QNBFS Daily Market Report April 28, 2019

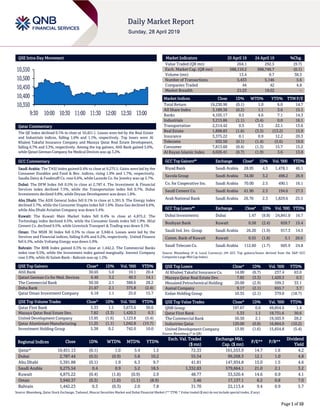

- 1. Page 1 of 10 QSE Intra-Day Movement Qatar Commentary The QE Index declined 0.1% to close at 10,451.1. Losses were led by the Real Estate and Industrials indices, falling 1.6% and 1.1%, respectively. Top losers were Al Khaleej Takaful Insurance Company and Mazaya Qatar Real Estate Development, falling 6.7% and 3.3%, respectively. Among the top gainers, Ahli Bank gained 5.0%, while Qatari German Company for Medical Devices was up 3.2%. GCC Commentary Saudi Arabia: The TASI Index gained 0.4% to close at 9,275.5. Gains were led by the Consumer Durables and Food & Bev. indices, rising 1.9% and 1.7%, respectively. Saudia Dairy & Foodstuff Co. rose 6.6%, while Lazurde Co. for Jewelry was up 5.7%. Dubai: The DFM Index fell 0.5% to close at 2,787.4. The Investment & Financial Services index declined 7.5%, while the Transportation index fell 0.7%. Dubai Investments declined 9.8%, while Deyaar Development was down 1.8%. Abu Dhabi: The ADX General Index fell 0.1% to close at 5,391.9. The Energy index declined 3.7%, while the Consumer Staples index fell 1.6%. Dana Gas declined 6.6%, while Abu Dhabi Aviation Company was down 5.4%. Kuwait: The Kuwait Main Market Index fell 0.4% to close at 4,875.2. The Technology index declined 6.5%, while the Consumer Goods index fell 1.9%. Hilal Cement Co. declined 9.5%, while Livestock Transport & Trading was down 9.1%. Oman: The MSM 30 Index fell 0.3% to close at 3,940.4. Losses were led by the Services and Financial indices, falling 0.4% and 0.2%, respectively. United Finance fell 6.3%, while Voltamp Energy was down 5.9%. Bahrain: The BHB Index gained 0.3% to close at 1,442.2. The Commercial Banks index rose 0.5%, while the Investment index gained marginally. Inovest Company rose 3.9%, while Al Salam Bank - Bahrain was up 1.2%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Ahli Bank 30.65 5.0 10.1 20.4 Qatari German Co for Med. Devices 6.46 3.2 40.3 14.1 The Commercial Bank 50.50 2.1 388.6 28.2 Doha Bank 21.67 2.1 375.8 (2.4) Qatar Oman Investment Company 6.18 1.1 25.0 15.7 QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar First Bank 5.33 1.1 3,673.6 30.6 Mazaya Qatar Real Estate Dev. 7.82 (3.3) 1,420.3 0.3 United Development Company 13.95 (1.6) 1,123.8 (5.4) Qatar Aluminium Manufacturing 11.25 (1.1) 1,042.8 (15.7) Investment Holding Group 5.38 0.2 742.0 10.0 Market Indicators 25 April 19 24 April 19 %Chg. Value Traded (QR mn) 264.1 292.5 (9.7) Exch. Market Cap. (QR mn) 588,110.2 588,746.7 (0.1) Volume (mn) 13.4 9.7 38.3 Number of Transactions 5,433 5,146 5.6 Companies Traded 44 42 4.8 Market Breadth 21:23 19:22 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 19,230.96 (0.1) 1.0 6.0 14.7 All Share Index 3,189.36 (0.2) 1.1 3.6 15.1 Banks 4,105.17 0.5 4.6 7.1 14.3 Industrials 3,215.86 (1.1) (3.4) 0.0 16.1 Transportation 2,514.42 0.5 3.5 22.1 13.6 Real Estate 1,898.83 (1.6) (3.3) (13.2) 15.9 Insurance 3,375.22 0.1 0.9 12.2 20.3 Telecoms 932.50 (0.1) (1.4) (5.6) 19.0 Consumer 7,813.60 (0.4) (1.3) 15.7 15.2 Al Rayan Islamic Index 4,026.41 (0.7) (1.9) 3.6 13.8 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Riyad Bank Saudi Arabia 28.95 4.5 1,478.1 46.1 Savola Group Saudi Arabia 34.00 3.2 498.2 26.9 Co. for Cooperative Ins. Saudi Arabia 70.00 2.5 490.1 16.1 Saudi Cement Co. Saudi Arabia 61.90 2.3 194.6 27.5 Arab National Bank Saudi Arabia 26.70 2.3 1,829.6 25.5 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Dubai Investments Dubai 1.47 (9.8) 24,841.0 16.7 Boubyan Bank Kuwait 0.58 (2.4) 659.7 15.4 Saudi Ind. Inv. Group Saudi Arabia 26.20 (1.9) 917.3 14.5 Comm. Bank of Kuwait Kuwait 0.55 (1.8) 5.1 20.6 Saudi Telecom Co. Saudi Arabia 112.60 (1.7) 605.9 24.8 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Al Khaleej Takaful Insurance Co. 14.00 (6.7) 237.4 63.0 Mazaya Qatar Real Estate Dev. 7.82 (3.3) 1,420.3 0.3 Mesaieed Petrochemical Holding 20.00 (2.9) 599.3 33.1 Aamal Company 9.17 (2.1) 655.7 3.7 Ezdan Holding Group 10.55 (2.1) 379.0 (18.7) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 197.67 0.6 49,854.6 1.4 Qatar First Bank 5.33 1.1 19,731.6 30.6 The Commercial Bank 50.50 2.1 19,503.9 28.2 Industries Qatar 120.00 (0.8) 16,864.0 (10.2) United Development Company 13.95 (1.6) 15,654.8 (5.4) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,451.13 (0.1) 1.0 3.4 1.5 72.33 161,553.9 14.7 1.6 4.2 Dubai 2,787.44 (0.5) (0.9) 5.8 10.2 55.54 99,268.3 12.1 1.0 4.8 Abu Dhabi 5,391.88 (0.1) 1.9 6.3 9.7 41.81 147,934.8 15.0 1.5 4.6 Saudi Arabia 9,275.54 0.4 0.9 5.2 18.5 1,332.83 579,664.1 21.0 2.1 3.2 Kuwait 4,875.22 (0.4) (1.8) (0.9) 2.9 48.77 33,520.4 14.6 0.9 4.1 Oman 3,940.37 (0.3) (1.0) (1.1) (8.9) 3.46 17,137.1 8.2 0.8 7.0 Bahrain 1,442.23 0.3 (0.3) 2.0 7.8 31.70 22,113.4 9.4 0.9 5.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) 10,350 10,400 10,450 10,500 10,550 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 10 Qatar Market Commentary The QE Index declined 0.1% to close at 10,451.1. The Real Estate and Industrials indices led the losses. The index fell on the back of selling pressure from Qatari shareholders despite buying support from GCC and non-Qatari shareholders. Al Khaleej Takaful Insurance Company and Mazaya Qatar Real Estate Development were the top losers, falling 6.7% and 3.3%, respectively. Among the top gainers, Ahli Bank gained 5.0%, while Qatari German Company for Medical Devices was up 3.2%. Volume of shares traded on Thursday rose by 38.3% to 13.4mn from 9.7mn on Wednesday. Further, as compared to the 30-day moving average of 12.5mn, volume for the day was 7.3% higher. Qatar First Bank and Mazaya Qatar Real Estate Development were the most active stocks, contributing 27.3% and 10.6% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 1Q2019 % Change YoY Operating Profit (mn) 1Q2019 % Change YoY Net Profit (mn) 1Q2019 % Change YoY Knowledge Economic City Saudi Arabia SR 82.1 1,031.5% 19.8 N/A 19.6 N/A Dallah Healthcare Co. Saudi Arabia SR 321.1 4.1% 41.2 -30.6% 35.2 -39.4% National Industrialization Company Saudi Arabia SR 2,571.5 -8.8% 529.1 -23.6% 159.5 -55.9% Saudia Dairy and Foodstuff Co. Saudi Arabia SR 1,813.0 7.1% 221.6 -19.1% 216.1 -17.0% Saudi Ceramic Co. Saudi Arabia SR 309.6 20.7% -9.8 N/A -25.0 N/A Zamil Industrial Investment Co. Saudi Arabia SR 1,021.0 5.3% -8.8 N/A -47.2 N/A United International Transportation Saudi Arabia SR 259.4 -4.0% 43.8 1.1% 41.6 5.1% Drake and Scull International Dubai AED 798.3 -69.7% -4,433.5 N/A -4,501.3 N/A United Fidelity Insurance Company Abu Dhabi AED 58.6 97.5% – – 0.2 N/A Emirates Driving Company Abu Dhabi AED 48.9 -11.5% – – 31.7 -6.8% Source: Company data, DFM, ADX, MSM, TASI, BHB. Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/25 US Department of Labor Initial Jobless Claims 20-April 230k 200k 193k 04/25 US Department of Labor Continuing Claims 13- April 1,655k 1,682k 1,654k 04/26 US Bureau of Economic Analysis GDP Annualized QoQ 1Q2019 3.2% 2.3% 2.2% 04/26 US Bureau of Economic Analysis GDP Price Index 1Q2019 0.9% 1.2% 1.7% 04/26 France INSEE National Statistics Office Consumer Confidence April 96.0 97.0 96.0 04/26 Japan Ministry of Internal Affairs and Communications Tokyo CPI YoY April 1.4% 1.1% 0.9% 04/26 Japan Ministry of Economy Trade and Industry Industrial Production MoM March -0.9% 0.0% 0.7% 04/26 Japan Ministry of Economy Trade and Industry Industrial Production YoY March -4.6% -3.8% -1.1% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 1Q2019 results No. of days remaining Status QATI Qatar Insurance Company 28-Apr-19 0 Due QAMC Qatar Aluminum Manufacturing Company 28-Apr-19 0 Due QNNS Qatar Navigation (Milaha) 28-Apr-19 0 Due IGRD Investment Holding Group 28-Apr-19 0 Due QFLS Qatar Fuel Company 28-Apr-19 0 Due MERS Al Meera Consumer Goods Company 28-Apr-19 0 Due GISS Gulf International Services 29-Apr-19 1 Due BRES Barwa Real Estate Company 29-Apr-19 1 Due Source: QSE Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 38.03% 40.34% (6,090,770.49) Qatari Institutions 19.25% 26.07% (17,997,387.60) Qatari 57.28% 66.41% (24,088,158.09) GCC Individuals 0.98% 0.95% 81,080.84 GCC Institutions 4.19% 3.21% 2,571,953.98 GCC 5.17% 4.16% 2,653,034.82 Non-Qatari Individuals 11.34% 12.41% (2,815,684.06) Non-Qatari Institutions 26.20% 17.02% 24,250,807.33 Non-Qatari 37.54% 29.43% 21,435,123.27

- 3. Page 3 of 10 Earnings Calendar Tickers Company Name Date of reporting 1Q2019 results No. of days remaining Status AHCS Aamal Company 29-Apr-19 1 Due SIIS Salam International Investment Limited 29-Apr-19 1 Due ZHCD Zad Holding Company 29-Apr-19 1 Due QGRI Qatar General Insurance & Reinsurance Company 29-Apr-19 1 Due AKHI Al Khaleej Takaful Insurance Company 29-Apr-19 1 Due MCCS Mannai Corporation 29-Apr-19 1 Due QOIS Qatar Oman Investment Company 29-Apr-19 1 Due DOHI Doha Insurance Group 29-Apr-19 1 Due ORDS Ooredoo 29-Apr-19 1 Due KCBK Al Khalij Commercial Bank 29-Apr-19 1 Due VFQS Vodafone Qatar 30-Apr-19 2 Due QGMD Qatari German Company for Medical Devices 30-Apr-19 2 Due DHBK Doha Bank 30-Apr-19 2 Due Source: QSE Stock Split Dates for Listed Qatari Companies Source: QSE

- 4. Page 4 of 10 News Qatar MPHC's net profit declines 21.2% YoY and 23.3% QoQ in 1Q2019 – Mesaieed Petrochemical Holding Company's (MPHC) net profit declined 21.2% YoY (-23.3% QoQ) to QR281.1mn in 1Q2019. The company's share of profit from joint ventures came in at QR234.6mn in 1Q2019, which represents a decrease of 26.1% YoY (-16.4% QoQ). EPS amounted to QR0.22 in 1Q2019 as compared to QR0.28 in 1Q2018. MPHC is one of the region’s premier diversified petrochemical conglomerates with interests in the production of olefins, polyolefins, alpha olefins and chlor-alkali products. The decrease in profit is primarily due to reduction in sales volumes and selling prices. The group’s profit was also aided by the recognition of a tax refund of approximately QR33mn for the quarter. The group continued to benefit from the supply of competitively priced ethane feedstock and fuel gas under long-term supply agreements. These contracting arrangements are an important value driver for the group’s profitability in a competitive market environment. The petrochemical segment’s profit for the quarter as compared to the corresponding period of previous year was impacted primarily by the drop in selling prices. While the production and sales volumes marginally increased by 1%, the selling prices dropped by 12%. The Chlor-Alkali segment’s profit reduced from previous year primarily due to decrease in sales revenue and other income. Sales revenue was impacted by the decrease in sales volumes by 10% and decrease in selling prices by 14%. Production was marginally lower by 2% from previous year. The closing cash position after the first three months of operations was a robust QR1.3bn as at March 31, 2019. The total assets at March 31, 2019 stood at QR14.6bn, compared to QR15.3bn as at December 31, 2018. (Company financials, Peninsula Qatar) UDCD launches sale of 10 tower plots in Floresta Gardens at Pearl-Qatar – United Development Company (UDCD) has launched the sales for ten tower plots in Floresta Gardens precinct, the master developer of The Pearl-Qatar and Gewan Islands. UDCD stated the land plots on sale in Floresta Gardens cover medium-rise residential towers, each consisting of 15 floors and approximately 125 to 140 residential units for each tower. Each land plot spans an area of 3,500 square meters with built-up areas ranging between 37,000 square meters and 41,000 square meters per plot. (Qatar Tribune) GISS to disclose 1Q2019 financial statements on April 29 – Gulf International Services (GISS) announced its intent to disclose 1Q2019 financial statements for the period ended March 31, 2019, on April 29, 2019. (QSE) QFBQ eyes US, Europe and other new markets – Qatar First Bank’s (QFBQ) efforts to achieve sustainable growth and turnaround its financial and business performance have started bearing positive results. The QSE-listed bank, under its newly adopted strategy, is working on shifting its operating model from asset management to fee income on structured products and diversifying its investments and operations to new markets, including the US, Europe and other promising markets, according to QFBQ’s Vice-Chairman, Abdulla bin Fahad bin Ghorab Al Marri. Al Marri said, “The new strategy which was approved about a few months ago, is all about strengthening the bank’s performance and profitability for its shareholders, which is going to turnaround the bank’s performance.” Al Marri added QFBQ is also trying to provide some financial advisory services to some of its investors for certain requirements for investment outside the region, including the Western Europe and the US. On the possibility of QFBQ entering new sectors to have new stream of revenues, he said that QFBQ is entering new sectors geographically as the bank in the past had concentrated its operations within the region aiming to tap the high growth potential. (Peninsula Qatar) Qatar expected to add 30 MTPA to global LNG production in 2025-26 – The year 2018 witnessed an important change of direction in the commissioning of new LNG projects. Stronger global market conditions led to new LNG projects getting approval in the past year. A larger volume of new proposed production received FID (final investment decisions) in 2018 than in the prior three years combined, MENA Advisors noted in its latest report. According to the report, Qatar is expected to add 30 MTPA (million tons per annum) to the global LNG production in 2025-26, taking the global production to over 500 MTPA, up by over 60% from 2008. A total of 21.5 MTPA (6% of existing capacity) received FID in 2018 and a further 15.6 MTPA reached FID in February 2019 with a number of other large US projects expected to reach FID this year. According to MENA Advisor, the global LNG market had a good year in 2018. LNG trade grew 10%, following on from strong growth of 12% in 2017. (Peninsula Qatar) Qatar to bring QR6.43bn to F&B sector in 2022 – Hosting of the FIFA World Cup in 2022 is likely to bring a one-time boost of QR6.43bn to Qatar’s Food & Beverage (F&B) sector, according to the latest sector analysis by the Middle East Credit Rating Agency (MERatings). Citing the food and beverage services sector in Qatar 2018 study which was conducted by the Qatar Development Bank (QDB), MERatings stated that hosting of the mega sporting event in 2022 will bring an estimated additional tourists of 3.1mn to the country with an average spending of QR288 per person per day spent on F&B for a stay ranging from three to eleven days. In its food and beverage services sector in Qatar 2018 study, the QDB also stated that the total revenue of F&B outlets in the country is estimated to increase to QR14.26bn in 2026 from QR6.99bn in 2016, at a compound annual growth rate (CAGR) of 7.4%. This growth is largely in line with the projected growth of the population and annual increase in tourist arrivals during this period. (Peninsula Qatar) Qatar Financial Centre Authority’s CEO sees a lot of demand for FDI program – Qatar Financial Centre Authority’s CEO, Yousuf Mohammed Al Jaida said that many companies from all over the world are showing interest in the $2bn incentive program the country is implementing in order to attract overseas investments. Qatar's strategy is focused on building out clusters for activities ranging from sports to media. (Bloomberg) Qatar’s retail space set to see huge expansion – Qatar’s retail space will be bolstered by nearly 519,300 square meters under development, thus providing new opportunities for the sector to grow, Alpen Capital stated in a report. With several new malls

- 5. Page 5 of 10 opening, majority of the prime retail destinations in Qatar continue to enjoy high levels of occupancy and attract significant footfall. Retail rents at prime malls and key high- street destinations have been rising, Alpen Capital stated in its report on ‘GCC Retail Industry’. Doha’s organized retail market accounted for approximately 1.4mn square meters of gross leasable area (GLA) spread across 21 retail malls as of 2018. “With a strong pipeline of upcoming malls and expansion of the retail sector, Qatar is expected to witness a rise in tourist spending, going forward,” Alpen Capital stated. In terms of growth drivers, Alpen Capital stated the country’s population was expected to grow at a compound annual growth rate (CAGR) of 0.4% between 2018 and 2023. The country's high level of national wealth has attracted several foreign workers driving optimism among international retailers to establish their presence across the nation, offering high-quality luxury brands. (Gulf-Times.com) Qatar Mining Company’s steel plant in Algeria to open by 4Q2019 – Qatar Mining Company’s board of directors held a meeting and discussed the progress of the company’s important developmental projects and growth strategy, including the company’s upcoming steel plant in Algeria, which is set to become operational before the end of this year. The board also issued needful recommendations and took important decisions with regard to the company’s activities. Qatar Mining Company’s CEO, Khalid bin Ahmed Al Obaidli, revealed the accelerated pace of construction work on its project, the Belara Steel and Steel Plant currently being implemented in Algeria, which is being implemented in partnership with the Algerian government for the establishment of the Algerian Qatari Steel Company. The factory is about 96% complete. (Peninsula Qatar) Baladna appoints Saba Al-Fadala as public relations, communications director – Baladna Food Industries (Baladna) appointed Saba Al-Fadala as its public relations and communications director. With her extensive experience in the food industry, Al-Fadala’s primary responsibility at Baladna will be in sustaining relations with key stakeholders and the local media, while also building a strong corporate social responsibility strategy for the brand. (Gulf-Times.com) Ooredoo showcases Qatar’s digital business future in IoT conference – Ooredoo saw strong turnout at its mega event showcasing Qatar’s Internet of Things (IoT) present and future, with hundreds of C-suite executives experiencing how the IoT can accelerate digital transformation. Attendees from the public, private, and academic sectors experienced how Ooredoo’s end-to-end IoT solutions and services can transform industry verticals – such as agriculture, manufacturing, construction, government, healthcare, tourism and hospitality, smart cities, and transportation. Ooredoo Qatar’s Chief Operating Officer, Yousuf Abdulla Al-Kubaisi said, “Strong turnout at our IoT Conference and Exhibition where we showcased how Ooredoo, with 5G-enabled Supernet, is the preferred partner for Internet of Things solutions that can enable digitalization. The IoT is a key transformation agent for Qatar’s organizations, and during the IoT conference we demonstrated how our solutions can enable them to gain real- time insights that can drive business competitiveness, transform customer experience, and enrich their daily business lives.” (Gulf-Times.com) Qatar emerges as front-runner for long-term LNG deal for Pakistan – Qatar has emerged as the front-runner for a long- term gas supply deal to Pakistan, a senior Pakistani official said, with the cabinet of Prime Minister Imran Khan set to decide in the coming weeks on an agreement. Qatar is already Pakistan’s biggest gas supplier after signing a 15-year agreement to export up to 3.75mn tons of LNG a year to the South Asian country. That 2016 deal supplied Pakistan’s first LNG terminal. Emerging as one of the world’s fastest growing LNG markets, Pakistan is looking to secure a long-term supply contracts for its second LNG terminal, which can receive 600mn cubic feet per day of natural gas. (Reuters) Silk Road to make Qatar a strategic hub in the region – Qatar is among the very first countries to have supported the Belt and Road Initiative that aims for wider links between Asia, Africa and Europe, HE the Minister of Transport and Communications Jassim Seif Ahmed Al-Sulaiti said. Al-Sulaiti said, “Qatar signed several agreements and MoUs that support that initiative. This returns positively on Qatar’s economy and supports its plan to becoming a key strategic and economic hub in the region and the world. In Qatar we look at the Belt and Road Initiative or the 'Silk Road' from a strategic standpoint to link it with all our infrastructure such as ports and airports. This helps reduce time and cost for transporting goods. At the same time, it will be the road for the passage of such goods from China to all countries around the world.” He added, “The Belt and Road Initiative, best known as Silk Road, which China launched in 2013, will contribute to creating new industrial cities and communities in a way that supports growth and common benefits for countries on its path.” (Gulf-Times.com) ‘IBD 2019’ summit to help boost FDI inflows to Qatar – Over 250 delegates are expected to participate in the ‘International Business Delegation (IBD) Summit 2019’, which opens Sunday and will run until May 1. According to IBD Summit’s Chairman, Yousuf Al-Jaber, the event aims to support government's efforts to increase foreign direct investment (FDI) inflows to Qatar by showcasing the country’s investment climate to international investors. Al-Jaber said, “Our team held a series of roadshows in various countries to market the investment potentials Qatar has to offer, and we also wanted to attract international companies wanting to participate in major projects related to Qatar’s hosting of the FIFA World Cup in 2022, as well as in the Qatar National Vision 2030.” Earlier, Al-Jaber emphasized that the summit is a first-of-its-kind event that would gather entrepreneurs, decision makers, and investors from 15 major cities worldwide to connect them with their counterparts in Doha and explore investment, partnership, and business opportunities in Doha and abroad. (Gulf-Times.com) Qatar, UK sign bilateral agreements on occasion of London's hosting of Qatar Day – Qatar and the UK have signed a number of bilateral agreements, including the Qatar Central Bank's donation agreement to the UK's King's College to establish a Qatar Centre for Global Banking & Finance within King's Business School. Both the sides also signed a membership agreement between Qatar Development Bank (QDB) and Innovate Finance's international hub, the first of its kind. Under

- 6. Page 6 of 10 the agreement, Innovate Finance renews its commitment to supporting the development of the FinTech ecosystem in Qatar, as well as the approval of QDB's membership of the Financial Conduct Authority's (FCA) Global Financial Innovation Network (GFIN). The signing ceremony was held on the occasion of London's hosting of Qatar Day with the support of the British Department for International Trade and the City of London, in partnership with the City of London Corp, in which the UK reiterated its commitment to enhancing trade and investment ties, and support Qatar to develop its financial services sector. British Department for International Trade and the Qatar Central Bank affirmed their commitment to bilateral cooperation in cyber-security and achieving the objectives set out in the memorandum of understanding signed between the two countries last year. (Gulf-Times.com) International US economy expands 3.2% in the first quarter; growth details weak – US economic growth accelerated in the first quarter, but the burst in growth was driven by a smaller trade deficit and the largest accumulation of unsold merchandise since 2015, temporary boosters that are seen weighing on the economy later this year. The rise in growth reported by the Commerce Department put to rest fears of a recession, that were stoked by a brief inversion of the US Treasury yield curve in March. However, it also exaggerates the health of the economy as consumer and business spending slowed sharply and investment in homebuilding contracted for a fifth straight quarter. GDP increased at a 3.2% annualized rate in the first quarter, the government stated in its advance GDP report. Growth was also driven by increased investment in roads by local and state governments. The economy grew at a 2.2% pace in the October-December period. Economists polled by Reuters had forecasted GDP increasing at a 2.0% rate in the first three months of the year. The economy will mark 10 years of expansion in July, the longest on record. (Reuters) US capital goods orders hit record high; weekly jobless claims rise – New orders for US-made capital goods increased by the most in eight months in March, hitting their highest level on record and brightening the outlook for manufacturing and the economy. The Commerce Department stated orders for non- defense capital goods excluding aircraft, a closely watched proxy for business spending plans, increased 1.3% to an all-time high of $70.0bn, powered by a jump in demand for computers and electronic products. In March, orders for machinery rose 0.3% after declining 0.7% in February. Orders for computers and electronic products soared 2.2%. The increase in these so- called core capital goods orders was the biggest since last July and followed a 0.1% gain in February. Economists polled by Reuters had forecasted core capital goods orders only nudging up 0.1% in March. They increased 2.8% on a YoY basis. In a separate report, the Labor Department stated initial claims for state unemployment benefits jumped 37,000 to a seasonally adjusted 230,000 for the week ended April 20. The increase was the largest since early September 2017. Claims dropped to 193,000 in the week prior, which was the lowest level since September 1969. Economists had forecasted claims rising to only 200,000 in the latest week. Claims tend to be volatile around this time of the year because of the different timings of Easter and Passover holidays, as well as spring breaks for schools and universities. (Reuters) CBI: UK’s factories stockpile for Brexit at fastest pace in at least 60 years – With Brexit looming, British factories stockpiled over the last three months at the fastest pace since records began in the 1950s, and they’re increasingly downbeat about their prospects, a survey showed. Confederation of British Industry’s (CBI) quarterly survey added to signs that Brexit and a slowdown in the global economy has lumbered manufacturers, who account for 10% of the British economy, with a headache. Expectations for export orders in the next three months fell to their lowest level since mid-2009, when Britain was reeling from the global financial crisis. The CBI’s monthly gauge of manufacturing orders fell unexpectedly to -5 in April from +1 in March, marking the weakest reading since October 2018. A Reuters poll of economists had pointed to a rise to +3. (Reuters) UK banks' mortgage approvals hit nine-month high in March – British banks last month approved the greatest number of mortgages since June 2018, a tentative sign that the worst of the housing market’s slowdown ahead of Brexit may have passed, data showed. Seasonally-adjusted data from the UK Finance industry body showed banks approved 39,980 mortgages in March, up 6% on a year ago and compared with 39,207 in February. The survey added to some early signs that the housing market may be picking up a little after slowing markedly last year. UK Finance stated lending to consumers expanded by 4.1% in March, the strongest growth rate since June and up from 3.5% in February. (Reuters) UK retailers report first rise in sales for five months – British retail sales rose for the first time in five months in April, a leading employers’ group stated, adding to signs that consumers have recovered their appetite for spending even as the country’s Brexit impasse drags on. Confederation of British Industry (CBI) stated the later timing of Easter this year probably helped to push its monthly sales balance up to +13, meaning more retailers reported rising sales than falling sales. The index suffered its biggest fall in 17 months in March when it sank to -18. Economists polled by Reuters had expected a reading of zero for April. Official data published last week showed retail sales volumes surged by the most in nearly two- and-a-half years in annual terms, leaping by 6.7%. CBI stated retailers were more optimistic about sales in the month ahead than they had been in March. (Reuters) Britain and China to hold new round of financial talks in London in June – Britain and China will hold the next round of their Economic and Financial Dialogue (EFD) in mid-June in London, Finance Minister Philip Hammond said, after months of reports that talks had been delayed by diplomatic tension. The EFD has been used in the past to announce closer cooperation on trade and banking initiatives, and to sign commercial contracts. However, relations between London and Beijing have been strained in recent years, most notably after a British warship sailed close to islands claimed by China last August. (Reuters) Japan's March factory output decline flags risk of GDP contraction – Japan’s industrial output fell in January-March at the fastest pace in almost five years, suggesting the economy may post a mild contraction in the first quarter as

- 7. Page 7 of 10 manufacturers struggle with the US-Sino trade war. Industrial output in January-March tumbled 2.6%, the biggest decline since April-June 2014, data from the Ministry of Economy, Trade and Industry (METI) showed. That followed a 1.4% expansion in the previous quarter. On a monthly basis, output fell 0.9% in March, more than a median estimate for a 0.1% decline in a Reuters poll of economists, and versus a 0.7% rise in February. The mounting pressure on Japan’s economy from weak external demand has hurt exports and threatens corporate profits, which could weigh on capital expenditure in the first quarter, analysts said. March industrial output fell due to a 3.4% decline in car output and a 6.7% drop in the production of machines used to make semiconductors and flat- panel displays, the data showed. (Reuters) Japan resists US pressure on forex in trade talks ahead of Abe- Trump summit – Japan is resisting increasing US pressure to link trade with currency issues as leaders of the two close allies are set to hold a summit in Washington, with trade and North Korea high on the agenda. Japanese ministers discussed trade and currency issues with their US counterparts in Washington ahead of the summit between Prime Minister Shinzo Abe and President Donald Trump, in a last-minute bid to keep Washington from linking the issues. Trump has made clear he is unhappy with Japan’s trade surplus with the US - much of it from auto exports - and wants a two-way deal to fix it. US Treasury Secretary, Steven Mnuchin had said that in future trade deals, including one with Japan, the US would like to include a provision to deter forex manipulation. Japan has resisted the idea, out of fear that it could tie its hands in monetary policy and any future attempts to keep an unwelcome yen spike in check. (Reuters) China's industrial profits pick up in March with 13.9% rise – Profits at China’s industrial firms grew in March, rebounding from four months of contraction, adding to optimism the world’s second-largest economy may be starting to stabilize. Profits in March rose 13.9% YoY to 589.52bn Yuan, the National Bureau of Statistics (NBS) stated, recovering from a 14% fall in the first two months. That marked the biggest monthly increase since July 2018. For the first quarter of the year, profits notched up by industrial companies dropped 3.3% to 1.3tn Yuan compared with a year earlier, according to the NBS. The growth in March mainly came from acceleration in production and sales, as well as a recovery of profits in key industrial sectors, Zhu Hong of the statistics bureau said in a statement accompanying the data. (Reuters) Regional MENA power projects to grab chunk of energy investment – Power projects in the MENA region are expected to receive the largest share of investments, $348bn of almost $1tn worth of investments set to be made in the region’s energy sector over the next five years as electricity consumption spirals higher, driven by burgeoning populations, urbanization and rising income levels. According to a new outlook from the Arab Petroleum Investments Corporation (APICORP), a multilateral development financial institution, this accounts for 36% of the $961bn worth of planned and committed investments for the sector in 2019-23. Saudi Arabia has the largest committed and planned investments in the medium term. While the estimate marks a 5% increase on APICORP’s 2018 outlook, total investment in the GCC, however, has shrunk 11% YoY, marking the second consecutive year of decline. The UAE is the only country in the GCC with committed investments up on year, the report added. In the power sector, where $90bn worth of projects is currently being executed, renewables make up for 34% of the investment. Saudi Arabia has set a target of 27.3 gigawatts (GW) of renewable energy by 2023, rising up to 58.7 GW by 2030. In the oil sector, of the $304bn of total investment, $166bn worth of projects are at the planning stage, while $138bn has been committed. (Zawya) Countries in OPEC+ deal are abiding by agreement to limit oil output – OPEC+ states including Saudi Arabia are complying with the terms of the agreement to limit oil output, Russian President, Vladimir Putin said. “We have agreements within the OPEC+. We fulfill our agreements and we do not have any news, any information, from our Saudi partners and any other OPEC member, that they are ready to exit these agreements,” he said. US President, Donald Trump said that he spoke to Saudi Arabia and others about increasing oil flow and said that all are in agreement after the administration announced that it would not extend waivers for buyers of Iranian crude that had allowed them to continue purchases despite American sanctions. (Gulf- Times.com) Saudi Arabia’s PIF on track to manage $400bn assets in 2020 – Saudi Arabia’s sovereign wealth fund, Public Investment Fund (PIF) is on track to manage $400bn of assets by the end of 2020, according to its Head of Corporate Finance and Treasury, Alireza Zaimi. Alireza Zaimi said, “We are going to become one of the largest and most impactful sovereign wealth funds in the world. We are growing our assets faster on the international pool as we are trying to diversify, and increase the size and proportion of our international assets.” Saudi Arabia is seeking to transform the PIF from a domestic holding company into the world’s largest sovereign fund. It’s already made a series of investments in companies such as Tesla Inc. and Uber Technologies Inc. as well as a $45bn commitment to SoftBank Group Corp.’s Vision Fund. The wealth fund currently has an AUM of $290bn, according to Sovereign Wealth Fund Institute (SWFI), making it the 11th largest globally. (Bloomberg) Saudi Arabia raises SR11.619bn from Riyal Sukuk offering – Saudi Arabia has raised SR11.619bn from its local Sukuk offering for the month of April, the finance ministry stated. The size of the first tranche is SR0.768bn and it will become SR2.768bn at the final size and will mature in 2024. The size of the second tranche is of SR0.918bn and it will become SR2.043bn at the final size maturing in 2028. The size of the third tranche is of SR0.686bn and it will become SR4.366bn at the final size maturing in 2034. The size of the fourth tranche is of SR9.247bn and it will mature in 2049. (Bloomberg) Saudi Arabia sells 30-year local currency Sukuk for the first time – Saudi Arabia has issued local currency Islamic bonds with 30-year maturity for the first time, raising $2.47bn. The longer maturity sale will be valuable for long-term financing pricing in the Kingdom and will support developmental and infrastructure projects, the ministry of finance stated. The issuance is also expected to be a reference point to price

- 8. Page 8 of 10 mortgage and savings products by having it as a risk-free point on which price models are based on. (Bloomberg) Saudi Arabia makes it easier for investors to buy local Sukuk – Saudi Arabia is making it much easier for investors to buy local currency Islamic bonds as the Kingdom seeks to deepen its debt market. The Public Debt Management of the Ministry of Finance is slashing the minimum amount required for investors to buy Sukuk to SR1,000 from SR1mn, state-run Saudi Press Agency reported. (Bloomberg) Saudi Telecom Company hires banks for its first Dollar Islamic bond sale – Saudi Telecom Company, majority owned by the Kingdom’s Public Investment Fund (PIF), appointed HSBC Holdings, JPMorgan Chase & Co., Standard Chartered, Samba Capital, First Abu Dhabi Bank, and KFH Capital Investment to manage the sale of its first Dollar Islamic bond sale of a total amount not exceeding $5bn and issue Sukuk thereunder in tranches through a series of issuances either directly or through an offshore special purpose vehicle to be established for this purpose. The company last month set up a $5bn Sukuk program. (Tadawul, Bloomberg) Saudi Arabia says China has not yet asked for more oil amid tighter Iran sanctions – Saudi Arabia’s Energy Minister, Khalid Al-Falih said that China has not yet asked for more crude oil after the US decided to end sanction waivers on Iranian oil imports that has permitted China to keep buying from Iran. The US re-imposed sanctions against Iran’s oil exports last November, however US initially allowed the eight biggest buyers of Iranian oil - China is number one - to keep purchasing limited imports for six months ending April. (Reuters) Saudi Aramco looking at potential gas JVs, sells first LNG cargo – Saudi Aramco’s CEO, Amin Nasser said that the company is in discussions with many partners around the world regarding potential joint ventures in gas, and that it has sold its first LNG cargo. Saudi Aramco wants to become a major player in gas and is eyeing projects around the world to help it gain a firm foothold in international gas business, he said. “There is a lot of potential to grow in gas. We are currently in discussion with a lot of partners around the world for growing our international gas position. For the time being we are looking at potential JV or partnership,” Amin Nasser said, adding that Saudi Aramco will also be looking at potentially exporting gas through both pipelines and as liquefied natural gas (LNG). Saudi Aramco’s trading arm has sold its first LNG from Singapore, he said. Aramco Trading Company has sold the LNG cargo on the spot market late last month to an Indian buyer, sources said. Saudi Aramco is pushing ahead with its conventional and unconventional gas exploration and production program to feed its fast growing industries, as the company plans to increase its gas output and become an exporter. Saudi Aramco has been looking at gas assets in Russia, Australia and Africa, Saudi Arabian Energy Minister, Khalid Al-Falih said. (Reuters) Saudi wealth fund 'not in a hurry' to issue bonds, considers funding options – Saudi Arabia’s sovereign wealth fund, Public Investment Fund (PIF) is ‘not in a hurry’ to issue bonds however is assessing several funding options, an executive said. The PIF has been given the task of helping to deliver the Vision 2030 reform plan, an ambitious economic program announced by the government in 2016 designed to free the Kingdom from dependence on oil exports. Last year the fund raised an $11bn international syndicated loan, its first commercial borrowing, and sources told Reuters this month it has been in talks with banks to raise a short-term bridge loan for as much as $8bn to use for new investments. (Reuters) Saudi Arabia reduces fees and trading commissions for local bond market – Saudi Arabia’s Capital Market Authority (CMA), the country’s bourse and its Debt Management Office (DMO) announced in a joint statement that it has reduced fees and commissions to encourage secondary market trading of debt. The three entities stated that trading commissions for the Tadawul, and the CMA had been reduced, while fees for new offerings and annual registration charges for issuers have also been reduced. In addition, Tadawul’s annual listing fees and fees for subsequent issuances fees were also reduced. The DMO also reduced the of par values for government issued Sukuk from SR1mn to one thousand, the statement said, signaling further government efforts to attempt to facilitate access to the bond market for retail investors. (Reuters) PIF-backed Saudi Arabian real estate firm to buy $200mn worth of mortgages – Saudi Real Estate Refinance Company (SRC), a subsidiary of sovereign wealth fund Public Investment Fund (PIF), stated that it has agreed to buy $200mn worth of mortgages from local banks and mortgage financing companies. The move comes after SRC recently completed a SR750mn Sukuk issue with multiple tenors, under a program that allows it to issue up to SR11bn of local currency denominated Islamic bonds. SRC, formed in 2017, is trying to boost the Kingdom’s secondary mortgage market. It aims to refinance 20% of Saudi Arabia’s mortgage market over the next decade. The agreements signed, included deals to buy portfolio of mortgages from Saudi British Bank and Banque Saudi Fransi, it stated. (Reuters) Saudi Aramco CEO: No more bond sales planned for 2019 – Saudi Aramco CEO, Amin Nasser said that no more bond sales have been planned for 2019. He also said that the company sees healthy growth in the oil demand and not worried about the impact of electric vehicles. The future supplies of shale oil are good for the industry. Saudi Aramco needs to remain the lowest-cost oil producer, at ~$3 per barrel. (Bloomberg) SAMBA's net profit falls 7.4% YoY to SR1,208mn in 1Q2019 – Samba Financial Group (SAMBA) recorded net profit of SR1,208mn in 1Q2019, registering decrease of 7.4% YoY. Total operating profit rose 13.2% YoY to SR2,195mn in 1Q2019. Total revenue for special commissions/investments rose 22.7% YoY to SR2,132mn in 1Q2019. Total assets stood at SR231.1bn at the end of March 31, 2019 as compared to SR228.9bn at the end of March 31, 2018. Loans and advances stood at SR115.1bn (-0.8% YoY), while customer deposits stood at SR170.2bn (-1.3% YoY) at the end of March 31, 2019. EPS came in at SR0.60 in 1Q2019 as compared to SR0.65 in 1Q2018. (Tadawul) UAE's RAK Bank sees room for smaller lenders in merger wave – National Bank of Ras Al-Khaimah’s (RAK Bank) CEO, Peter England said that there is still room for smaller banks in the UAE even as a consolidation wave creates bigger competitors. The CEO said, “In our case we have a reason for being, we are the largest small-and-medium enterprise bank in the country and that gives us a reason for existing on our own.” Controlled

- 9. Page 9 of 10 by the government of Ras Al-Khaimah, RAK Bank has carved out a niche in a country of about 50 lenders by mainly servicing SMEs. The sector contributes about 35% of the bank’s profit, he added. RAK Bank continuously evaluates merger possibilities because “we would be foolish not to, we would want to merge because it makes sense purely from a business perspective, however doesn’t create challenges from a shareholder perspective, and it’s not easy to find one,” he said. He expects loan growth of 3% - 4% in 2019; lending will increase 6% - 7% when it includes lending to financial institutions and interbank credit. Net interest margin can be seen declining to high 4%, very low fives by year end from 5.3% in 1Q2019, mainly due to greater mix of lower margin loans to financial institutions, corporates. Provisions or cost of risk, was 4% annualized in 1Q2019, that will drop to mid-threes, low threes by year end and he added that he sees Dubai property prices declining over next 12-18 months, mainly due to oversupply and will stabilize at a later stage. (Bloomberg) China to invest $3.4bn in Dubai for trading initiative – China plans to invest $3.4bn in two Dubai-based trading facilities, increasing the influence of the world’s second-largest economy in the Gulf region. The country will invest $2.4bn in a 60mn square-feet (5.6mn square-meters) operation that will be used to store Chinese products for shipping around the world, Dubai ports group DP World stated, citing Sheikh Mohammed bin Rashid Al Maktoum, ruler of Dubai. “It will include wholesale and retail outlets that help enhance regional and international trade,” according to the statement. DP World has also signed an agreement with China to create a $1bn project in Dubai to import, process, pack and export agricultural, marine and animal products. The UAE has been seeking Chinese investments, and companies from the Asian country invested $300mn in Abu Dhabi’s industrial zone in 2017. China Cosco Shipping Corp. agreed in 2016 to spend $738mn on a new port in Abu Dhabi. (Bloomberg) Investors bolster oversight in emerging-market private equity after Abraaj collapse – Investors in private equity funds that focus on emerging markets are tightening oversight after the collapse of a Middle East buyout firm, a survey has found. Many investors said that they planned to put more money into such funds over the next two years, however also to install extra checks and balances, suggested the survey by the Emerging Markets Private Equity Association (EMPEA). Dubai-based Abraaj Capital Ltd has been the largest buyout fund in the Middle East and North Africa (MENA) region until it fell apart last year after a dispute with investors, including the Gates Foundation, over a $1bn healthcare fund. Two of its top executives have been arrested. “The fallout has prompted many limited partners to expand the scope of their due diligence processes to include a closer look at the internal operations and governance arrangements of fund managers,” EMPEA stated. (Reuters) DP World shipping container volumes plunge in UAE in the first quarter, flat globally – Ports operator DP World reported a sharp drop in shipping container volumes in the UAE in the first quarter of 2019 and flat growth globally. DP World operates 78 marine and inland terminals, supported by over 50 related businesses in over 40 countries. Gross container volumes fell by 0.6% on a reported basis and gross like-for-like volumes declined by 0.7%, it stated. Dubai-based company handled 3.5mn TEU (twenty-foot equivalent unit) in the UAE, down 8.8% due to the challenging macro environment and loss of lower-margin cargo, it stated. It handled 17.5mn TEUs globally, similar to volumes a year earlier. Consolidated volumes, at terminals over which DP World has control, fell 3% on a like- for-like basis to 9.2mn TEUs. DP World’s Chairman and CEO, Sultan bin Sulayem said, “The company saw softer volumes due to a strong prior year performance and general caution in some markets given the current uncertainty in the macro environment. In the UAE, volume weakness was mainly due to a loss of low margin throughput as it focuses on profitable cargo. While we expect the recent trends to continue into the second quarter, we do expect an improvement in the second half of the year.” (Gulf-Times.com) KKR and BlackRock raising $3bn for ADNOC pipeline deal – The US investment firms KKR and BlackRock are raising a $3bn loan to back the purchase of a 40% stake in ADNOC Oil Pipelines, an entity of the Abu Dhabi state oil company, according to Project Finance International, a news service that is part of Refinitiv. BNP Paribas, SMBC, Mizuho, Santander and First Abu Dhabi Bank are leading the loan, which has a 23-year maturity and is now being syndicated to other banks, PFI reported. ADNOC Oil Pipelines will lease the oil company’s interest in 18 pipelines covering 350 km, transporting crude oil and condensates across ADNOC’s upstream concessions, for 23 years. ADNOC sealed the $4bn pipeline deal in February. (Reuters) Mubadala launches $1bn Abu Dhabi-based investment fund – State-owned Mubadala Investment Company (Mubadala) stated that it has launched a new $1bn fund, Abu Dhabi Catalyst Partners, to explore opportunities within the UAE and abroad. The new fund will be based in Abu Dhabi Global Market (ADGM), the financial center of Abu Dhabi, and will make use of Mubadala’s networks to originate investment opportunities in the region, Mubadala stated. “The new fund will target opportunities across asset management, specialty finance and financial infrastructure, with investees expected to have a presence in ADGM,” it stated. Mubadala manages more than $225bn in assets and has committed $15bn to the $100bn SoftBank Vision Fund. (Reuters) Oman’s oil exports fall to 0.829mn bpd in March – Oman’s oil exports fell to 0.829mn bpd in March from 0.841mn bpd in February, representing a fall of 1.4% MoM, according to data published by National Center for Statistics & Information (NCSI). Oman produced 0.97mn bpd of crude oil and condensate in March, representing a rise of 0.3% YoY. The average daily crude oil and condensate output remained little changed from the previous month. (Bloomberg)

- 10. Contacts Saugata Sarkar, CFA, CAIA Shahan Keushgerian Zaid al-Nafoosi, CMT, CFTe Head of Research Senior Research Analyst Senior Research Analyst Tel: (+974) 4476 6534 Tel: (+974) 4476 6509 Tel: (+974) 4476 6535 saugata.sarkar@qnbfs.com.qa shahan.keushgerian@qnbfs.com.qa zaid.alnafoosi@qnbfs.com.qa Mehmet Aksoy, PhD QNB Financial Services Co. W.L.L. Senior Research Analyst Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6589 PO Box 24025 mehmet.aksoy@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNB FS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNB FS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNB FS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNB FS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNB FS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNB FS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNB FS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNB FS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNB FS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNB FS. Page 10 of 10 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 45.0 70.0 95.0 120.0 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 QSE Index S&P Pan Arab S&P GCC 0.4% (0.1%) (0.4%) 0.3% (0.3%) (0.1%) (0.5%)(1.0%) (0.5%) 0.0% 0.5% 1.0% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,286.25 0.7 0.9 0.3 MSCI World Index 2,173.82 0.4 0.6 15.4 Silver/Ounce 15.09 0.9 0.7 (2.6) DJ Industrial 26,543.33 0.3 (0.1) 13.8 Crude Oil (Brent)/Barrel (FM Future) 72.15 (3.0) 0.3 34.1 S&P 500 2,939.88 0.5 1.2 17.3 Crude Oil (WTI)/Barrel (FM Future) 63.30 (2.9) (1.1) 39.4 NASDAQ 100 8,146.40 0.3 1.9 22.8 Natural Gas (Henry Hub)/MMBtu 2.61 2.8 2.8 (18.1) STOXX 600 391.01 0.5 (0.5) 12.9 LPG Propane (Arab Gulf)/Ton 65.50 (2.6) 5.6 3.1 DAX 12,315.18 0.5 0.2 13.8 LPG Butane (Arab Gulf)/Ton 66.37 (3.8) 1.5 (5.2) FTSE 100 7,428.19 0.2 (0.8) 12.0 Euro 1.12 0.2 (0.8) (2.8) CAC 40 5,569.36 0.4 (0.8) 14.8 Yen 111.58 (0.0) (0.3) 1.7 Nikkei 22,258.73 (0.2) 0.6 10.0 GBP 1.29 0.1 (0.6) 1.3 MSCI EM 1,078.06 0.1 (1.3) 11.6 CHF 0.98 0.1 (0.5) (3.7) SHANGHAI SE Composite 3,086.40 (1.0) (6.0) 26.5 AUD 0.70 0.4 (1.5) (0.1) HANG SENG 29,605.01 0.2 (1.2) 14.4 USD Index 98.01 (0.2) 0.6 1.9 BSE SENSEX 39,067.33 1.5 (0.7) 8.1 RUB 64.74 0.1 1.1 (7.1) Bovespa 96,236.04 0.6 2.1 8.0 BRL 0.25 0.5 0.0 (1.3) RTS 1,247.01 0.1 (1.1) 16.7 104.6 97.2 84.0