falling 2.6% and 2.1%, respectively. Among the top gainers, Medicare Group gained 2.0%, while Gulf Warehousing Co. was up 1.4%. Volume of shares traded on Tuesday fell by 40.3% to 5.2mn from 8.7mn on Monday. Further, as compared to the 30-day moving average of 8.4mn, volume for the day was 38.3% lower. Vodafone Qatar and Mesaieed Petrochemical Holding Co. were the most active stocks, contributing 12.5% and 11.9% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 3Q2015 % Change YoY Operating Profit (mn) 3Q2015 % Change YoY Net Profit (mn) 3Q2015 % Change YoY The National Company for Glass Industries (ZOUJAJ) Saudi Arabia SR 0.0 NA 2.1 -67.2% 6.3 -62.5% The National Shipping Company of Saudi Arabia (Bahri) Saudi Arabia SR 0.0 NA 545.3 490.1% 510.3 501.4% Oman Foods International * Oman OMR 1.9 -26.6% 0.0 NA 0.0 NA Shell Oman Marketing Co. (SOMC) ** Oman OMR 252.8 -7.9% 0.0 NA 10.8 19.7% Omani Euro Food Industries (OEFI) Oman OMR 1.4 -1.1% 0.0 NA -0.2 NA Packaging Co. * Oman OMR 6.0 31.7% 0.0 NA 0.4 806.8% Shurooq Investment Services Holding Co. (SISCO) * Oman OMR 0.2 -8.8% 0.0 NA -0.3 NA Gulf Mushroom Products Co. (GMPC) * Oman OMR 4.6 -2.0% 0.0 NA 0.2 -3.1% Construction Materials Industries & Contracting (CMI) Oman OMR 1.7 -9.1% 0.0 NA 0.0 NA Majan Glass Co. Oman OMR 7.6 -4.7% 0.0 NA -1.1 NA Oman Chromite Co. (OCC) Oman OMR 1.4 -9.6% 0.0 NA 0.2 -55.0% Al Anwar Holdings. * Oman OMR 5.3 34.9% 0.0 NA 3.5 71.7% National Aluminium Products Co. * Oman OMR 18.5 36.9% 0.0 NA 0.6 19.8% Gulf International Chemicals (GIC) * Oman OMR 3.0 7.2% 0.0 NA 0.7 181.6% United Power Co. * Oman OMR 8.2 3.1% 0.0 NA 0.8 67.7% Raysut Cement Co. * Oman OMR 69.4 -1.9% 0.0 NA 15.8 -24.3% National Securities ** Oman OMR 0.1 -79.4% 0.0 NA -0.5 NA Financial Services * Oman OMR 0.4 -47.4% 0.0 NA -0.1 NA Oman Textile Holding Co. (OHTC) Oman OMR 3.2 149.1% 0.0 NA 0.9 NA Oman Fisheries Co. * Oman OMR 11.0 -3.5% 0.0 NA -0.2 NA Oman Cement Co. * Oman OMR 38.9 -7.4% 0.0 NA 7.0 -38.7% Source: Company data, DFM, ADX, MSM (*9M2015 results, **6M 2015-16 results) Overall Activity Buy %* Sell %* Net (QR) Qatari 39.25% 45.54% (13,772,851.93) GCC 10.11% 10.97% (1,873,842.76) Non-Qatari 50.64% 43.49% 15,646,694.69

- 3. Page 3 of 9 Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 10/13 US Nat'l Fed. of Ind. Business NFIB Small Business Optimism September 96.1 95.5 95.9 10/13 EU ZEW Zentrum fuer Europaeische ZEW Survey Expectations October 30.1 – 33.3 10/13 Germany Federal Statistical Off Wholesale Price Index MoM September -0.60% – -0.80% 10/13 Germany Federal Statistical Off Wholesale Price Index YoY September -1.80% – -1.10% 10/13 Germany ZEW Zentrum fuer Europaeische ZEW Survey Current Situation October 55.2 64.0 67.5 10/13 Germany ZEW Zentrum fuer Europaeische ZEW Survey Expectations October 1.9 6.5 12.1 10/13 UK ONS PPI Output Core NSA MoM September 0.10% 0.00% -0.10% 10/13 UK ONS PPI Output Core NSA YoY September 0.20% 0.20% 0.00% 10/13 UK ONS ONS House Price YoY August 5.20% 5.00% 5.20% 10/13 UK ONS CPI MoM September -0.10% 0.00% 0.20% 10/13 UK ONS CPI YoY September -0.10% 0.00% 0.00% 10/13 UK ONS CPI Core YoY September 1.00% 1.10% 1.00% 10/13 UK ONS Retail Price Index September 259.6 260.0 259.8 10/13 UK ONS RPI MoM September -0.10% 0.10% 0.50% 10/13 UK ONS RPI YoY September 0.80% 1.00% 1.10% 10/13 UK ONS RPI Ex Mort Int.Payments (YoY) September 0.90% 1.10% 1.20% 10/13 UK ONS PPI Input NSA YoY September -13.30% -13.00% -14.60% 10/13 UK ONS PPI Output NSA YoY September -1.80% -1.80% -1.90% 10/13 UK British Retail Consortium BRC Sales Like-For-Like YoY September 2.60% 1.50% -1.00% 10/13 China National Bureau of Statistics Trade Balance September $60.34bn $48.21bn $60.24bn 10/13 China National Bureau of Statistics Exports YoY September -3.70% -6.00% -5.50% 10/13 China National Bureau of Statistics Imports YoY September -20.40% -16.00% -13.80% 10/13 China Customs General Administration Exports YoY CNY September -1.10% -7.40% -6.10% 10/13 China Customs General Administration Imports YoY CNY September -17.70% -16.50% -14.30% 10/13 China Customs General Administration Trade Balance CNY September 376.20bn 292.42bn 368.03bn Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earning Calendar Tickers Company Name Date of reporting 3Q2015 results No. of days remaining Status QNBK QNB Group 7-Oct-15 - Reported QIBK Qatar Islamic Bank 13-Oct-15 - Reported ABQK Al Ahli Bank 14-Oct-15 - Reported MRDS Mazaya Qatar 14-Oct-15 0 Due QIGD Qatari investor group 19-Oct-15 5 Due DBIS Dlala Brokerage & Investment Holding Company 19-Oct-15 5 Due KCBK Al khalij Commercial Bank 20-Oct-15 6 Due DOHI Doha Insurance 20-Oct-15 6 Due QEWS Qatar Electricity & Water Company 20-Oct-15 6 Due SIIS Salam International 20-Oct-15 6 Due AKHI Al Khaleej Takaful 20-Oct-15 6 Due IHGS Islamic Holding 20-Oct-15 6 Due QIIK International Islamic Bank 20-Oct-15 6 Due GWCS Gulf Warehousing Company 21-Oct-15 7 Due QGTS Qatar Gas Transport Company (Nakilat) 21-Oct-15 7 Due QIMD Industrial Manufacturing Company 22-Oct-15 8 Due QNNS Qatar Navigation 24-Oct-15 10 Due QATI Qatar Insurance 25-Oct-15 11 Due MARK Masraf Al Rayan 25-Oct-15 11 Due DHBK Doha Bank 25-Oct-15 11 Due QISI Islamic Insurance 25-Oct-15 11 Due QGRI General Insurance 25-Oct-15 11 Due QOIS Qatar Oman 25-Oct-15 11 Due MCGS Medicare Group 25-Oct-15 11 Due UDCD United Development Company 26-Oct-15 12 Due QFLS Qatar Fuel Company 26-Oct-15 12 Due ERES Ezdan Real Estate Company 26-Oct-15 12 Due MERS Al Meera Consumer Goods Company 27-Oct-15 13 Due ORDS Ooredoo 28-Oct-15 14 Due

- 4. Page 4 of 9 AHCS Aamal Company 29-Oct-15 15 Due NLCS National Leasing 29-Oct-15 15 Due ZHCD Zad Holding Company 29-Oct-15 15 Due QNCD National Cement Company - - - CBQK Commercial Bank - - - BRES Barwa Real Estate Company - - - GISS Gulf International Services - - - IQCD Industries Qatar - - - MPHC Mesaieed Petrochemical Holding Co - - - MCCS Mannai Corp. - - - QCFS Qatar Cinema & Film Distribution Company - - - WDAM Widam Food Co. - - - QGMD Qatar German Company for Medical Devices - - - VFQS Vodafone Qatar - - - Source: QSE News Qatar QIBK’s 3Q2015 QoQ net income growth driven by strong fees, cost control and lower investment provisions – Qatar Islamic Bank (QIBK) reported a net profit of QR515.24mn in 3Q2015, gaining by 4.2% QoQ (+27.3% YoY), in-line with our estimate of QR494.01mn (+4.3% variation) vs. BBG consensus of QR487.25mn. The bank generated net interest and investment income of QR708.78mn, also in-line with our estimate (QR705.05mn). Net interest and investment income declined by 3.3% QoQ (+24.5% YoY). The QoQ appreciation in net income was aided by robust fees & commissions (+24.2% and +38.1% QoQ and YoY, respectively), cost control (opex down by 2.6% QoQ while the cost to income ratio improved to 29.1% vs. 29.9% and 32.9% in 2Q2015 and 3Q2014, respectively) and lower investment provisions (down 18.0% QoQ). QIBK’s net loans expanded by 7.1% QoQ (+37.5% YTD) to 82.05bn while deposits gained by 2.2% QoQ (+30.1% YTD) to 86.63bn. As such QIBK’s LDR moved to 95% vs. 90% in 2Q2015 (101% in 3Q2014). The bank’s NPL ratio improved to 0.7% vs. 0.9% at the end of 2014. Moreover QIBK’s coverage ratio also improved to 106% vs. 94% at the end of 2014. QIBK’s CAR stood at 14.2% at the end of 3Q2015. (QNBFS Research, Company Financials) QIBK mandate banks to arrange investor meetings for Sukuk program – Qatar Islamic Bank (QIBK) has mandated Barwa Bank, Citi, HSBC, Noor Bank, QInvest and Standard Chartered Bank as Joint Lead Managers to arrange a series of fixed income investor meetings in Asia, Middle East and Europe commencing on October 16, 2015. A benchmark USD Regulation S Senior Sukuk offering under the existing QIBK Sukuk Ltd $1.5bn Trust Certificate Issuance Program may follow subject to market conditions. (QSE) ABQK 3Q2015 bottom-line slips QoQ due to muted investment gains and flat net interest income, in-line with our estimate – Ahli Bank (ABQK) reported a net profit of QR166.59mn in 3Q2015, declining marginally by 1.7% QoQ (+7.2% YoY). Earnings were in-line with our estimate of QR160.46mn (+3.8% variation). The marginal decline in the sequential net profit was mainly due to drop in income from investment securities to QR1.33mn vs. 18.82mn in 2Q2015. The net interest income was largely flat at QR185.15mn (- 3.8% YoY). The bank’s total assets grew by 2.6% YTD (down 3.3% QoQ) to QR32.2bn in 3Q2015. ABQK’s loans & advances grew by 5.2% YTD (up 0.5% QoQ) to QR22.43bn, while customer deposits rose 6.8% YTD (down 1.9% QoQ) to QR21.25bn. (QNBFS Research, Company Financials) ZHCD to disclose financial statements on October 29 – Zad Holding Company (ZHCD) will announce its financial reports for the period ending September 30, 2015 on October 29, 2015. (QSE) QSE to hold introductory meeting to discuss GWCS rights issues – The Qatar Stock Exchange (QSE) has invited brokers, journalists and all interested investors to attend the introductory meeting, which will be dedicated to discuss the rights issues of the Gulf Warehousing Company (GWCS), which will start as of October 18, 2015. During the meeting, QSE will brief the attendees on the rights issues mechanism, as well as its calculation and execution methods in light of the approval obtained from the Qatar Financial Markets Authority (QFMA). The meeting will be held in the premises of QSE on October 15, 2015. (QSE) Kahramaa hikes water, electricity tariffs – The Qatar General Electricity and Water Corporation (Kahramaa) has hiked water and electricity charges with effect from September 2015. Consumers were surprised to receive the "inflated bills" in October since there was no prior notification from Kahramaa about the increase. However, the September bill which the consumers received this month carried a note saying "The tariff has been revised from September 2015". According to sources, the water tariff which remained the same at QR4.40 per cubic meter for consumers big and small earlier has been replaced by a slab system, whereby customers will be charged on the basis of their consumption. Customers still have to pay only QR4.40 per cubic meter for up to 20 cubic meters of water. Those who consume more will have to pay according to the following slab: QR5.40 per cubic meter for 20 -50 cubic meters, QR6.40 for 50-100 and QR7.40 for 100- 150 cubic meters. For electricity also a similar hike has been applied. While the tariffs differed only after 4,000 kilowatt per hour (kwh) earlier, now the minimum rate of QR0.08/kwh is applicable only to consumption up to 2,000 kwh. Thereafter, the revised rate of QR0.09/kwh will be charged up to consumption of 4,000kwh. Those using more than 4,000kwh will have to pay QR0.10 per additional unit. There are additional slabs for every 2,000kwh. Moreover, it is understood that villa compounds and workers accommodations, mainly large labor camps, may have to pay more as the combined use of electricity and water in such places would attract higher rates than in individual residential units. (Gulf-Times.com) ERES installs water-saving devices in residential units – Ezdan Real Estate Company (ERES) has completed installation of 120,000 water-saving devices in 7,000 of its residential units. The project aims to reduce daily water consumption per capita by 40% to 60% as part of implementation of a comprehensive plan to make the group’s properties water-saving entities. The objective is in line with the national program for conservation and energy efficiency ‘Tarsheed’, for which the group had signed a memorandum of

- 5. Page 5 of 9 understanding (MoU) with Qatar General Electricity & Water Corporation (Kahramaa) in 2014. (Peninsula Qatar) Fine of up to QR20,000 for wasting water – HH the Emir Sheikh Tamim bin Hamad al-Thani has issued a law that seeks to rationalize the use of water & electricity and imposes stringent penalties on those found wasting these precious resources. Law No 20 for 2015, issued by the Emir, amends some provisions of Law No 26 for 2008. The Cabinet had issued a draft law in this regard in September 2015 after reviewing the Advisory Council’s recommendations. The new law imposes a maximum fine of QR20,000 on those, who use or authorize the use of drinking water to wash vehicles or equipment or clean the yards of buildings and facilities with water hoses or other means of direct flow. (Gulf- Times.com) Ministry: Overtime payments of workers must be sent to bank – Local Arabic daily Al Sharq has reported that the Ministry of Labor & Social Affairs (MOLSA) has affirmed that according to the Wage Protection System (WPS), employers have to forward allowances and overtime payments to the bank account of their workers. MOLSA said that all the allowances and dues of a worker other than his monthly salary could be added together and put under extra wages category. (Gulf-Times.com) Qatargas successfully completes gas fuel trials on Q-Max ship – Qatargas and collaborators have announced the successful completion of the second phase of main engine gas injection system trials on Qatar Gas Transport Co. (Nakilat) owned Q-Max Liquefied Natural Gas (LNG) ship Rasheeda. QNA reported that the world’s top LNG producer and the globe’s premier integrated LNG enterprise RasGas and Nakilat collaborated on the project that will use the pioneering MEGI technology in maritime propulsion. The trials involved commissioning Rasheeda’s gas burning M-Type Electronically Controlled Gas Injection (MEGI) System. The Qatar Petroleum-sponsored project cost stakeholders over $30mn. The technology upgradation move pre-empts global environmental legislation. (Peninsula Qatar) Real estate trades surpass QR500mn – The total trading value in real estate sales contracts registered with the Land Registry Department of the Ministry of Justice during the period October 4 to 8, 2015 reached QR507.9mn. The real estate sales included various types of plots of land, houses, various types of buildings and residential units in the municipalities of Doha, Umm Salal, Al Khor, Al Dhakira, Al Rayyan, Al Zain, Al Wakra and Al Shama. (Peninsula Qatar) QA to launch daily non-stop flights to Adelaide from May 2016 – Qatar Airways (QA) will launch daily non-stop scheduled flights between Doha and Adelaide on May 2, 2016. The airline has embarked on a major expansion in Australia, recently announcing the launch of daily flights to Sydney from March 1, 2016. Adelaide will be the first destination in Australia to which QA will fly its state-of-the-art A350 aircraft, for which it is the global launch customer. The long-haul service to Adelaide, a key business and leisure destination in South Australia, will enable QA to maximize A350’s efficiency and performance. With the addition of Adelaide, QA’s Australian capacity will rise to 28 flights a week, spread across four key cities including Melbourne, Perth and Sydney. (Gulf-Times.com) VFQS launches new service for safer internet communication – Vodafone (VFQS) has launched its DDoS mitigation proposition for businesses and governments in Qatar, which will provide assured connectivity to dedicated internet customers, enabling safer communications over the internet. DDoS attacks are Denial-of- Service attacks that leverage the massive, distributed, and stolen computing power from infected endpoints to flood target networks and web applications with traffic. DDoS attacks disrupt operations and prevent users from accessing critical web applications. (Gulf-Times.com) QPMC signs material supply deals with 24 local contractors –Qatar Primary Materials Company (QPMC) Chief Executive Officer Eisa al-Hammadi said the company executed supply agreements with some 24 local contractors to source to them 1.1052mn tons of materials, which will help them meet the demands of the local construction industry. He said QPMC recently signed five agreements with private sector establishments, all Qatari-owned companies, for procurement of primary construction materials for the Qatari market, mainly gabbro and limestone. (Gulf-Times.com) International US small business confidence ticks up in September – The US small business confidence rose marginally in September as stock market volatility raised concerns about sales growth, suggesting the economy was expanding at a moderate pace. The National Federation of Independent Business (NFIB) said its Small Business Optimism Index gained 0.2 point to 96.1 in September. It said that the level was consistent with a 2.5% annualized growth rate. Seven of the index’s 10 components eked out small gains last month, while the share of small business owners expecting stronger sales volumes in the next few months fell six points. Even as small business owners worried about sales growth, they were upbeat about business conditions over the next six months and profits. They also believed now was a good time to expand. There was a slight increase in the share of owners planning to increase inventory. The survey continued to point to tame inflation pressures over the near-term. (Reuters) China inflation moderates, making room for easing − China’s consumer inflation moderated and factory gate deflation extended a record stretch of declines, signaling the People’s Bank of China still has room to ease monetary policy further to support a slowing economy. The National Bureau of Statistics said the consumer- price index increased 1.6% YoY in September, slowing from a 2% rise in August. The producer-price index fell 5.9%, extending its streak of negative readings to 43 months. Food price inflation slowed to 2.7% YoY, from 3.7% in August. Non food prices climbed 1%. Prices of consumer goods increased 1.4%, while services increased 2.1%. With consumer inflation well below the government target of 3% all year, the central bank has further capacity to spur lending even after cutting interest rates five times since November 2014. (Bloomberg) IMF cuts growth view on South Africa − According to the International Monetary Fund (IMF), if economic growth in South Africa this year is bad news, 2016 is set to be even worse. The Washington-based lender has cut its estimate for 2015 to 1.4% from 2%. More concerning was its projection that the gross domestic product (GDP) will expand just 1.3% in 2016, which would be the slowest pace since a recession in 2009. The IMF’s projections are more pessimistic than those from the World Bank and South Africa’s central bank. The World Bank is forecasting a GDP growth of 1.5% in 2015 and 1.7% in 2016, while the Reserve Bank estimates 1.5% and 1.6%, respectively. China’s slump is hurting South Africa in two ways − curbing demand from its biggest trading partner and reducing revenue from platinum, iron ore and other metals that account for about half of the nation’s exports. Slower growth makes Finance Minister Nhlanhla Nene’s fiscal targets more difficult to achieve. Nene has pledged to narrow the budget deficit to 2.5% of GDP in the year through March 2018 from an estimated 3.9% in 2015. (Bloomberg) JP Morgan revenue drops on trading in 3Q2015 − JPMorgan Chase & Company, the biggest US bank, said revenue fell 6.4% in 3Q2015, driven by a slump in trading and mortgage-banking results. While net income rose 22% to $6.8bn, adjusted earnings per share,

- 6. Page 6 of 9 excluding a tax benefit and other items, were $1.32. That missed the $1.38 average estimate of 29 analysts surveyed by Bloomberg. The results at JPMorgan, the first of the big US lenders to report, show pressure is still high at Wall Street firms to cut expenses as volatile markets and the continuation of record-low US interest rates erode profit. Though the bank non-interest costs shrank 2.7% to $15.4bn, that was still not enough keep up with the drop in revenue. Firmwide net revenue was $23.5bn in 3Q2015, down from $25.1bn a year earlier. Chief Financial Officer, Marianne Lake said the bank has cut its workforce by about 10,000 jobs so far in 2015, without indicating whether more may follow. (Bloomberg) Regional Dallah Healthcare bonus shares added to investors’ portfolio – The Saudi Stock Exchange (Tadawul) has announced the addition of Dallah Healthcare Holding Company’s bonus shares into the investors’ portfolio. Earlier, Dallah Healthcare’s EGM approved an increase in the capital via bonus shares. (Tadawul) Arab National Bank reports SR764.2mn net profit in 3Q2015 – Arab National Bank reported a net profit of SR764.2mn in 3Q2015 as compared to SR747.9mn in 3Q2014, representing a YoY increase of 2.18%. The bank’s total assets had stood at SR164.86bn as of September 30, 2015 as compared to SR149.94bn on September 30, 2014. Loans & advances reached SR112.75bn, while customer deposits had stood at SR132.52bn. EPS had amounted to SR2.37 in 3Q2015 versus SR2.25 in 3Q2014. (Tadawul) Al Rajhi Bank net profit up 3.55% YoY in 3Q2015 – Al Rajhi Bank reported a net profit of SR1.72bn in 3Q2015 as compared to SR1.66bn in 3Q2014, representing a YoY increase of 3.55%. The bank’s total assets stood at SR325.21bn as of September 30, 2015 as compared to SR298.71bn on September 30, 2014. Loans & advances reached SR209.91bn, while customer deposits stood at SR265.48bn. EPS amounted to SR3.19 in 3Q2015 versus SR3.27 in 3Q2014. (Tadawul) Sabic to shut Innovative Plastics unit, to transfer Pittsfield HQ to Houston – Saudi Basic Industries Corporation (SABIC) has announced its plan to close its SABIC Innovative Plastics unit and to transfer its headquarters from Pittsfield to Houston. As a result of its transformation strategy, SABIC Innovative Plastics’ commodity products will be placed in the parent company’s chemicals and polymers units, while the remaining products will be placed in a new specialties unit. The company is still evaluating Pittsfield’s Polymer Processing Development Center and its location. SABIC said the Pittsfield headquarter (HQ) will be closed during 2016, with major relocation to Houston completed by mid- 2016. (GulfBase.com) CDSI: Saudi non-oil exports, imports decline in 2Q2015 – According to Central Department of Statistics and Information (CDSI), Saudi Arabia’s non-oil exports had fallen in 2Q2015 to around SR46.64bn as compared to SR56.19bn in 2Q2014, representing a decline of 17%. On the other hand, the value of the Kingdom’s imports had fallen 2.2% to around SR166.23bn in 2Q2015 as compared to SR170.05bn in 2Q2014. As per the report, Saudi’s non-oil commodity exports had registered a decline of 1% as compared to 1Q2015, in which they had registered around SR47.10bn. The value of the Kingdom’s imports recorded a rise of 2.3% when compared to 1Q2015, which registered around SR162.53bn. (GulfBase.com) Saudi Aramco awards SR38mn supply contract to Arabian Pipes – Saudi Arabian Oil Company (Saudi Aramco) has awarded a supply contract worth SR38mn to Arabian Pipes Company. Under the terms of the agreement, Arabian Pipes will supply 110 kilometers of welded steel pipes to Saudi Aramco in 2Q2016 from Jubail factory. The financial impact of the transaction will appear in 2Q2016. (Tadawul) France agrees to ink potential deals worth €10bn with KSA – France has agreed to sign potential deals worth €10bn with Saudi Arabia, including for patrol boats, although few contracts appeared to have been finalized. Meanwhile, Saudi has lifted a 15-year-old ban on French beef, opening one of the markets closed to France due to past cases of mad cow disease and offering potential support to the French meat industry hurt by low prices and a Russian embargo. (Reuters) Mueen Recruitment obtains operating license – Abdullah Al Othaim Markets Company has said that Mueen Recruitment Company has obtained the final operating license from the Ministry of Labor for a period of 10 Hijri years. Al Othaim had earlier announced its participation in establishing Mueen, which is expected to start its commercial operations by the beginning of 2016. Al Othaim expects the financial impact in its results will appear in 2Q2016. (Tadawul) EA, IBM sign $700mn IT contract – Etihad Airways (EA) has signed a 10-year deal worth $700mn with IBM for a range of information technology (IT) services and infrastructure. IBM will provide a global technology framework for EA and its partners, including setting up a cloud data center in Abu Dhabi that will be developed and operated by IBM, one of the first such facilities in the Middle East. (Reuters) Mashreq CEO: UAE bank liquidity still good – Mashreq Bank CEO Abdul Aziz al-Ghurair has said that liquidity in the UAE banking sector is still good. The government has adequate means to manage liquidity. He said Mashreq had no immediate plans to issue bonds. (Reuters) UAE, Germany plan talks over Air Berlin-EA code share – The United Arab Emirates (UAE) is seeking talks this week aimed at gaining Germany’s approval for code share flights operated by Air Berlin and Etihad Airways (EA). Air Berlin has 65 code share flights with EA, which bring it about $159mn in turnover. However, the routes have come under scrutiny by the German government over the last year because the current bilateral agreement between the two countries restricts where EA can fly to within Germany. Air Berlin and EA are still awaiting approval for this winter flight schedule, which is due to start at the end of October 2015. (Reuters) Al Qamzi: Dubai economy may grow 4% in 2015 as trade & tourism benefit from cheap oil – The Department of Economic Development (DED) Director General Sami Al Qamzi has said that Dubai’s economy is set to expand by 4% in 2015 as the lower oil price benefits sectors such as trade and tourism. He said growth in India and the US, as well as rising demand in Europe, would also boost the Emirate. The International Monetary Fund (IMF) has revised its growth forecast lower for the UAE to 3% in 2015 and 3.1% in 2016, down from 4.6% in 2014, as the oil slump results in weaker real estate and corporate activities. According to the IMF’s annual report on the UAE’s economy, IMF forecasts that $13bn will be added to the UAE’s economy by the ending of sanctions on Iran, as trade between the two countries rises between now and 2018. That is equivalent to a 1% gain in real GDP growth each year over the next three years. Raed Safadi, Executive Director of Economic Research & Policy at the DED, said inflation is expected to remain between 4.5-5% in 2015, while IMF is forecasting inflation of 3.8% in 2015, up from 2.3% in 2014. (GulfBase.com) Sunrise Properties raises AED515mn in Islamic loan deal – Emirates NBD has said that Sunrise Properties has secured an AED515mn Islamic loan for the development of a luxury hotel project. Emirates NBD was joined by Doha Bank, and acted as the main arranger of the deal. The company will use the loan to finance the Emerald Palace Kempinski Hotel project on Dubai’s Palm Jumeirha group of islands. (Reuters)

- 7. Page 7 of 9 DEWA names Harbin, ACWA preferred bidders for clean coal plant – The Dubai Electricity & Water Authority (DEWA) has chosen a consortium, including China’s Harbin Electric and Saudi Arabia’s ACWA Power International, as the preferred bidder to build and operate a 1,200-megawatt (MW) clean coal power plant. Harbin Electric and Alstom of France will build the plant while those companies as well as ACWA Power and US-based NRG Energy will operate it. The plant is the Phase I of the proposed $1.8bn Hassyan clean coal project by DEWA. A unit with the capacity of 600 MW will be operational by March 2020 while another unit of the same size by March 2021. ACWA Power CEO Paddy Padmanathan said that the consortium was working with Export-Import Bank of China and a range of banks to obtain a $1.4bn loan. The banks include Industrial and Commercial Bank of China, Bank of China, Standard Chartered and Abu Dhabi’s First Gulf Bank. DEWA will be the major stakeholder with a 51% share in the company established to build and operate the Hassyan plant. (Reuters) Abu Dhabi to introduce policy on affordable housing target for developers – The Abu Dhabi Urban Planning Council has said that a new policy, which sets affordable housing targets for developers in Abu Dhabi, could be introduced before 2015-end. The new policy will place targets for developers to achieve 20% of affordable homes within new housing schemes. (GulfBase.com) JLL: Abu Dhabi property prices steady despite weak demand – According to JLL, high occupancy levels in premium office and residential properties in Abu Dhabi had helped keep overall prices steady in 3Q2015 despite weakening demand. As per JLL, sales prices were steady in 3Q2015 as compared to 12 months earlier, but rents for apartments and houses rose 7% and 3%, respectively over the same period. JLL said the performance differs because rents are linked to end-user demand while sales are mostly sentiment driven. JLL Abu Dhabi office head David Dudley said some of Abu Dhabi’s mega projects are expected to be delayed further and phased over a longer time frame. On the positive side, supply remains under control. JLL said demand for office space remains suppressed. While there are a few vacant units in premium office buildings, the overall office vacancy rate had risen to 27% as of September 30, 2015 from 25% a year earlier. (Reuters) Jazeera Airways gets shareholders’ nod to reduce capital base – Kuwait’s Jazeera Airways has received shareholders’ approval to reduce its capital by more than a half, as it adjusts from having closed its airline leasing business. The airline’s extraordinary general meeting (EGM) on October 12, 2015 approved a board recommendation to cut the capital from KD42mn to KD20mn through a share buyback program. Jazeera Airways will buy back 220 million shares at the nominal share price of 100 fils, resulting in a KD22mn shareholder payout. The share buyback brings the airlines’ total payout to shareholders in 2015 to KD52.7mn. Earlier, in January, Jazeera Airways announced that it was selling off its entire fleet to lessors and would close its own leasing arm. (GulfBase.com) KNPC signs contracts for Al-Zour refinery – Daewoo Engineering & Construction Company, Tecnicas Reunidas SA and Hyundai Heavy Industries Company are among firms, which have signed contracts to build Kuwait’s KD4.87bn Al Zour oil refinery. The refinery, with a capacity of 615,000 barrels per day (bpd), will raise Kuwait’s total refining capacity to 1.4mn bpd when completed in July 2019. Kuwait National Petroleum Company (KNPC) Project Manager Khaled Al-Awadhi said the refinery will be built in five packages, with the first valued at KD1.28bn awarded to Technicas, Hanwha Engineering & Construction Corporation and China Petroleum & Chemical Corporation (Sinopec). The second and third packages at a combined value of KD1.75bn were awarded to Fluor Corporation, Daewoo and Hyundai Heavy Industries Company, while the fourth package valued at KD475mn was given to Saipem SpA and Essar Oil Limited. The fifth package of KD454mn was awarded to Hyundai Engineering & Construction Company, Saipem and SK Holdings Company. The refinery, likely to be the largest in the Middle East, could be a major boost to Kuwait’s economy, which has slowed due to political tensions and low oil prices. (Bloomberg, GulfBase.com) NBK 3Q2015 profit rises 9.1% YoY on higher interest income – National Bank of Kuwait (NBK) reported a net profit of KD64.5mn in 3Q2015 as compared to KD59.1mn in 3Q2014, representing a YoY increase of 9.1%. The bank’s interest income rose to KD112.3mn in 3Q2015 from KD102.1mn in 3Q2014, driven by strong business volume. Interest income accounted for 65.7% of the total revenue, while operating revenue was up 2.1% to KD170.9mn. NBK’s total assets grew 9.4% YoY to KD23.78bn at the end of September 30, 2015. (Reuters) Kuwait Oil output to reach 3mn by 2015-end – Kuna reported that Kuwait Oil Company’s crude output capacity would reach 3mn barrels per day by 2015-end. Kuwait Oil is a subsidiary of the Kuwait Petroleum Corporation, a Government-owned holding company. (Bloomberg) Bank Muscat net profit rises 7.5% YoY in 9M2015 – Bank Muscat reported a net profit of OMR136.2mn in 9M2015 as compared to OMR126.7mn in 9M2014, representing a YoY increase of 7.5%. The bank’s operating profit had reached OMR176.6mn in 9M2015 as compared to OMR169.3mn in 9M2014. Net Interest Income from conventional banking had stood at OMR176.0mn in 9M2015 as compared to OMR170.3mn in 9M2014, while net income from Islamic financing was OMR13.7mn in 9M2015 as compared to OMR12.4mn for the same period of 2014. Non-interest income at OMR 112.9mn was higher by 8.4% as compared to OMR104.1mn for 9M2014. Net loans & advances from the conventional operation had increased by 8.7% to OMR6.57bn as against OMR6.04bn at the end of September 30, 2014. Customer deposits, including CDs from the conventional operations, had increased by 6.7% to OMR6.78bn in 9M2015 as against OMR6.35bn in 9M2014. (MSM) Dhofar Power extends ONEIC contract – Dhofar Power Company has extended the contract for electricity meters reading, billing and collection awarded to Oman National Engineering & Investment Company (ONEIC) for the period of one year ending April 30, 2017. ONEIC said that the contract has been extended with the same contract terms and conditions. (MSM) Bank Dhofar net profit up 10.12% YoY in 9M2015 – Bank Dhofar reported a consolidated net profit of OMR33.4mn in 9M2015 as compared to OMR30.33mn in 9M2014, representing an increase of 10.12% YoY. Bank Dhofar’s operating income stood at OMR84.64mn in 9M2015 as compared to OMR73.31mn in 9M2014. The bank’s total assets stood at OMR3.34bn as of September 30, 2015 as compared to OMR2.92bn as of September 30, 2015. Net loans & advances grew 16.83% YoY to OMR2.64bn, while customer deposits jumped 15.96% YoY to reach OMR2.55bn. (MSM) Omifco’s expansion plan depends on government supplying additional gas – Oman India Fertiliser Company (Omifco) plans to build a third train in Sur and implement a debottlenecking project, which together will almost double the existing urea capacity from 1.652mn tons to more than 3mn tons per annum which depends on the government’s decision to supply additional gas. Omifco is a $960mn joint venture equally owned by Oman Oil Company and India’s two fertilizer firms. Presently, Omifco has two identical plants of 2,530 tons per day each of urea and two identical plants of 1,750 tons per day each of ammonia at Qalhat in Sur. As much as 80% of ammonia production is used for manufacturing urea. The

- 8. Page 8 of 9 expansion plans depends on the government’s decision to supply additional gas. (GulfBase.com) Oman United Insurance authorizes Muscat Clearance to distribute dividends – Oman United Insurance Company has authorized Muscat Clearance & Depository Company to distribute dividends approved by the AGM dated March 30, 2015. Shareholders who do not claim their dividends have to approach Muscat Clearance & Depository Company with supportive documents as proof of their rights. (MSM) AECOM wins Diyar Al Muharraq design contract – Diyar Al Muharraq has signed an agreement with AECOM for comprehensive primary designing of infrastructure within the master-planned development. AECOM’s contractual obligations include providing primary design and construction supervision for all the infrastructural components of Diyar Al Muharraq including roads, grade separation, landscaping, environmental impact assessment, all transportation and logistics requirements and utilities, including the potable water network, sanitary network, electrical distribution network, telecommunications network and waste management. Diyar Al Muharraq is a Bahrain-based urban developer, while AECOM is a US-based infrastructure services firm. (GulfBase.com) Ezytrips launches online travel portal – Ezytrips, a Bahraini homegrown technology startup, has launched an online travel portal eyeing a share of the growing online bookings business. Ezytrips General Manager, Nitin Menon said that www.ezytrips.co is now live and operating through a franchise agreement with Bahraini firm Dadabhai Travel and Tours. He said an investment of $0.5mn has been made in this venture so far. (GulfBase.com) Bahrain Bourse announces Hijri New Year holiday – Bahrain Bourse will be officially closed on October 15, 2015 on the occasion of Hijri New Year for the year 1437 Hijri. The bourse will resume business on October 18, 2015. (Bahrain Bourse)

- 9. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 9 of 9 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE Index S&P Pan Arab S&P GCC (0.5%) (0.3%) (0.0%) (0.2%) (0.6%) 0.1% (0.3%) (0.8%) (0.6%) (0.4%) (0.2%) 0.0% 0.2% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,168.80 0.4 1.0 (1.4) MSCI World Index 1,661.07 (0.8) (0.8) (2.8) Silver/Ounce 15.91 0.5 0.5 1.4 DJ Industrial 17,081.89 (0.3) (0.0) (4.2) Crude Oil (Brent)/Barrel (FM Future) 49.24 (1.2) (6.5) (14.1) S&P 500 2,003.69 (0.7) (0.6) (2.7) Crude Oil (WTI)/Barrel (FM Future) 46.66 (0.9) (6.0) (12.4) NASDAQ 100 4,796.61 (0.9) (0.7) 1.3 Natural Gas (Henry Hub)/MMBtu 2.44 (0.0) 2.9 (18.7) STOXX 600 358.47 (0.8) (1.1) (1.5) LPG Propane (Arab Gulf)/Ton 46.00 (3.7) (6.4) (6.1) DAX 10,032.82 (0.8) (0.5) (4.1) LPG Butane (Arab Gulf)/Ton 61.00 (6.2) (6.2) (2.8) FTSE 100 6,342.28 (1.2) (1.7) (5.5) Euro 1.14 0.2 0.2 (5.9) CAC 40 4,643.38 (0.9) (1.1) 2.3 Yen 119.75 (0.2) (0.4) (0.0) Nikkei 18,234.74 (0.7) (0.7) 4.2 GBP 1.52 (0.7) (0.5) (2.1) MSCI EM 854.29 (1.3) (0.6) (10.7) CHF 1.04 0.5 0.4 3.8 SHANGHAI SE Composite 3,293.23 (0.1) 3.5 (0.3) AUD 0.72 (1.6) (1.2) (11.4) HANG SENG 22,600.46 (0.6) 0.6 (4.2) USD Index 94.76 (0.1) (0.1) 5.0 BSE SENSEX 26,846.53 (0.7) (1.4) (5.2) RUB 63.07 1.7 2.5 3.8 Bovespa 47,362.64 (6.3) (6.3) (34.8) BRL 0.26 (3.3) (3.3) (31.9) RTS 866.52 (1.1) (2.2) 9.6 141.7 118.8 114.5