QNBFS Daily Market Report March 4, 2019

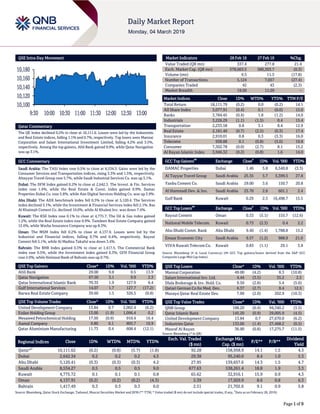

- 1. Page 1 of 9 QSE Intra-Day Movement Qatar Commentary The QE Index declined 0.2% to close at 10,111.6. Losses were led by the Industrials and Real Estate indices, falling 1.1% and 0.7%, respectively. Top losers were Mannai Corporation and Salam International Investment Limited, falling 4.2% and 3.5%, respectively. Among the top gainers, Ahli Bank gained 9.9%, while Qatar Navigation was up 3.1%. GCC Commentary Saudi Arabia: The TASI Index rose 0.5% to close at 8,534.3. Gains were led by the Consumer Services and Transportation indices, rising 3.3% and 1.5%, respectively. Altayyar Travel Group rose 5.7%, while Saudi Industrial Services Co. was up 5.1%. Dubai: The DFM Index gained 0.2% to close at 2,642.3. The Invest. & Fin. Services index rose 1.4%, while the Real Estate & Const. index gained 0.9%. Damac Properties Dubai Co. rose 5.8%, while Aan Digital Services Holding Co. was up 3.9%. Abu Dhabi: The ADX benchmark index fell 0.3% to close at 5,120.4. The Services index declined 3.1%, while the Investment & Financial Services index fell 2.1%. Ras Al Khaimah Cement Co. declined 10.0%, while Al Khaleej Inv. was down 7.4%. Kuwait: The KSE Index rose 0.1% to close at 4,775.7. The Oil & Gas index gained 1.2%, while the Real Estate index rose 0.9%. Tamdeen Real Estate Company gained 12.6%, while Warba Insurance Company was up 8.3%. Oman: The MSM Index fell 0.2% to close at 4,137.9. Losses were led by the Industrial and Financial indices, falling 0.7% and 0.4%, respectively. Raysut Cement fell 5.1%, while Al Madina Takaful was down 3.4%. Bahrain: The BHB Index gained 0.3% to close at 1,417.5. The Commercial Bank index rose 0.5%, while the Investment index gained 0.3%. GFH Financial Group rose 2.0%, while National Bank of Bahrain was up 0.7%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Ahli Bank 29.00 9.8 0.5 13.9 Qatar Navigation 67.50 3.1 9.9 2.3 Qatar International Islamic Bank 70.35 1.9 127.9 6.4 Gulf International Services 14.07 1.7 127.7 (17.2) Barwa Real Estate Company 39.60 1.5 326.5 (0.8) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% United Development Company 13.84 0.7 2,002.4 (6.2) Ezdan Holding Group 13.00 (1.9) 1,096.4 0.2 Mesaieed Petrochemical Holding 17.50 (0.9) 910.4 16.4 Aamal Company 9.80 0.1 805.7 10.9 Qatar Aluminium Manufacturing 11.73 0.4 608.4 (12.1) Market Indicators 28 Feb 19 27 Feb 19 %Chg. Value Traded (QR mn) 337.4 277.8 21.4 Exch. Market Cap. (QR mn) 578,663.5 580,303.7 (0.3) Volume (mn) 9.5 11.5 (17.8) Number of Transactions 5,124 7,057 (27.4) Companies Traded 42 43 (2.3) Market Breadth 19:20 11:29 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,111.79 (0.2) 0.0 (0.2) 14.1 All Share Index 3,077.91 (0.4) 0.1 (0.0) 15.0 Banks 3,784.45 (0.4) 1.8 (1.2) 14.0 Industrials 3,226.29 (1.1) (1.5) 0.4 15.4 Transportation 2,233.58 0.8 3.1 8.4 12.9 Real Estate 2,181.40 (0.7) (2.5) (0.3) 17.4 Insurance 2,910.01 0.8 0.3 (3.3) 16.0 Telecoms 938.88 0.1 (0.8) (5.0) 19.8 Consumer 7,302.78 (0.0) (2.7) 8.1 15.2 Al Rayan Islamic Index 3,946.32 (0.2) (0.8) 1.6 14.0 GCC Top Gainers ## Exchange Close # 1D% Vol. ‘000 YTD% DAMAC Properties Dubai 1.46 5.8 6,540.8 (3.3) Al Tayyar Travel Group Saudi Arabia 25.55 5.7 5,399.5 27.8 Yanbu Cement Co. Saudi Arabia 29.00 3.6 150.7 20.8 Al Hammadi Dev. & Inv. Saudi Arabia 25.70 2.8 601.1 2.4 Gulf Bank Kuwait 0.29 2.5 16,498.7 15.5 GCC Top Losers ## Exchange Close # 1D% Vol. ‘000 YTD% Raysut Cement Oman 0.33 (5.1) 155.7 (12.6) National Mobile Telecom. Kuwait 0.73 (2.3) 0.4 2.2 Abu Dhabi Comm. Bank Abu Dhabi 9.40 (1.4) 1,788.8 15.2 Emaar Economic City Saudi Arabia 9.57 (1.2) 988.9 21.0 VIVA Kuwait Telecom Co. Kuwait 0.83 (1.1) 29.1 3.8 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Mannai Corporation 49.00 (4.2) 8.3 (10.8) Salam International Inv. Ltd. 4.44 (3.5) 35.2 2.5 Dlala Brokerage & Inv. Hold. Co. 9.50 (2.8) 5.4 (5.0) Qatari German Co for Med. Dev. 6.37 (2.7) 8.4 12.5 Mazaya Qatar Real Estate Dev. 7.00 (2.0) 202.9 (10.3) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 188.20 (0.4) 94,340.2 (3.5) Qatar Islamic Bank 145.20 (0.9) 29,005.9 (4.5) United Development Company 13.84 0.7 27,670.0 (6.2) Industries Qatar 133.00 (1.4) 27,468.2 (0.5) Masraf Al Rayan 36.90 (0.8) 17,275.7 (11.5) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar*# 10,111.62 (0.2) (0.8) (5.7) (1.8) 92.28 158,958.9 14.1 1.5 4.3 Dubai 2,642.34 0.2 0.2 0.2 4.5 29.38 95,240.0 8.4 1.0 5.3 Abu Dhabi 5,120.41 (0.3) (0.3) (0.3) 4.2 27.95 139,657.6 14.3 1.5 4.7 Saudi Arabia 8,534.27 0.5 0.5 0.5 9.0 677.63 538,261.4 18.8 1.9 3.3 Kuwait 4,775.72 0.1 0.1 0.1 0.8 65.62 32,916.1 15.9 0.9 4.3 Oman 4,137.91 (0.2) (0.2) (0.2) (4.3) 5.39 17,929.9 8.6 0.8 6.3 Bahrain 1,417.49 0.3 0.3 0.3 6.0 2.51 21,702.6 9.1 0.9 5.8 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and DFM (** TTM; * Value traded ($ mn) do not include special trades, if any, # Data as on February 28, 2019) 10,100 10,120 10,140 10,160 10,180 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 9 Qatar Market Commentary The QE Index declined 0.2% to close at 10,111.6. The Industrials and Real Estate indices led the losses. The index fell on the back of selling pressure from GCC and non-Qatari shareholders despite buying support from Qatari shareholders. Mannai Corporation and Salam International Investment Limited were the top losers, falling 4.2% and 3.5%, respectively. Among the top gainers, Ahli Bank gained 9.9%, while Qatar Navigation was up 3.1%. Volume of shares traded on Wednesday fell by 17.8% to 9.5mn from 11.5mn on Tuesday. However, as compared to the 30-day moving average of 8.8mn, volume for the day was 7.4% higher. United Development Company and Ezdan Holding Group were the most active stocks, contributing 21.2% and 11.6% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2018 % Change YoY Operating Profit (mn) 4Q2018 % Change YoY Net Profit (mn) 4Q2018 % Change YoY Sahara Petrochemicals Co. Saudi Arabia SR 210.0 – 557.8 14.7% 500.8 12.7% Herfy Food Services Co. Saudi Arabia SR 1,227.3 6.0% 220.6 2.5% 204.2 2.1% Saudi Arabian Fertilizer Co.* Saudi Arabia SR 3,859.8 39.9% 1,696.2 105.6% 1,738.4 97.9% City Cement Co.* Saudi Arabia SR 344.9 -35.6% 71.3 -29.7% 111.0 18.9% Arabian Cement Co. * Saudi Arabia SR 600.7 -33.7% -30.0 – -26.2 – Saudi Industrial Services Co. * Saudi Arabia SR 564.7 0.4% 88.1 19.2% 46.7 -20.6% Dar Alarkan Real Estate Dev. Co. * Saudi Arabia SR 6,412.3 35.4% 888.2 -6.7% 508.8 -8.1% Mouwasat Medical Services Co. * Saudi Arabia SR 1,677.0 11.3% 404.0 8.6% 360.0 6.8% Sharjah Cement and Ind. Dev. Co.* Abu Dhabi AED 596.8 -8.2% – – 29.4 -54.7% Fidelity United* Abu Dhabi AED 146.2 71.1% – – -9.4 – Ras Al Khaimah Co for White Cement* Abu Dhabi AED 228.1 -9.9% – – 13.0 -57.3% Bahrain & Kuwait Insurance Co.* Bahrain BHD 81.6 37.1% – – 3.2 21.7% Agility Public Warehousing* Kuwait KD 1,336.6 9.9% – – 81.1 18.4% Aramex Dubai AED 5,086.1 7.7% 684.7 22.6% 492.6 13.1% Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financials for FY2018) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 02/28 US Department of Labor Initial Jobless Claims 23-February 225k 220k 217k 02/28 US Department of Labor Continuing Claims 16-February 1,805k 1,737k 1,726k 02/28 US Bureau of Economic Analysis GDP Annualized QoQ 4Q2018 2.6% 2.2% 3.4% 02/28 US Bureau of Economic Analysis GDP Price Index 4Q2018 1.8% 1.7% 1.8% 03/01 US Markit Markit US Manufacturing PMI February 53 53.7 53.7 03/01 US Institute for Supply Management ISM Manufacturing February 54.2 55.8 56.6 02/28 UK GfK NOP (UK) GfK Consumer Confidence February -13 -15 -14 03/01 EU Markit Markit Eurozone Manufacturing PMI February 49.3 49.2 49.2 03/01 EU Eurostat Unemployment Rate January 7.8% 7.9% 7.8% 03/01 EU Eurostat CPI Core YoY February 1.0% 1.1% 1.1% 03/01 EU Eurostat CPI Estimate YoY February 1.5% 1.5% 1.4% 02/28 Germany German Federal Statistical Office CPI MoM February 0.5% 0.4% -0.8% 02/28 Germany German Federal Statistical Office CPI YoY February 1.6% 1.5% 1.4% 03/01 Germany Markit Markit/BME Germany Manufacturing PMI February 47.6 47.6 47.6 03/01 Germany Deutsche Bundesbank Unemployment Change (000's) February -21k -5k -4k 03/01 Germany Deutsche Bundesbank Unemployment Claims Rate SA February 5.0% 5.0% 5.0% Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 17.88% 19.73% (6,245,767.05) Qatari Institutions 23.41% 18.00% 18,235,892.31 Qatari 41.29% 37.73% 11,990,125.26 GCC Individuals 0.76% 1.96% (4,064,187.83) GCC Institutions 4.09% 4.50% (1,378,608.81) GCC 4.85% 6.46% (5,442,796.64) Non-Qatari Individuals 6.01% 4.97% 3,507,483.50 Non-Qatari Institutions 47.85% 50.83% (10,054,812.12) Non-Qatari 53.86% 55.80% (6,547,328.62)

- 3. Page 3 of 9 Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 02/28 France INSEE National Statistics Office PPI MoM January 0.1% – -1.1% 02/28 France INSEE National Statistics Office PPI YoY January 1.4% – 1.3% 02/28 France INSEE National Statistics Office CPI MoM February 0.0% 0.4% -0.4% 02/28 France INSEE National Statistics Office CPI YoY February 1.3% 1.5% 1.2% 02/28 France INSEE National Statistics Office GDP QoQ 4Q2018 0.3% 0.3% 0.3% 03/01 France Markit Markit France Manufacturing PMI February 51.5 51.4 51.4 02/28 Japan METI Industrial Production MoM January -3.7% -2.5% -0.1% 02/28 Japan METI Industrial Production YoY January 0.0% 1.3% -1.9% 03/01 Japan Economic and Social Research Institute Consumer Confidence Index February 41.5 41.6 41.9 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2018 results No. of days remaining Status QGRI Qatar General Insurance & Reinsurance Company 4-Mar-19 0 Due AKHI Al Khaleej Takaful Insurance Company 5-Mar-19 1 Due SIIS Salam International Investment Limited 6-Mar-19 2 Due ERES Ezdan Holding Group 10-Mar-19 6 Due IGRD Investment Holding Group 12-Mar-19 8 Due DBIS Dlala Brokerage & Investment Holding Company 13-Mar-19 9 Due Source: QSE News Qatar CBQK disclosures relating to National Bank of Oman discontinuing discussions on the possible merger with Bank Dhofar – The Commercial Bank (CBQK) noted that National Bank of Oman announced that National Bank of Oman and Bank Dhofar decided to discontinue the merger discussions. CBQK holds 34.9 % of the shares in National Bank of Oman and has previously made disclosures to the market on July 30, 2018 and December 20, 2018 in respect of the possible merger between National Bank of Oman and Bank Dhofar. (QSE) QCSD deposits bonus shares of Ahli Bank – Qatar Central Securities Depository (QCSD) deposited bonus shares of Ahli Bank. Hence, the new capital is QR2,313,964,780 and new total shares is 231,396,478. The bonus shares will be available for trading from March 4, 2019. (QSE) WDAM’s EGM approves the recommendation of the agenda – Widam Food Company (WDAM) disclosed that the quorum of its second EGM held on March 3, 2019 was met. The meeting resulted in the following resolutions: (i) Approved the split of the nominal value of shares from QR10 to QR1 per share and the amendment of Articles (5), (9), (34), of the company Articles of Association accordingly to comply with QFMA’s regulations on split of nominal shares of listed companies, (ii) Authorized the Chairman of the board of directors to make the necessary amendments to the Articles of Association and to sign and to complete the legal procedures with the official authorities. (QSE) Nebras expands presence in Jordan’s power sector – Nebras Power and Nebras Power Investment Management BV (NPIM) have entered into a sale and purchase agreement (SPA) to acquire the AES Corporation’s (AES) interest in three Jordanian power projects together with Mitsui & Company. Nebras currently owns nearly 24% in each of the three projects. Mitsui & Company currently owns a 40% interest in each of the three projects. The closing of the acquisition is subject to obtaining approval from lenders to each of the project companies. Upon closing, NPIM will be a majority shareholder and will have operational control on these plants, which have an aggregate capacity of more than 650MW representing more than 14% of the current installed capacity in Jordan. Nebras’ Chairman, Fahad Hamad Al-Mohannadi said, “This step is in line with the vision of Nebras’ board of directors to place the company as a successful international company, and we are continuing the development and investments with our international partners in power generation and water desalination projects regionally and globally. The expansion of our investments in Jordan is a result of the trust and confidence we have in the Jordanian energy market and its regulations over the last few years." (Gulf-Times.com) BRES announces the assignment of Issa bin Mohammed Al Mohannadi as Managing Director of the group – Barwa Real Estate Company’s (BRES) board of directors announced the acceptance of the resignation of Salman bin Mohammed Ahmed Al Hassan Al Mohannadi as CEO of Barwa Real Estate Group, and the assignment of Essa bin Mohammed Al Mohannadi, Vice Chairman of the board of directors and as Managing Director to assume the functions of the group's Executive Management as of March 1, 2019. (QSE) IHGS announces the names of candidates for board of directors – Islamic Holding Group (IHGS) announced the closure of the candidacy for the board of directors on February 24, 2019 for the coming period 2019-2021. IHGS has approved the candidates nominated by the Nominations Committee. IHGS noted that it has submitted to the board a list of six candidates for the non-independent category. The candidates include

- 4. Page 4 of 9 Mohammed Ebrahim M B Al-Sulaiti as non-independent representative of Qatar International Islamic Bank and Rashid Nasser R S Al-Kaabi as independent member, among others. (QSE) WOQOD postpones its EGM to March 25 – Qatar Fuel Company (WOQOD) rescheduled its Extraordinary General Assembly Meeting (EGM) to March 25, 2019, due to lack of quorum on Sunday. (Qatar Tribune) IIF: Qatar’s economic activity continues to pick up despite blockade, EM stress – Qatar, whose external financial position showed marked improvement in 2018 despite the ongoing regional tension and growing emerging market (EM) stress, can not only withstand crises domestically but also assert its influence on the broader region. Although a trade and diplomatic blockade by the Saudi Arabia-led quartet is approaching its second year and showing no signs of abating, Institute of International Finance (IIF) stated economic activity has continued to pick up. With the resumption of non-resident capital inflows in multiple forms, Qatar’s external position showed marked improvement in 2018 even in the face of ongoing regional tension and growing emerging market stress, it stated. Highlighting that non-resident capital inflows have been very strong, in stark contrast to other EMs, the IIF stated Qatar issued a $12bn triple-tranche Eurobond in April 2018 at modest premiums over the US Treasuries, attracting significant interest from foreign investors even in the face of an offering of similar size from Saudi Arabia. Finding that Qatar Stock Exchange index was one of the top performers worldwide in 2018, returning approximately 20% even as many global benchmarks declined outright; the IIF stated non-resident inflows surpassed $26bn in the first three quarters of the year, with both non-resident deposits and bank loans picking up. (Gulf-Times.com) Qatar Petroleum and ExxonMobil make major gas find off shore Cyprus – Qatar Petroleum and ExxonMobil announced they have made a significant natural gas discovery on the Glaucus-1 prospect, located in Block 10 in the Eastern Mediterranean, approximately 180 kilometer south west from Limassol port, off shore Cyprus. The Glaucus-1 well encountered approximately 133 meters of gas-bearing reservoir. The well was safely drilled to a depth of approximately 4,200 meters in a water depth of 2,063 meters. Based on preliminary interpretation of well data, the discovery could represent an in-place resource of approximately 5tn to 8tn cubic feet. Further analysis will be undertaken over the coming months to better determine this estimate. (Gulf-Times.com) Construction activities see double-digit growth in January – Building and construction activities in Qatar gained momentum in the first month of 2019, reaffirming the resilience of the Qatari economy in general and the real estate sector in particular, despite regional and global challenges. Some 790 new building permits were issued in January 2019, registering a sharp jump of nearly 17% compared to 677 permits issued in December 2018, official data showed. Data related to building permits and building completion are of particular importance as they are considered indicators for the performance of the construction sector which in turn occupies a significant position in the national economy. The real estate market, despite the ongoing unjust blockade and other challenges, remained stable in 2018. In fact the market witnessed some recovery over the last financial year. According to Qatar Central Bank’s (QCB) Real Estate Price Index, this had declined to 245.21 points in January 2018, increased to 248.22 points in November, before ending the year at 246.54 points in December 2018. Analysts said that the construction is one of the key sectors of any economy as it drives demand for construction materials such as steel, cement and other goods, especially items related to the mechanical, electric and plumping sector. (Peninsula Qatar) Ooredoo, Atos partner to drive Qatar’s digital transformation – Ooredoo, the region’s leading enabler of digital business innovation, and Atos, a global leader in digital transformation, have announced a partnership for enterprises to accelerate their digital business competitiveness during the Mobile World Congress. Thanks to this new partnership, Ooredoo’s customers can now benefit from Atos’ industry leading experiences and solutions in Infrastructure as a Service (IaaS), cloud transformation, and also cybersecurity services. Atos’ solutions cover Big Data, security, infrastructure and data management, business and platform solutions, unified communication and collaboration, and digital payments. Ooredoo’s Chief Business Officer, Sheikh Nasser bin Hamad bin Nasser Al-Thani said, “As Qatar’s organisations digitally transform, boardrooms need to modernise their technology infrastructure and information security. Mobile World Congress is an ideal event to announce Ooredoo’s partnership with Atos to provide our Qatar business customers with industry-leading solutions that can enhance businesses, and the daily lives of customers and citizens.” (Gulf-Times.com) Ooredoo, Dell EMC launch smart stadium solution for global mega events – Ooredoo and Dell EMC launched a smart stadium demo to transform mega events around the world during Mobile World Congress. The technology titans have developed smart stadium technology that aims to maximize the safety and security of athletes and coaches, fans, media, and organizers at Qatar’s soccer tournament in 2022 and additional mega events worldwide. The smart stadium solution combines the speed, capacity, and reliability of Ooredoo’s industry-leading 5G network with Dell EMC’s deep learning capabilities to deliver enhanced security. As the first country to demo the solution, Qatar can accelerate its digital transformation, as well as strengthen its position as a hub for global events. Ooredoo expects to roll-out the solution across its markets in the Middle East, North Africa, and South East Asia. (Gulf-Times.com) Qatargas supplies commissioning LNG cargo to India’s Ennore terminal – Qatargas has supplied a commissioning Liquefied Natural Gas (LNG) cargo for India’s newest LNG receiving terminal, Ennore, near the southern Indian city of Chennai. The commissioning LNG cargo was delivered onboard the vessel ‘Golar Snow’ on February 25, 2019 by the Swiss commodity trader, Gunvor, to the state-owned Indian Oil Corporation Limited (IOCL), which owns and operates the five million tons per annum (MTPA) terminal. Qatargas sold the cargo Free On Board (FOB) basis to Gunvor. India is a key market for Qatargas given its geographical proximity and growth potential. In addition to the Ennore Terminal, terminals located at Mundra

- 5. Page 5 of 9 and Jaigarh are also due to be commissioned in the near future as well as a host of other gas related infrastructure projects. These additional terminals will increase India’s capacity to import LNG from 30 MTPA to 44 MTPA – a 46% increase as India continues to make strides in achieving its ambitious target of 15% gas in the energy mix. (Peninsula Qatar) NEBI seen boosting growth prospects across sectors in Qatar – Qatar's New Emerging Belt Initiative (NEBI), linking a $2.1tn economic bloc with Doha, is expected to lift the prospects across the sectors, particularly trade and banking, and the economy as a whole. Terming NEBI as an excellent strategy, the Qatar Free Zones Authority (QFZA) is of the view that beyond the alliance with natural partners, Qatar should also reach out to the rest of the world. "The inter-linkages between these countries are positive for Qatar's free zones as companies themselves will lead to more companies to enter Qatar. It is a win-win," QFZA’s CEO said recently. NEBI is a new economic corridor of Qatar focusing on Kuwait, Oman, India, Pakistan and Turkey with a combined economy of more than $2.1tn, as part of the strategy to forge new alliances and connect businesses. It aims to position Qatar as the most promising hub for firms to set up to operate in and out of Qatar via key strategic alliances. In the current geopolitical environment, Qatar can emerge as an alternative hub. (Gulf-Times.com) QICCA highlights benefits of establishing economic courts – Qatar is seeking to establish a specialized court for investment and trade, in line with the requirements of the country to create an easy investment environment, an official of the Qatar International Centre for Conciliation and Arbitration (QICCA) stated. The statement was made by QICCA’s board member for International Relations Sheikh Thani bin Ali Al-Thani on the sidelines of a seminar. Sheikh Thani said the State of Qatar is witnessing a great economic movement that extends to all areas, even as he stressed the need to find alternative means of commercial disputes settlement that are consistent with the nature of these disputes leading to fair solutions. He said the seminar was aimed at introducing the ‘economic court,’ considered one of the specialized courts for investment, trade, economy, and business-related cases, in view of QICCA’s role in reviewing the latest practices in the field of arbitration and the presentation of similar experiences. (Gulf-Times.com) International US consumer spending, factory data point to weak first quarter GDP growth – US personal income fell for the first time in more than three years in January and consumer spending dropped by the most since 2009 in December, putting the economy on a weak growth path early in the first quarter. The economic outlook was also darkened by other data showing factory activity hit a more than two-year low in February, with manufacturers reporting slowing new orders and hiring. The reports extended the run of soft data on an economy that lost momentum at the tail end of 2018 and gave more credence to the Federal Reserve’s patient stance towards raising interest rates further this year. The economy is losing speed as the stimulus from a $1.5tn tax cut package and increased government spending fades. A trade war between the US and China, higher interest rates, softening global growth and uncertainty over Britain’s exit from the European Union are clouding the outlook. The Commerce Department stated personal income slipped 0.1% in January, the first decline since November 2015, after jumping 1.0% in December. Income was weighed down by decreases in dividend, farm proprietors’ and interest income. Income was boosted in December by a one- time special dividend by information technology firm VMware Inc as well as government payments to farmers caught up in the US-China trade war. Wages increased by a moderate 0.3% in January after rising 0.5% in December. Economists polled by Reuters had forecasted incomes rising 0.3% in January. (Reuters) US economic growth in 2018 misses Trump's 3% target – The US economy fell short of the Trump administration’s 3% annual growth target in 2018 despite $1.5tn in tax cuts and a government spending blitz, and economists say growth will only slow from here. A better-than-expected performance in the fourth quarter pushed gross domestic product up 2.9% for the year, just shy of the goal, Commerce Department data showed. Gross domestic product increased at a 2.6% annualized rate in the fourth quarter after advancing at a 3.4% pace in the July- September period. Economists polled by Reuters had forecasted GDP rising at a 2.3% rate in the fourth quarter. Growth in 2018 was the strongest since 2015 and better than the 2.2% logged in 2017. The expansion will be the longest on record in July. (Reuters) US jobless claims rise; continuing claims at 10-month high – The number of Americans filing applications for jobless benefits increased more than expected last week and the number of people on unemployment rolls increased to a 10-month high, suggesting some slowing in the labor market. Initial claims for state unemployment benefits rose 8,000 to a seasonally adjusted 225,000 for the week ended Feb. 23, the Labor Department stated. Data for the prior week was revised to show 1,000 more applications received than previously reported. The Labor Department stated no states were estimated. Economists polled by Reuters had forecast claims rising to 220,000 in the latest week. The four-week moving average of initial claims, considered a better measure of labor market trends as it irons out week-to-week volatility, fell 7,000 to 229,000 last week. The claims report showed the number of people receiving benefits after an initial week of aid increased 79,000 to 1.81mn for the week ended February 16, the highest level since April 2018. The four-week moving average of these so-called continuing claims rose 6,750 to 1.76mn. (Reuters) CBI: UK firms report weakest growth since April 2013 – British businesses reported their weakest growth in nearly six years during the past three months due to fears of a no-deal Brexit and rising global trade barriers, the Confederation of British Industry (CBI) stated. The CBI’s index of private-sector activity over the past three months dropped to -3 in February from zero in January. This was its lowest since April 2013, when Britain was still recovering from the global financial crisis. Firms expected similar weakness in the three months ahead, when Britain is due to leave the European Union after over 40 years of membership. (Reuters) UK factories brace for Brexit, but consumers less worried – British factories are cutting jobs and bracing for Brexit by stockpiling goods at a record pace, but consumers seem less

- 6. Page 6 of 9 worried, suggesting their spending might help to shore up the economy, data showed. A measure of manufacturing - the IHS Markit/CIPS Purchasing Managers’ Index - hit a four-month low in February, and the fall would have been worse if factories had not rushed to build up inventories to see them through any Brexit border chaos. A measure of stockpiling hit a record high for any Group of Seven economy while factories cut jobs at the fastest pace in six years and were increasingly downbeat about the future. However separate data showed households took out more mortgages and increased borrowing in January by more than any forecast for both indicators in a Reuters poll of economists. (Reuters) Eurozone’s February factory growth slammed into reverse – Eurozone’s manufacturing activity went into reverse for the first time in over five years last month as trade war worries, slowing global growth and Britain’s imminent departure from the European Union hit demand, a survey found. The downbeat survey, which showed the slowdown was being led by Europe’s powerhouse Germany, will likely concern European Central Bank policymakers, coming just two months after they drew a line under their EUR2.6tn stimulus program. Faced with a further slowdown in Eurozone growth, the ECB will re-launch cheap bank loans as early as June and delay rate hikes to 2020 in a bid to stave off a recession, a Reuters poll predicted. IHS Markit’s February final manufacturing Purchasing Managers’ Index fell for a seventh month, coming in at 49.3 from January’s 50.5, just above a flash reading but its first time below the 50 level separating growth from contraction since June 2013. An index measuring output which feeds into a composite PMI - seen as a good gauge of economic health - fell to 49.4 from 50.5, its lowest since May 2013. (Reuters) Germany’s jobless drop, retail sales rise bode well for household spending – Germany’s jobless total fell far more than expected in February and retail sales surged in January, data showed, boosting expectations that private consumption will prop up growth in Europe’s largest economy in the first quarter. Household spending has become a key growth driver in recent years as Germans benefit from record-high employment and low borrowing costs and a GfK survey published this week showed the good mood among German shoppers was unchanged going into March. The number of people out of work in Germany decreased by 21,000 to 2.236mn in February, seasonally-adjusted data from the Labour Office showed. That compared with the forecast for a drop of 5,000. The unemployment rate remained at 5.0%, the lowest since German reunification in 1990. Separate data from the Statistics Office showed German retail sales jumping by 3.3% on the month in January, marking their strongest rise since October 2016. (Reuters) Japan’s final February manufacturing PMI confirms fastest pace of decline in two-and-a-half years – Japanese manufacturing activity contracted in February at the fastest pace in two-and-a-half years as factories cut back output amid shrinking domestic and export orders, a revised survey showed. The survey highlighted the extent of the damage that the US- China trade war has already inflicted on Japan and other export- oriented countries in Asia. The Final Markit/Nikkei Japan Manufacturing Purchasing Managers Index (PMI) was a seasonally adjusted 48.9, slightly above a flash reading of 48.5 but below January’s final 50.3. The index fell below the 50 threshold that separates contraction from expansion for the first time since August 2016 and showed the fastest contraction since June 2016. The output component of the final PMI index was 47.4, above a preliminary 47.0 but still down from a final 54.4 in January to show the fastest contraction since May 2016. (Reuters) Japan’s fourth-quarter capital expenditure points to upward revision to GDP but outlook weak – Japan’s capital expenditure accelerated in October-December in a sign economic growth will be revised up for the quarter, but economists warn slowing global trade may yet hurt activity in the first half of this year. Capital expenditure grew 5.7% in October-December from the same period last year, led by increased spending in the telecommunications, chemicals, and real estate sectors. That was faster than a 4.5% increase in the previous quarter. Excluding software, capital expenditure rose 3.3% in October- December from the previous quarter on a seasonally-adjusted basis after a revised 4.4% decline in July-September. A preliminary estimate released last month showed Japan’s economy expanded an annualized 1.4% in the fourth quarter, bouncing back from a string of natural disasters that disrupted factory production. (Reuters) Quantitative traders are poised for a comeback in China – Almost four years after Beijing blamed them for exacerbating a $5tn stock-market collapse, quantitative traders are poised for a comeback in China. Barring an unexpected turn, Chinese authorities will soon allow quants to use their own software to automatically execute trades through brokerages. So-called direct connections were banned during the 2015 crash, rendering some of the nation’s most popular computer-driven trading strategies unworkable or difficult to scale. While brokerages are likely to move cautiously as they reopen the connections, anticipation of a pick-up in quant activity has already added fuel to this year’s world-beating surge in Chinese stocks. Analysts said the move may ultimately boost trading, improve brokerages’ profitability and make China’s retail- dominated equity market more attractive to institutional investors. (Gulf-Times.com) Regional OPEC oil output drops further in February as Saudi Arabia over- delivers on cuts – OPEC oil supply fell to a four-year low in February, a Reuters survey found, as top exporter Saudi Arabia and its Gulf allies over-delivered on the group’s supply pact while Venezuelan output registered a further involuntary drop. The 14-member Organization of the Petroleum Exporting Countries (OPEC) pumped 30.68mn barrels per day (bpd) last month, the survey showed, down 300,000 bpd from January and the lowest OPEC total since 2015, according to Reuters surveys. The survey suggests that Saudi Arabia and its Gulf allies over- delivered on pledged supply curbs to avert the possibility of a new glut building up this year. (Reuters) Tadawul expects $15bn -$20bn in passive fund inflows in 2019 – Saudi Arabia’s stock exchange expects passive fund inflows of $15bn to $20bn this year as it gears up for inclusion in emerging market benchmarks, its CEO, Khalid Al-Hussan said. Tadawul, Saudi Arabia’s main stock exchange and the Middle East’s

- 7. Page 7 of 9 largest bourse, will join the FTSE Russell and MSCI emerging market indices in March and May this year, heightening interest among foreign investors in the Saudi Arabian market. “We anticipate from the passive funds $15bn to $20bn in 2019, the active side is very hard to anticipate,” he said. Foreigners have been net buyers of Saudi Arabian stocks since the start of the year. “Over the history of inclusions you can’t avoid some volatility (but) the tranches will help reduce a lot the impact of this volatility,” he said. The Saudi bourse has a total market capitalization of around $535bn, with a free float of about 40%. (Reuters) Saudi Arabian market cross-listing regulations expected in second quarter – Regulations to allow companies from other Gulf countries to list on Saudi Arabia’s stock market is expected to be finalized in the second quarter of this year, the CEO of Tadawul, Khalid Al-Hussan said. Saudi Arabia’s Capital Market Authority and Tadawul are working with potential investors in the Gulf countries on the new cross-listing rules, he said. He said that there is good interest from companies in the Gulf region to list on the Saudi Arabian market. Bahraini financial services firm GFH expressed an interest in listing on the Saudi Arabian market last year and hired Gulf International Bank to help in the process. Many potential candidates for IPOs in the Kingdom are also looking at dual listings and at issuing global depository receipts (GDRs), bankers say. There is growing interest from foreign investors in the Saudi market ahead of its inclusion in the FTSE Russell and MSCI’s emerging market indexes later this year. (Reuters) Saudi Arabia may raise April crude prices for Asia – Saudi Arabia is expected to raise April prices for most of the crude grades it sells to Asia, following a strengthening of Middle East oil benchmark Dubai over the past month, several trade sources said. The April official selling price (OSP) for flagship Arab Light crude could remain unchanged or rise by up to $0.35 a barrel from the previous month, sources said. This comes after backwardation in the first and third month Dubai price spread widened by $0.30 a barrel during February trade compared with the previous month, sources said. Prompt prices are higher than those in future months in a backwardated market, implying stronger demand for spot oil. (Reuters) Algeria seeks to supply oil to Saudi Aramco refinery in South Korea – Algeria’s state energy company, Sonatrach discussed with Saudi Aramco the opportunity to supply oil to Saudi Aramco’s refinery in South Korea with Saharan blend crude and cooperate on petrochemicals and LPG, Sonatrach stated. Officials signed an amendment to contract for supply of Arabian Light crude to Sonatrach’s Augusta refinery in Italy. (Bloomberg) Islamic Development Bank mulls green Sukuk – Islamic Development Bank (IsDB), the multilateral lender to 57 member countries, is considering selling green Sukuk and Islamic bonds denominated in currencies other than the US Dollar and the Euro, its President, Bandar Hajjar said. "We would like to widen the scope of our Sukuk issues to include new types such as green Sukuk or in currencies we have not tried before," he said. "Our annual financing has reached $12bn, which is not enough to meet the needs of IsDB’s member states. IsDB must therefore mobilize financing of its balance sheet," he said. (Bloomberg) Uber in advanced talks to buy Middle East rival Careem – Uber Technologies Inc is in advanced discussions to buy its Dubai- based rival Careem Networks FZ, Bloomberg reported. The companies may announce a cash-and-stock transaction that values Careem at about $3bn in the coming weeks, the report stated. Negotiations are going on and no final decision has been taken, according to the report. Uber, which is on track to go public this year, has been seeking new avenues of growth even as it faces severe competition in its core business of ride hailing. Uber has received estimates from IPO bankers that have pegged its value at up to $120bn, sources said. (Reuters) UAE oil output dropped to 3.05mn bpd in February – UAE crude production was in line with the volume it pledged to produce under the OPEC+ agreement reached in Vienna in December, representing a drop in oil output to 3.05mn bpd in February, the Ministry of Energy and Industry stated. The country has agreed to cut crude output by 96k bpd from a starting point of 3.168mn. In addition to crude, UAE also produces ~400k bpd of condensate, according to the most recent Annual Statistical Report published by the ministry. (Bloomberg) Abraaj collapse may spur oversight changes – The Dubai Financial Services Authority (DFSA) could make changes to its oversight procedures following last year’s collapse of private equity group Abraaj, its CEO, Bryan Stirewalt said. Dubai-based Abraaj was the largest buyout fund in the Middle East and North Africa until it collapsed last year in the aftermath of a row with investors, including the Gates Foundation, over a $1bn healthcare fund. (Peninsula Qatar) Dubai plans to expedite SME payments to revive its economy – Dubai plans to expedite government payments to small and medium (SME) sized companies in an effort to revive economic growth in the Middle East’s trade and business hub. The government will pay SMEs within 30 days instead of 90 days, according to the state-run WAM news agency. The measure is expected to result in $435mn of additional liquidity to the companies, the news agency reported. The plan also includes a reduction in insurance costs for SMEs that will not affect their eligibility for government tenders. One of the most diversified economies in the Middle East, Dubai is grappling with the impact of low hydrocarbon prices on its oil-rich neighbors as well as the introduction of new fees and taxes in the Gulf. Property prices have declined and the Emirate’s main stock index dropped 25% in 2018. Authorities last year announced a raft of measures to reduce the cost of doing business in the Emirate. The federal government has loosened restrictions on visas to attract more tourists and investors. (Bloomberg) Abu Dhabi's ADIA unit partners with India's Kotak Investment to launch fund – Abu Dhabi’s sovereign wealth fund stated that its subsidiary is launching a fund with India’s Kotak Investment Advisors. The fund will target a range of non- performing loan (NPL) opportunities in India, ADIA stated. The fund will “target both pre-stress and distressed opportunities, with a key focus on providing financial support to pre-stress businesses to prevent them from entering insolvency,” it stated. The partnership will “help to ease the burden of NPLs on the Indian financial system,” Executive Director of the Private Equities department at ADIA, Hamad Shahwan Aldhaheri said. (Reuters)

- 8. Page 8 of 9 The National: ADNOC Logistics plans to expand its fleet – ADNOC Logistics & Services plans to expand its fleet to cope with increased demand from growth in the state-owned firm’s upstream and downstream businesses, The National’s CEO, Abdulkareem Al Masabi said. The company, formed after the merger of three Abu Dhabi National Oil Company (ADNOC) units in 2016, will buy its first crude-oil tankers, while increasing the gas and dry bulk fleet by more than 25 vessels over the next five years, the newspaper reported. The firm currently has 123 vessels across its shipping, marine services, offshore logistics and merchant fleet segments, it said. ADNOC is aiming to grow its capacity to as much as 5mn barrels per day from 3.5mn by 2030, the National reported. The purchase of two very large crude carriers by the upstream business and plans to triple petrochemicals capacity by its downstream unit will create more expansion opportunities for the firm, he said. ADNOC Logistics is currently seeking partnership opportunities, with a long-term view on increased commercialization of its business, he said. The firm will look to privatize the business in the future, but a possible initial public offering of all or parts of the logistics and services segment is not on the table, the newspaper reported. (Bloomberg) Kuwait said to plan $10bn investment fund with China – Kuwait is planning to create a $10bn fund with China to invest in the two countries, according to sources. The Gulf state is discussing the creation of a Kuwait-China Silk Road Fund that will invest in Kuwaiti projects related to the Silk City and islands development, according to sources. It could also be used for strategic investments in China and other areas under the Asian country’s “One Belt, One Road” initiative, sources said. China and Kuwait, each will be responsible for raising around $5bn for the fund, sources added. The Asian country will also work with Chinese strategic partners to arrange debt financing for projects, which could give the fund an investment capacity of as much as $30bn, they said. Under the proposal, the fund’s Chinese backers could introduce strategic partners to work on its investment projects as contractors, according to sources. Deliberations about the fund are at an early stage, and details like the size and investment targets could change, the sources added. (Gulf-Times.com) Oman signs oil agreement with Occidental Oman for Block 72 – Oman has signed an exploration and production-sharing agreement with Occidental Oman, its oil and gas ministry stated. Block 72 occupies an area of 3,530 square kilometer, the ministry stated. In December, Oman signed two agreements giving Occidental Petroleum the rights to explore for oil and natural gas in concessions 51 and 65. (Reuters) Bahrain is working on getting second portion of $10bn aid – Bahrain is working on getting second portion of $10bn aid package from Gulf allies, newspaper Watan reported, citing Finance Minister, Sheikh Salman bin Khalifa Al-Khalifa. The minister did not provide details on the size of tranches. (Bloomberg)

- 9. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 9 of 9 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg ( # Data as on February 28, 2019) Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Jan-15 Jan-16 Jan-17 Jan-18 Jan-19 QSEIndex S&PPanArab S&PGCC 0.5% (0.2%) 0.1% 0.3% (0.2%) (0.3%) 0.2% (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar# Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,293.40 (1.5) (2.6) 0.9 MSCI World Index 2,096.35 0.5 0.4 11.3 Silver/Ounce 15.21 (2.6) (4.5) (1.9) DJ Industrial 26,026.32 0.4 (0.0) 11.6 Crude Oil (Brent)/Barrel (FM Future) 65.07 (1.5) (3.1) 20.9 S&P 500 2,803.69 0.7 0.4 11.8 Crude Oil (WTI)/Barrel (FM Future) 55.80 (2.5) (2.5) 22.9 NASDAQ 100 7,595.35 0.8 0.9 14.5 Natural Gas (Henry Hub)/MMBtu 3.19 7.4 16.4 0.1 STOXX 600 374.24 0.2 1.0 10.0 LPG Propane (Arab Gulf)/Ton 66.62 (2.4) (6.2) 4.9 DAX 11,601.68 0.6 1.4 9.1 LPG Butane (Arab Gulf)/Ton 72.75 (4.8) (12.1) 3.9 FTSE 100 7,106.73 (0.0) 0.0 9.4 Euro 1.14 (0.1) 0.3 (0.9) CAC 40 5,265.19 0.3 1.1 10.5 Yen 111.89 0.4 1.1 2.0 Nikkei 21,602.69 0.4 (0.4) 6.4 GBP 1.32 (0.5) 1.1 3.5 MSCI EM 1,051.54 0.1 (0.7) 8.9 CHF 1.00 (0.1) 0.1 (1.7) SHANGHAI SE Composite 2,994.01 1.6 6.9 23.1 AUD 0.71 (0.2) (0.7) 0.4 HANG SENG 28,812.17 0.6 (0.0) 11.2 USD Index 96.53 0.4 0.0 0.4 BSE SENSEX 36,063.81 0.4 0.6 (1.8) RUB 65.93 0.0 0.8 (5.4) Bovespa 94,603.75 (2.0) (4.6) 10.2 BRL 0.26 (0.5) (0.7) 2.8 RTS 1,187.35 (0.1) (0.9) 11.1 98.3 92.2 78.7