QSE Falls 0.8% as Banks and Real Estate Indices Decline

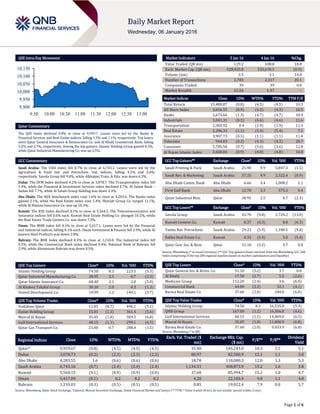

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.8% to close at 9,959.7. Losses were led by the Banks & Financial Services and Real Estate indices, falling 1.3% and 1.1%, respectively. Top losers were Qatar General Insurance & Reinsurance Co. and Al Khalij Commercial Bank, falling 5.2% and 2.7%, respectively. Among the top gainers, Islamic Holding Group gained 8.3%, while Qatar Industrial Manufacturing Co. was up 2.5%. GCC Commentary Saudi Arabia: The TASI Index fell 0.7% to close at 6,743.2. Losses were led by the Agriculture & Food Ind. and Petrochem. Ind. indices, falling 4.1% and 2.6%, respectively. Savola Group fell 9.8%, while Alkhaleej Train. & Edu. was down 6.3%. Dubai: The DFM Index declined 0.2% to close at 3,078.7. The Transportation index fell 1.4%, while the Financial & Investment Services index declined 0.7%. Al Salam Bank – Sudan fell 7.7%, while Al Salam Group Holding was down 2.4%. Abu Dhabi: The ADX benchmark index rose 1.6% to close at 4,283.6. The Banks index gained 2.1%, while the Real Estate index rose 1.4%. Sharjah Group Co. surged 11.1%, while Al Khazna Insurance Co. was up 10.3%. Kuwait: The KSE Index declined 0.1% to close at 5,564.2. The Telecommunication and Insurance indices fell 0.6% each. Kuwait Real Estate Holding Co. plunged 10.2%, while the Real Estate Trade Centers Co. was down 7.3%. Oman: The MSM Index fell 0.1% to close at 5,417.1. Losses were led by the Financial and Industrial indices, falling 0.1% each. Oman Investment & Finance fell 2.9%, while Al Jazeera Steel Products was down 2.8%. Bahrain: The BHB Index declined 0.3% to close at 1,210.0. The Industrial index fell 0.5%, while the Commercial Bank index declined 0.4%. National Bank of Bahrain fell 2.9%, while Aluminium Bahrain was down 0.5%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Islamic Holding Group 74.50 8.3 223.5 (5.3) Qatar Industrial Manufacturing Co 38.95 2.5 0.7 (2.3) Qatar Islamic Insurance Co. 68.40 2.1 2.0 (5.0) Al Khaleej Takaful Group 30.10 2.0 0.3 (1.3) United Development Co. 19.99 1.2 149.1 (3.7) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Vodafone Qatar 12.05 (0.7) 496.1 (5.1) Ezdan Holding Group 15.01 (1.3) 361.4 (5.6) Masraf Al Rayan 35.05 (1.8) 309.3 (6.8) Gulf International Services 48.15 (1.1) 299.1 (6.5) Qatar Gas Transport Co. 23.00 0.7 288.4 (1.5) Market Indicators 5 Jan 16 4 Jan 16 %Chg. Value Traded (QR mn) 129.2 108.8 18.8 Exch. Market Cap. (QR mn) 528,925.8 533,678.3 (0.9) Volume (mn) 3.5 3.1 14.0 Number of Transactions 2,783 2,317 20.1 Companies Traded 39 39 0.0 Market Breadth 12:26 1:37 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 15,480.87 (0.8) (4.5) (4.5) 10.3 All Share Index 2,656.55 (0.9) (4.3) (4.3) 10.5 Banks 2,673.66 (1.3) (4.7) (4.7) 10.9 Industrials 3,041.31 (0.5) (4.6) (4.6) 11.6 Transportation 2,383.92 0.4 (1.9) (1.9) 11.3 Real Estate 2,206.33 (1.1) (5.4) (5.4) 7.1 Insurance 3,987.73 (0.5) (1.1) (1.1) 11.0 Telecoms 944.03 (0.2) (4.3) (4.3) 20.7 Consumer 5,785.50 (0.7) (3.6) (3.6) 12.8 Al Rayan Islamic Index 3,668.84 (0.9) (4.8) (4.8) 10.8 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Printing & Pack. Saudi Arabia 25.90 9.9 5,847.3 (1.5) Saudi Res. & Marketing Saudi Arabia 57.25 9.9 2,322.4 (0.9) Abu Dhabi Comm. Bank Abu Dhabi 6.66 3.4 1,008.2 1.1 First Gulf Bank Abu Dhabi 12.70 3.3 575.3 0.4 Qatar Industrial Man. Qatar 38.95 2.5 0.7 (2.3) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Savola Group Saudi Arabia 43.70 (9.8) 2,729.2 (13.0) Kuwait Cement Co. Kuwait 0.37 (6.3) 0.8 (6.3) Yanbu Nat. Petrochem. Saudi Arabia 29.23 (5.9) 1,180.5 (9.8) Salhia Real Estate Co. Kuwait 0.35 (5.4) 5.0 (5.4) Qatar Gen. Ins. & Rein. Qatar 51.10 (5.2) 3.7 0.0 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Qatar General Ins. & Reins. Co. 51.10 (5.2) 3.7 0.0 Al Khalij 17.50 (2.7) 5.5 (2.6) Medicare Group 112.20 (2.4) 3.6 (6.0) Commercial Bank 44.00 (2.2) 32.1 (4.1) Barwa Real Estate Co. 37.60 (2.0) 248.0 (6.0) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Islamic Holding Group 74.50 8.3 16,535.0 (5.3) QNB Group 167.00 (1.2) 16,506.8 (4.6) Gulf International Services 48.15 (1.1) 14,469.0 (6.5) Masraf Al Rayan 35.05 (1.8) 11,000.9 (6.8) Barwa Real Estate Co. 37.60 (2.0) 9,453.9 (6.0) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 9,959.67 (0.8) (4.5) (4.5) (4.5) 35.48 145,243.0 10.3 1.5 5.1 Dubai 3,078.73 (0.2) (2.3) (2.3) (2.3) 80.97 82,580.9 12.1 1.1 3.8 Abu Dhabi 4,283.55 1.6 (0.6) (0.6) (0.6) 18.78 118,080.3 12.0 1.3 5.3 Saudi Arabia 6,743.16 (0.7) (2.4) (2.4) (2.4) 1,134.51 408,873.9 15.2 1.6 3.8 Kuwait 5,564.15 (0.1) (0.9) (0.9) (0.9) 37.68 85,994.7 15.2 1.0 4.7 Oman 5,417.09 (0.1) 0.2 0.2 0.2 4.20 22,183.4 9.8 1.1 4.8 Bahrain 1,210.03 (0.3) (0.5) (0.5) (0.5) 0.85 19,022.4 7.9 0.8 5.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 9,900 9,950 10,000 10,050 10,100 10,150 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index declined 0.8% to close at 9,959.7. The Banks & Financial Services and Real Estate indices led the losses. The index fell on the back of selling pressure from GCC and non-Qatari shareholders despite buying support from Qatari shareholders. Qatar General Insurance & Reinsurance Co. and Al Khalij Commercial Bank were the top losers, falling 5.2% and 2.7%, respectively. Among the top gainers, Islamic Holding Group gained 8.3%, while Qatar Industrial Manufacturing Co. was up 2.5%. Volume of shares traded on Tuesday rose by 14.0% to 3.5mn from 3.1mn on Monday. However, as compared to the 30-day moving average of 6.8mn, volume for the day was 49.1% lower. Vodafone Qatar and Ezdan Holding Group were the most active stocks, contributing 14.2% and 10.4% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Global Economic Data and Earnings Calendar Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 01/05 US National Association of Purch. ISM New York December 62.0 – 60.7 01/05 EU Eurostat CPI Estimate YoY December 0.20% 0.30% 0.20% 01/05 EU Eurostat CPI Core YoY December 0.90% 1.00% 0.90% 01/05 Germany Deutsche Bundesbank Unemployment Change (000's) December -14k -8k -14k 01/05 Germany Deutsche Bundesbank Unemployment Claims Rate SA December 6.30% 6.30% 6.30% 01/05 Germany Destatis CPI Brandenburg MoM December 0.00% – 0.00% 01/05 Germany Destatis CPI Brandenburg YoY December -0.10% – -0.10% 01/05 UK Markit Markit/CIPS UK Construction PMI December 57.8 56.0 55.3 01/05 Spain Spanish Labor Ministry Unemployment MoM Net ('000s) December -55.8 -50.0 -27.1 01/05 Italy ISTAT CPI EU Harmonized MoM December -0.10% 0.20% -0.50% 01/05 Italy ISTAT CPI EU Harmonized YoY December 0.10% 0.40% 0.20% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2015 results No. of days remaining Status QIBK Qatar Islamic Bank 19-Jan-16 13 Due GWCS Gulf Warehousing Company 20-Jan-16 14 Due KCBK Al Khalij Commercial Bank 20-Jan-16 14 Due QNCD Qatar National Cement Company 20-Jan-16 14 Due NLCS National Leasing (Alijarah) 21-Jan-16 15 Due VFQS Vodafone Qatar 26-Jan-16 20 Due DOHI Doha Insurance 31-Jan-16 25 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 45.82% 38.47% 9,497,367.84 Qatari Institutions 6.62% 10.92% (5,548,190.72) Qatari 52.44% 49.39% 3,949,177.12 GCC Individuals 0.95% 2.24% (1,668,002.60) GCC Institutions 6.43% 5.53% 1,160,005.18 GCC 7.38% 7.77% (507,997.42) Non-Qatari Individuals 20.65% 16.29% 5,626,814.46 Non-Qatari Institutions 19.53% 26.55% (9,067,994.16) Non-Qatari 40.18% 42.84% (3,441,179.70)

- 3. Page 3 of 6 News Qatar DOHI BoD meeting on January 31 – Doha Insurance’s (DOHI) board of directors (BoD) would meet on January 31, 2016 to discuss the financial statements for the period ended December 31, 2015. The company’s general assembly meeting is due to be held on February 28, 2016. (QSE) QCFS BoD to meet on January 20 – Qatar Cinema and Film Distribution (QCFS) has announced that its board of directors (BoD) will meet on January 20, 2016 to approve the financial results ending on December 31, 2015. (QSE) ORDS launches Qatar’s first desert navigation app – Ooredoo (ORDS) has launched a dedicated Inland Sea application aimed to help people easily navigate through desert dunes to safe spots and tourist attractions. The first-ever Qatar desert navigation app will provide users with important information such as geography and terrain, camping sites, emergency numbers and Supernet signal towers, so that desert visitors can stay connected. Importantly, the application will offer users satellite navigation through the desert to the Inland Sea using Ooredoo’s Supernet. Meanwhile, ORDS has announced that its CloudClinik service, launched early in 2015, has become the fastest-growing Electronic Medical Records (EMR) system for primary care clinics in Qatar. Built in consultation with renowned medical specialists, CloudClinik takes care of everything from walk-in or online patient registration, to appointment tracking and insurance claim generation, all this while ensuring security of patient data. To ensure that businesses understand the industry-changing abilities of the service, ORDS held a business event for clinics in Qatar in December and has seen a wide range of institutions adopt the cloud-based solution since then. (Gulf- Times.com) ABQK unveils new Payroll Card solution – Ahlibank (ABQK) has launched a new Payroll Card solution, which is designed to meet needs of employees who earn up to QR6,000 per month. Key features include no monthly salary processing charges for employer or Payroll Card holders, free usage of all ABQK ATMs, no minimum balance requirement and no monthly charges for cardholders. The card is also enabled for all ATMs and point-of- sale payments in Qatar using NAPS, as well as for usage overseas using the VISA network. Moreover, customers can access a dedicated Payroll Card contact center. (Gulf-Times.com) BMI: Qatar insurance sector may write gross premiums worth QR8.23bn in 2016 – According to BMI, a Fitch Group company, growth in Qatar’s insurance sector would be “intense” over the period up to 2017 due in large part to a surge in motor vehicle underwriting. BMI further forecasts “total gross premiums” written by Qatar’s insurance sector to reach QR8.23bn in 2016. Driven by a robust economy, high income levels and large-scale public investment, Qatar’s insurance sector would outperform the majority of Western markets over the next few years. BMI also notes that “however, the dominance of domestic insurers and the absence of any life insurance market of note will continue to deter many of the larger multinational players”. The market researcher estimates that Qatar’s insurance sector may have written gross premiums totaling QR7.8bn in 2015. BMI forecasts total gross premiums to reach QR8.58bn in 2017. BMI added that “Qatar’s insurance sector remains well-placed for expansion going into 2016”. (Gulf-Times.com) Sheikh Faisal: Make most of opportunities for growth – Al Faisal Holding Chairman Sheikh Faisal bin Qassim al-Thani has said that a growing population looking for a wide range of goods & services is creating “ample business opportunities” for Qatari entrepreneurs across the board. Sheikh Faisal, who is also chairman of the Qatari Businessmen Association (QBA), told global publishing, research and consultancy firm Oxford Business Group (OBG) that “virtually all sectors of the economy” were ripe for private sector investment, with Qatar’s ongoing infrastructure projects and new city developments offering plenty of potential for growth. (Gulf-Times.com) International Deutsche Bank cuts US GDP forecasts – Deutsche Bank economists have reduced their forecast on the US economic growth for 4Q2015 and 1Q2016 due to recent disappointing data on trade, construction spending and manufacturing activity. They, in a research note, said they pared their view on GDP for 4Q2015 by 1 percentage point to 0.5%, which still might be too high in light of what could be much larger inventory liquidation than what Deutsche Bank has assumed. The year-end weakness would extend to 1Q2016. The economists scaled back their 1Q2016 GDP forecast by half a point to 1.5%. They stuck with their GDP estimates for 2Q2016, 3Q2016 and 4Q2016 at 2.2%, 2.1%, and 2.4%, respectively. Despite the downgrades, the Deutsche Bank economists expect further improvement in the jobs market, which would allow the Federal Reserve to raise short-term interest rates by 25 basis points in 1Q2016 from the current 0.25-0.50% range. (Reuters) US auto sales in 2015 set record – Automakers have set a new US sales record for 2015, even as December sales fell short of expectations. Most forecasters said sales should rise to another record in 2016. According to Auto data Corp, US sales hit a record of 17.47mn vehicles for full year 2015, breaking the mark of 17.41mn vehicles recorded in 2000. Low gasoline prices, easy credit and moderate economic growth boosted the industry. Wards Auto, which provides data used by the US government for economic analysis, said 2015 sales set a record at 17.39mn vehicles sold, breaking the 2000 mark of 17.35mn. (Reuters) Eurozone core inflation dip adds to ECB’s headache – Eurozone core inflation slowed for the second month in a row in December, a big headache for the European Central Bank (ECB), which has printed hundreds of billions of euros to kick-start price growth with little to show for it. Inflation has undershot the ECB’s target for nearly three years and even radical policy steps, including €1.5tn of asset purchases, will take years at best to push price growth back toward 2%, threatening the bank’s credibility. Opponents of policy easing had relied on relatively strong readings of core inflation, which excludes volatile energy and food prices, in arguing that weak price growth was mostly an effect of the big oil price fall. However, even core data has started to soften, indicating that low energy prices are feeding into prices of goods and services very quickly. Eurostat said headline inflation, targeted by the ECB, held steady at 0.2%, missing expectations for a rise to 0.3% and still far short of the bank’s target. Meanwhile, core inflation, closely watched by policy hawks like Germany’s Bundesbank, eased to 0.8% from 0.9% in November and 1% in October. (Reuters) Greece’s proposed pension reforms get no backing from opposition – Greece’s leftist-led government offered a reform plan for the country’s pension system that would cut future benefits, with no backing from the political opposition, before talks with official lenders resume later in January 2016. Reforming the country’s ailing pension system, which Prime Minister Alexis Tsipras has said is on the verge of collapse, is a prerequisite for the first review of Greece’s €86bn bailout agreed in July 2015. The tough pension reforms will be a test for Tsipras’ ruling coalition, which has a majority of just three seats in parliament, and his resolve to carry out measures demanded by international creditors, who must sign off on the plan. The proposed overhaul of the pension system,

- 4. Page 4 of 6 which has been a drag on the budget for years, sets a ceiling of €2,300 on the maximum monthly pension outlay and an upper limit of €3,000 for those getting more than one pension. The plan calls for merging all six main pension funds into one and foresees cuts in future main pensions that could reach up to 30%. It sets a lower limit at €384 per month. The plan includes higher social security contributions for employers and employees, by one percentage point for those paid by employers and by 0.5 percentage point for employees. (Reuters) PMI: Japanese services expand again in December, firms see increase in new orders – According to a recent survey, service sector activity in Japan expanded in December at roughly the same pace it did in November and new business grew at the fastest in four months, a sign that domestic demand is strengthening. The Markit/Nikkei Japan Services Purchasing Managers Index (PMI) was at a seasonally adjusted 51.5 in December, little changed from 51.6 in November. December was the ninth consecutive month the index remained above the 50 threshold. The index for new business rose to 52.0 from 51.6 for November, indicating the fastest growth in four months. The business expectations index, which measures forecasts of output over the next year, also reached the highest in four months, rising to 54.8 in December from 54.0 in November. In 2014, services accounted for 65% of Japan’s GDP, while manufacturing had a 21% share. Meanwhile, Bank of Japan Governor Haruhiko Kuroda said he is willing to take bold steps if needed to ensure that inflation reaches the central bank’s 2% price target. Kuroda, also said gains in wages are needed to ensure inflation accelerates in a sustainable manner. (Reuters) Regional GPCA: Qatar’s plastic industry expands to 8% of GCC portfolio – According to a recent report by the Gulf Petrochemicals and Chemicals Association (GPCA), expansions in Qatar’s plastic industry in 2015 increased the country’s regional market share, as it now accounts for 8% of the GCC’s plastic portfolio. Plastic production in the Gulf region would grow at a steady 3.2% until the decade-end, spurred by a sustained rollout of strategic projects. Further, the report notes that the region’s plastic production capacity tripled in the last 10 years, reaching 26.2mn tons in 2015, earning $32bn in revenues. During the 2005-2015 period, annual production rose 11.7%, and clustered around prominent projects in Saudi Arabia. Like Saudi Arabia, development strategies that benefit plastic production have also been implemented elsewhere in the GCC. (Gulf-Times.com) Tadawul deposits Alandalus IPO shares in investors' portfolios – The Saudi Stock Exchange (Tadawul) has deposited IPO shares of Alandalus Property Company in investors’ portfolio on January 5, 2016. (Tadawul) City Cement starts commercial operations of WHR unit – City Cement Company has started commercial operations of its Waste Heat Recovery (WHR), which will reduce the cost of cement production by nearly SAR2 per ton. The facility, with a capacity reaching up to 14.2 megawatts, will rationalize fuel consumption and reduce carbon dioxide emissions. The company said that the financial impact of this technology will be reflected in the financials of 2016 and beyond. (Tadawul) Al-Tayyar to acquire 30% stake in Thakher – Al-Tayyar Travel Group Holding Company will acquire a 30% stake in Thakher Investment and Real Estate Development Company instead of 25%, as per its amended agreement. Under the terms of the new agreement, Al-Tayyar will buy 15% of Thakher from Mohammed Alsubeaie & Sons Investment Company (MASIC) and 15% from Abdullah Almishal & Sons Company (Almishal) at a total value of SR803.8mn. Al-Tayyar will issue 9.65mn shares to MASIC and Almishal through a capital increase at SR83.30 per share as compared with the previously-agreed upon price of SR102.90. Accordingly, the combined shareholding of MASIC and Almishal in Al-Tayyar will reach 4.60%. The previous agreement stated that Al-Tayyar will acquire 12.5% each from the two shareholders at a total value of SR669.9mn. (Tadawul) WTO: UAE achieves top rankings in 2015 international trade statistics – According to a study released by the World Trade Organisation (WTO), the UAE has managed to achieve top rankings in international trade statistics of 2015. Minister of Economy Sultan Bin Saeed Al Mansouri said that the figures and data contained in the WTO International Trade Statistics 2015 are promising, and reflect the continued success of the UAE’s economic policies year after year. The WTO figures show that non- oil foreign trade amounted to AED1.63tn in 2014, and is expected to grow 10% to AED1.75tn in 2015. In terms of ranking, the UAE is the 16th top global exporter with a growth of 4% from 2010-2014 as opposed to the 6% global average. However, in terms of global imports, the country was ranked 20th with a 12% growth contrasting with the 5% global growth. In terms of the global services trade, the UAE is ranked 19th with a value of AED257.1bn in imports. The country is ranked 42nd globally in service exports, with international trade reaching AED73.4bn with a 16% increase from 2010-2014. In 2014, the UAE service exports had achieved 14% growth as compared to 2013. (GulfBase.com) Sharjah plans Islamic bond issue in 1Q2016 – According to sources, Sharjah is planning to raise funds through a dollar-denominated Islamic bond, in what could be the first sovereign Sukuk issuance from the Gulf region in 2016. The sources said the issue would be of benchmark size, traditionally understood to be in excess of $500mn. Six local and international banks have reportedly been mandated to arrange the Sukuk including HSBC, which is leading the transaction. The sovereign is aiming to issue the Sukuk in 1Q2016 and could announce investor meetings for the deal as early as January 2016. (Reuters) UAE regulator tells banks to seek approval before disclosing dividends – According to sources, banks in the UAE have been told to get dividends approved by the central bank before announcing the details of payments to markets and shareholders. The demand for clearance from the regulator was aimed at safeguarding lenders' capital base and ensuring they did not overextend themselves as liquidity becomes scarcer. Shareholders have become used to enjoying healthy dividend payouts in recent years as bank earnings surged in line with a strengthening local economy. But banks' profits have begun to suffer from the impact of lower oil prices in recent months as liquidity has tightened, government deposits have fallen and some small businesses have defaulted on their debt. (Reuters) Salama GM & Assistant to Group CEO steps down – Islamic Arab Insurance Company (Salama) has announced that its General Manager (GM) and Assistant to Group CEO, Ahmad Sami Sharif has resigned from his position. The company’s Reinsurance Manager and Head of Non-Motor Business Unit (General Takaful) has assumed the position of Acting General Manager (General and Health Takaful) with effect from January 4, 2016. (DFM) DDFG reports sales turnover of AED7bn in 2015 – The Dubai Duty Free Group (DDFG) has reported a sales turnover of AED7.057bn for 2015, slightly up as compared to 2014 record-breaking sales of AED6.999bn. DDFG recorded 26,848,832 sales transactions in 2015, which is an average of 73,558 sales transactions per day across both Dubai International and Al Maktoum International. Perfumes continued to be the highest selling category with annual sales topping AED1.137bn, which represents 16.5% of the total annual sales. (GulfBase.com)

- 5. Page 5 of 6 Dubai’s Rera index updated for 2016 – Dubai Land Department’s Real Estate Regulatory Authority (Rera) has updated the rental calculator to provide leasing rates for various apartments and villas in 2016. The calculator, which serves as an online tool for determining rental increases, suggests some price ranges and advises tenants whether or not they are entitled to an increase in 2016. (GulfBase.com) OCI founder and board member resigns – Oman Cables Industry (OCI) has announced that its founder and long-serving Director, Hussain Bin Salman Al Lawati has resigned from the membership of board of with effect from January 4, 2016. (MSM) Bank Dhofar secures $250mn three-year loan – According to sources, Bank Dhofar has raised a $250mn three-year loan to be used for general funding. The lender joins a number of Gulf banks that have tapped the loan market in recent weeks to bolster their balance sheets, while regional liquidity dropped amid persistently low oil prices. Bank ABC, BNP Paribas, Commerzbank, Credit Agricole, HSBC and National Bank of Abu Dhabi have reportedly funded the transaction. (Reuters) SGRF plans $260mn mining venture – State General Reserve Fund (SGRF) plans to cooperate with other state and private investors to establish a venture to buy into the mining industry. SGRF Executive President Abdulsalam Al Murshidi said that the venture, Mining Development Oman (MDO), will have $260mn of capital and establish vehicles for its investments in various locations. Oman Investment Fund, Oman Oil Company and Oman National Investments Development Company will combine with the SGRF to take a total 60% stake in MDO, while the remaining 40% will be offered to the public. Al Murshidi said MDO would be a partial investor in mining projects, seeking partners locally, regionally, and internationally, but did not elaborate on where the projects would be located or give other details. (Reuters) Ooredoo Kuwait COO resigns – Ooredoo Kuwait's Chief Operating Officer (COO) Hani El-Kukhun has resigned from his position with effect from January 1, 2016. (Reuters) ONA: Oman seeks private cash for waterfront project – Oman News Agency (ONA) quoting Minister of Transport and Communications Ahmed bin Mohammed al-Futaisi has reported that Oman is planning a OMR500mn waterfront development around Port Sultan Qaboos in capital Muscat that will be paid from the private sector investment. The project is the first announced following the publication of the Oman’s five-year plan on Sunday, which highlighted an increased role for outside investment to help maintain development projects at a time of lower oil prices and squeezed state finances. The project, due to be completed over four phases up to 2027, will be 51% state-owned through the Oman Tourism Development Company (Omran), while the remaining 49% will be held by investors. Financing will be arranged through pension funds and private sector investment with no government cash involved. (GulfBase.com) Integrated Capital acquires more than 5% outstanding shares of GFH – Abu Dhabi-based Integrated Capital has acquired more that 5% of GFH Financial Group’s (GFH) overall outstanding shares. (Bahrain Bourse)

- 6. Contacts Saugata Sarkar Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa ` QNB Financial Services SPC Contact Center: (+974) 4476 6666 PO Box 24025 Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 QSEIndex S&P Pan Ar ab S&P GCC (0.7%) (0.8%) (0.1%) (0.3%) (0.1%) 1.6% (0.2%) (1.0%) 0.0% 1.0% 2.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,077.68 0.3 1.5 1.5 MSCI World Index 1,630.64 (0.0) (1.9) (1.9) Silver/Ounce 13.99 0.8 1.2 0.9 DJ Industrial 17,158.66 0.1 (1.5) (1.5) Crude Oil (Brent)/Barrel (FM Future) 36.42 (2.1) (2.3) (2.3) S&P 500 2,016.71 0.2 (1.3) (1.3) Crude Oil (WTI)/Barrel (FM Future) 35.97 (2.1) (2.9) (2.9) NASDAQ 100 4,891.43 (0.2) (2.3) (2.3) Natural Gas (Henry Hub)/MMBtu 2.32 (2.6) 0.5 0.5 STOXX 600 358.88 (0.0) (3.0) (3.0) LPG Propane (Arab Gulf)/Ton 39.25 (1.9) 0.3 0.3 DAX 10,310.10 (0.4) (5.5) (5.5) LPG Butane (Arab Gulf)/Ton 57.50 (2.1) 0.0 0.0 FTSE 100 6,137.24 0.5 (2.2) (2.2) Euro 1.07 (0.8) (1.0) (1.0) CAC 40 4,537.63 (0.3) (3.2) (3.2) Yen 119.06 (0.3) (1.2) (1.0) Nikkei 18,374.00 (0.1) (2.2) (2.2) GBP 1.47 (0.3) (0.5) (0.4) MSCI EM 768.46 0.1 (3.2) (3.2) CHF 0.99 (0.6) (0.7) (0.6) SHANGHAI SE Composite 3,287.71 (0.1) (7.6) (7.6) AUD 0.72 (0.4) (1.9) (1.7) HANG SENG 21,188.72 (0.7) (3.3) (3.3) USD Index 99.40 0.5 0.7 0.8 BSE SENSEX 25,580.34 0.0 (2.6) (2.4) RUB 73.35 0.6 1.1 1.1 Bovespa 42,419.32 1.7 (3.5) (3.5) BRL 0.25 0.8 (1.2) (1.2) RTS 752.70 0.5 (0.6) (0.6) 115.0 103.0 102.3