QSE Index declines 0.7% as Real Estate and Insurance stocks fall

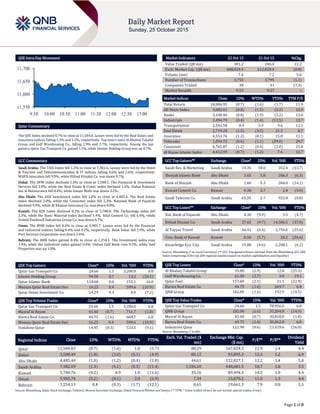

- 1. Page 1 of 8 QSE Intra-Day Movement Qatar Commentary The QSE Index declined 0.7% to close at 11,584.8. Losses were led by the Real Estate and Insurance indices, falling 1.3% and 1.2%, respectively. Top losers were Al Khaleej Takaful Group and Gulf Warehousing Co., falling 2.9% and 2.7%, respectively. Among the top gainers, Qatar Gas Transport Co. gained 1.5%, while Islamic Holding Group was up 0.7%. GCC Commentary Saudi Arabia: The TASI Index fell 1.3% to close at 7,382.6. Losses were led by the Hotel & Tourism and Telecommunication & IT indices, falling 4.6% and 2.6%, respectively. WAFA Insurance fell 9.9%, while Etihad Etisalat Co. was down 9.7%. Dubai: The DFM Index declined 1.0% to close at 3,588.5. The Financial & Investment Services fell 2.8%, while the Real Estate & Const. index declined 1.4%. Dubai National Ins. & Reinsurance fell 8.4%, while Emaar Malls was down 3.2%. Abu Dhabi: The ADX benchmark index fell 1.0% to close at 4,485.4. The Real Estate index declined 3.0%, while the Consumer index fell 2.3%. National Bank of Fujairah declined 9.9%, while Al Khazna Insurance Co. was down 8.8%. Kuwait: The KSE Index declined 0.2% to close at 5,780.8. The Technology index fell 2.3%, while the Basic Material index declined 1.4%. Hilal Cement Co. fell 6.9%, while United Foodstuff Industries Group Co. was down 6.7%. Oman: The MSM Index fell 0.2% to close at 5,905.7. Losses were led by the Financial and Industrial indices, falling 0.4% and 0.2%, respectively. Bank Sohar fell 2.9%, while Port Services Corporation was down 2.4%. Bahrain: The BHB Index gained 0.4% to close at 1,254.1. The Investment index rose 1.4%, while the Industrial index gained 0.4%. United Gulf Bank rose 9.3%, while Seef Properties was up 1.0%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Co. 24.66 1.5 3,206.0 6.8 Islamic Holding Group 99.50 0.7 13.2 (20.1) Qatar Islamic Bank 118.60 0.6 155.1 16.0 Mazaya Qatar Real Estate Dev. 16.25 0.4 599.6 (10.9) Qatar Oman Investment Co. 14.29 0.3 8.0 (7.2) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Qatar Gas Transport Co. 24.66 1.5 3,206.0 6.8 Masraf Al Rayan 43.40 (0.7) 711.7 (1.8) Barwa Real Estate Co. 44.75 (1.6) 669.7 6.8 Mazaya Qatar Real Estate Dev. 16.25 0.4 599.6 (10.9) Vodafone Qatar 14.95 (0.3) 533.5 (9.1) Market Indicators 22 Oct 15 21 Oct 15 %Chg. Value Traded (QR mn) 301.2 246.4 22.2 Exch. Market Cap. (QR mn) 608,024.4 612,820.4 (0.8) Volume (mn) 7.6 7.2 5.6 Number of Transactions 3,753 3,795 (1.1) Companies Traded 38 41 (7.3) Market Breadth 9:23 9:27 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,006.95 (0.7) (1.6) (1.7) 11.9 All Share Index 3,082.61 (0.8) (1.5) (2.2) 12.0 Banks 3,100.46 (0.8) (1.9) (3.2) 12.6 Industrials 3,494.79 (0.4) (1.4) (13.5) 12.7 Transportation 2,541.58 0.4 3.4 9.6 12.1 Real Estate 2,719.20 (1.3) (3.2) 21.2 8.7 Insurance 4,553.76 (1.2) (0.1) 15.0 12.1 Telecoms 1,054.72 (0.6) (1.1) (29.0) 29.7 Consumer 6,765.87 (1.2) (0.4) (2.0) 15.0 Al Rayan Islamic Index 4,412.99 (0.7) (1.2) 7.6 12.7 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Saudi Res. & Marketing Saudi Arabia 14.35 10.0 352.4 (13.7) Sharjah Islamic Bank Abu Dhabi 1.65 5.8 286.3 (6.3) Bank of Sharjah Abu Dhabi 1.60 5.3 260.0 (14.1) Kuwait Cement Co. Kuwait 0.38 2.7 2.4 (5.0) Saudi Telecom Co. Saudi Arabia 65.20 2.7 922.0 (0.8) GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Nat. Bank of Fujairah Abu Dhabi 4.30 (9.9) 3.5 (4.7) Etihad Etisalat Co. Saudi Arabia 27.65 (9.7) 14,586.5 (37.0) Al Tayyar Travel Saudi Arabia 66.41 (6.4) 2,756.6 (25.6) Com. Bank of Kuwait Kuwait 0.50 (5.7) 20.2 (20.6) Knowledge Eco. City Saudi Arabia 15.88 (4.6) 2,208.1 (6.2) Source: Bloomberg (# in Local Currency) (## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Al Khaleej Takaful Group 33.00 (2.9) 12.8 (25.3) Gulf Warehousing Co. 61.30 (2.7) 3.0 19.1 Qatar Fuel 157.60 (2.1) 21.1 (22.9) Barwa Real Estate Co. 44.75 (1.6) 669.7 6.8 QNB Group 182.00 (1.6) 192.9 (14.5) QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Qatar Gas Transport Co. 24.66 1.5 78,956.6 6.8 QNB Group 182.00 (1.6) 35,204.8 (14.5) Masraf Al Rayan 43.40 (0.7) 30,818.0 (1.8) Barwa Real Estate Co. 44.75 (1.6) 30,062.8 6.8 Industries Qatar 122.90 (0.6) 23,429.6 (26.8) Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar 11,584.83 (0.7) (1.6) 1.0 (5.7) 88.29 167,024.3 11.9 1.4 4.4 Dubai 3,588.49 (1.0) (3.0) (0.1) (4.9) 80.12 93,895.3 12.4 1.2 6.9 Abu Dhabi 4,485.40 (1.0) (1.2) (0.4) (1.0) 44.61 122,827.1 12.2 1.4 5.0 Saudi Arabia 7,382.59 (1.3) (4.1) (0.3) (11.4) 1,556.20 448,681.5 16.7 1.8 3.5 Kuwait 5,780.76 (0.2) 0.9 1.0 (11.6) 35.16 89,494.3 14.5 1.0 4.4 Oman 5,905.74 (0.2) (0.1) 2.0 (6.9) 7.34 23,870.2 11.0 1.3 4.4 Bahrain 1,254.13 0.4 (0.3) (1.7) (12.1) 0.65 19,661.3 7.9 0.8 5.5 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 11,550 11,600 11,650 11,700 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 8 Qatar Market Commentary The QSE Index declined 0.7% to close at 11,584.8. The Real Estate and Insurance indices led the losses. The index fell on the back of selling pressure from GCC shareholders despite buying support from Qatari and non-Qatari shareholders. Al Khaleej Takaful Group and Gulf Warehousing Co. were the top losers, falling 2.9% and 2.7%, respectively. Among the top gainers, Qatar Gas Transport Co. gained 1.5%, while Islamic Holding Group was up 0.7%. Volume of shares traded on Thursday rose by 5.6% to 7.6mn from 7.2mn on Wednesday. However, as compared to the 30-day moving average of 8.0mn, volume for the day was 4.2% lower. Qatar Gas Transport Co. and Masraf Al Rayan were the most active stocks, contributing 42.0% and 9.3% to the total volume, respectively. Source: Qatar Stock Exchange (* as a % of traded value) Earnings Releases, Global Economic Data and Earnings Calendar Earnings Releases Company Market Currency Revenue (mn) 3Q2015 % Change YoY Operating Profit (mn) 3Q2015 % Change YoY Net Profit (mn) 3Q2015 % Change YoY Shell Oman Marketing Co. (SOMC)* Oman OMR 252.8 -7.9% – – 10.8 19.7% Source: Company data, DFM, ADX, MSM (*9M2015 results) Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 10/22 US Department of Labor Initial Jobless Claims 17-October 259k 265k 256k 10/22 US Department of Labor Continuing Claims 10-October 2,170k 2,186k 2,164k 10/22 US Federal Housing Finance Agency FHFA House Price Index MoM August 0.30% 0.50% 0.50% 10/22 US Bloomberg Bloomberg Consumer Comfort 18-October 43.5 -- 45.2 10/22 US Bloomberg Bloomberg Economic Expectations October 42.0 -- 44.5 10/23 US Markit Markit US Manufacturing PMI October 54.0 52.7 53.1 10/22 EU European Central Bank ECB Main Refinancing Rate 22-October 0.05% 0.05% 0.05% 10/22 EU European Central Bank ECB Deposit Facility Rate 22-October -0.20% -0.20% -0.20% 10/22 EU European Central Bank ECB Marginal Lending Facility 22-October 0.30% 0.30% 0.30% 10/23 EU Markit Markit Eurozone Manufacturing PMI October 52.0 51.7 52.0 10/23 EU Markit Markit Eurozone Services PMI October 54.2 53.5 53.7 10/23 EU Markit Markit Eurozone Composite PMI October 54.0 53.4 53.6 10/22 France INSEE Business Confidence October 101.0 100.0 100.0 10/22 France INSEE Manufacturing Confidence October 103.0 103.0 104.0 10/23 France Markit Markit France Manufacturing PMI October 50.7 50.2 50.6 10/23 France Markit Markit France Services PMI October 52.3 51.7 51.9 10/23 France Markit Markit France Composite PMI October 52.3 51.6 51.9 10/23 Germany Markit Markit/BME Germany Manufacturing PMI October 51.6 51.7 52.3 10/23 Germany Markit Markit Germany Services PMI October 55.2 53.9 54.1 10/23 Germany Markit Markit/BME Germany Composite PMI October 54.5 53.7 54.1 10/22 UK ONS Retail Sales Ex Auto Fuel YoY September 5.90% 4.70% 3.20% 10/22 UK ONS Retail Sales Inc Auto Fuel YoY September 6.50% 4.80% 3.50% 10/22 Spain INE Unemployment Rate 3Q2015 21.18% 21.89% 22.37% 10/22 Spain Ministerio de Ind., Energ Trade Balance August -3,194.6m – -1,396.1m 10/23 Italy ISTAT Industrial Orders MoM August -5.50% – 0.40% 10/23 Italy ISTAT Industrial Orders NSA YoY August 2.10% – 10.40% 10/23 Italy ISTAT Industrial Sales MoM August -1.60% – -1.10% 10/23 Italy ISTAT Industrial Sales WDA YoY August -2.40% – 2.30% 10/23 Italy ISTAT Retail Sales MoM August 0.30% – 0.30% 10/23 Italy ISTAT Retail Sales YoY August 1.30% – 1.60% 10/23 China The People's Bank of China 1-Year Lending Rate 23-October 4.35% – 4.60% 10/23 China The People's Bank of China Reserve Requirement (Major Ban 23-October 17.50% – 18.00% Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 59.84% 51.17% 26,116,517.53 GCC 5.83% 16.48% (32,081,143.56) Non-Qatari 34.32% 32.35% 5,964,626.03

- 3. Page 3 of 8 Earning Calendar Tickers Company Name Date of reporting 3Q2015 results No. of days remaining Status QNBK QNB Group 7-Oct-15 - Reported QIBK Qatar Islamic Bank 13-Oct-15 - Reported ABQK Al Ahli Bank 14-Oct-15 - Reported MRDS Mazaya Qatar 14-Oct-15 - Reported MCCS Mannai Corp. 16-Oct-15 - Reported CBQK Commercial Bank 18-Oct-15 - Reported QIGD Qatari Investors Group 19-Oct-15 - Reported DBIS Dlala Brokerage & Investment Holding Company 19-Oct-15 - Reported KCBK Al Khaliji 20-Oct-15 - Reported DOHI Doha Insurance 20-Oct-15 - Reported QEWS Qatar Electricity & Water Company 20-Oct-15 - Reported SIIS Salam International Investment 20-Oct-15 - Reported AKHI Al Khaleej Takaful Insurance 20-Oct-15 - Reported IHGS Islamic Holding Group 20-Oct-15 - Reported QIIK Qatar International Islamic Bank 20-Oct-15 - Reported GWCS Gulf Warehousing Company 21-Oct-15 - Reported QGTS Qatar Gas Transport Company (Nakilat) 21-Oct-15 - Reported QNCD Qatar National Cement Company 21-Oct-15 - Reported QCFS Qatar Cinema & Film Distribution Company 21-Oct-15 - Reported QIMD Qatar Industrial Manufacturing Company 22-Oct-15 - Reported WDAM Widam Food Company 22-Oct-15 - Reported QNNS Qatar Navigation (Milaha) 24-Oct-15 - Reported QATI Qatar Insurance Company 25-Oct-15 0 Due MARK Masraf Al Rayan 25-Oct-15 0 Due DHBK Doha Bank 25-Oct-15 0 Due QISI Qatar Islamic Insurance 25-Oct-15 0 Due QGRI Qatar General Insurance & Reinsurance 25-Oct-15 0 Due QOIS Qatar & Oman Investment 25-Oct-15 0 Due MCGS Medicare Group 25-Oct-15 0 Due GISS Gulf International Services 25-Oct-15 0 Due QGMD Qatar German Company for Medical Devices 25-Oct-15 0 Due UDCD United Development Company 26-Oct-15 1 Due QFLS Qatar Fuel Company 26-Oct-15 1 Due ERES Ezdan Real Estate Company 26-Oct-15 1 Due MERS Al Meera Consumer Goods Company 27-Oct-15 2 Due MPHC Mesaieed Petrochemical Holding Company 27-Oct-15 2 Due BRES Barwa Real Estate Company 27-Oct-15 2 Due ORDS Ooredoo 28-Oct-15 3 Due IQCD Industries Qatar 28-Oct-15 3 Due AHCS Aamal Company 29-Oct-15 4 Due NLCS National Leasing (Alijarah) 29-Oct-15 4 Due ZHCD Zad Holding Company 29-Oct-15 4 Due VFQS Vodafone Qatar 12-Nov-15 18 Due Source: QSE

- 4. Page 4 of 8 News Qatar Milaha bottom-line rises 7.6% QoQ in 3Q2015; in-line with our estimates – Qatar Navigation’s (Milaha) net profit rose 7.5% QoQ and 1.7% YoY in 3Q2015 to QR307.72mn, bang in-line with our estimates of QR307.58mn. Milaha Maritime & Logistics revenue grew by 35.8% YoY to QR255.67mn on the back of an increase in project and infrastructure activity in Qatar (container shipping and port volumes increased). Milaha Offshore reported revenue of QR198.36mn, growing by 12.4% YoY, mainly attributed to its diving services segment. Milaha Gas & Petrochem (MG&P) reported revenue of QR138.63mn. Revenue was driven by strong charter rates from its fully owned and operated product tankers and gas carriers. Moreover, MG&P bottom-line was aided by investments in associates. Milaha Capital’s performance was lackluster with revenue dropping by 54.8% YoY to QR87.49mn. The weak results were due subdued performance from the unit’s investment portfolio. Milaha Trading posted revenue of QR117.34mn, jumping by 19.8% YoY. The growth was driven by a pick-up in equipment sales. (QNBFS Research, QSE) WDAM net profit falls 15% QoQ in 3Q2015 – Widam Food Company’s (WDAM) net profit declined 15% QoQ to QR18.48mn in 3Q2015 as compared to QR21.72mn in 2Q2015. However, it surged 54.7% on YoY basis. The QoQ decline in net profit was due to a steep increase in general and administrative expenses (up 96% QoQ). In addition, revenue fell marginally on a QoQ basis to QR120.93mn (up 7.5% YoY). EPS fell to QR1.03 in 3Q2015 from QR1.21 in 2Q2015. (QSE, QNBFS Research) QGRI bottom-line plunges 59.4% QoQ in 3Q2015 – Qatar General Insurance & Reinsurance Company (QGRI) reported a 59.4% QoQ (76.1% YoY) drop in its 3Q2015 net profit to QR18.18mn. The net profit was primarily impacted by net claim rising 24.5% QoQ to QR35.96mn along with other expenses, which jumped 33.4% QoQ to QR64.76mn in 3Q2015. The net earned premiums declined only marginally by 0.7% QoQ (-4.9% YoY) and stood at QR47.86mn in 3Q2015. EPS declined to QR0.23 in 3Q2015 as compared to QR0.56 in 2Q2015. (QSE, QNBFS Research) QR1.29bn spend on medical bills under Seha scheme – Qatari Minister of Public Health, HE Abdullah Bin Khalid Al Qahtani has revealed that the medical bills of Qatari citizens within the Social Medical Insurance scheme (Seha) amounted to QR1.285bn since the beginning of the insurance system in July 2013 till October 21, 2015. He said the value of medical bills for citizens in the private health sector received by the National Health Insurance Company and audited in the first fiscal year (July 2013 to March 2014) and second fiscal year (April 2014 to March 2015) amounted to QR894mn, in addition to QR391mn in the period (April 1 to October 21, 2015). Mr. Abdullah refuted recent news that the total of the invoices received by the company from the private sector amounted to QR10bn. The Minister announced that the implementation of the third and the last phase of the insurance system will start in 2016 to include all residents in the state, including employees, workers, domestic helpers and visitors, noting that adding workers in the third phase will coincide with the opening of new hospitals next year for single workers. (Peninsula Qatar) Q-Post plans big push in online shopping – Qatar Postal Services Company (Q-Post) is planning to expand its presence in Europe, the US and Asia. The new service of Q-post, named Ship 2-Q, is expected to start early in 2016. Under the new service, Q-Post will provide a local address to its customers in America, Europe and Asia. The retailer will deliver packages to local addresses given by buyers in Qatar. Once the package is delivered to a local address, Q-Post will collect the package and ship it to the buyer’s local address in Qatar. This move will allow Qatari customers to buy goods even from those online retailers that do not offer shipping services to Qatar. (Peninsula Qatar) HMC to develop pharmacy residence program – Hamad Medical Corporation’s (HMC) Corporate Pharmacy Department has started a collaborative partnership with the American Society of Health System Pharmacists (ASHP) to develop an internationally accredited pharmacy residency program. The partnership is a key part of the Corporate Pharmacy Strategy 2015-2018 and supports HMC’s progression as an Academic Health System (AHS). (Peninsula Qatar) Moody’s: Qatar insurance market fastest growing in Gulf – According to Moody’s, Qatar has become the fastest growing insurance market in the Gulf Cooperation Council (GCC), registering a CAGR of 20.7% over 2006-2014; even as it presents scope for further growth. Qatar is also the third largest insurance market in the GCC, with total premiums of $2.2bn, about 10% of the regional premiums written. As per the report, the growth has accelerated recently with the 2013 reported premiums representing over 48% YoY growth and 2014 premiums representing a further growth of over 9%, driven by the implementation of large infrastructure projects to cater to the 2022 FIFA World Cup. Moody’s expect the high competition in Qatar insurance market to somewhat ease in the future mainly due to growing infrastructure projects and other growth drivers. (Gulftimes.com) ORDS gets IFC loan for network expansion in Myanmar – Ooredoo’s (ORDS) Myanmar operations has secured $150mn loan from the International Finance Corporation (IFC), which the company will use to co-finance its ambitious development of mobile phone infrastructure in the country. By 2015-end, Ooredoo’s network in Myanmar is expected to cover over 85% of the population. To date, Ooredoo has set up around 2,800 mobile phone towers across the country and targets to operate 3,000 towers by year-end. Ooredoo Myanmar CEO, Rene Meza said the loan will contribute to financing the rollout of the company’s national 3G mobile network in Myanmar, as well as the license payment and operating expenses. He said the operator will also increase its fiber cable capacity from presently 5,000 kilometers (km) to over 12,000km, as well as double its points of sales from around 90,000 until 2016. (Gulftimes.com) QDB: Qatar SMEs sign deals worth QR150mn at World Export Forum – Qatar Development Bank (QDB) CEO, Abdulaziz bin Nasser al-Khalifa has said that small and medium-sized enterprises (SMEs) have signed deals worth QR300mn, nearly half of the amount coming from Qatari companies, during the 2015 World Export Development Forum held recently in Doha. (Gulf- Times.com) Key US-Qatar economic and investment meet tomorrow – The US Department of State will hold the inaugural US-Qatar Economic and Investment Dialogue tomorrow, in Washington DC. The State Department said Secretary of State John Kerry and Secretary of Treasury Jacob J Lew will launch the event with their Qatari counterparts, Minister of Foreign Affairs HE Dr. Khalid bin Mohamed Al Attiyah and Minister of Finance HE. Ali Sherif Al Emadi. Qatar is a strategic partner of the US, and the two countries work closely across a range of issues. The Economic and Investment Dialogue represents a milestone that will strengthen the bilateral relationship that already includes record levels of trade and investment. (Peninsula Qatar) QATI expands in UAE, offers products online – Qatar Insurance Company (QATI) has expanded its presence in the UAE by making its personal insurance products available online to individual

- 5. Page 5 of 8 customers under the theme ‘Global Insurance - Local Assurance’. Senior Deputy Group President & CEO, Ali Al Fadala said the expansion into the direct personal insurance business in the UAE is part of company’s global strategy. (Peninsula Qatar) Al Rayan Bank’s real estate financing to UK-based GCC customers up 131% – Al Rayan Bank PLC (UK based subsidiary of MARK) has recorded a significant growth in the volume of property transactions it has financed in the UK in 2015, particularly from individuals from the Gulf Cooperation Council (GCC) region. The financing to the GCC investors had increased by 131% YoY in September 2015. The bank’s announcement comes just four months after it opened its exclusive private banking branch in Knightsbridge, to serve its premier and private banking clients from the GCC. (Peninsula Qatar) KPMG: Construction sector maturity improved – KPMG Director and Head of Infrastructure Advisory in Qatar, Mihir Shah has said that overall maturity of the construction sector in Qatar has improved over time due to large capital spend, improving technology and exposure to international best practice through tie-ups with international contractors. He believes that findings of KPMG’s Global Construction Project Owner’s Survey have very strong correlation with the construction industry in Qatar and the region at large. (Peninsula Qatar) EIA: Qatar 2014 crude exports hit 595,000 bpd – Citing OPEC estimates, the Qatar country report released by the US Energy Information Administration (EIA) has noted that Qatar had exported a total of 595,000 barrels per day (bpd) of crude oil and 522,000 bpd of refined petroleum products in 2014. Qatar sent all of its crude oil refined product exports to Asian countries in 2014. According to the EIA, most of Qatar’s refined products, an estimated 60%, went to Japan. Qatar, the world’s second-largest exporter of natural gas, exported nearly 4.3 Tcf (trillion cubic feet) in 2014. The country was again the world’s largest LNG exporter in 2014, accounting for 32% of global natural gas exports. Most of Qatar’s exports go to markets in Asia in the form of LNG, while the country sends a small amount of natural gas via the Dolphin Pipeline to the UAE and Oman. (Peninsula Qatar) Qatargas delivers 2,300 LNG cargoes to Japan customers – Qatar Petroleum president & CEO, Saad Sherida al-Kaabi said that Qatargas has successfully delivered around 2,300 LNG cargoes to Japanese customers since 1997. He was speaking at the annual reception hosted by Qatargas for Japanese partners, clients and contracting companies in Japan recently. (Gulf-Times.com) International US, Europe step up efforts on trade deal with new offers – According to negotiators for the US and the European Union (EU), the two parties have promised to cut tariffs on almost all types of imported goods in a bid to wrap up a free trade pact by the end of 2016. Although the main benefits of the Transatlantic Trade and Investment Partnership (TTIP) are seen in agreeing on regulation and common standards to cut business costs, the new market access offers mark an important step forward for the two-year-old talks, which have been languishing. Chief EU negotiator, Ignacio Garcia-Bercero said the new offers exchanged this week would eliminate duties on 97% of tariff lines - a lot more than Washington had first offered, but only a slight increase on Brussels’ initial proposal. Although average tariffs on the nearly $700bn a year worth of goods traded between the two blocs are below 3%, some individual products have import taxes in the double-digits. Negotiators declined to specify which goods were excluded from the new offers, but EU officials have said agriculture is one sensitive area where protections would remain. (Reuters) PMI: Eurozone business activity picks above expectations in October – Eurozone business activity picked up more than expected in October as new work for services companies flooded in at the fastest rate since April, but there was still no sign of inflationary pressures. Markit’s Composite Flash PMI, based on surveys of thousands of companies and considered a good guide to growth, came in at 54.0 in October, up from Septembers 53.6 and above even the most optimistic Reuters forecast of 53.4. A factory output index, which feeds into the composite PMI, dipped to 53.3 from 53.4 but manufacturers appeared to benefit from a weaker euro, as the new export orders index rose to a four-month high of 52.6. The survey data should be welcomed by the European Central Bank (ECB), coming more than six months after it embarked on a trillion-euro quantitative easing program to try and boost inflation and growth in the troubled bloc. (Reuters) ECB keeps rates unchanged at record low – The European Central Bank (ECB) kept interest rates unchanged, turning the focus to President Mario Draghi’s assessment of the economy for any clues on whether more stimulus is in the pipeline. The 25-member Governing Council left the main refinancing rate at a record-low of 0.05% on October 22. The deposit rate and the marginal lending rate stayed at minus 0.2% and 0.3%, respectively. The ECB is grappling with a complex scenario of mixed domestic economic signals, an uncertain global outlook, and divergent opinions on what is needed to combat feeble inflation. In the run-up to the meeting in Malta, Draghi and most of his colleagues said it is too early to decide whether to expand their €1.1tn bond-buying program, leaving economists and investors guessing when, if at all, he will commit to doing more. (Bloomberg) China cuts rates again as growth engine stalls – China’s central bank cut interest rates for the sixth time in less than a year, and again lowered the amount of cash that banks must hold as reserves in a bid to jump start growth in its stuttering economy. The People’s Bank of China (PBOC) said on its website that it was lowering the one-year benchmark bank lending rate by 25 basis points (bps) to 4.35%, effective from October 24. The one-year benchmark deposit rate was lowered by 25 bps to 1.50%. The reserve requirement ratio (RRR) was also cut by 50 bps for all banks, taking the ratio to 17.5% for the biggest lenders, while banks that lend to agricultural firms and small companies received another 50-bps reduction to their RRR. China’s policy loosening came a day after the European Central Bank said it could give a bigger policy jolt to the economy as soon as December to fight falling prices. (Reuters) Regional Moody’s: GCC insurance market poised for further growth – According to a report by Moody’s Investors Service, the GCC remains the fastest growing insurance region, outpacing all other markets with top-line growth of close to 15% in 2014. Moody’s said the GCC insurance industry has more than tripled between 2006 and 2014, with insurance premiums increasing to $22.2bn from $6.4bn. This represents a CAGR of 16.8% over the period, although growth in each market varies, ranging from 20.7% CAGR in Qatar to 6.4% CAGR in Kuwait. Saudi Arabia is the second largest insurance market in the GCC, with total premiums of $8.1bn in 2014. Saudi represented over 36% of the GCC premiums written in 2014. Saudi insurers are benefiting from a strong economic operating environment, with the sovereign rated Aa3 by Moody’s, driven by its very high economic and fiscal strengths. With a CAGR of 20.3% between 2006 to 2014, Saudi was the second fastest growing insurance market in the GCC after Qatar. As per the report, growth in the sector will be driven by, inter alia, increased economic wealth in the region, together with increased insurance penetration. Currently, insurance penetration within the GCC is well below 2% of the GDP (besides the UAE and Bahrain), as compared to 5.2% in Austria, which has similar premium size to the GCC and much lower than that of advanced economies such as

- 6. Page 6 of 8 in the US (7.3%) and UK (10.6%). Moody’s expects significant further growth driven by the region’s high economic and fiscal strength, despite slower-than-expected oil price recovery. The sector growth would continue to be supported by governments making an increasing number of insurance products compulsory. (GulfBase.com) ATMC discloses use of rights issue proceeds – Alinma Tokio Marine Company (ATMC) has said that gross proceeds from its rights issue, which had happened in August 2015, amounted to SR250mn and net SR247.14mn, after deducting IPO expenses of SR2.86mn. An amount of SR25mn has been added to the statutory deposit to align it with the capital increase, while SR222.14mn has been invested in liquidity fund for short-term. (Tadawul) Dallah Healthcare discloses allocation of IPO proceeds – Dallah Healthcare Holding has said that gross proceeds from its IPO, which had happened in November 2012, amounted to SR539.6mn and net SR513.1mn, after deducting IPO expenses of SR26.5mn. The company paid SR38mn for the acquisition of a pharmaceutical, a herbal and cosmetics factory, while it paid SR35.5mn for a subscription in Dr. Mohamed Alfaqeeh Co., targeting to set up a hospital in east Riyadh. Dallah Healthcare paid SR133.8mn against buying of land in west Riyadh area and SR64.6m against payments for engineering works, consultation, land survey and excavation digging and designs. The company said that an initial operation of Namar Hospital is expected in 3Q2017. The hospital project was 15.8% completed at the end of September 2015. (Tadawul) Zain Saudi appoints Chairman – Zain Saudi has appointed Prince Naif Bin Sultan Bin Mohammed Bin Saud Al Kabeer as its Chairman. He will replace Farhan Bin Naif Al-Jarbaa, who submitted his resignation on October 11, 2015. (Reuters) Mobily to agree new loan covenants by 2015-end – Etihad Etisalat Company (Mobily) CEO Ahmad Farroukh has said that the company will reach an agreement with its lenders to set new covenants for some outstanding loans by 2015-end. Farroukh said Ramadan and the month of holidays in August 2015 had contributed to delays. The failure to agree on new loan covenants led some of Mobily’s borrowings to be classified as current liabilities. Mobily had said in March 2015 that a total of SR2.4bn of financing facilities will be due in 2015 and SR2.1bn in 2016, with the rest of the company’s debt spread across the period until 2024. (Reuters) APICORP completes $500mn Sukuk issuance – Arab Petroleum Investments Corporation (APICORP) has successfully placed a $500mn, five-year Sukuk as part of its $3bn Sukuk. The total order book for the issuance was $832mn, meaning it was roughly 1.7x oversubscribed, with over 40 participating investors. The Sukuk witnessed around 20% participation from Asia and Europe, with strong interest across all asset classes. The transaction marks a strategic step forward for APICORP in becoming a regular issuer of Sukuk in the global markets. It positions the company’s credit alongside its multilateral development bank peers. (Peninsula Qatar) Colliers: KSA targets higher industrial sector contribution to GDP – Colliers International, in its Jeddah Warehouse & Logistics Market Overview, has said that the government of Saudi Arabia is targeting a contribution of 20% of the GDP from the industrial sector by 2020, up from 10% in 2013. Jeddah’s warehouse, logistics and manufacturing market is set to play a key role in meeting this objective. As per the report, approximately 45mn square meter (sqm) of land has been allocated to Modon, a quasi- government organization that promotes investment and job creation in the industrial manufacturing sector through the development of industrial cities. Of this, 25mn sqm has already been developed in Jeddah, with the remaining 20mn sqm still in the construction pipeline. (GulfBase.com) KSA mulls wide range of fiscal reforms – International Monetary Fund (IMF) Director, Middle East & Central Asia Department, Masood Ahmed has said that the Saudi Arabian government is planning a wide range of possible adjustments to its spending and revenue policies to cope with the blow to its finances due to cheap oil prices. According to IMF estimates, Riyadh faces a record budget deficit of well over $100bn in 2015, amounting to 21.6% of the GDP, as low oil prices slash the revenues of the world’s largest crude exporter. Masood said Saudi fiscal reforms could come in four main areas. One would be adjusting costly subsidies that keep domestic energy prices low; the second would be boosting non-oil revenues by, for example, introducing a value-added tax. The government could also save money by improving the efficiency of public investment projects, and control current spending by rationalizing the state sector wage bill. (GulfBase.com) Jadwa: KSA oil exports up 3% YoY during January-August 2015 – Jadwa Investment, in its Quarterly Oil Market Update report, has said that Saudi Arabia would not change course on its strategy of retaining market share. The country’s exports are expected to remain at around current levels for the remainder of 2015 and 2016. Latest available data shows that during January-August 2015, Kingdom’s exports were up 3% YoY at 7.38mn barrels per day (bpd), below 10-year highs of 7.54mn bpd, recorded in 2012. Both Saudi and Iraq saw the largest YoY increases in OPEC supply in 3Q2015, pushing the organization’s output to a two-year high of 32mn bpd. As per Jadwa economists, the policy implemented by Saudi over regaining market share seems to be paying off with Saudi crude exports amounting to around 8.1% of the global market since November 2014, after falling to 7.9% in 2014. (GulfBase.com) IMF raises 2015 Gulf fiscal deficit forecast – The International Monetary Fund (IMF) has warned that the regional economies could burn through their financial buffers within five years as they face a $700bn deficit. The fund lowered its projection for the Gulf growth to 3.3% in 2015, down from a 3.4% projection in May 2015, as lower oil prices batter the region. The fund expects the regional growth to slow further next year to around 2.8%. The IMF expects the Gulf fiscal deficit to reach 13% of the GDP in 2015 as compared to a deficit of 8% it had forecasted in May 2015. According to the IMF projections, the UAE is expected to run a fiscal deficit of about 5.5% of the GDP in 2015, with further deficits in 2016 and 2017. However, the country may achieve a balance thanks to its diversified economy. Saudi Arabia is forecasted to run a fiscal deficit of 20% of the GDP in 2015 and may face budget deficits over the next five years. The IMF has urged the Gulf countries to adjust to the new oil price and implement a slew of measures to deal with the new realities that include more entrants to the job market. (GulfBase.com) Arcadis: KSA regional leader in built asset wealth in 2015 – According to the latest Global Built Asset Wealth Index published by Arcadis, Saudi Arabia is the region’s leader in built asset wealth. On a regional basis, Saudi Arabia has a built asset wealth of $3.15tn, while the UAE and Qatar rank at $1.33tn and $0.45tn, respectively. The index, which was compiled for Arcadis by the Center for Economics and Business Research (CEBR), calculates the value of all the buildings and infrastructure that contribute to economic productivity in 32 countries, which collectively make up 87% of the global GDP. Total built asset wealth globally now stands at an estimated $218tn, which is the equivalent to $30,700 per person alive today. (GulfBase.com) Germany gives EA January extension for Air Berlin code-share – Etihad Airways (EA) has won a temporary extension from the

- 7. Page 7 of 8 German transport ministry for code-sharing with Air Berlin that was set to expire on October 25, 2015 amid a government dispute over aviation rights. The German government said the two carriers could continue their cooperation till January 15. The German government had not granted EA and Air Berlin approval to maintain the code-share agreement for the winter season that begins October 25, 2015 and runs into March 2016. (Bloomberg, WSJ) Du signs major deals to expand reach, services – Emirates Integrated Telecommunications Company (Du) has signed a number of partnerships at the Gitex Technology Week with Oman Telecommunications Company (Omantel), Vodafone, and Drake & Scull (DSI). Omantel partnership will enhance Du’s reach to Oman, Vodafone agreement brings a new breed of Internet of Things (IoT) services to the UAE, and DSI deal is based on business communications. The partnership agreement with Omantel provides an opportunity for Du to expand the regional reach of its IPTV platform. As per the agreement with DSI, Du will provide its cutting edge telecommunication services to DSI to integrate all aspects of business telecommunication within the UAE as well as exploring the possibility of implementing international leased line circuits. Vodafone deal is an extension to its existing partnership with Vodafone to provide Machine to Machine (M2M) solutions to the UAE businesses. This new technology will allow more complex data to be shared via IoT- allowing for more sophisticated services. (GulfBase.com) Emaar to plan mall, hotel venture for Expo 2020 – According to sources, Emaar Properties is planning to build a shopping center and several hotels on the Dubai site that will be used to stage the World Expo 2020. Emaar will build the properties in a joint venture with Dubai World Trade Centre. Reportedly, the hotels, planned for the Expo 2020 site, will be designed to cater to business travelers. (GulfBase.com) MAF picks banks for a potential dollar Sukuk – According to sources, Majid Al Futtaim (MAF) has picked banks to arrange a potential dollar-denominated benchmark size Sukuk, and is planning to issue it before 2015-end. MAF has picked banks including Standard Chartered, HSBC, Dubai Islamic Bank and Abu Dhabi Islamic Bank to arrange the Sukuk issue. The Sukuk will be issued under its $1.5bn issuance program through its Cayman Islands-based entity, MAF Sukuk. (GulfBase.com) Dubai South secures AED4.16bn credit facility at Expo Milan – Italian export credit company, SACE, has announced an AED4.16bn credit facility to assist the development of Dubai South. The funding can be used for deals with Italian contractors or other goods and service providers from Italy for the development of Dubai South, which is the world’s first purpose-built Aerotropolis being overseen by Dubai Aviation City Corporation (Dacc). Dubai South is a 145 square kilometers city being built around the Al Maktoum International Airport. (GulfBase.com) Abu Dhabi Media signs MoU with Etisalat – Abu Dhabi Media and Emirates Telecommunication Corporation (Etisalat) have signed an MoU to improve efficiency through the use of cutting-edge platforms and technology. As part of the agreement, the two sides will exchange knowledge, studies and institutional experiences. The partnership will also involve improved wireless coverage and fixed telecom services. (GulfBase.com) CBRE: Abu Dhabi anticipates 8,500 new housing units annually over three years – According to a study by CBRE, Abu Dhabi is anticipating around 8,500 new housing units per annum over the next three years to be added to the market. However, in the last five years, the arrival of housing units in the capital was as high as 11,000 per annum. The study said while there are clearly some headwinds for the residential market, the low level of expected completions over the next three years will help provide a cushion against the ill effects of the declining commercial market and a slowdown in some other sectors of the economy, which ultimately influences demand for housing. Among residential property types, smaller units such as studios and one-bedroom apartment units remain in strong demand. (GulfBase.com) KFH 3Q2015 net profit surges 21.6% YoY – Kuwait Finance House (KFH) has reported a net profit of KD43.4mn in 3Q2015 as compared to KD35.7mn in 3Q2014, representing an increase of 21.6% YoY. The Islamic lender made a net profit of KD105.7mn in 9M2015, up 17.3% as compared to 9M2014. In September 2015, KFH ruled out a sale or merger for its Malaysian unit. Instead, the bank will begin restructuring the unit with immediate effect. (Reuters) Equate to buy ME Global for $3.2bn – Boubyan Petrochemical Company has said that its affiliate Equate has signed a $3.2bn deal to buy ME Global from Dow Chemical of the US. Under the terms of the agreement, around $200mn of the total value would go towards paying down loans and commitments of ME Global. ME Global is a 50-50 ethylene glycol producing joint venture between Dow Chemical and Petrochemical Industries Company, a unit of Kuwait Petroleum Corporation. Boubyan owns 9% stake in Equate. (Reuters) Sohar Power seeks shareholders’ nod for 7.1% cash dividend – Sohar Power Company has invited its shareholders to consider and approve the proposal to distribute 7.1% cash dividends (7 baizas per share) based on the audited financial statements for the period ended 30 September 2015. Shareholders, who are registered on the ordinary general meeting (OGM) date i.e. November 11, 2015, will be eligible to receive the dividend. (MSM) OA to buy 20 ‘737 MAX’ aircraft from Boeing – Boeing Company has said that it booked 20 firm orders for its 737 MAX single-aisle aircraft from Oman Air (OA). The order from OA nearly doubles its 737 fleet. OA’s order includes conversions of six 737 NG planes to 737 MAX jets, for a net gain of 14 in Boeing's order book. According to the OA website, OA currently operates 21 Boeing 737 aircraft, and has no Airbus A320s. (Reuters) Bahrain Bourse announces Ashoura holiday – Bahrain Bourse will remain officially closed on October 25 and 26 on the occasion of Ashoura for the year 1437 Hijri. The Bourse will resume business on October 27, 2015. (Bahrain Bourse) Batelco says assessing options for Jordan unit – Bahrain Telecommunications Company (Batelco) has responded to media reports regarding its Jordan unit’s sale. The telecom operator said it continues to assess options for Umniah Mobile Company but has not decided any course or entered into any agreements in respect of any option. Umniah had over 3mn customers in Jordan and a market share of about 32% in 2014. (Bahrain Bourse)

- 8. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 8 of 8 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 Sep-11 Sep-12 Sep-13 Sep-14 Sep-15 QSE In dex S&P Pan Arab S&P GCC (1.3%) (0.7%) (0.2%) 0.4% (0.2%) (1.0%) (1.0%) (1.6%) (0.8%) 0.0% 0.8% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,164.56 (0.1) (1.1) (1.7) MSCI World Index 1,706.61 1.0 1.4 (0.2) Silver/Ounce 15.83 (0.2) (1.5) 0.8 DJ Industrial 17,646.70 0.9 2.5 (1.0) Crude Oil (Brent)/Barrel (FM Future) 47.99 (0.2) (4.9) (16.3) S&P 500 2,075.15 1.1 2.1 0.8 Crude Oil (WTI)/Barrel (FM Future) 44.60 (1.7) (5.6) (16.3) NASDAQ 100 5,031.86 2.3 3.0 6.2 Natural Gas (Henry Hub)/MMBtu 2.27 (3.2) (4.8) (24.4) STOXX 600 377.36 0.9 0.6 0.3 LPG Propane (Arab Gulf)/Ton 42.63 (0.3) (3.7) (13.0) DAX 10,794.54 1.8 3.4 (0.2) LPG Butane (Arab Gulf)/Ton 59.00 (0.4) (2.3) (9.9) FTSE 100 6,444.08 0.8 0.3 (3.4) Euro 1.10 (0.8) (2.9) (8.9) CAC 40 4,923.64 1.4 1.3 4.9 Yen 121.47 0.6 1.7 1.4 Nikkei 18,825.30 1.6 1.3 6.3 GBP 1.53 (0.5) (0.8) (1.7) MSCI EM 868.56 1.2 0.4 (9.2) CHF 1.02 (0.6) (2.6) 1.6 SHANGHAI SE Composite 3,412.43 1.5 0.7 3.2 AUD 0.72 0.1 (0.7) (11.7) HANG SENG 23,151.94 1.3 0.4 (1.9) USD Index 97.13 0.8 2.7 7.6 BSE SENSEX 27,470.81 0.9 0.6 (2.9) RUB 62.37 (0.3) 1.8 2.7 Bovespa 47,596.59 (0.3) (0.8) (35.4) BRL 0.26 0.7 1.1 (31.7) RTS 872.86 1.4 (0.9) 10.4 138.7 114.6 110.7