QNBFS Daily Market Report March 30, 2022

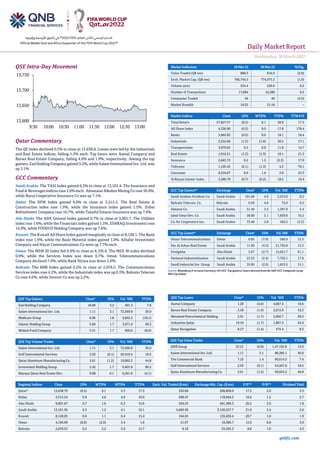

- 1. Daily MarketReport Wednesday,30March2022 qnbfs.com QSE Intra-Day Movement Qatar Commentary The QE Index declined 0.5% to close at 13,638.8. Losses were led by the Industrials and Real Estate indices, falling 1.2% each. Top losers were Aamal Company and Barwa Real Estate Company, falling 4.6% and 1.9%, respectively. Among the top gainers,Zad Holding Company gained 3.2%,while Salam International Inv. Ltd. was up 3.1%. GCC Commentary Saudi Arabia: The TASI Index gained 0.3% to close at 13,101.4. The Insurance and Food & Beverages indices rose 2.0% each. Almasane Alkobra Mining Co rose 30.0%, while Buruj Cooperative Insurance Co was up 7.1%. Dubai: The DFM Index gained 0.9% to close at 3,515.2. The Real Estate & Construction index rose 1.9%, while the Insurance index gained 1.5%. Dubai Refreshment Company rose 10.7%, while Takaful Emarat Insurance was up 7.6%. Abu Dhabi: The ADX General Index gained 0.7% to close at 9,901.7. The Utilities index rose 1.6%, while the Financials index gained 1.5%. ESHRAQ Investments rose 14.9%, while FOODCO Holding Company was up 7.6%. Kuwait: The Kuwait All Share Index gained marginally to close at 8,128.1. The Bank index rose 1.9%, while the Basic Material index gained 1.0%. AlSafat Investment Company and Hayat Communications Co were up 7.7% each. Oman: The MSM 30 Index fell 0.9% to close at 4,195.0. The MSX 30 index declined 0.9%, while the Services Index was down 0.7%. Oman Telecommunications Company declined 7.0%, while Bank Nizwa was down 2.0%. Bahrain: The BHB Index gained 0.2% to close at 2,078.5. The Communications Services index rose 4.2%, while the Industrials index was up 0.3%. Bahrain Telecom Co rose 4.6%, while Inovest Co was up 2.2%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Zad Holding Company 18.00 3.2 401.3 7.8 Salam International Inv. Ltd. 1.11 3.1 72,569.8 36.0 Medicare Group 6.96 1.8 3,852.5 (18.1) Islamic Holding Group 5.89 1.7 3,071.0 49.3 Widam Food Company 3.31 1.7 850.0 (8.0) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Salam International Inv. Ltd. 1.11 3.1 72,569.8 36.0 Gulf International Services 2.03 (0.1) 26,919.4 18.5 Qatar Aluminum Manufacturing Co. 2.61 (1.2) 19,062.3 44.8 Investment Holding Group 2.42 1.7 9,401.8 96.5 Mazaya Qatar Real Estate Dev. 0.88 0.1 9,291.8 (4.1) Market Indicators 29 Mar 22 28 Mar 22 %Chg. Value Traded (QR mn) 800.3 816.9 (2.0) Exch. Market Cap. (QR mn) 766,744.5 774,475.3 (1.0) Volume (mn) 234.4 220.6 6.2 Number of Transactions 17,884 16,380 9.2 Companies Traded 44 46 (4.3) Market Breadth 16:25 21:18 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 27,827.57 (0.5) 0.1 20.9 17.5 All Share Index 4,356.90 (0.5) 0.0 17.8 178.4 Banks 5,862.83 (0.5) 0.6 18.1 18.4 Industrials 5,252.06 (1.2) (1.8) 30.5 17.1 Transportation 3,979.02 0.2 0.9 11.8 14.7 Real Estate 1,916.21 (1.2) (1.3) 10.1 21.3 Insurance 2,663.72 0.2 1.5 (2.3) 17.9 Telecoms 1,105.45 (0.1) (1.3) 4.5 70.1 Consumer 8,534.07 0.9 1.4 3.9 23.3 Al Rayan Islamic Index 5,589.79 (0.7) (0.2) 18.5 19.4 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Arabian Fertilizer Co. Saudi Arabia 191.00 4.9 2,274.0 8.2 Bahrain Telecom. Co. Bahrain 0.59 4.6 72.0 0.5 Almarai Co. Saudi Arabia 51.40 3.2 1,397.9 5.4 Jabal Omar Dev. Co. Saudi Arabia 28.00 3.1 7,830.6 10.2 Co. for Cooperative Ins. Saudi Arabia 73.40 2.8 420.2 (5.3) GCC Top Losers## Exchange Close# 1D% Vol.‘000 YTD% Oman Telecommunications Oman 0.85 (7.0) 586.9 13.3 Dar Al Arkan Real Estate Saudi Arabia 11.60 (4.3) 31,730.0 15.3 Fertiglobe Abu Dhabi 5.67 (2.7) 12,621.7 61.1 National Industrialization Saudi Arabia 23.52 (2.4) 7,726.1 17.8 Saudi Industrial Inv. Group Saudi Arabia 35.85 (2.0) 1,653.5 15.1 Source: Bloomberg (# in Local Currency) (## GCC Top gainers/ losers derived from the S&P GCC Composite Large Mid Cap Index) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Aamal Company 1.20 (4.6) 4,067.4 10.6 Barwa Real Estate Company 3.56 (1.9) 2,015.9 16.3 Mesaieed Petrochemical Holding 2.91 (1.7) 5,902.7 39.2 Industries Qatar 19.34 (1.7) 1,867.5 24.9 Qatar Navigation 8.27 (1.4) 575.4 8.3 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% QNB Group 23.21 (0.8) 1,47,192.8 15.0 Salam International Inv. Ltd. 1.11 3.1 80,285.1 36.0 The Commercial Bank 7.25 1.4 60,614.5 7.4 Gulf International Services 2.03 (0.1) 54,567.6 18.5 Qatar Aluminum Manufacturing Co. 2.61 (1.2) 50,024.2 44.8 Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 13,638.79 (0.5) 0.1 5.3 17.3 220.66 209,858.0 17.5 2.0 3.3 Dubai 3,515.24 0.9 4.0 4.8 10.0 208.47 118,944.5 16.6 1.2 2.7 Abu Dhabi 9,901.67 0.7 1.6 6.2 16.6 459.25 481,389.3 26.2 2.6 1.9 Saudi Arabia 13,101.36 0.3 1.2 4.1 16.1 2,660.30 3,150,257.7 21.9 2.4 2.6 Kuwait 8,128.05 0.0 1.1 6.4 15.4 164.65 155,639.4 20.7 1.8 1.9 Oman 4,194.99 (0.9) (2.0) 3.4 1.6 21.67 19,389.7 12.0 0.8 3.9 Bahrain 2,078.53 0.2 2.2 5.9 15.7 9.18 33,295.5 8.8 1.0 4.5 13,600 13,650 13,700 13,750 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Daily MarketReport Wednesday,30March2022 qnbfs.com Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Market and Dubai Financial Market (** TTM; * Value traded ($ mn) do not include special trades, if any) Qatar Market Commentary • The QE Index declined 0.5% to close at 13,638.8. The Industrials and Real Estate indices led the losses. The index fell on the back of selling pressure from Qatari and Arab shareholders despite buying support from GCC and Foreign shareholders. • Aamal Company and Barwa Real Estate Company were the top losers, falling 4.6% and 1.9%, respectively. Among the top gainers, Zad Holding Company gained 3.2%, while Salam International Inv. Ltd. was up 3.1%. • Volume of shares traded on Tuesday rose by 6.2% to 234.4mn from 220.6mn on Monday. However, as compared to the 30-day moving average of 299.3mn, volume for the day was 21.7% lower. Salam International Inv. Ltd. and Gulf International Services were the most active stocks, contributing 31% and 11.5% to the total volume, respectively. Overall Activity Buy %* Sell %* Net (QR) Qatari Individuals 33.50% 35.18% (13,445,946.5) Qatari Institutions 26.89% 41.80% (119,274,867.5) Qatari 60.40% 76.98% (132,720,814.0) GCC Individuals 0.45% 0.53% (639,279.5) GCC Institutions 3.91% 1.34% 20,556,330.0 GCC 4.35% 1.86% 19,917,050.5 Arab Individuals 8.43% 9.56% (9,009,308.6) Arab Institutions 0.00% 0.03% (198,392.9) Arab 8.43% 9.58% (9,207,701.5) Foreigners Individuals 2.85% 2.02% 6,663,301.0 Foreigners Institutions 23.97% 9.56% 115,348,164.1 Foreigners 26.82% 11.58% 122,011,465.1 Source: Qatar Stock Exchange (*as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 4Q2021 % Change YoY Operating Profit (mn) 4Q2021 % Change YoY Net Profit (mn) 4Q2021 % Change YoY Red Sea International Co.* Saudi Arabia SR 468.2 -12.2% (109.4) N/A (130.4) N/A Ash-Sharqiyah Development Co.* Saudi Arabia SR – – (4.8) N/A (0.2) N/A Riyadh Cement Co Saudi Arabia SR 671.1 13.7% 231.0 1.3% 211.6 -3.8% Al Babtain Power & Telecommunication Co.* Saudi Arabia SR 1,474.5 6.3% 97.6 -31.7% 51.2 -36.2% Abdulmohsen Alhokair Group for Tourism and Development* Saudi Arabia SR 708.4 15.5% (86.1) N/A (171.6) N/A Aljouf Mineral Water Bottling Co Saudi Arabia SR 67.6 -5.6% 5.1 9.3% 4.7 2.9% Dar Alarkan Real Estate Development Co.* Saudi Arabia SR 2,493.1 28.2% 684.8 36.1% 132.5 605.3% Alhasoob Co Saudi Arabia SR 256.5 0.4% 12.8 9.0% 11.9 8.3% Al-Omran Industrial Trading Co.* Saudi Arabia SR 0.1 -3.0% 0.0 223.4% 0.0 1131.0% Development Works Food Co.* Saudi Arabia SR 100.9 6.7% (0.3) N/A 2.7 N/A Red Sea International Co.* Saudi Arabia SR 468.2 -12.2% (109.4) N/A (130.4) N/A Ash-Sharqiyah Development Co.* Saudi Arabia SR – – (4.8) N/A (0.2) N/A Source: Company data, DFM, ADX, MSM, TASI, BHB. (*Financial for FY2021) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 03/29 US Federal Housing Finance Agency FHFA House Price Index MoM Jan 1.60% 1.2% 1.20% 03/29 US Conference Board Conf. Board Consumer Confidence Mar 107.2 107 105.7 03/29 Germany German Federal Statistical Office Import Price Index MoM Feb 1.3% 1.6% 4.3% 03/29 Germany German Federal Statistical Office Import Price Index YoY Feb 26.30% 27.2% 26.9% 03/29 Germany GfK AG GfK Consumer Confidence Apr -15.5 -14.5 -8.5 03/29 France INSEE National Statistics Office Consumer Confidence Mar 91 94 97 Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Earnings Calendar Tickers Company Name Date of reporting 4Q2021 results No. of days remaining Status ERES Ezdan Holding Group 30-Mar-22 0 Due Tickers Company Name Date of reporting 1Q2022 results No. of days remaining Status QIBK Qatar Islamic Bank 12-Apr-22 13 Due QFLS Qatar Fuel Company 13-Apr-22 14 Due ABQK Ahli Bank 19-Apr-22 20 Due Source: QSE

- 3. Daily MarketReport Wednesday,30March2022 qnbfs.com Qatar QatarEnergy acquires 40% interest in exploration block offshore Egypt – QatarEnergy entered into an agreement with ExxonMobil to acquire a working interest in an exploration block offshore Egypt. Under the terms of the agreement, which is subject to customary approvals by the government of Egypt, QatarEnergywill hold a 40 percent working interest in the contractor’s share in the North Marakia Offshore Block in the Mediterranean Sea, while an affiliate of ExxonMobil (Operator) will hold the remaining 60 percent working interest. Commenting on this occasion, HE Saad Sherida Al Kaabi, the Minister of State for Energy Affairs, the President and CEO of QatarEnergy said, “This agreement represents another important step in establishing QatarEnergy’s presence in the Arab Republic of Egypt’s upstream oil and gas sector, and in implementing our international growth strategy.”Minister Al Kaabi added, “We are pleased to sign this agreement and to work with our valued long-term partner ExxonMobil to explore exciting prospects in this promising region. We are also delighted to have the opportunity to work with EGAS and the Egyptian Ministry of Petroleum and Mineral Resources and I would like to take this opportunity to thank the Egyptian authorities and our partners for their valuable support and cooperation. ”North Marakia Offshore was awarded to ExxonMobil in 2020 and covers an area of 4,847 km2 in water depths of 1,000 m to 2,000 m. (Peninsula Qatar) FM: Qatar’s relations with Egypt back to normal – Deputy Prime Minister and Minister of Foreign Affairs HE Sheikh Mohammed bin Abdulrahman Al Thani underlined that the bilateral relations between the State of Qatar and the Arab Republic of Egypt have returned back to their normal state and solid base, thanks to the keenness of the leadership of the two brotherly countries, and the sincere efforts made in the past period,noting that this matter will reflect positively on the two countries and the region. (Peninsula Qatar) Qatar, Egypt agrees on investments and partnerships worth $5bn – The State of Qatar and the Arab Republic of Egypt have agreed on a set of investments and partnerships in Egypt, totaling $5bn in the coming period. This came during a meeting between Prime Minister of Egypt HE Dr. Mostafa Madbouly and Deputy Prime Minister and Minister of Foreign Affairs HE Sheikh Mohammed bin Abdulrahman Al Thani and Minister of Finance HE Ali bin Ahmed Al Kuwari in Cairo yesterday. (Peninsula Qatar) NATO Chief lauds strong ties with Qatar in all fields – The Secretary- General of North Atlantic Treaty Organization (NATO) Jens Stoltenberg received the credentials of HE Abdulaziz bin Ahmed Al Malki as Head of Mission of the State of Qatar and Ambassador Extraordinary and Plenipotentiary to NATO. During the meeting, the Ambassador conveyed the greetings of Amir HH Sheikh Tamim bin Hamad Al Thani to the Secretary-General of NATO, and His Highness’ wishes of good health, progress and prosperity to him. For his part, the Secretary-General of NATO entrusted the Ambassador with his greetings to HH the Amir and wished further progress and prosperity for the Qatari people. During the meeting, the Ambassador touched on the strong and distinguished relations that unite Qatar and NATO, pointing out that they witnessed great progress in all fields, both civil and military in the past period. He noted that these relations come within the framework of the keenness of the State of Qatar and its wise leadership to maintain international peace and security, and to cooperate in the field of conflict resolution through dialogue and peaceful means. (Peninsula Qatar) Qatar’s industrial sector PPI up 65.69% in February – The overall monthly Producer Price Index (PPI) of Qatar’s industrial sector for February 2022 was estimated at 97.26 points, showing an increase of 65.69% when compared to the PPI of the corresponding month the previous year (February 2021). When compared on a month-on-month (MoM) basis, the PPI of February 2022 showed an increase of 4.22% against the PPI of the previous month (January 2022), official data released by the Planning and Statistics Authority (PSA) show. The ‘Mining’ sector PPI registered an increase of 5.37% when compared with the PPI of January 2022, primarily due to the price increase of “Crude petroleum and natural gas” by 5.38%, while “Stone, Sand, and Clay” decreased by 0.13%. PPI of February 2022, when compared with its counterpartin the previous year (February 2021), there was an increase of 72.68%. In the ‘Manufacturing’ sector index, an increase of 2.17% has been recorded in February 2022, when compared with the previous month’s Manufacturing index (January 2022). When compared with the previous year’s (February 2021) index, the “Manufacturing” PPI of February 2022 showed an increase of 53.61%. The PPI of the Electricity and Water group showed a decrease of 13.71% compared to January 2022, resulting from prices fall in “Water” by 14.81%, and “Electricity” by 12.90%. When compared the PPI of February 2022 to the PPI of February 2021 (YoY) showed a decrease of 2.12 %, affected by prices fall in “Electricity” by 2.55% and “Water” by 1.53%. (Peninsula Qatar) FDI inflows in Qatar’s non-hydrocarbon sector exceed hydrocarbon space – Qatar’s non-hydrocarbon sector continues to drive economic growth. The country’s Foreign Direct Investment (FDI) and performance of inflows in the non-hydrocarbon sector have continually exceeded the inflows in the hydrocarbon space said a senior official. A panel discussion entitled ‘The Future of Foreign Direct Investment in Post-COVID Era’ in the recently concluded Doha Forum discussed priorities about FDI and how to ensure economic development in this new environment. Sheikh Ali Alwaleed Al Thani, CEO of Investment Promotion Agency Qatar noted, “If you look at Qatar’s FDI inflows specifically, especially the performance of inflows in the non-hydro-carbon sector which has continually exceeded the inflows in the hydrocarbon space,” he said. (Peninsula Qatar) Commercial Bank opens its first exclusive Sadara Youth lounge – Commercial Bank inaugurated yesterday its first exclusive Sadara Youth lounge at the Qatar University Metro Station Branch. Showcasing a modern design and looks, the branch is customized to the needs young generation, especially students. This branch allowed Qatar University students to unleash their creativity and design their own space through a competition held back in 2020. Commercial Bank adopted a concept designed by the students and brought it to life. It embraces creativity and innovation, something meaningful to students, useful, and yet can still be fun. Sadara Youth is a proposition that appeals to 18 to 25-year-old Qatari nationals. With a unique banking experience, a dedicated mobile app and the first in market vertical Visa credit card. It is designed with an experiential and educational approach to banking that is quickly making Commercial Bank a preferred Bank with this population. (Peninsula Qatar) ‘Commercial Bank to open smartbranches at four metro stations thisyear’ – Commercial Bank is opening smart branches at four metro stations as part of strengthening its digital banking footprint in Qatar. “We are looking at smart branches at metro stations in Al Wakra, DECC (Doha Exhibition and Convention Centre, Qatar University and the departure terminals in Hamad International Airport,” Nayef al-Beshri, AGM and head of branches, Commercial Bank, told Gulf Times on the sidelines of the inauguration of its first exclusive Sadara Youth lounge at the Qatar University Metro Station branch. Asked by Gulf Times when these branches would be operational, he said the bank is targeting this year itself. "Smart branches are being located in the Qatar Rail network as we would like to focus more on digital solutions," he said, adding one of the core values in the Commercial Bank is digitization and creativity. Its modern look-and-feel new breed of “smart branches” offer customers increased self-service functionality, and customers can use the branches 24x7 at their convenience to print their checkbooks, credit and debit cards instantaneously in less than five minutes. (Gulf-Times.com) MoCI calls upon joint-stock companies to hold ordinary General Assembly meeting – The Ministry of Commerce and Industry (MoCI) called on all public and private joint-stock companies to hold the ordinary General Assembly meeting within four months after the end of their fiscal year, in accordance with Article (123) of LawNo. (11) of 2015 on Promulgating the Commercial Companies Law, amended by Law No. (8) of 2021. The Article stipulates that: “The General Assembly shall convene at the invitation of the board of directors at least once a year in the place and time prescribed by the board of directors after approval by the Department. The General Assembly shall be held within the four (4) months following the end of the

- 4. Daily MarketReport Wednesday,30March2022 qnbfs.com company’s financial year. The boardof directors may convene the General Assembly whenever necessary. (Peninsula Qatar) Vodafone Qatar partners with Rafeeq – Vodafone Qatar has announced a new partnership with the Qatari food delivery platform Rafeeq. The two companies will work together to identify how tailored, innovative digital solutions and customer insights based on Big Data, can support Rafeeq to optimize their operations and enhance customer service and experience. Vodafone’s portfolio of business solutions is created to cater for businesses across a diverse range of industries, and all sizes. For Rafeeq, Vodafone’s Internet of Things (IoT) Fleet Management and Big Data and Advanced Analytics solutions are examples of technologies that can help the food delivery platform meet their business objectives. (Peninsula Qatar) Qatar Airways Cargo, WiseTech Global launch eBookings connectivity – Qatar Airways Cargo, the world’s leading air cargo carrier, and WiseTech Global, a leading provider of software solutions to the logistics industry, announced yesterday that the launch of a direct eBooking solution between their global operating systems has gone live. This connection further enhances the flight schedule and operational data exchange implemented last year. The eBooking connection between WiseTech’s flagship CargoWise platform and Qatar Airways Cargo management system, CROAMIS, enables freight forwarders using CargoWise to choose their flight and confirm a booking with Qatar Airways Cargo in real-time, without having to leave the platform. Similarly, existing bookings made via the solution can be modified. (Peninsula Qatar) Business visit explores opportunities between Qatar, Los Angeles Area – The US-Qatar Business Council (USQBC) recently organized a business visit to Los Angeles, California to engage with key policymakers and the local business community to expand and enhance economic partnerships between Qatar and the Los Angeles Area economic community. The business visit featured the following representatives: Mansoor al- Sulaitin, Consul General of State of Qatar in Los Angeles; Eric Garcetti, Mayor of Los Angeles; Rep Lou Correa (CA-46); Fahad al-Dosari, the State of Qatar Commercial Attaché to the US; Mohamed Barakat, USQBC managing director and treasurer of the board of directors; Maria S Salinas, president and CEO, Los Angeles Area Chamber of Commerce; and Peter McPartlin, Paramount Pictures EVP for Strategic Planning and Business Operations. The business visit kicked-off with a virtual meeting between Barakat, al-Dosari, and Correa (CA-46). Participants discussed the importance of the relationship between Qatar and the metropolitan area of Los Angeles and ways to enhance future business and investment ties. (Gulf-times.com) IT Minister: Qatar on fast track to digital transformation – The government is keen on maintaining the acceleration of Qatar’s digital transformation, HE the Minister of Communications and Information Technology Mohamed bin Ali bin Mohamed al-Mannai said yesterday at the opening ceremony of Smart City Expo Doha 2022, being held under the patronage of HE the Prime Minister and Minister of Interior Sheikh Khalid bin Khalifa bin Abdulaziz alThani. The two-day global forum organized by the Ministry of Communications and Information Technology (MCIT), in partnership with Fira de Barcelona, is being held at Msheireb Downtown Doha, which is hosting smart city experts from more than 60 countries. Held under the theme ‘Sustainable Future of Resilience’, Smart City Expo Doha 2022 has attracted global innovators to the event that has witnessed the unveiling of three smart city projects, which are supported by the Tasmu Accelerator. (Gulf-Times.com) International Tightening US labor market underpins consumer confidence despite soaring inflation – US consumer confidence rebounded from a one-year low in March amid growing labor market optimism, but rising interest rates as the Federal Reserve battles raging inflation could hurt motor vehicle purchases and crimp consumer spending. The labor market continues to favor workers, with other data on Tuesday showing job openings hovering near recordhighsin February. Tightening labor market conditions are boosting wages, providing some cushion against inflation. Consumers' one-year inflation expectations shot up to an all-time high of 7.9%. The Conference Board said its consumer confidence index rose to a reading of 107.2 this month from a downwardly revised 105.7 in February. Economists polled by Reuters had forecast the index falling to 107.0 from February's initially reported 110.5. The improvement in confidence followed the rolling back of COVID-19 restrictions across the country and was despite gasoline prices remaining above $4.00 per gallon as Russia's war against Ukraine rages on. The Conference Board's so-called labor market differential, derived from data on respondents' views on whether jobs are plentiful or hard to get, increased to a record high 47.4 this month from a reading of 41.5 in February. This measure correlates to the unemployment rate from the Labour Department. The jobless rate was at a two-year low of 3.8% in February. Consumers' upbeat views of the labor market were underscored by the Labor Department's Job Openings and Labor Turnover Survey, or JOLTS report showing job openings, a measure of labor demand, fell 17,000 to 11.266mn on the last day of February. Despite the second straight monthlydecline, job openings were not too far from a record high of 11.448mn set in December. Economists had forecast 11mn vacancies. Job openings in the finance and insurance sector fell by 63,000 and decreased 39,000 in the nondurable goods manufacturing industry. But vacancies rose by 32,000 in the arts, entertainment and recreation sector, while education services reported 26,000 additional openings. The job openings rate was unchanged at 7.0%. Hiring increased 263,000 to 6.689mn, led by construction, but fell in the information sector. The hires rate climbed to 4.4% from 4.3% in January. (Reuters) BRC: UK retailers raise prices by most in nearly 11 years – Major British retailers increased their prices by the most in almost 11 years this month, according to a survey published on Wednesday that tallies with forecasts showing the country's inflation rate is set to accelerate further. The British Retail Consortium said shop prices rose by 2.1% in March for the fastest annual increase since September 2011, gathering speed from February's 1.8% increase. For most of the past year, the BRC's shop price inflation measure showed falls in prices, reflecting fierce competition between supermarkets and other big retailers. But it has now risen for five straight months. Helen Dickinson, the BRC's chief executive, said rising costs were starting to be exacerbated by fallout from Russia's invasion of Ukraine which would become more severe. Britain's consumer prices inflation rate touched a 30-year high of 5.6% in February and is set to climb above 8% soon with domestic power tariffs due to jump by more than half in April, leaving households facing the biggest hit to their living standards this year since at least the 1950s. The Bank of England raised borrowing costs for the third time in a row earlier this month, taking Bank Rate back to 0.75%, its pre-pandemic level and investors expect another hike in May to 1.0%. (Reuters) UK consumer lending surges, driven by record credit card borrowing – Lending to consumers in Britain rose last month by the most in nearly five years, driven by a record rise in credit card borrowing, according to data that analysts said could be a sign of the growing cost-of-living squeeze. Figures from the Bank of England on Tuesday showed consumer credit rose by a net 1.876bn pounds ($2.46bn) in February, about 1bn pounds more than expected in a Reuters poll of economists and the biggest increase sinceMarch 2017. Inflationhit a 30-year high of 6.2% in February and the government’s budget watchdog this week forecast the rate will climb close to 9% in late 2022, contributing to the biggest fall in living standards since at least the 1950s. Paul Dales, chief UK economist at Capital Economics, said households typically reduce demand for credit during periods when finances are tight, and he expected consumer lending to slow. Net lending for January was revised down to 143 million pounds from a previously reported 608 million pounds. Credit card lending accounted for the bulk of the increase, in February at 1.5 billion pounds - the biggest rise since monthly records started in 1993. The BoE data also showed mortgage approvalsand thevalue ofsecured lending were weaker than expected, a tentative sign that the housing market may have lost a little of its recent heat. Lenders approved 70,993 mortgages last month, down from 73,841 in January. (Reuters) Regional Looking at GCC for CEPA: Goyal – It’s a journey that we are all embarking with the United Kingdom, Canada, Israel, Australia and with the European Union. We hope to also look at the entire Gulf Cooperation

- 5. Daily MarketReport Wednesday,30March2022 qnbfs.com Council (GCC)region for a Comprehensive Economic Partnership (CEPA),” Goyal said. He continued, “in all of these journeys, I think UAE and India have made an excellent document, covering a wide variety of subjects can certainly help as a template and set the goal and agenda for our future engagement.” He also noted that Prime Minister Narendra Modi-led India from the front over the CEPA signed with UAE and his vision has always been to achieve a “historic high in goods and services” between the two countries. “At some time in the near future, we hope to also to look at the entire GCC region for a comprehensive economic partnership,” he added. (Bloomberg) Middle Eastern telcos to form Alliance Networks, a new digital infra venture – Eight prominent companies from within the Middle Eastern telecoms/tech ecosystem have inked a memorandum of understanding to create a new digital infrastructure services company. Named Alliance Networks, this new entity will see the coming of Alliance International Management (AIM); Amsterdam Internet Exchange (AMS-IX); Bahrain National Holding Company (BNH); Gulf Bridge International (GBI); GCC Interconnection Authority (GCCIA); Gulf Data Hub (GDH); Gulfnet Communications Company (B.Online); and Nuetel Communications (Nuetel). “Today’s market is all about agility, experience and seamless connection between hubs across the region,” said Adel Al Daylami, CEO of AIM. “We’re proud to be part of Alliance Networks and supporting an innovative business that will ultimately benefit the region including technology providers and end-users.” "AMS-IX is excited to work with strong partners and develop key digital infrastructure and connectivity services for its peers and the wider Internet community," said Peter van Burgel, CEO of AMS-IX. (Bloomberg) German-Arab Chamber to boost economic relations – During a forum organized by the Sharjah Chamber of Commerce and Industry (SCCI), the chamber called on German businessmen and investors to explore investment opportunities within the emirate’s business community, in order to access new avenues of partnership and develop economic and trade relations between Sharjah and the European nation. The forum was organized in collaboration with the German-Arab Chamber of Industry and Commerce (GACIC), for a delegation of businessmen and investors in several vital sectors from Germany, and attended by Abdullah Sultan Al Owais, Chairman of the SCCI, and Dr. Peter Ramsauer, President of GACIC, along with representatives from the local private sector and the Sharjah International Airport Free Zone (SAIF Zone). Speaking on the occasion, Abdullah Sultan Al Owais said that the forum is a significant step towards enhancing economic cooperation and developing relations between the business communities at various levels. He also highlighted the strength of UAE-Germany relations, especially considering the outstanding results of the two countries' comprehensive strategic partnership since 2004. He further added that this has made Gulf Cooperation Council (GCC) countries the seventh-largest export destination for German industry outside Europe. According to the SCCI Chairman, these figures provide a solid foundation for strengthening bilateral trade relations between the business communities of both countries and opening new communication channels. (Bloomberg) Saudi Arabia sees investments of $608mn, 2,400 jobs – Four startups – including three e-commerce companies and a HealthTech firm – a leading global accelerator and a venture capital fund will invest up to $608.25mn in Saudi Arabia, creating 2,400 jobs. The new licenses were announced by Saudi Arabia’s Ministry of Investment (MISA) at the Global Entrepreneurship Congress from March 27 to 30 and are evidence of the kingdom’s burgeoning start-up and venture capital ecosystem. Khalid Al Falih, Minister of Investment, said: “As the world continues to emerge from the Covid-19 pandemic, entrepreneurs are shaping our ‘new normal’. In Saudi Arabia the start-up scene is thriving, and there is enormous potential for venture capitalists. “An enhanced regulatory environment and our recently launched National Investment Strategy are unleashing opportunities not previously available in the kingdom and these new investments are a result of the economic transformation happening now under Vision 2030.” (Bloomberg) Al-Falih: Saudi Arabia 'fertile land' for international investors, companies – Minister of Investment Eng. Khalid Al-Falih stressed that the Kingdom of Saudi Arabia has a strategic status at the international level and can attract investors, innovators, entrepreneurs and scientists. Participating in a discussion panel as part of the Global Entrepreneurs Congress (GEC), which is organized by the Small and Medium Enterprises General Authority (Monsha’at) in cooperation with the Global Entrepreneurship Network (GEN), Eng. Al-Falih said: “Investment in the Kingdom of Saudi Arabia previously relied greatly on gas and oil, and this is a big opportunity to think of increasing, developing and diversifying investment opportunities to be available in all sectors and looking for diversification and innovation through offered suggestions to reach the target and investment growth”. (Bloomberg) Edgnex kicks off its $1bn data center rollout: First stop, Saudi Arabia – Digital infrastructure company Edgnex has selected the Kingdom of Saudi Arabia (KSA) as the first location for the data center facilities it plans to establish in Europe, Asia, Africa and the Middle East in the near future. The company, which was established in August 2021 by Hussain Sajwani, Emirati billionaire and founder of property developer Damac Group, unveiled ambitions to “disrupt” the data center market in the region by promising to deliver “new speed and agility” for the benefit of local economies, enterprises and end users. In Saudi Arabia, the infrastructure provider will position a colocation data center less than 20km away from the city center and 47km from the airport, which is set to offer “low- latency access to the entire KSA market” alongside “high-fiber density and connectivity.” The facility will have a maximum IT load of 20 megawatts (MW) and will cover an area of 17,720 square meters. It’s expected to go live in Q3 2023. (Bloomberg) Big 5 Saudi attracts over 400 top construction firms – The Big 5 Saudi, a leading event for the kingdom's construction industry, opened its doors today (March 28) in the capital Riyadh featuring some 400 exhibiting companies and 30 nations, including country pavilions from Italy, Germany, the UAE, Greece, Kuwait, Poland, Spain, Egypt and Qatar. The first live and in-person construction event since the onset of Covid-19, Big 5 Saudi is likely to attract 15,000 industry professionals. Previously held in Jeddah, the leading expo brand is making its Riyadh debut this year and is being held the Riyadh International Convention and Exhibition Centre. Now in its 10th year, the Big 5 Saudi will see companies showcase some 1,000 construction products and solutions over the next three days. (Zawya) An agreement between “Dubai Financial” and “Dubai Energy” to explore opportunities to develop various financial products – The Dubai Financial Market and the Dubai Mercantile Exchange signed a cooperation agreement that provides a general framework aimed at diversifying investment opportunities through joint development of new financial products that meet the needs of the huge and diversified investor base in the Dubai Financial Market, which exceeds 852,000 investors. The agreement was signed by Hamed Ali, CEO of the Dubai Financial Market and Nasdaq Dubai, and Raed Al Salami, Director General of the Dubai Mercantile Exchange, in the presence of Ahmed Sharaf, Chairman of the Board of Directors of the Dubai Energy Inch, during the activities of “Dubai Derivatives Day”, the joint forum organized by the Dubai Financial Center Global in partnership with the Dubai Mercantile Exchange and CME Group, which is the world’s leading and most diversified derivatives market. (Bloomberg) Motorsport 'added $4.8mn to UAE tourism sector in 2021-22' – Dubai Autodrome, a major motorsport and entertainment venue in the Middle East, said that the 2021-2022 motorsport season recorded a contribution of AED17.9mn ($4.87mn) to the UAE’s tourism and economy sectors. Dubai Autodrome hosted several regional and global championships during the season, spanning six months from 1 October 2021 to 13 March 2022. (Zawya) Alizz Islamic Bank – Outlook Revised to Stable from Negative – Capital Intelligence Ratings (CI Ratings or CI) today announced that ithas revised the Outlook on the Long-Term Rating on the Oman National Scale of Alizz Islamic Bank (AIB) to Stable from Negative. This follows CI Ratings’ recent revision of the Outlook for Oman’s sovereign rating to Stable from Negative. At the same time, CI Ratings has affirmed AIB’s Long- and Short-Term Ratings on the same scale at ‘omAA’ and ‘omA1+’, respectively. The Bank’s Long-Term rating incorporates an uplift for extraordinary support. The revision of Oman’s LT FCR Outlook to Stable

- 6. Daily MarketReport Wednesday,30March2022 qnbfs.com reflects the ongoing strengthening of fiscal and external balances, as well as improving government debt metrics – developments which are largely driven by the direct and indirect impact of higher hydrocarbon prices. Oman’s ratings (‘BB’/‘B’) remain supported by the country’s moderate fiscal and external buffers, relatively sound banking system, as well as CI’s expectation that financial support would be forthcoming from other GCC countries in the event of need. The sovereign’s ratings are constrained by limited economic diversification, with dependence on hydrocarbon output, limited revenue mobilization (albeit improving), and geopolitical risk factors and institutional weaknesses. (Bloomberg) Ahli Bank (Oman) – Outlook Revised to Stable from Negative – Capital Intelligence Ratings (CI Ratings or CI) today announced that ithas revised the Outlook for Ahli Bank Oman’s (AB) Long-Term Foreign Currency Rating (LT FCR) and Bank Standalone Rating (BSR) to Stable from Negative. This follows CI Ratings’ recent revision of the Outlook for Oman’s sovereignrating to Stable from Negative. At the same time, CI has affirmed the Bank’s LT FCR and BSR of ‘BB’ and ‘bb’, respectively. The Bank’s Short-Term Foreign Currency Rating (ST FCR) of ‘B‘, Core Financial Strength (CFS) rating of ‘bbb-’ and Extraordinary Support Level (ESL) of Moderate were also affirmed. As AB’s LT FCR remains set at the same level as Oman’s sovereign rating of ‘BB’, the rating is closely correlated with the sovereign’s creditworthiness. Any improvement or deterioration in Oman’s LT FCR and/or outlook will have a corresponding effect on AB’s ratings and Outlook. (Bloomberg) Oman Arab Bank – Outlook revised to Stable from Negative Capital Intelligence Ratings - (CI Ratings or CI) announced that it has revised the outlook on Oman Arab Bank’s (OAB) Long-Term Foreign Currency Rating (LT FCR) and Bank Standalone Rating (BSR) to Stable fromNegative. This follows CI Ratings’ recent revision of the outlook for Oman’s sovereign rating to Stable from Negative. At the same time, CI Ratings has affirmed OAB’s LT FCR and Short-Term Foreign Currency Rating (ST FCR) at ‘BB’ and ‘B’, respectively. The Bank’s BSR of ‘bb’, Core Financial Strength (CFS) rating of ‘bbb-’ and Extraordinary Support Level (ESL) of Moderate were also affirmed. As OAB’s LT FCR remains set at the same level as Oman’s sovereign rating of ‘BB’, the rating is closely correlated with the sovereign’s creditworthiness. Any improvement or deterioration in Oman’s LT FCR and/or outlook will have a corresponding effect on OAB’s ratings and outlook. (Bloomberg) National Bank of Oman – Outlook revised to Stable from Negative Capital Intelligence Ratings – (CI Ratings or CI) announced that it has revised the Outlook on National Bank of Oman’s (NBO) Long-Term Foreign Currency Rating (LT FCR) and Bank Standalone Rating (BSR) to Stable from Negative. This follows CI Ratings’ recent revision of the outlook for Oman’s sovereignrating to Stable from Negative. At the same time, CI has affirmed NBO’s LT FCR and Short-Term Foreign Currency Rating (ST FCR) at ‘BB’ and ‘B’, respectively. The Bank’s BSR of ‘bb’, Core Financial Strength (CFS) rating of ‘bbb-’ and Extraordinary Support Level (ESL) of Moderate were also affirmed. As NBO’s LT FCR remains set at the same level as Oman’s sovereign rating of ‘BB’, the rating is closely correlated with the sovereign’s creditworthiness. Any improvement or deterioration in Oman’s LT FCR and/or outlook will have a corresponding effect on NBO’s ratings and outlook. (Bloomberg) Mubasher Financial launches Arab Markets initiative in Bahrain – The Chairman of Mubasher Financial Group, Mohammed Rasheed Al Ballaa, has launched the Arab Markets initiative to enable brokerage companies to offer trading services across all Arab markets. The announcement was made during the general assembly of the Arab Federation of Capital Markets (AFCM), held in Bahrain’s Manama on Monday, 28 March. The Arab Markets initiative provides various economic news, financial and trading data, as well as advanced technical analysis tools. In the meantime, Al Ballaa introduced the Arab Companies service, which provides access to electronic trading in private companies' shares, supports private companies, and brings together qualified investors. (Zawya)

- 7. Daily MarketReport Wednesday,30March2022 qnbfs.com Rebased Performance Source: Bloomberg Daily Index Performance Source: Bloomberg Asset/Currency Performance Close ($) 1D% WTD% YTD% Gold/Ounce 1,919.43 (0.2) (2.0) 4.9 Silver/Ounce 24.77 (0.4) (3.0) 6.3 Crude Oil (Brent)/Barrel (FM Future) 110.23 (2.0) (8.6) 41.7 Crude Oil (WTI)/Barrel (FM Future) 104.24 (1.6) (8.5) 38.6 Natural Gas (Henry Hub)/MMBtu 5.32 (2.0) (2.4) 45.4 LPG Propane (Arab Gulf)/Ton 140.13 (0.4) (6.1) 24.8 LPG Butane (Arab Gulf)/Ton 155.13 (2.0) (10.3) 11.4 Euro 1.11 0.9 0.9 (2.5) Yen 122.88 (0.8) 0.7 6.8 GBP 1.31 0.0 (0.7) (3.2) CHF 1.07 0.4 (0.0) (2.0) AUD 0.75 0.3 (0.1) 3.4 USD Index 98.40 (0.7) (0.4) 2.9 RUB 118.69 0.0 0.0 58.9 BRL 0.21 0.1 (0.3) 17.1 Source: Bloomberg Global Indices Performance Close 1D%* WTD%* YTD%* MSCI World Index 3,110.81 1.6 2.0 (3.7) DJ Industrial 35,294.19 1.0 1.2 (2.9) S&P 500 4,631.60 1.2 1.9 (2.8) NASDAQ 100 14,619.64 1.8 3.2 (6.6) STOXX 600 462.09 2.5 2.7 (7.8) DAX 14,820.33 3.6 4.4 (8.6) FTSE 100 7,537.25 0.8 (0.1) (1.3) CAC 40 6,792.16 3.9 4.5 (7.6) Nikkei 28,252.42 1.7 (0.1) (7.9) MSCI EM 1,136.45 1.0 1.0 (7.8) SHANGHAI SE Composite 3,203.94 (0.2) (0.2) (12.1) HANG SENG 21,927.63 1.1 2.4 (6.6) BSE SENSEX 57,943.65 1.3 2.0 (1.9) Bovespa 1,20,014.17 1.3 0.8 33.5 RTS 881.59 7.1 6.3 (44.8) Source: Bloomberg (*$ adjusted returns) 60.0 80.0 100.0 120.0 140.0 160.0 180.0 Feb-18 Feb-19 Feb-20 Feb-21 Feb-22 QSE Index S&P Pan Arab S&P GCC 0.3% (0.5%) 0.0% 0.2% (0.9%) 0.3% 1.0% (1.0%) (0.5%) 0.0% 0.5% 1.0% 1.5% Saudi Arabia Qatar Kuwait Bahrain Oman Abu Dhabi Dubai 168.4 157.7 155.8

- 8. Daily MarketReport Wednesday,30March2022 qnbfs.com Contacts QNB Financial Services Co. W.L.L. Contact Center: (+974) 4476 6666 info@qnbfs.com.qa Doha, Qatar Saugata Sarkar, CFA, CAIA Head of Research saugata.sarkar@qnbfs.com.qa Shahan Keushgerian Senior Research Analyst shahan.keushgerian@qnbfs.com.qa Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services Co. W.L.L. (“QNBFS”) a wholly-owned subsidiary of Qatar National Bank (Q.P.S.C.). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange. Qatar National Bank (Q.P.S.C.) is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arisingfrom use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. Wetherefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warrantiesastotheaccuracyandcompletenessofthe informationitmaycontain,anddeclinesanyliabilityinthatrespect.Forreports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommen- dationsofQNBFSFundamentalResearchasaresultofdepending solelyonthehistoricaltechnicaldata(priceandvolume).QNBFS reservestherighttoamendtheviewsandopinionsexpressedinthispublicationat anytime.Itmayalsoexpressviewpointsormake investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS. COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS.