Weekly market report

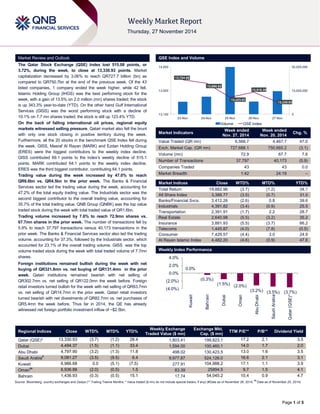

- 1. Page 1 of 5 Market Review and Outlook QSE Index and Volume The Qatar Stock Exchange (QSE) Index lost 515.08 points, or 3.72%, during the week, to close at 13,330.93 points. Market capitalization decreased by 3.06% to reach QR727.7 billion (bn) as compared to QR750.7bn at the end of the previous week. Of the 43 listed companies, 1 company ended the week higher, while 42 fell. Islamic Holding Group (IHGS) was the best performing stock for the week, with a gain of 13.5% on 2.0 million (mn) shares traded; the stock is up 343.3% year-to-date (YTD). On the other hand Gulf International Services (GISS) was the worst performing stock with a decline of 10.1% on 7.7 mn shares traded; the stock is still up 123.4% YTD. On the back of falling international oil prices, regional equity markets witnessed selling pressure. Qatari market also felt the brunt with only one stock closing in positive territory during the week. Furthermore, all the 20 stocks in the benchmark QSE Index fell during the week. GISS, Masraf Al Rayan (MARK) and Ezdan Holding Group (ERES) were the biggest contributors to the weekly index decline. GISS contributed 69.1 points to the index’s weekly decline of 515.1 points. MARK contributed 64.1 points to the weekly index decline. ERES was the third biggest contributor, contributing 64.1 points. Trading value during the week increased by 47.0% to reach QR6.6bn vs. QR4.5bn in the prior week. The Banks & Financial Services sector led the trading value during the week, accounting for 47.2% of the total equity trading value. The Industrials sector was the second biggest contributor to the overall trading value, accounting for 35.7% of the total trading value. QNB Group (QNBK) was the top value traded stock during the week with total traded value of QR1.6bn. Trading volume increased by 7.6% to reach 72.9mn shares vs. 67.7mn shares in the prior week. The number of transactions fell by 5.9% to reach 37,797 transactions versus 40,173 transactions in the prior week. The Banks & Financial Services sector also led the trading volume, accounting for 37.3%, followed by the Industrials sector, which accounted for 23.1% of the overall trading volume. GISS was the top volume traded stock during the week with total traded volume of 7.7mn shares. Foreign institutions remained bullish during the week with net buying of QR321.8mn vs. net buying of QR131.4mn in the prior week. Qatari institutions remained bearish with net selling of QR302.7mn vs. net selling of QR122.0mn the week before. Foreign retail investors turned bullish for the week with net selling of QR63.7mn vs. net selling of QR14.7mn in the prior week. Qatari retail investors turned bearish with net divestments of QR82.7mn vs. net purchases of QR5.4mn the week before. Thus far in 2014, the QE has already witnessed net foreign portfolio investment inflow of ~$2.5bn. Market Indicators Week ended Nov. 27, 2014 Week ended Nov. 20, 2014 Chg. % Value Traded (QR mn) 6,566.7 4,467.7 47.0 Exch. Market Cap. (QR mn) 727,688.1 750,665.2 (3.1) Volume (mn) 72.9 67.7 7.6 Number of Transactions 37,797 40,173 (5.9) Companies Traded 43 43 0.0 Market Breadth 1:42 24:19 – Market Indices Close WTD% MTD% YTD% Total Return 19,882.96 (3.7) (1.2) 34.1 All Share Index 3,388.77 (3.5) (0.7) 31.0 Banks/Financial Svcs. 3,412.26 (2.6) 0.8 39.6 Industrials 4,391.82 (3.4) (0.9) 25.5 Transportation 2,391.91 (1.7) 2.2 28.7 Real Estate 2,640.98 (5.5) (3.2) 35.2 Insurance 3,881.93 (5.5) (3.7) 66.2 Telecoms 1,445.87 (4.0) (7.8) (0.5) Consumer 7,429.57 (4.4) 3.0 24.9 Al Rayan Islamic Index 4,482.20 (4.6) (0.9) 47.6 Market Indices Weekly Index Performance Regional Indices Close WTD% MTD% YTD% Weekly Exchange Traded Value ($ mn) Exchange Mkt. Cap. ($ mn) TTM P/E** P/B** Dividend Yield Qatar (QSE)* 13,330.93 (3.7) (1.2) 28.4 1,803.41 199,823.1 17.2 2.1 3.5 Dubai 4,494.37 (1.5) (1.1) 33.4 1,594.00 100,460.1 14.0 1.7 2.0 Abu Dhabi 4,797.90 (3.2) (1.3) 11.8 498.02 130,423.5 13.0 1.6 3.5 Saudi Arabia# 9,081.27 (3.5) (9.5) 6.4 9,977.87 524,126.0 16.6 2.1 3.1 Kuwait 6,986.68 0.0 (5.1) (7.5) 277.91 104,988.2 17.1 1.1 3.9 Oman## 6,936.88 (2.0) (0.5) 1.5 83.39 25894.5 9.7 1.5 4.1 Bahrain 1,436.93 (0.3) (0.5) 15.1 17.74 54,045.2 10.4 0.9 4.7 Source: Bloomberg, country exchanges and Zawya (** Trailing Twelve Months; * Value traded ($ mn) do not include special trades, if any) (#Data as of November 26, 2014, ## Data as of November 25, 2014) 13,754.89 13,690.02 13,423.83 13,518.35 13,330.93 0 15,000,000 30,000,000 13,100 13,550 14,000 23-Nov 24-Nov 25-Nov 26-Nov 27-Nov Volume QSE Index 0.0% (0.3%) (1.5%) (2.0%) (3.2%) (3.5%) (3.7%) (4.0%) (2.0%) 0.0% 2.0% 4.0% Kuwait Bahrain Dubai Oman Abu Dhabi Saudi Arabia Qatar (QSE)*

- 2. Page 2 of 5 News Economic News MDPS: Industrial PPI declines 7.6% YoY in September – According to the Ministry of Development Planning & Statistics (MDPS), the monthly Producer Price Index (PPI) of the industrial sector for September 2014 stood at 158.4, showing a decline of 3.4% MoM and a decrease of 7.6% on a YoY basis. The index, which covers mining, electricity & water and manufacturing activities, is a measure of the average selling prices received by domestic producers for their output. The mining group’s PPI (77% weight) showed a decline of 4% MoM (-8.8% on a YoY basis). The manufacturing group’s PPI (21% weight) registered a negligible fall of 0.6% MoM (-2.5% on a YoY basis). The PPI of electricity and water (2% weight) declined 0.2% MoM (-4.5% on a YoY basis). (Peninsula Qatar) Emir endorses Cabinet decisions on expropriation of real estate – HH the Emir Sheikh Tamim bin Hamad Al-Thani endorsed Cabinet decision No. 60 of 2014 expropriating some real estate for public interest. The decision stipulated that real estate necessary for the implementation of the project explained in the decision of the Minister of Municipality & Urban Planning No. 67 of 2014 shall be expropriated for public interest. The Emir also endorsed the following laws and Cabinet decisions on expropriating real estate for public interest: Law Nos 61, 63, 64, and 65 of 2014. The decisions stipulated that real estate necessary for the implementation of the projects explained in the decision of the Minister of Municipality & Urban Planning Nos 70, 83, 84 and 85 of 2014 shall be expropriated for public interest. The Cabinet endorsed decision Nos 66, 67, 68 and 69 of 2014 expropriating some real estate for public interest. The decisions stipulated that real estate necessary for the implementation of the project explained in the decision of the Minister of Municipality and Urban Planning No 86, 91, 97 and 98 of 2014 shall be expropriated for public interest. The decisions stipulated that the measures included in law No. 13 of 1988 for paying damages to the owners of the expropriated real estate are to be taken in accordance with this decision. The decisions are to go into force from the date of issue in the official gazette. The Emir also endorsed Cabinet Decision No. 71 of 2014 reforming the Committee of Trustees of the State Encouragement Award. (Gulf-Times.com) PM: Solid fundamentals bolster Qatar’s sustainability – Despite turbulent global market conditions, HE the Prime Minister and Minister of Interior Sheikh Abdullah bin Nasser bin Khalifa Al-Thani has reassured the economic sustainability of Qatar, which is anchored on solid economic fundamentals. He said that the economic growth of Qatar is well-connected with the development of the global economy and therefore the country is concentrating on following-up these developments and the potential consequences. He was referring to big-ticket projects that form part of the Qatar National Vision 2030 in the areas of infrastructure, economic growth, and building Qatari human capital. According to the Prime Minister, financial activities pave the way for more participation of the private sector in the economic environment. He emphasized that Qatar is constantly supporting the non-hydrocarbon sector through the expansion of industrial areas and by increasing the capacity of storage as well as the growth of small and medium-sized enterprises (SMEs). (Gulf-Times.com) QCB Governor reaffirms strength of Qatar banking sector – The Qatar Central Bank (QCB) Governor, HE Sheikh Abdullah bin Saud Al-Thani, said that Qatar's banking sector has performed outstandingly despite the challenges faced by the global financial sector. He said that such an outstanding performance reflects the strength of QCB's supervisory and regulatory role in ensuring the compliance of all banks operating in the country with laws and legislation governing the local and international financial sectors, including the calculation of bank capital adequacy based on the Basel Committee III requirements and QCB directives, which are being implemented since the beginning of 2014. He further added that QCB's supervisory role aims to ensure banks' compliance with laws on combating terrorism funding and money laundering so as to enhance the performance of the entire banking sector. (QNA) Qatar to expand public transport, to ply 2,000 buses by 2020 – Qatar has set an ambitious five-year plan starting from 2015 to develop its public transport sector in a big way. HE the Minister of Transport Jassim Seif Ahmed Al-Sulaiti said that the plan would see at least 2,000 public transport buses on the roads by 2020. The minister said the country was preparing well to meet the travel requirements of not only the large number of visitors expected for the 2022 FIFA World Cup, but was also committed toward putting in place a vastly developed public transport infrastructure for residents. He further pointed out that the country's authorities are committed toward building about 2,500 kilometers of Expressways by 2030. The minister said the Doha Metro network, for which work is going on at a fast pace, will see the laying of 84 kilometers of railway lines and have 38 stations by 2019. Separately, the Lusail Light Rail would have a length of 35 kilometers with 32 stations. (Gulf- Times.com) QCB to issue T-bills worth QR4bn on December 2 – The Qatar Central Bank (QCB) will issue new three-month treasury bills worth QR2bn, along with six-month and nine-month T-bills worth QR1bn each on December 2, 2014. (QCB) Market & Corporate News CBQK Group CEO resigns and joins the board as advisor – The Commercial Bank of Qatar (CBQK) announced that Andrew C. Stevens has been appointed as an adviser to the board of directors. Mr. Stevens has resigned as the Group Chief Executive Officer with an immediate effect to assume his new role, after spending 25 years with the bank. His new responsibilities will include advising the board as well as representing CBQK on the board committees of its subsidiaries and associate banks, such as Alternatifbank in Turkey, United Arab Bank in the UAE and the National Bank of Oman. Mr. Stevens’ current responsibilities across the group will be assumed by CBQK’s CEO Mr. Abdulla Saleh Al Raisi and the executive team. (QSE) QATI eyes QR910mn from convertible notes – Qatar Insurance Company (QATI), a leading risk provider, is raising QR910mn by issuing convertible notes to the General Retirement & Social Insurance Authority (GRSA), as part of its efforts to shore up the capital base and strengthen the solvency regime. QATI’s Vice Chairman Abdullah bin Khalifa Al-Attiya said as per the solvency and capital adequacy reviews, the company needs to increase its capital by the end of 2015 or during 2016, to be in line with the projected future expansion plans. Based on the reviews, QATI’s board has resolved to issue convertible notes totaling QR910mn with a maturity of five years and annual coupon, which is yet to be agreed upon. The notes, which could be converted any time after three years of issuance and priced at a premium once converted, will not exceed 8mn shares, which represent only 5% of the current share capital. (Gulf-Times.com)

- 3. Page 3 of 5 Qatar Stock Exchange Top Gainer Top 5 Decliners Source: Qatar Stock Exchange (QSE) Source: Qatar Stock Exchange (QSE) Most Active Shares by Value (QR Million) Most Active Shares by Volume (Million) Source: Qatar Stock Exchange (QSE) Source: Qatar Stock Exchange (QSE) Investor Trading Percentage to Total Value Traded Net Traded Value by Nationality (QR Million) Source: Qatar Stock Exchange (QSE) Source: Qatar Stock Exchange (QSE) 13.5% 0.0% 5.0% 10.0% 15.0% Islamic Holding Group -10.1% -8.1% -7.7% -7.5% -7.5% -12.0% -8.0% -4.0% 0.0% Gulf International Services National Leasing Medicare Group United Development Barwa Real Estate 1,644.4 1342.4 879.1 387.3 334.5 0.0 600.0 1,200.0 1,800.0 QNB Group Industries Qatar Gulf International Services Islamic Holding Group Masraf Al Rayan 7.7 7.1 7.0 6.8 5.7 0.0 3.0 6.0 9.0 Gulf International Services QNB Group Industries Qatar Masraf Al Rayan Vodafone Qatar 0% 20% 40% 60% 80% 100% Buy Sell 22.14% 23.40% 11.03% 15.64% 7.00% 6.03% 59.82% 54.92% Qatari Individuals Qatari Institutions Non-Qatari Individuals Non-Qatari Institutions 2,178 4,388 2,564 4,002 (385) 385 (1,000) - 1,000 2,000 3,000 4,000 5,000 Qatari Non-Qatari Net Investment Total Sold Total Bought

- 4. Page 4 of 5 TECHNICAL ANALYSIS OF THE QSE INDEX Source: Bloomberg The Index ended the week losing 3.7% from the previous week as heavy selloff took place after the rebalancing of the MSCI Emerging Markets Index. Indicators are looking bearish as the RSI confirmed the negative divergence with the price. Volumes increased with the drop, which suggests the strength of the decline may continue this week. MACD is below its signal line which is also negative. On the positive side, the Index closed at the uptrend line which can be a support level to bounce of off. A break below the 13,200 will drag the Index to the 12,900 level. On the flip side, a break above 13,550 could be a bullish signal and portend a move up toward the 13,800 level. DEFINITIONS OF KEY TERMS USED IN TECHNICAL ANALYSIS RSI (Relative Strength Index) indicator – RSI is a momentum oscillator that measures the speed and change of price movements. The RSI oscillates between 0 to 100. The index is deemed to be overbought once the RSI approaches the 70 level, indicating that a correction is likely. On the other hand, if the RSI approaches 30, it is an indication that the index may be getting oversold and therefore likely to bounce back. MACD (Moving Average Convergence Divergence) indicator – The indicator consists of the MACD line and a signal line. The divergence or the convergence of the MACD line with the signal line indicates the strength in the momentum during the uptrend or downtrend, as the case may be. When the MACD crosses the signal line from below and trades above it, it gives a positive indication. The reverse is the situation for a bearish trend. Candlestick chart – A candlestick chart is a price chart that displays the high, low, open, and close for a security. The ‘body’ of the chart is portion between the open and close price, while the high and low intraday movements form the ‘shadow’. The candlestick may represent any time frame. We use a one-day candlestick chart (every candlestick represents one trading day) in our analysis. Doji candlestick pattern – A Doji candlestick is formed when a security's open and close are practically equal. The pattern indicates indecisiveness, and based on preceding price actions and future confirmation, may indicate a bullish or bearish trend reversal. Shooting Star/Inverted Hammer candlestick patterns – These candlestick patterns have a small real body (open price and close price are near to each other), and a long upper shadow (large intraday movement on the upside). The Shooting Star is a bearish reversal pattern that forms after a rally. The Inverted Hammer looks exactly like a Shooting Star, but forms after a downtrend. Inverted Hammers represent a potential bullish trend reversal.

- 5. Contacts Saugata Sarkar Abdullah Amin, CFA Shahan Keushgerian Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6569 Tel: (+974) 4476 6509 saugata.sarkar@qnbfs.com.qa abdullah.amin@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa Sahbi Kasraoui Ahmed Al-Khoudary QNB Financial Services SPC Manager – HNWI Head of Sales Trading – Institutional Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6544 Tel: (+974) 4476 6548 PO Box 24025 sahbi.alkasraoui@qnbfs.com.qa ahmed.alkhoudary@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 5 of 5 Source: Bloomberg Company NamePrice(November 27) % Change 5-Day% Change YTDMarket Cap. QR MillionTTM P/EP/BDiv. YieldQatar National Bank229.00(1.12)33.14160,238 15.42.93.1Qatar Islamic Bank105.60(3.12)53.0424,953 16.92.13.8Commercial Bank of Qatar73.00(3.31)23.7321,676 12.01.32.3Doha Bank59.20(2.31)1.7215,296 10.71.37.6Al Ahli Bank54.10(3.39)27.878,937 15.72.2N/AQatar International Islamic Bank84.60(3.64)37.1212,806 15.92.44.4Masraf Al Rayan48.25(5.02)54.1536,188 19.33.33.1Al Khaliji Bank22.00(2.61)10.067,920 14.11.44.5National Leasing23.24(8.14)(22.92)1,150 28.70.96.5Dlala Holding55.10(3.33)149.321,223 15.44.0N/AQatar & Oman Investment16.25(3.85)29.79512 20.31.33.7Islamic Holding Group203.9013.47343.26816 57.712.70.8Banking and Financial Services291,714 Zad Holding89.00(3.26)28.061,164 10.81.53.9Qatar German Co. for Medical Devices11.82(1.50)(14.66)137 N/A0.8N/ASalam International Investment17.00(3.41)30.671,943 26.51.25.9Medicare Group126.50(7.66)140.953,560 23.94.21.4Qatar Cinema & Film Distribution44.50(7.00)10.97254 21.41.7N/AQatar Fuel220.30(3.38)0.8118,606 16.22.83.5Qatar Meat and Livestock66.00(5.71)27.661,188 22.14.63.2Al Meera Consumer Goods212.00(6.03)59.044,240 15.73.13.8Consumer Goods and Services31,093 Qatar Industrial Manufacturing47.15(2.18)11.822,241 11.41.4N/AQatar National Cement139.40(0.29)17.146,845 15.42.64.3Industries Qatar191.00(2.30)13.08115,555 18.13.65.8Qatari Investors Group45.00(3.85)2.975,595 26.32.51.7Qatar Electricity and Water190.00(1.55)14.9020,900 13.53.23.6Mannai Corp.107.30(2.90)19.354,895 9.22.45.1Aamal14.20(3.40)(5.33)8,520 15.71.2N/AGulf International Services109.00(10.14)123.3620,257 20.35.61.5Mesaieed Petrochemical Holding31.80(0.63)N/A39,951 N/A2.91.1Industrials224,757 Qatar Insurance90.70(6.97)70.4914,561 14.52.52.2Doha Insurance34.90(1.69)39.601,745 12.41.65.7Qatar General Insurance & Reinsurance45.60(1.94)14.243,154 2.10.52.7Al Khaleej Takaful Insurance51.90(5.64)84.851,152 13.11.6N/AQatar Islamic Insurance86.00(1.15)48.531,290 15.74.34.4Insurance21,902 United Development25.90(7.50)20.289,171 24.40.93.7Barwa Real Estate48.30(7.47)62.0818,795 13.71.44.1Ezdan Real Estate18.02(4.25)6.0047,798 35.51.51.7Mazaya Qatar Real Estate Development21.90(4.87)95.892,190 10.21.83.4Real Estate77,954 Qatar Telecom116.90(3.23)(14.80)37,445 14.71.53.4Vodafone Qatar17.70(6.45)65.2714,964 N/A2.71.0Telecoms52,409 Qatar Navigation (Milaha)101.50(0.49)22.2911,624 11.60.94.9Gulf Warehousing59.00(6.94)42.172,806 21.73.32.5Qatar Gas Transport (Nakilat)23.98(1.48)18.4213,429 15.33.64.6Transportation27,859 Qatar Exchange727,688