Daily Market Report: QSE Rises 0.3% as Transportation, Industrials Gain

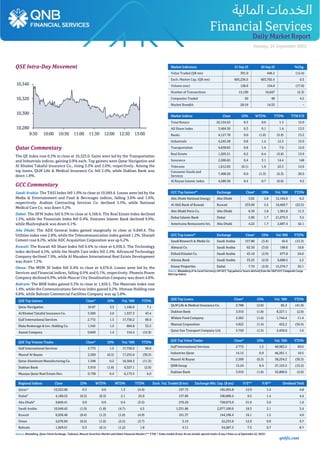

- 1. qnbfs.com Daily MarketReport Sunday, 24 September 2023 QSE Intra-Day Movement Qatar Commentary The QE Index rose 0.3% to close at 10,323.0. Gains were led by the Transportation and Industrials indices, gaining 0.8% each. Top gainers were Qatar Navigation and Al Khaleej Takaful Insurance Co., rising 3.3% and 2.0%, respectively. Among the top losers, QLM Life & Medical Insurance Co. fell 2.0%, while Dukhan Bank was down 1.8%. GCC Commentary Saudi Arabia: The TASI Index fell 1.0% to close at 10,949.4. Losses were led by the Media & Entertainment and Food & Beverages indices, falling 3.8% and 1.6%, respectively. Arabian Contracting Services Co. declined 5.5%, while National Medical Care Co. was down 5.2%. Dubai: The DFM Index fell 0.3% to close at 4,168.6. The Real Estate index declined 1.5%, while the Financials Index fell 0.4%. Emirates Islamic Bank declined 9.9%, while Mashreqbank was down 6.1%. Abu Dhabi: The ADX General Index gained marginally to close at 9,849.4. The Utilities index rose 2.8%, while the Telecommunication index gained 1.2%. Sharjah Cement rose 8.2%, while ADC Acquisition Corporation was up 6.2% Kuwait: The Kuwait All Share Index fell 0.4% to close at 6,936.5. The Technology index declined 4.5%, while the Health Care index fell 2.4%. Advanced Technology Company declined 7.9%, while Al Masaken International Real Estate Development was down 7.2%. Oman: The MSM 30 Index fell 0.4% to close at 4,676.8. Losses were led by the Services and Financial indices, falling 0.9% and 0.1%, respectively. Phoenix Power Company declined 6.9%, while Muscat City Desalination Company was down 4.8%. Bahrain: The BHB Index gained 0.3% to close at 1,929.5. The Materials Index rose 1.4%, while the Communications Services index gained 0.2%. Ithmaar Holding rose 9.8%, while Bahrain Commercial Facilities Company was up 3.8%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Navigation 10.87 3.3 1,166.0 7.1 Al Khaleej Takaful Insurance Co. 3.300 2.0 1,337.3 43.4 Gulf International Services 2.772 1.5 17,730.2 90.0 Dlala Brokerage & Inv. Holding Co. 1.545 1.5 864.8 35.3 Aamal Company 0.849 1.4 154.4 (12.9) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Gulf International Services 2.772 1.5 17,730.2 90.0 Masraf Al Rayan 2.209 (0.3) 17,255.0 (30.3) Qatar Aluminum Manufacturing Co. 1.348 0.2 16,364.3 (11.3) Dukhan Bank 3.910 (1.8) 8,327.1 (2.0) Mazaya Qatar Real Estate Dev. 0.738 0.4 6,173.5 6.0 Market Indicators 21 Sep 23 20 Sep 23 %Chg. Value Traded (QR mn) 391.0 446.2 (12.4) Exch. Market Cap. (QR mn) 605,236.5 603,702.4 0.3 Volume (mn) 128.6 154.8 (17.0) Number of Transactions 15,190 16,047 (5.3) Companies Traded 50 48 4.2 Market Breadth 26:19 14:32 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 22,154.52 0.3 0.0 1.3 12.9 All Share Index 3,464.56 0.3 0.1 1.4 13.5 Banks 4,127.78 0.0 (1.0) (5.9) 13.2 Industrials 4,245.58 0.8 1.4 12.3 15.0 Transportation 4,638.63 0.8 1.4 7.0 12.0 Real Estate 1,503.51 0.2 0.4 (3.6) 13.9 Insurance 2,500.65 0.4 3.1 14.4 148 Telecoms 1,612.05 (0.1) 1.9 22.3 12.6 Consumer Goods and Services 7,498.26 0.0 (1.3) (5.3) 20.3 Al Rayan Islamic Index 4,589.38 0.4 0.7 (0.0) 9.2 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Abu Dhabi National Energy Abu Dhabi 3.62 2.8 12,164.6 6.2 Al Ahli Bank of Kuwait Kuwait 233.00 2.2 10,469.7 (22.5) Abu Dhabi Ports Co. Abu Dhabi 6.39 1.8 1,381.8 11.3 Dubai Islamic Bank Dubai 5.90 1.7 21,079.3 3.5 Americana Restaurants Int. Abu Dhabi 4.22 1.7 2,687.4 42.1 GCC Top Losers## Exchange Close# 1D% Vol.‘000 YTD% Saudi Research & Media Gr. Saudi Arabia 157.80 (3.4) 45.6 (13.3) Almarai Co. Saudi Arabia 62.50 (3.0) 198.6 16.8 Etihad Etisalat Co. Saudi Arabia 43.10 (2.9) 677.8 24.0 Alinma Bank Saudi Arabia 33.25 (2.9) 6,680.5 2.2 Emaar Properties Dubai 7.74 (2.9) 15,376.7 32.1 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/ losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% QLM Life & Medical Insurance Co. 2.788 (2.0) 85.3 (41.9) Dukhan Bank 3.910 (1.8) 8,327.1 (2.0) Widam Food Company 2.263 (1.6) 1,744.4 11.4 Mannai Corporation 4.822 (1.4) 452.2 (36.5) Qatar Gas Transport Company Ltd. 3.720 (1.3) 2,450.0 1.6 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Gulf International Services 2.772 1.5 48,983.2 90.0 Industries Qatar 14.15 0.9 46,261.1 10.5 Masraf Al Rayan 2.209 (0.3) 38,254.2 (30.3) QNB Group 15.24 0.4 37,153.5 (15.3) Dukhan Bank 3.910 (1.8) 32,800.6 (2.0) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 10,322.96 0.3 0.0 1.3 (3.4) 107.73 165,955.8 12.9 1.4 4.8 Dubai# 4,168.55 (0.3) (0.3) 2.1 25.0 137.06 190,000.4 9.5 1.4 4.4 Abu Dhabi# 9,849.41 0.0 0.0 0.4 (3.5) 276.29 758,673.0 31.9 3.0 1.6 Saudi Arabia 10,949.42 (1.0) (1.8) (4.7) 4.5 1,331.86 2,977,100.6 18.3 2.1 3.4 Kuwait 6,936.46 (0.4) (1.3) (1.0) (4.9) 161.37 144,196.4 16.1 1.5 4.0 Oman 4,676.84 (0.4) (1.0) (2.5) (3.7) 3.19 22,253.8 12.9 0.9 4.7 Bahrain 1,929.51 0.3 (0.1) (1.2) 1.8 3.11 54,287.3 7.3 0.7 8.7 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades if any # Data as of September 22, 2023) 10,280 10,300 10,320 10,340 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. qnbfs.com Daily MarketReport Sunday, 24 September 2023 Qatar Market Commentary • The QE Index rose 0.3% to close at 10,323.0. The Transportation and Industrials indices led the gains. The index rose on the back of buying support from GCC and Foreign shareholders despite selling pressure from Qatari and Arab shareholders. • Qatar Navigation and Al Khaleej Takaful Insurance Co. were the top gainers, rising 3.3% and 2.0%, respectively. Among the top losers, QLM Life & Medical Insurance Co. fell 2.0%, while Dukhan Bank was down 1.8%. • Volume of shares traded on Thursday fell by 17.0% to 128.6mn from 154.9mn on Wednesday. Further, as compared to the 30-day moving average of 184.4mn, volume for the day was 30.2% lower. Gulf International Services and Masraf Al Rayan were the most active stocks, contributing 13.8% and 13.4% to the total volume, respectively. Overall Activity Buy%* Sell%* Net (QR) Qatari Individuals 24.36% 27.67% (12,933,008.92) Qatari Institutions 44.18% 42.27% 7,469,021.00 Qatari 68.55% 69.95% (5,463,987.91) GCC Individuals 0.22% 0.24% (77,900.50) GCC Institutions 2.00% 1.94% 239,833.02 GCC 2.22% 2.18% 161,932.52 Arab Individuals 10.24% 10.37% (492,716.96) Arab Institutions 0.00% 0.00% - Arab 10.24% 10.37% (492,716.96) Foreigners Individuals 3.02% 3.10% (336,548.72) Foreigners Institutions 15.97% 14.40% 6,131,321.07 Foreigners 18.99% 17.51% 5,794,772.35 Source: Qatar Stock Exchange (*as a% of traded value) Global Economic Data Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 09-21 US Department of Labor Initial Jobless Claims Sep 201k 225k 221k 09-21 US Department of Labor Continuing Claims Sep 1662k 1692k 1683k 09-21 US National Assoc. of Realtors Existing Home Sales Aug 4.04m 4.10m 4.07m 09-21 US National Assoc. of Realtors Existing Home Sales MoM Aug -0.70% 0.70% -2.20% 09-22 US Markit S&P Global US Manufacturing PMI Sep 48.90 48.20 47.90 09-22 US Markit S&P Global US Services PMI Sep 50.20 50.70 50.50 09-22 US Markit S&P Global US Composite PMI Sep 50.10 50.40 50.20 09-22 UK Markit S&P Global/CIPS UK Manufacturing PMI Sep 44.20 43.20 43.00 09-22 UK Markit S&P Global/CIPS UK Services PMI Sep 47.20 49.40 49.50 09-22 UK Markit S&P Global/CIPS UK Composite PMI Sep 46.80 48.70 48.60 09-22 EU Markit HCOB Eurozone Manufacturing PMI Sep 43.40 44.00 43.50 09-22 EU Markit HCOB Eurozone Services PMI Sep 48.40 47.60 47.90 09-22 EU Markit HCOB Eurozone Composite PMI Sep 47.10 46.50 46.70 09-22 Germany Markit HCOB Germany Manufacturing PMI Sep 39.80 39.50 39.10 09-22 Germany Markit HCOB Germany Services PMI Sep 49.80 47.10 47.30 09-22 Germany Markit HCOB Germany Composite PMI Sep 46.20 44.70 44.60 09-22 Japan Ministry of Internal Affairs and Communications Natl CPI YoY Aug 3.20% 3.00% 3.30% 09-22 Japan Markit Jibun Bank Japan PMI Composite Sep 51.80 NA 52.60 09-22 Japan Markit Jibun Bank Japan PMI Mfg Sep 48.60 NA 49.60 09-22 Japan Markit Jibun Bank Japan PMI Services Sep 53.30 NA 54.30 Qatar Qatar sells QR500mn 7-day Bills at Yield 5.755% - Qatar sold QR500mn ($137.1mn) of bills due Sept. 28 on Sept. 21. The bills have a yield of 5.755% and settled on Sept. 21. (Bloomberg) Gulf International Services Board of Directors approves final merger transaction agreements of Amwaj - Gulf International Services (GISS), Board of Directors has approved final merger transaction agreements of Amwaj. GIS obtained Extra-Ordinary General Assembly approval on 13th March, 2023 and authorized its Board of Directors to take necessary steps to execute final merger. Accordingly, GISS Board of Directors approved the final merger transaction agreements. As part of the merger transaction, all the details as published on 20th February 2023 remains unchanged as part of this final approval. (QSE) Ooredoo, QFZ sign MoU to support global businesses and investments in Qatar - Ooredoo signed a memorandum of understanding (MoU) with the Qatar Free Zones Authority (QFZ) to support international businesses and investments in the country. The new strategic partnership announced yesterday aims to expand the connectivity and ICT solutions available to prospective and existing investors and businesses in the free zones. This collaboration is set to transform Qatar into a global business hub, empowering foreign businesses to operate seamlessly within the country and establish a strong foundation for their growth. The agreement was signed by Sheikh Ali bin Jabor al-Thani, chief executive officer, Ooredoo Qatar and Sheikh Mohamed HF al-Thani, chief executive officer, QFZ at Ooredoo’s headquarters. Sheikh Ali said, “Ooredoo is committed to delivering cutting-edge solutions and connectivity services that empower businesses of all sizes and sectors to thrive. This landmark partnership with QFZ marks a significant milestone in our dedication to supporting international businesses and investment in the country, significantly contributing to upgrading Qatar’s business ecosystem, fostering innovation, and – ultimately – driving economic growth.” As part of this agreement, Ooredoo will off er a comprehensive suite ofbusiness products and services, encompassing fixed and mobile connectivity services, as well as cutting-edge ICT solutions. These offerings will be extended to QFZ and its network of investors, providing them with preferential commercial terms and making it easier than ever to establish and expand

- 3. qnbfs.com Daily MarketReport Sunday, 24 September 2023 their operations. Sheikh Mohamed said, “This partnership marks a key milestone for expanding the ICT and telecommunications services that QFZ investors can leverage in the free zones. As the Ooredoo presence comes online through a dedicated office in the Investor Relations Center in the Business Innovation Park in Ras Bufontas Free Zone, investors will be able to integrate state-of-the-art ICT and telecoms services seamlessly into their businesses, offered at a lower cost and in a customized and tailor-made manner to meet business needs.” QFZ was established in 2018 and launched soft operations in 2020 to oversee and regulate world-class free zones in Qatar and secure fixed investments within the zones. It offers outstanding opportunities and benefits for businesses seeking to establish operations and expand regionally and globally, providing quality infrastructure, a skilled workforce, 100% foreign ownership, access to investment funds, tax exemptions and par. (Gulf Times) Aamal seeks to expand footprint outside of Qatar - Aamal Company (Aamal) plans to expand its business beyond GCC and is seeking a potential partnership to export its products, said a senior official. “We are looking to expand Aamal’s operations beyond the boundaries of Qatar. Our strategy is firstly to enhance our services in Qatar and keep growing, and secondly to look to a potential partnership to help us export outside of Qatar,” said Aamal Company Chief Executive Officer, Rashid Ali Al Mansoori, talking to The Peninsula. The official also spoke of a visit to Africa and Asia to explore potential opportunities for the company to expand its footprint. “The growth in the GCC region is better than the worldwide growth. Since we were established, our strategy at Aamal is based on diversification and continually applying the high standards which have helped us to gain attraction and our good reputation. So, it’s important for Aamal to find neighboring countries to expand into, especially in manufacturing, and also to go beyond the GCC and worldwide,” he added. Diversity stands as a foundational principle for Aamal, fueling growth through 30 dynamic business units with market leading positions in key growth sectors including industrial manufacturing, real estate, medical equipment and pharmaceutical, automotive and managed services sectors. The company’s diversified business model has proven its resilience and shown strong growth. The company’s subsidiaries are working to advance the Qatar National Vision 2030, Al Mansoori noted, and Aamal Company is one of the major listed companies on the Qatar Stock Exchange (QSE). “Diversification of activities is our strength and we have the ambition to grow and continue to support the Qatar National Vision 2030.” The company seeks to take advantage of the growth opportunities enabled by the National Vision and to leverage its position as a leading participant across various key economic sectors. “Under the trading sector we have the automotive, pharmaceutical and the medical equipment activities and we are also looking to expand more into oil and gas, electric vehicles, and the IT sector. All these are our plans and we are already putting in cornerstones for these new sectors. We have also started to negotiate some deals with potential joint ventures,” he added. “In the industrial sector we are the major supplier of copper cable in Qatar. We produce a very high standard of copper cables and have won a contract with Kahramaa for QR1.2bn.” Since the beginning of the year, Aamal subsidiaries have successfully won key contracts such as Elsewedy Cables Qatar being awarded a 30- month EPC contract by Kahramaa. This contract is for the establishment of new under-ground Extra High Voltage / High Voltage Cables (EHV/HV) in addition to different voltage levelsfrom 132kV,66kV and modifications of the existing circuits. Speaking during the interview, Al Mansoori went on to say that “We also have a subsidiary which produces concrete and cementing. We are a leading producer of paving stones and concrete blocks.” Aamal Cement Industries supplies a range of curb stones and concrete blocks for a variety of uses including highways, walkways, and bus stops. “Another important sector is the pharmaceutical and medical sector. We are one of the largest distributors of medicine in Qatar and a market leading supplier for pharmaceuticals, medical equipment and automotive products across Qatar.In the real estate sector, Aamal’s flagship–theCityCenter–isoneof the oldest and mostrenownedshopping malls. The footfall is between 30,000 to 40,000 visitors per day which makes it one of the best destinations for shoppers.” Commenting on the recent award of a contract worth QR15.4m he said, “We have always been chosen for our quality of services. This contract is for the provision of hospitality services across all premises belonging to the Ministry of Municipality and is one of a series of contracts awarded to Aamal Services this year.” Elaborating about the company’s ESG framework, the official stated “We are committed to applying corporate governance practices of the highest standards. There are a lot of opportunities across sustainability, ESG, and society.” Responding to a query regarding the momentum in the Qatari market after the FIFA World Cup 2022, Al Mansoori said, “Qatar’s economy is always growing and will continue to grow as there are a lot of projects and opportunities such as the North Field Expansion.” (Peninsula Qatar) QTerminals completes acquisition of majority stake in Netherlands-based Kramer Holding - QTerminals, a terminal operating company jointly established by Mwani Qatar and Milaha, has officially completed the acquisition of a majority stake in Kramer Holding, a provider of integrated logistics and container services located in the Port of Rotterdam in the Netherlands. This was announced by QTerminals in its social medial platform X. The acquisition represents an important milestone in the expansion of QTerminals, as the Port of Rotterdam is the largest in Europe and is a significant addition to QTerminals group’s diversification. It further reinforces the QTerminals Group’s commitment to contributing towards the Qatar National Vision 2030, which aims for the diversificationof the national economy and foreign investments. “Kramer Group is an important strategic step for QTerminals as we will expand our presence into Europe’s largest port. Kramer Group complements QTerminals and adds existing business, a robust value-creating service offering and European network to QTerminals portfolio,” QTerminals Group CEO Neville Bissett had said earlier. QTerminals will retain Kramer’s key management personnel and employees, including Andre Kramer, who will continue as the chief executive off icer. Kramer Group has both core and strategic importance to the Port of Rotterdam, as it supplements the port’s activities whilst having direct access to the deep- sea terminals of the Port of Rotterdam. The Kramer Group is an integrated container handling and storage, terminal, container development and logistics services provider, located in the Port of Rotterdam, and is the only independent terminal in the Maasvlakte area, and one of the few multi-user depot terminals in the port. The acquisition of the Kramer Group by QTerminals allows its entry and presence in the largest port in Europe which makes QTerminals Group’s position stronger in relation to future opportunities in Europe and other developed global markets. The presence of QTerminals in the Port of Rotterdam is strategic and reputable for QTerminals Group in particular and for Qatar in general as QTerminals’ profile will become known in the largest European port. By acquiring Kramer Group, QTerminals will continue to develop its world leading technical and operational know-how to enhance and optimize its potential as one of the leading providers of integrated container logistics services in England (Gulf Times) Hotel occupancy levels on growth path in Qatar - Qatar’s hospitality sector is witnessing a strong rebound with hotels across segments seeing an increase in occupancy rates. Among the hotels, two- and one-star hotels have recorded the highest occupancy rate in July this year, according to the Planning and Statistics Authority (PSA) data. The occupancy rate of two- and one-star hotels surged to 90 % in July leading to the rise in hotel visitors and guests. The hotel and hotel apartments in Qatar witnessed a robust performance with the overall occupancy rate being at 52 % in July 2023. The hotels of all categories, ranging from five star to two and one star, have seen rise in occupancy rates and revenue per availableroom, according to thedata. The three-star hotels occupancy rate has jumped to 71 % in July 2023. Similarly, the occupancy rate of four- star hotels was 50 % in July this year. In case of five star, the hotels’ occupancy rates stood at 46 % in the review period. The occupancy rates of deluxe hotel apartments and standard hotel apartments for July this year were 77 % and 57 % respectively. Hotels in Qatar have also witnessed a rise in revenue per available room which is used to assess a hotel’s ability to fill its available rooms at an average rate. It is important because it helps hotel industry measure the overall success of their hotel. Revenue per available room for five-star hotels stood at QR268 in July 2023 while it was QR111 in four-star hotels; QR199 in three stars; and QR129 in two- and one-star hotels. The average room rate for deluxe and standard hotel apartments rose to QR326 and QR211 respectively in July this year. The average room rate for five-star hotels showed an increase

- 4. qnbfs.com Daily MarketReport Sunday, 24 September 2023 of QR584 and incase of four-star hotel it reached QR222, while the overall hotel and hotel apartment average room rate was QR394 in July 2023. Qatar has welcomed over 2.56mn visitors, exceeding the full year arrival figures witnessed in 2022. Thenumber of visitors so far in 2023 mark a 157 % increase over the same period last year, according to Qatar Tourism. More events are coming up in this year’s Arab Tourism Capital, with the Geneva InternationalMotor Show– Qatar, Formula 1 and Expo 2023 slated for October, and which will be followed by the MotoGP in November. The hospitality sector is on course to witness yet another strong momentum in the country with the addition of 3,000 hotel keys, ValuStrat has said in its report, recently (Peninsula Qatar) Realty trading over QR307mn in last week - The volume of real estate trading in sales contracts at the Department of Real Estate Registration at the Ministry of Justice during the period from 10 September to 14 September 2023 reached QR218,470,521. Total sales contracts for residential units in the Real Estate Bulletin for the period from 10 September to 14 September 2023, is QR88,738,310. The weekly bulletin issued by the Department shows that the list of real estate properties traded for sale has included vacant lands, houses, Residential Buildings, Administrative building, Shops, Residential units (Peninsula Qatar) Kuwait voices support for hosting Expo 2023 in Qatar - Prime Minister of Kuwait Sheikh Ahmad Nawaf Al Ahmad Al Jaber Al Sabah expressed Kuwait’s welcoming of Qatar hosting Expo 2023 Doha under the theme “Green Desert, Better Environment,” with the aim of promoting innovative solutions for the sustainability of desert regions. This statement was made by Sheikh Ahmad Nawaf Al Ahmad Al Jaber Al Sabah during his speech at the 78th session of the United Nations General Assembly in New York City, rep-resenting Amir of Kuwait H H Sheikh Nawaf Al Ahmad Al Jaber Al Sabah. The Kuwaiti PM emphasized the importance of international cooperation based on partnership and responsibility in addressing the myriad risks and threats facing today’s world, including conflicts between nations, the proliferation of weapons of mass destruction, the rise of terrorism, increasing poverty levels, as well as threats related to natural disasters, climate change, food security challenges, and modern cyber threats and their impact on cybersecurity. He renewed Kuwait’s commitment to the multiparty inter-national system, the principles and goals of the UN Charter, and the development and enhancement of international governance to ensure the fulfilment of its noble mission in preserving international peace and security and serving humanity. He expressed the Kuwaiti government’s anticipation of the support of UN member states for Kuwait’s candidacy for membership to the Human Rights Council for the 2024-2026 term at the elections next month. Regarding regional matters, he noted Kuwait’s commitment to the agreement regulating navigation in Khawr Abd Allah, concluded between Kuwait and Iraq in 2012, and the security exchange protocol with Iraq signed between the Kuwaiti Naval Force Command and the Iraqi Naval Force Command in 2008, both of which are of vital importance in maintaining security and navigation safety. Furthermore, the Kuwaiti PM affirmed that the ownership of natural resources in the sub-merged area adjacent to the Kuwaiti-Saudi divided zone, including the entire Dorra field, is solely a common ownership between Kuwait and the Kingdom of Saudi Arabia, and both have exclusive rights to exploit theseresources. He alsoreiteratedhis country’s unwavering stanceon the Palestinian issue and emphasized the necessity of achieving peace in Yemen, Sudan, and Syria. (Peninsula Qatar) Qatar's healthcare workforce doubles in 10 years: Official - The strength of Qatar's health sector workforce has doubled over the past ten years, showing tremendous efforts by the Ministry of Public Health (MoPH) to provide world-class healthcare to all in Qatar. “The number of workforces working in the public and private health sectors of Qatar has increased to 46,000, compared to 20,000 health workers in 2011,” said Medical Director of Hamad General Hospital, Dr. Yousef Al Maslamani. Speaking to Qatar TV recently, he said there were great developments in health and medical science fields in last ten years. “To keep pace with fast development in health sector, we provided qualified medical staff and upgraded the medical equipment,” said Al Maslamani. He said that the MoPH, Hamad Medical Corporation (HMC) and Primary Health Care Corporation (PHCC) are coordinating constantly with medical colleges including nursing and dental and other health institutions graduating technicians, physiotherapists and nutritionists for competent medial cadres. “HMC is providing internship and other necessary training to fresh graduates of medical institutions and a large number of them are hired for HMC and MoPH,” said Al Maslamani. He said that the new medical staff undergoes rigorous training programmes. “HMC offers 26 training pro-grammes for doctors, which are accredited internally and run by US based prestigious organizations. The educational and training programmes run by HMC aim at providing necessary capability to medial cadres to serve patients in a better way,” said Al Maslamani. He said that Qatar witnessed remarkable growth in health sector as the number of hospitals and beds increased following the international standards of healthcare. (Peninsula Qatar) Chairman of Qatar Free Zones participates in WGTS - Minister of State and Chairman of the Board of Directors of the Free Zones Authority in Qatar H E Ahmad Al Sayed, spoke yesterday on a panel discussion at the Wyoming Global Technology Summit (WGTS). This year’sWGTS focused on economic diversification through the tactful deployment of energy- created wealth. The Summit regularly brings together government leaders, high-tech entrepreneurs, and financial experts to discuss the most pertinent issues related to economic diversification. Minister Al Sayed’s perspective included the role of foreign direct investment on economic diversification and job creation. He highlighted Qatar’s unique role in using wealth and investment to target job creation and economic advancement. While in Jackson Hole, Minister Al Sayed met with a number of local government and business leaders to discuss methods of enhancing the bilateral trade and investment relationship between the State of Qatar and the State of Wyoming. Minister Al Sayed also met on the sidelines of the conference with Doug Burgum, the Governor of North Dakota. They also dis-cussed bilateral trade and investment opportunities between the State of Qatar and North Dakota. The conference brought together some of the preeminent wealth and technology leaders from around the world to explore methods of economic diversification and technology on rural populations in Wyoming globally. (Peninsula Qatar) International Fed officials flag further hikes even after holding steady - US Federal Reserve officials warned on Friday of further rate hikes even after voting to hold the benchmark federal funds rate steady at a meeting this week, with three policymakers saying they remain uncertain the inflation battle is finished. Their comments were tempered by words like "patience," and an acknowledgement that price increases have been slowing. But in the first public comments since the central bank this week agreed to hold its benchmark rate steady in a range of from 5.25% to 5.50%, the emphasis was on the possibility that rates may still rise, and on the fact that monetary policy will likely remain tight longer than previously expected. "Inflation is still too high, and I expect it will likely be appropriate for the (Federal Open Market) Committee to raise rates further and hold them at a restrictive level for some time to return inflation to our 2% goal in a timely way," Fed Governor Michelle Bowman said in prepared remarks for an Independent Community Bankers of Colorado event. "Progress on inflation is likely to be slow given the current level of monetary policy restraint," she said, noting that in policymaker projections issued by the Fed earlier this week inflation remains above the 2% target "at least until the end of 2025." A potential further rise in energy prices, she noted, was a particular risk worth monitoring. In separate remarks to the Maine Bankers Association, Boston Fed President Susan Collins said a further tightening of monetary policy "is certainly not off the table," though she also counseled "patience" as the Fed tries to get the right signal from sometimes noisy inflation data. "It is too soon to be confident that inflation is on a sustainable trajectory back to the 2% target," Collins said, with job growth still "above trend," and elevated inflation in aspects of the service sector still a concern. "I expect rates may have to stay higher, and for longer, than previous projections had suggested," said Collins. San Francisco Fed President Mary Daly, considered among the more dovish Fed officials, said she still needed more data to determine whether interest rates should rise again, though she called it "prudent" for the Fed to be patient in future rate decisions. "The thing that would be a problem is if we decided that we wanted to call it done, we'd say we're done, we say definitely one more, when we actually don't know," she said in an event held in coordination with Greater Phoenix Leadership. Minneapolis Fed President Neel Kashkari, a voter on rate policy this year, did not talk about

- 5. qnbfs.com Daily MarketReport Sunday, 24 September 2023 his current monetary policy views during an event at the Economic Club of Minnesota, but did say the economy appeared to be motoring along despite the swift Fed rate hikes since March of 2022. "Consumer spending continues to exceed our expectations," Kashkari said. "I would have thought with 500 basis points or 525 basis points of interest rate increases we would have slammed the brakes on consumer spending, and it has not." The central bank's decision to hold its benchmark overnight interest rate steady this week was unanimous. Bowman said she supported it because of "mixed data" that alongside signs of continued "solid" economic growth also included some decline in inflation and evidence of slowing job growth. Collins and Daly do not currently have a vote on rate policy under a Fed system that rotates votes among the 12 Reserve Bank presidents year by year. New projections issued at the end of a two-day policy meeting on Wednesday showed 12 of 19 Fed officials expect one additional quarter point rate increase this year. The Fed has two scheduled sessions left in 2023, concluding on Nov. 1 and Dec. 13. More notably, officials projected that while they still expect to begin reducing interest rates next year as inflation falls, the path down will be slower than previously anticipated. Thoughopinions are diffuse, policymakers at the median now see only a half percentage point of rate cuts in 2024 versus the full percentage point decline seen in their June quarterly outlook. (Reuters) UK recession risk deepens but consumers stay unfazed - Britain's economy displayed clear recession signals on Friday, a day after the Bank of England called a halt to its long run of interest rate increases that have turned the tide on inflation but at the expense of a hit to businesses. A business survey, which the BoE factored into its decision to keep rates on hold, showed companies endured a much tougher September than feared, marked by growing unemployment. The preliminary reading of the UK S&P Global Purchasing Managers' Index (PMI) for the services sector sank to its lowest since the pandemic lockdown of January 2021 and below all forecasts in a Reuters poll of economists. Aside from during the COVID-19 pandemic, the index last fell this low during the Global Financial Crisis. Its gauge of jobs suffered its biggest fall on record outside of the pandemic. Sterling was down about 0.4% against the US dollar at 1105 GMT, a touch above its lowest since March as investors pondered how long the BoE could stick to its plan to keep interest rates around current levels before cutting them to help the economy. PMIs for the euro zone picked up a little but still suggested a recession was approaching. A separate survey by the Confederation of British Industry (CBI) showed factory output fell and was expected to be stagnant in the remainder of 2023. "Bouncing along the bottom is likely to be a story which persists for the near term," MartinBeck, chiefeconomic advisor to forecasters the EY ITEM Club, said. While the full impact of the BoE's 14 back-to-back rate hikes had yet to be felt and the jobs market was weakening, weaker inflation and relief that borrowing costs may have peaked suggested the economy would avoid a serious downturn, Beck said. There was some signs of resilience among consumers alongside the weak readings of business activity. Official data showed retail sales rose in August, partially recovering from a rain- induced plunge in July, and a measure of consumer confidence climbed to its highest since January 2022. However, data company S&P Global said its survey was consistent with a drop in quarterly economic output of 0.4%. "The disappointing PMI survey results for September mean a recession is looking increasingly likely in the UK," said Chris Williamson, chief business economist at S&P Global. Samuel Tombs, an economist with Pantheon Macroeconomics, disagreed, saying wages were finally outpacing inflation, household energy prices were about to fall back further and consumer confidence levels were holding up. "Needless to say, though, today's report further increases the chances that the BoE's tightening cycle is over," he said. (Reuters) Exxon weighs chemicals output boost as EVs threaten gasoline use - Exxon Mobil Corp, which operates one of the world’s biggest oil-refining networks, is trying to be more responsive to changing consumer demands as the energy transition gathers pace. The changes it’s considering include potentially replacing some gasoline production with chemicals. The oil giant has long pursued a strategy of upgrading refineries to expand production and make higher-value products from crude oil such as lubricants and plastic feedstock. But it now sees those projects potentially helping the company to move away from traditional fuels, demand for which is likely to wane in coming decades. The strategy, discussed by this week by executives at a presentation to investors and media, shows how even Exxon, one of the leading proponents of fossil fuels, is being forced to reckon with a future in which electric vehicles significantly eat into gasoline consumption. Exxon has already reduced production of fuel oil and high-Sulphur petroleum at refineries in Singapore and the UK. Over time, it’s open to cutting output of gasoline, the focus of the company’s refining business since Henry Ford introduced the Model T nearly 100 years ago. The goal is to produce more chemicals, found in everything from paint to plastic, for which there are few lowcarbon alternatives. “We’re planning on modifying some of that yield from gasoline to distillate and chemicals feed,” JackWilliams, Exxon senior vice-president, said on Wednesday at the company’s office in Spring, Texas. “We’ve got projects that we know we would do to take those steps.” Exxon gets most of its earnings from oil and natural gas production but refining has always been in its corporate DNA, right back to its original incarnation as part of John D. Rockefeller’s Standard Oil, which was established in the 19th century. Refining allows Exxon to earn money right along the fossil fuel supply chain, from the wellhead to the gas tank. But with traditional fuels such as gasoline under threat from EVs, refineries worldwide are being forced to adapt quickly. Some European plants shut down during the pandemic, while others in the US switched to biodiesel. Exxon wants to take a more nuanced approach by upgrading facilities to switch in and out of products depending on demand. To give an example, an Exxon refinery in Singapore used to produce fuel oil that sold for $10 per barrel below the price of Brent crude, but after a recent upgrade, the facility produces lubricant base stocks that sell for $50 above Brent. Exxon has upgraded and added to its refineries at Fawley in the UK and Beaumont in Texas to produce more diesel, which is used for heavy-duty transportation and is less vulnerable to competition from electric vehicles. “You just have more variables now due to the energy transition,” said Jay Saunders, a natural resources fund managers at Jennison Associates, which has $186bn under management. “Having a high-quality refining asset with flexibility will be very important.” Exxon’s refining and chemicals footprint is at least double that of its Big Oil competitors, potentially making it more vulnerable to a speedy energy transition, and especially the growth of electric vehicles. But executives believe the potential for reconfigurations is far greater than that of its peers, providing an opportunity to profit in a low-carbon future. “This really allows us to pivot as demand evolves,” said Karen McKee, President of Exxon’s Product Solutions division. Biodiesel is particularly attractive to Exxon because reconfiguring its existing refineries costs about half as much as building a new plant, said Neil Hansen, senior vice president of product solutions. Demand for biodiesel, which is manufactured from vegetable oil or recycled restaurant grease, is expected to quadruple to 9mn barrels a day by 2050, he said. Exxon is halfway through an eight-year plan to overhaul its fuels and chemicals division, which also involves cutting costs, improving operational performance and selling assets that don’t make the grade. Exxon will operate just 13 refineries worldwide by the end of 2023 after selling five in the past four years to focus on the biggest and lowest-cost operations. Chemicals will be key to the strategy’s success. Exxon sees demand growth for its high-performance chemicals at about 7% a year, contrasting sharply with gasoline, which is expected to peak globally by the end of the decade. To keep up with this demand, Exxon plans to build a new dedicated chemical plant every four to seven years, Williams said. The company’s refineries provide an additional means to make chemicals, but they will focus on responding to consumer preference rather than making a big bet on any particular product, Williams said. (Gulf Times) Former official: Even China's 1.4bn population can't fill all its vacant homes - Even China's population of 1.4bn would not be enough to fill all the empty apartments littered across the country, a former official said on Saturday, in a rare public critique of the country's crisis-hit property market. China's property sector, once the pillar of the economy, has slumped since 2021 when real estate giant China Evergrande Group defaulted on its debt obligations following a clampdown on new borrowing. Big-name developers such as Country Garden Holdings continue to teeter close to default even to this day, keeping home-buyer sentiment depressed. As of the end of August, the combined floor area of unsold homes stood at 648mn square meters (7bn square feet), the latest data from the National Bureau of Statistics (NBS) show.

- 6. qnbfs.com Daily MarketReport Sunday, 24 September 2023 That would be equal to 7.2mn homes, according to Reuters calculations, based on the average home size of 90 square meters. That does not count the numerous residential projects that have already been sold but not yet completed due to cash-flow problems, or the multiple homes purchased by speculators in the last market upturn in 2016 that remain vacant, which together make up the bulk of unused space, experts estimate. "How many vacant homes are there now? Each expert gives a very different number, with the most extreme believing the current number of vacant homes are enough for 3bn people," said He Keng, 81, a former deputy head of the statistics bureau. "That estimate might be a bit much, but 1.4bn people probably can't fill them," He said at a forum in the southern Chinese city Dongguan, according to a video released by the official media China News Service. His negative view of the economically significant sector at a public forum stands in sharp contrast to the official narrative that the Chinese economy is "resilient". "All sorts of comments predicting the collapse of China's economy keep surfacing every now and then, but what has collapsed is such rhetoric, not China's economy," a spokesperson at the foreign ministry said at a recent news conference. (Reuters) Regional GCC Secretary General discusses areas of cooperation between the GCC and Cuba - Gulf Cooperation Council (GCC) Secretary General Jassem Mohamed Albudaiwi, stated that he discussed areas of cooperation between the GCC and Cuba, as well as ways to enhance and develop them in fields that serve common interests. His remarks came during a meeting Wednesday with the Minister of Foreign Affairs of the Republic of Cuba, Bruno Rodriguez, on the sidelines of the 78th session of the United Nations General Assembly held in New York City. The secretary general said several topics were discussed during the meeting, including reviewing the bilateral relations, and ways to enhance and develop them in fields that achieve joint goals. He praised Cuba's signing the Memorandumof Understanding with the Association ofCaribbean States, which was inked two days ago between the GCC countries and the association. He also highlighted Cuba's active contributions to the GCC healthcare sector. (Zawya) Crown Prince: Saudi Arabia is biggest success story of 21st century - NEOM - Crown Prince and Prime Minister Mohammed bin Salman said that Saudi Arabia is the biggest success story of the 21st century. In an interview with Bret Baier, chief political anchor of Fox News, at NEOM, the Crown Prince said the Palestinian issue is crucial to normalizing ties with Israel as he wanted to see a good life for the Palestinians. In the interview on “Special Report with Bret Baier” that was aired on Thursday morning, he reiterated that if Iran possessed a nuclear weapon, Saudi Arabia would do the same “for security reasons and thebalance of power.” Saudi Arabia had achieved the fastest growth in gross domestic product (GDP) among the G20 countries for two consecutive years, the Crown Prince said while pointing out about the bid to join G7. “We tried to join the G7, but some countries wanted to dictate their conditions to us,” he said. In his first interview with a major American news network since 2019, the Crown Prince addressed a wide range of domestic, regional and international issues. Prince Mohammed bin Salman highlighted the robust growth and comprehensive social and economic reforms that Saudi Arabia is witnessing under its Vision 2030. “Saudi Arabia is so big, so I'm quite sure most people in the world, directly or indirectly, have something to do with Saudi Arabia. Our vision is great and we are surprised every day when achieving our goals quickly as our non-oil growth this year will be among the fastest in the G20 countries,” he said. When asked about efforts to normalize relations with Israel, the Crown Prince emphasized that the Kingdom has no relationship with Israel at present. “Every day we get closer, it seems it's for the first time real one serious. We get to see how it goes," he said. The Crown Prince insisted his country could work with Israel, no matter who is in charge, calling the deal "the biggest historical deal since the end of the Cold War," which he stated would rest upon agreements related to the treatment of the Palestinians. "If we have a breakthrough of reaching a deal that gives the Palestinians their needs and makes the region calm, we're going to work with whoever is there," he said, while reiterating that he wanted to see "a good life for the Palestinians." When asked about the potential for Iran to obtain a nuclear weapon and what it means for Saudi Arabia, the Crown Prince clearly stated that should Iran ever obtain such a weapon Saudi Arabia would "have to get one, for security reasons, for balancing power." "We are concerned if any country gets a nuclear weapon: That's a bad, that's a bad move," he said. "They don't need to get nuclear weapons because you cannot use them. Any country using a nuclear weapon that means they are having a war with the rest of the world," he said while reiterating the position of Saudi Arabia that the region must be stable for Saudi Arabia to achieve its goals. "The world cannot see another Hiroshima. If the world sees 100,000 people dead that means you are in a war with the rest of the world. So to use this effort to reach a nuclear weapon because you cannot use it if you use it, you got to have a big fight with the rest of the world." The Crown Prince also spoke about relations with the United States, saying: “We have important security ties with Washington. We have a special relationship with President Joe Biden, and he is very focused and prepares himself well,” he said while adding that Saudi Arabia wants American and foreign companies to come and invest in a safe environment in the Middle East. "We are one of the five largest buyers of American weapons, and our move to buy weapons from countries other than the United States is not in their interest." He also highlighted the various attacks Osama bin Laden planned and executed against Saudi Arabia in the 1990s. Bin Laden was able to recruit Saudis to help his cause but that it "doesn’t make any sense" for the country itself to help a man actively hurting it. "After that, killing Saudis and foreign people at that time in Saudi Arabia, he's our enemy and he's the American enemy," the Crown Prince said. Referring to the Khashoggi issue, the Crown Prince said that Saudi Arabia prosecuted those involved in Khashoggi’s killing and made reforms to prevent such things happening again. “Anyone involved in Khashoggi’s killing is serving time in prison and must face the law. We take all the legal measurements that any country took ... We did that in Saudi Arabia and the case was closed," he said. "Also, we try to reform the security system to be sure that these kinds of mistakes do not happen again, and we can see in the past five years nothing of those things happened. It's not part of what Saudi Arabia does." He noted that the country is working to reform some laws and the government does not interfere in the work of the judiciary. The Crown Prince also touched on economic files, stressing that the Kingdom monitors supply and demand in the oil market and takes the necessary measures to stabilize the energy market. “Our role in OPEC + is to bridge the gap between supply and demand. We are keen on the stability of energy markets and we are doing what is necessary in this regard.” Referring to the recent deal signed with regard to establishing India – Middle East – Europe Economic Corridor during the G20 Summit, the Crown Prince said that the Economic Corridor that will connect the Middle East with Europe will save time and money and will shorten the distance to Europe to 3-6 days. Regarding the BRICS group of countries, in which Saudi Arabia will join in January 2024, Prince Mohammed bin Salman said that this group “is not against the United States, as evidenced by the presence of Washington’s allies within it.” The Crown Prince stressed that the BRICS group, which includes Brazil, Russia, India, China and South Africa, is not a political alliance. The Crown Prince also explained about the measures being taken to make the Kingdom a major global tourism destination. He said that attracting tourism is linked to developing other major sectors, including sports, entertainment and culture. “We do not mind developing the sports sector as it has become effective in economic returns. We are working to ensure that sports contribute 1.5 % of the gross domestic product (GDP) soon,” he added. (Zawya) Saudi women's meteoric rise in the workforce: A transformative journey - In a remarkable shift, Saudi Arabia has witnessed a significant decrease in unemployment rates among women, marking a transformative journey toward gender equality in the workforce. As the Kingdom continues to empower its female population, this trend not only signifies economic progress but also reflects a broader societal transformation. The fourth quarter of 2022 recorded a momentous drop in unemployment rates among Saudi women, which plunged to 15.4 % compared to previous years (2019, 2020, and 2021). This change aligns perfectly with the expanding role of women in the Saudi economy, where they are making their presence felt across various sectors. According to a report by the General Authority for Statistics in Saudi Arabia, the percentage of working women among the population rose to 30.4 % in the fourth quarter of 2022, marking an increase from the 27.6 % recorded in the same quarter

- 7. qnbfs.com Daily MarketReport Sunday, 24 September 2023 of 2021. Additionally, women's participation in the labor market reached 36 %, up from 35.6 % in the fourth quarter of 2021. The report also highlights a growing trend of Saudi women engaging in freelance work. In 2021, the number of documents issued for female freelancers reached an all-time high of 961,189, a stark contrast to the 105,518 documents issued in 2020 and a mere 7,997 in 2019. Saudi Arabia's stock market has witnessed a significant influx of female investors in recent times, with 2021 recording 1,516,995 Saudi female investors, surpassing the figures for 2019 and 2020. Standard & Poor's credit rating agency anticipates that the increased participation of women in the workforce in Saudi Arabia will enhance the Kingdom's economic growth opportunities. The agency's report noted that labor market reforms have led to an increase in the female workforce participation rate to approximately 36 % in 2022, compared to 19 % in 2016. The report states, "If the current pace of workforce participation continues over the next ten years, the agency's economic group estimates that the Saudi economy could reach $39bnor more, representing a 3.5 % increase compared to the historical scenario of workforce participation growth from 2000 to 2022." Furthermore, it suggests that sustained annual growth of one percentage point in the overall female workforce participation over the next decade could accelerate the Kingdom's annual real economic growth by an average of 0.3 percentage points to reach 2.4 %, assuming that workforce productivity remains similar to the past two decades. The agency attributed the increase in female workforce participation to higher education levels and several government initiatives, such as expanding childcare services, allowing women to drive, increasing remote work and hybrid work options, abolishing the requirement for male guardian approval to start a business, and increasing the number of female positions in the military. (Zawya) Saudi economy joins trillion-dollar club; private sector registers impressive growth - Saudi Arabia has achieved escalating success contributing to improvements in key economic indicators, as reflected in reports from the International Monetary Fund and related international organizations. The Saudi economy was ranked as one of the fastest growing among the G20 nations in 2022. According to a report by the Saudi Chambers of Commerce, released in celebration of the country's 93rd National Day, Saudi Arabia's Gross Domestic Product (GDP) reached SR4.155tn, exceeding the trillion-dollar mark for the first time and joining the global trillion-dollar economies. This achievement comes ahead of the state's 2025 targets and is accompanied by an impressive growth rate of 8.7%, the highest among G20 nations. This growth is primarily attributed to its robust productive capabilities, leading to a self-sufficiency rate of 81.2% and an increased investment rate, reaching 27.3%. These developments have bolstered confidence in the Saudi economy, leading to an uptick in trust in the Saudi riyal. Deposits in the local currency now account for 67.7% of total savings, up from 66.5% in 2021. Internationally, Saudi Arabia has secured the 17th position in the global economic rankings and ranks 17th out of 64 countries as the most competitive economy globally, according to the annual Global Competitiveness Report by the International Institute for Management Development (IMD). The country also ranks second globally in the growth rate of international tourists and 51st in the Global Innovation Index. The Saudi economy's integration into the global economy has increased to 63.1%. Regarding the role of the Saudi private sector, the report underscores its continued strong performance as an effective partner in comprehensive development and in achieving the ambitious Vision 2030 goals. The private sector's GDP reached SR1.634tn, contributing 41% to the overall GDP with a growth rate of 5.3%. This contribution remains steadydue to significant growth in the oilsector, which expanded at a rate exceeding 15%. Non-governmental investments reached SR907.5bn, growing by 32.6%, and accounted for approximately 87.3% of total fixed investments. The private sector also played a pivotal role in employment, as the number of employees in the private sector increased from 8.084mn in 2021 to 9.422mn in 2022, a growth rate of 16.6%. In line with localization efforts, the number of Saudi employees in the private sector rose from 1.910mn in 2021 to 2.195mn in 2022, a growth rate of 14.9%, resulting in a 58.2% overall Saudi workforce participation in the private sector. The report highlights the success of Saudi policies aimed at diversifying the economic base and supporting the penetration of Saudi exports into global markets. Exports of goods and services increased by 54.4%, with the export capacity of the Saudi economy rising from 33% to 39.3% of the GDP. The capacity of exports to cover imports of goods and services also increased from 134.5% in 2021 to 171.9% in 2022. Non-oil exports reached 315.7bnriyals, growing by 13.7% and accounting for 20.5% of total goods exports, reaching 178 countries worldwide. The report predicts that the Saudi economy, along with the private sector, will continue its robust performance in line with various economic indicators and government support packages, as well as the implementation of various large-scale projects across the Kingdom's regions. (Zawya) UAE central bank hits pause on interest rate hikes - Following the US Federal Reserve Board’s announcement on Wednesday to keep the key interest rates unchanged, the Central Bank of the UAE (CBUAE) has decided to maintain the Base Rate applicable to the Overnight Deposit Facility without change at 5.40%, effective from Thursday, 21 September 2023.The CBUAE has also decided to maintain the rate applicable to borrowing short-term liquidity from the apex bank through all standing credit facilities at 50 basis points above the Base Rate. Though the US Fed left the rates unchanged, a move widely predicted by analysts, it has signaled one more rate hike this year, indicating that borrowing costs will likely stay higher for a longer time. "Officials are prepared to raise rates further if appropriate, and we intend to hold policy at a restrictive level until we’re confident that inflation is moving down sustainably toward our objective,” Fed Chairman Jerome Powell said in a statement published after the Federal Open Market Committee meeting. Most of the GCC central banks follow the Fed's policy regarding interest rates as their currencies are pegged to the US dollar. (Zawya) RAKEZ team visits China’s Guangdong province to boost trade and economic synergies - RAS AL KHAIMAH - A delegation from Ras Al Khaimah Economic Zone (RAKEZ), led by Group CEO Ramy Jallad, successfully wrapped up its roadshow in China’s Guangdong province to foster deeper ties with local enterprises, prominent trade associations, and key government entities and explore new opportunities for economic and trade cooperation. The delegation hosted business forums across three major cities, including Guangzhou, Shenzhen, and Dongguan, highlighting the prospects of the growing Middle Eastern market amid Chinese firms. The forums allowed participants to dive deep into understanding Ras Al Khaimah’s economic landscape and industry, while RAKEZ engaged closely with local enterprises to further understand their plans for overseas ventures and investments. The discussions were instrumental for both parties in identifying potential areas of collaboration and creating effective foreign trade platforms for long-term bilateral business ties. The delegation met with companies from key sectors, including automotive, media equipment, energy, pharmaceuticals, security, IT, electronics, telecom, construction, finance, and e-commerce. The trade associations that actively participated in RAKEZ’s business forums were the Guangzhou Association of Trade in Services, Shenzhen Electronics Industrial Association, and Shenzhen State-owned Assets Supervision and Administration Commission. Furthermore, the delegation interacted with representatives from government entities like Dongguan Bureau of Commerce and Songshan Lake Hi-Tech Industrial Development Zone. Commenting on the visit, Jallad said, “The potential for business collaboration between Guangdong and Ras Al Khaimah is vast, spanning across multiple sectors. Hundreds of Chinese companies, from SMEs to manufacturing giants, have already chosen RAKEZ as theirbase. A significant portion of these companies play a pivotal role in advancing sustainability efforts in both Ras Al Khaimah and the UAE. We are actively engaging with Chinese government entities, Fortune 500 multinationals, trade associations, and SMEs to assist them with their expansion goals to the Middle East through Ras Al Khaimah. As a foreign trade and export powerhouse in China, Guangdong is a natural partner in this endeavor.” He further added, “Given RAKEZ’s strategic positioning in an emirate that is central to the UAE-China trade relationship, coupled with our unwavering dedication to our investors through a customer-first approach andexcellent aftercareservices,we are aligned to leverage the UAE’s expanding trade relationship with China and support the goal of amplifying our bilateral trade to US$200bnby 2030. Our persistent efforts underscore our commitment to further bolstering Ras Al Khaimah’s position as a global industrial and business hub.” Over the decades, the UAE has emerged as China’s most significant

- 8. qnbfs.com Daily MarketReport Sunday, 24 September 2023 export market and second-largest trading partner in the Middle East, while China stands as the UAE’s largest trading partner, with the value of non-oil trade between the two countries exceeding US$72bn in 2022, reflecting an 18% growth from US$61bnin 2021. Following the Belt and Road Initiative, numerous Chinese investors, particularly state-owned enterprises, have solidified their presence in the UAE, participating in key infrastructural projects encompassing ports, railroads, and highways. Jallad believes that Chinese firms will further benefit from the Initiative by establishing their presence in Ras Al Khaimah. He said, “Our goal is to show them that Ras Al Khaimah is the right choice and right place for them to grow. As a service provider, we offer our companies end-to-end services and value-added services, ensuring that all is in place so that investors can plug and play and focus on their business.” (Zawya) Ajman's exports surge 19% in H1'23 - The Ajman Chamber of Commerce and Industry (ACCI) has revealed that the volume of exports from the emirate grew 19.6 % during the first half of 2023 (H1'23). The emirate’s total exports reached AED4.57bnin H1'23, compared to some AED4.3bnduring the same period in 2022. Ships and boats topped the list of exported products, followed by mineral oils, fish, and steel products. Saudi Arabia was the top destination for the emirate's exports, followed by Italy, Kuwait, and Türkiye. This growth in Ajman's export volume reflects itsefforts to follow thedirectivesof the UAE’s leadership to create a sustainable economic environment, which drives the development of private sector businesses. It also highlights the commitment of all relevant government entities in Ajman to diversify proactive tools and supportive services to increase exports of local products, in line with Ajman's targets and vision. Ajman's advanced logistical infrastructure directly improves shipping and transportation operations, making them more efficient. This, coupled with continuous upgrades to industrial zones, positively impacted the growth of direct investments, especially those allocated to the industrial sector. The ACCI has adopted a dynamic business agenda to increase the volume of exports from the emirate and open new markets for local products by participating in diverse international exhibitions with its member companies and factories and encouraging international partnerships to promote local products and facilitate access to foreign markets. (Zawya) Dubai ranks first in Arab world, fifth globally on Xinhua-Baltic International Shipping Centre Development Index - Dubai has maintained its ranking among the top five global maritime centers on the 2023 International Shipping Centre Development (ISCD) Index for the fourth consecutive year. The city also earned the top rank for sea freight and logistics services in the Arab world, as per the latest report issued by the Baltic Exchange for Trade and Shipping and the Xinhua Agency of the China Economic Information Service. The report placed Dubai fifth out of the 20 most prominent international centers for commercial maritime shipping ahead of Rotterdam, Hamburg, Athens/Piraeus, Ningbo/ Zhoushan, and New York/New Jersey. Dubai is the only Arab city on the list. Singapore, London, Shanghai and Hong Kong secured the top four ranks on the Index. Sultan Ahmed bin Sulayem, Chairman of the Ports, Customs and Free Zone Corporation, said the global recognition reinforces Dubai’s leadership in the field of maritime shipping. Dubai's distinguished position in the sector also reflects its vast contributions to the growth of the global maritime industry. He noted that international maritime freight traffic accounts for more than 80% of the total volume of global trade, demonstrating the vital importance of this sector and its role in driving economic growth. The Ports, Customs and Free Zone Corporation, represented by the Dubai Maritime Authority, strives to ensure that Dubai continues to be among the world’s best maritime centers. The Authority’s constant efforts to uphold thehighest standards and introduce innovative solutions are setting new benchmarks, further raising Dubai’s status as a key player in shaping the future of international maritime trade. Sheikh Dr. Saeed bin Ahmed bin Khalifa Al Maktoum, Executive Director of the Dubai Maritime Authority, said Dubai’s ranking on the International Shipping Centre Development Index strengthens its profile on the global maritime map. Dubai’s ability to maintain its high ranking for four consecutive years reflects its progress in enhancing the competitiveness and efficiency of its maritime sector. The implementation of the Authority’s Maritime Sector Strategy has bolstered the city’s position as a leading international maritimehub. “The DubaiMaritime City Authority seeks to enhance cooperation with various stakeholders to further reinforce the growth and development of the maritime sector in the emirate. We are working on a series of plans and initiatives to promote the sustainable development of the sector,” he added Sheikh Saeed emphasized that Dubai's ranking as the only Arab city among the top 20 international maritime shipping centers underscores the emirate's dedication to continuous growth and its rising stature on the global stage. Dubai's aspiration to be among the most influential maritime hubs has led to the creation of infrastructure and services that rank among the best in the world.By adopting internationalbest practices, Dubai continues to set new standards in its maritime business environment, he noted. (Zawya) UAE, Armenia sign four deals during joint business forum in Yerevan - Abdullah Mohamed Al Mazrouei, Chairman of the Federation of UAE Chambers of Commerce and Industry (FCCI) and Chairman of Abu Dhabi Chamber of Commerce and Industry, and Vahan Kerobyan, Armenia's Minister of Economy, inaugurated today the UAE-Armenia Business Forum in the Armenian capital, Yerevan. The forum saw the signing of four Memorandums of Understanding (MoUs); with three of them between the business communities in both countries and one to establish a UAE-Armenia Business Council. Organized by the FCCI, the UAE Embassy in Yerevan, and Enterprise Armenia, the event was attended by Dr. Nariman Al Mulla, UAE Ambassador to the Republic of Armenia, a UAE trade delegation of around 100 representatives of government and private entities, and over 200 representatives of Armenian companies. In his keynote, Al Mazrouei invited businesses in both countries to leverage the opportunities and facilities providedby both countries,noting that the signing of MoUs with Enterprise Armenia and the Armenian Chamber of Commerce and Industry will help create new investment opportunities and forge a stronger UAE-Armenian partnership that benefits both countries. For his part, the Armenian Minister of Economy said that the UAE-Armenia trade exchange reached over US$1bn, making the UAE one of Armenia's top three trade partners, alongside Russia and China. In the first 7 months of 2023, the trade exchange between our countries was valued at $870mn, three-fold its value last year, while investments grew by 20 % in H1 2023, he added, commending the UAE's decision to waive pre-entry visas between the UAE and Armenia. The UAE trade delegation held several meetings with Armenian officials, including the Deputy Prime Minister, the Minister of Economy and the Minister of High-Tech Industry, during which they discussed prospects for boosting trade and investment cooperation and launching economy-driving projects in both countries. UAE unveils key pillars for transforming country's food, agriculture sector into global power - Abdullah bin Touq Al Marri, Minister of Economy, affirmed the UAE’s commitment to transforming its food and agriculture sector to grow its contribution to GDP by US$10bnand creating 20,000 jobs in the next five years, as he unveiled the seven key pillars of the strategic direction in achieving it. The key strategies include localizing innovation, fostering a UAE-first culture and food supply chain, and providing farmers with thenecessary support and resources to make them a global leader in agri-food innovation and sustainability. Closing the fifth Future Food Forum on Thursday, Bin Touq praised the country’s F&B sector initiatives in skill development and digital-infrastructure capabilities achieved through various programmer to reshape how food is produced, distributed, and consumed in the region and globally. He commended the UAE Food Platform’s (launched during the Forum) ability to enable public-private collaboration in food security and optimizing the F&B ecosystem with digital infrastructures to drive the sector growth and attract investments and trade opportunities. The two-day event, held on 20th-21st September at Le Meridian Dubai Hotel, delved into the growing role of the food sector in UAE’s economy and well-being and the industry’s future. Present for driving the UAE’s economic development and industrial growth is promising and crucial to our future. The UAE, today, is considered one of the most important hubs of global food logistics. Everybody knows it’s the most accessible port for shipping containers between the source and the destination, easing for food supply and consumption. Food is also an important aspect of overall trade. Food products trade amounted to AED 130bnin 2022 alone compared to AED 105bnin 2021, registering a growth of 24 % in one year; food trading was 5.7 % of the UAE non-oil trade. Bin Touq said, “With a growing

- 9. qnbfs.com Daily MarketReport Sunday, 24 September 2023 population, food security assuming the highest priority, the UAE is doing well on this front and was on the top of the global food security index 2022 compared to other MENA counterparts, but the challenges for food in these uncertain times are real and present. Thankfully, our food industry’s resilience and adaptability make it adept in addressing this challenge while constantly emphasizing sustainable practices, which will nurture our earth for centuries.” “Today, I stand before you to share a vision to propel our beloved country to new heights and ensure future food security. We are working on a strategy to transform our Food and Agriculture cluster into a global power; the essential pillars around this work, which I’m about to say represents our commitment to innovation sustainability and self-sufficiency and food production,” he added. He noted that the first pillar is localizingthe next generation of agridisruptors and growing them into global champions by nurturing local talents and innovation by identifying and supporting the next-generation solutions. Second is making the UAE a global regulatory powerhouse ensures that our products are of higher standards and have international recognition. The third involves promoting a UAE-first culture to foster the entire food value chain by prioritizing domestic production and reducing reliance on imports. Meanwhile, the fourth pillar remains critical as it aims to provide sufficient funding to industry players. Bin Touq said, “Access to funding is why people grow, industries evolve, and our strategy will look into securing funding and support. This brings us to our fifth pillar of fostering innovation with world-class R&D innovation, which is the cornerstone of progress. We will provide world-class research and development packages to inspire change.” Furthermore, the sixth pillar will focus on enabling players to diversify and access new markets by creating pathways for all agricultureplayers. Finally, the strategy aims tobuild the next generation of farmers, who are the future of agriculture and agri- tech. Bin Touq expressed commitment to providing farmers with the knowledge, technology and resources they need to succeed through training programmer, modernization efforts, and support systems to ensure that the agriculture workforce is prepared to address the challenges and opportunities ahead. (Zawya) UAE-Saudi trade reaches $159.7bn in 5 years - The volume of trade exchange between the UAE and the Kingdom of Saudi Arabia grew by 28 % in 2022, reaching AED 137.51bn, compared to AED 107.41bnin 2018. This brings the total non-oil trade between the two countries to AED 586.75bnover five years. As per Ministry of Economy data, in 2022, the bilateral trade between the two countries was divided into AED 34.31bn in imports, AED 36.01bn in non-oil exports, and AED 67.18bn in re- exports. The statistics included data on trade exchange between the two countries during the period from 2018 to 2022, indicating the growth of trade exchange between the two sides in 2019 to reach AED 113.25bn, compared to AED 107.41bn in 2018. The year 2021 also recorded growth, reaching AED 124.65bn, compared to AED 103.91bn in 2020. The volume of trade exchange between the two sides reached AED 137.51bn last year. The fruitful relations between the two countries have had a positive impact on the comprehensive and sustainable development in both countries in various fields, including trade exchange, economic cooperation, and joint investment. This serves the process of progress and sustainable development and is in the interest of improving the quality of life and the well-being and prosperity of the two brotherly peoples. Saudi Arabia ranked third among the five largest destinations for non-oil UAE exports in the first half of 2023. UAE imports from Saudi Arabia accounted for 25 % of total non-oil bilateral trade, while national exports and re- exports to Saudi Arabia made up 75% in 2022. Saudi Arabia was the third trading partner for the UAE's non-oil trade with the world in 2022. The UAE's imports from Saudi Arabia grew to AED 34.49bn in 2022, a 23 % increase from 2018. The UAE's non-oil exports to Saudi Arabia grew to AED 35.96bnin 2022, a 14 % increase from 2018. The value of UAE re- exports to Saudi Arabia increased to AED 67.16bnin 2022, a 40 % rise from 2018. The UAE is the second-largest re-export market for Saudi Arabia and is also the second-largest export destination and the third-largest import source for Saudi Arabia. The economic, investment, and trade cooperation relations between the UAE and Saudi Arabia are witnessing increasing growth in various fields, which contributes to the strengthening, development, and prosperity of the two brotherly countries and peoples. (Zawya) DMCC in new push for China trade ties - DMCC, a leading free zone in Dubai, has concluded its roadshow to Shenzhen and Hong Kong, further strengthening the longstanding bilateral relationship with China and exploring new opportunities for economic cooperation, trade and foreign direct investment. During the visit, DMCC, the Government of Dubai Authority on commodities trade and enterprise, signed a Memorandum of Understanding (MoU) with the Hong Kong-Middle East Business Chamber Limited (HKME) to promote innovation and bilateral trade. The agreement will see both entities collaborate on the exchange of market best practices, transfer of knowledge and professional expertise, as well as the provision of trade and logistical support. In turn, this will support the objectives of the Belt and Road Initiative, strengthening economic cooperation between the countries along the proposed “Belt and Road” route. Ahmed Bin Sulayem, Executive Chairman and Chief Executive Officer, DMCC, said: “We are delighted to be back in China as we continue on our path of strong and collaborative growth. China occupies a key position as one of DMCC's top strategic markets, while DMCC has become a preferred destination for Chinese businesses with more than 800 now established in our award-winning community. “With over $77bnin non- oil trade recorded last year between China and the UAE, we expect our cooperation to be even further boosted through the UAE’s impending membership of BRICS, which will enhance the strength and capacity of the One Belt One Road initiative.” Shaikh Saoud Ali Almualla, Consul General of the UAE in the Hong Kong Special Administrative Region, added: "Business and trade are at the forefront of economic growth and prosperity. The UAE and China share a vision of mutual growth and prosperity, and our collectiveresponsibility is to nurture and expand these ties. I must thank DMCC for standing as a beacon of excellence and innovation in this endeavor, providing a driving force for trade facilitation and fostering greater connectivity between major trade hubs such as Dubai and Hong Kong.” During the roadshow, Ahmed Bin Sulayem, Executive Chairman and Chief Executive Officer of DMCC, was awarded the Extraordinary 40 Award, alongside prominent industry leaders, for his role in driving the global diamond and jewelry industry forward. He also participated in a panel discussion at the Jewelry & Gem World Hong Kong (JGW), one of the world’s most prominent jewelry events, titled, “From Rough To Brilliant: Charting A Course For An Exciting Future,” during which he shared insights on Dubai’s journey to becoming a leading global diamond trading hub. The visit also saw DMCC release a special edition of its Future of Trade thought leadership report focused on lab-grown diamonds (LGDs), titled “Coming of Age – The Future of Lab Grown Diamonds”. The report examines the dynamics that have driven the meteoric rise of the LGD market segment over the past few years. The release of the LGD-focused report comes following a successful inauguration of the LGD Symposium hosted by DMCC in July 2023. This roadshow series marks the second visit to China this year, following the Made for Trade China roadshow across the commercial and trade hubs of Shanghai, Guangzhou and Chongqing in June 2023. DMCC showcased Dubai’s thriving business environment and how DMCC acts as a central platform and business district of choice for Chinese companies to expand in Dubai and internationally. (Zawya) 34 deals inked at agricultural coop conference of China-Arab States Expo - A total of 34 deals worth approximately RMB3.432bn(AED1.73bn) were signed at the conference on high-quality modern agricultural cooperation, one of the activities of the 6th China-Arab States Expo (Expo), held in Yinchuan, the capital of northwest China's Ningxia Hui Autonomous Region, on 22nd September. As agriculture has become a key part of China-Arab cooperation, trade in agricultural products has seen steady growth, according to the China Economic Net. Last year, trade value of agricultural products between China and Arab countries reached US$5bn(AED18.36bn), said Li Jinxiang, national chief veterinary officer of the Ministry of Agriculture and Rural Affairs, in his keynote speech at the Conference on High-quality Modern Agricultural Development and Cooperation. Giving full play to its technological advantages in plantation, animal husbandry, and water-saving irrigation, China has established overseas agricultural technology transfer sub-centers in eight countries, including Jordan and Pakistan. For example, China has promoted dairy cattle embryo transfer technology in Mauritania, set up vegetable growing demonstration areas in Jordan, grown rice in deserts in the United Arab Emirates, and promoted smart irrigation and water-