27 April Daily market report

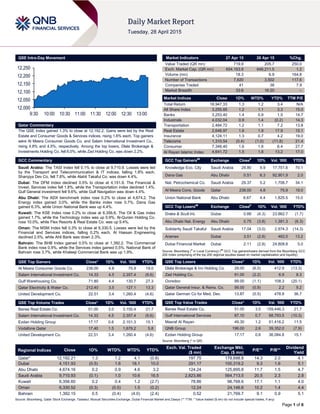

- 1. Page 1 of 6 QSE Intra-Day Movement Qatar Commentary The QSE Index gained 1.3% to close at 12,192.2. Gains were led by the Real Estate and Consumer Goods & Services indices, rising 1.6% each. Top gainers were Al Meera Consumer Goods Co. and Salam International Investment Co., rising 4.8% and 4.5%, respectively. Among the top losers, Dlala Brokerage & Investments Holding Co. fell 6.0%, while Zad Holding Co. was down 2.2%. GCC Commentary Saudi Arabia: The TASI Index fell 0.1% to close at 9,710.9. Losses were led by the Transport and Telecommunication & IT indices, falling 1.8% each. Sharqiya Dev Co. fell 7.8%, while Alahli Takaful Co. was down 4.4%. Dubai: The DFM Index declined 0.5% to close at 4,151.9. The Financial & Invest. Services index fell 1.8%, while the Transportation index declined 1.4%. Gulf General investment fell 9.6%, while Gulf Navigation was down 4.4%. Abu Dhabi: The ADX benchmark index rose 0.2% to close at 4,674.2. The Energy index gained 3.0%, while the Banks index rose 0.7%. Dana Gas gained 6.3%, while Union National Bank was up 4.4%. Kuwait: The KSE Index rose 0.2% to close at 6,356.6. The Oil & Gas index gained 1.7%, while the Technology index was up 0.9%. Al-Qurain Holding Co. rose 10.0%, while Flex Resorts & Real Estate Co. was up 9.4%. Oman: The MSM Index fell 0.3% to close at 6,330.5. Losses were led by the Financial and Services indices, falling 0.2% each. Al Hassan Engineering declined 2.5%, while Ahli Bank was down 2.3%. Bahrain: The BHB Index gained 0.5% to close at 1,392.2. The Commercial Bank index rose 0.9%, while the Services index gained 0.5%. National Bank of Bahrain rose 3.7%, while Khaleeji Commercial Bank was up 1.9%. QSE Top Gainers Close* 1D% Vol. ‘000 YTD% Al Meera Consumer Goods Co. 238.00 4.8 75.9 19.0 Salam International Investment Co. 14.33 4.5 2,357.4 (9.6) Gulf Warehousing Co. 71.80 4.4 130.7 27.3 Qatar Electricity & Water Co. 212.40 3.5 127.1 13.3 United Development Co. 22.51 3.4 1,260.4 (4.6) QSE Top Volume Trades Close* 1D% Vol. ‘000 YTD% Barwa Real Estate Co. 51.00 3.0 3,155.4 21.7 Salam International Investment Co. 14.33 4.5 2,357.4 (9.6) Ezdan Holding Group 17.17 0.6 2,101.3 15.1 Vodafone Qatar 17.40 1.5 1,679.2 5.8 United Development Co. 22.51 3.4 1,260.4 (4.6) Market Indicators 27 Apr 15 26 Apr 15 %Chg. Value Traded (QR mn) 719.9 205.7 250.0 Exch. Market Cap. (QR mn) 654,163.9 646,211.5 1.2 Volume (mn) 18.3 6.9 164.8 Number of Transactions 7,620 3,502 117.6 Companies Traded 41 38 7.9 Market Breadth 33:6 16:20 – Market Indices Close 1D% WTD% YTD% TTM P/E Total Return 18,947.33 1.3 1.2 3.4 N/A All Share Index 3,255.85 1.2 1.1 3.3 15.0 Banks 3,253.40 1.4 0.9 1.5 14.7 Industrials 4,032.04 0.9 1.4 (0.2) 14.3 Transportation 2,484.72 1.2 1.1 7.2 13.8 Real Estate 2,646.97 1.6 1.9 17.9 15.1 Insurance 4,124.11 1.3 0.7 4.2 19.0 Telecoms 1,310.54 (0.4) (1.0) (11.8) 21.4 Consumer 7,348.40 1.6 1.8 6.4 27.7 Al Rayan Islamic Index 4,641.72 1.5 1.8 13.2 17.0 GCC Top Gainers## Exchange Close# 1D% Vol. ‘000 YTD% Knowledge Eco. City Saudi Arabia 28.80 9.9 17,751.6 70.1 Dana Gas Abu Dhabi 0.51 6.3 92,901.9 2.0 Nat. Petrochemical Co. Saudi Arabia 29.37 5.2 1,708.7 34.1 Al Meera Cons. Goods Qatar 238.00 4.8 75.9 19.0 Union National Bank Abu Dhabi 6.67 4.4 1,825.5 15.0 GCC Top Losers## Exchange Close# 1D% Vol. ‘000 YTD% Drake & Scull Int. Dubai 0.88 (4.3) 23,862.7 (1.7) Abu Dhabi Nat. Energy Abu Dhabi 0.75 (3.8) 1,381.3 (6.3) Solidarity Saudi Takaful Saudi Arabia 17.04 (3.0) 2,974.3 (14.3) Aramex Dubai 3.51 (2.8) 462.0 13.2 Dubai Financial Market Dubai 2.11 (2.8) 24,808.8 5.0 Source: Bloomberg ( # in Local Currency) ( ## GCC Top gainers/losers derived from the Bloomberg GCC 200 Index comprising of the top 200 regional equities based on market capitalization and liquidity) QSE Top Losers Close* 1D% Vol. ‘000 YTD% Dlala Brokerage & Inv Holding Co. 29.00 (6.0) 412.9 (13.3) Zad Holding Co. 91.00 (2.2) 6.9 8.3 Ooredoo 99.00 (1.1) 108.3 (20.1) Qatar General Insur. & Reins. Co. 56.00 (0.9) 2.2 9.2 Qatar German Co for Med. Dev. 13.87 (0.5) 478.9 36.7 QSE Top Value Trades Close* 1D% Val. ‘000 YTD% Barwa Real Estate Co. 51.00 3.0 159,446.3 21.7 Gulf International Services 87.10 0.7 68,793.5 (10.3) Masraf Al Rayan 49.30 1.2 51,416.2 11.5 QNB Group 196.00 2.6 39,352.0 (7.9) Ezdan Holding Group 17.17 0.6 36,084.8 15.1 Source: Bloomberg (* in QR) Regional Indices Close 1D% WTD% MTD% YTD% Exch. Val. Traded ($ mn) Exchange Mkt. Cap. ($ mn) P/E** P/B** Dividend Yield Qatar* 12,192.21 1.3 1.2 4.1 (0.8) 197.75 179,698.8 14.3 2.0 4.1 Dubai 4,151.93 (0.5) 1.6 18.1 10.0 291.17 100,319.2 9.3 1.6 5.1 Abu Dhabi 4,674.16 0.2 0.9 4.6 3.2 124.24 125,895.8 11.7 1.5 4.7 Saudi Arabia 9,710.93 (0.1) 1.0 10.6 16.5 2,823.86 564,713.5 20.5 2.3 2.8 Kuwait 6,356.60 0.2 0.4 1.2 (2.7) 78.86 98,768.6 17.1 1.1 4.0 Oman 6,330.52 (0.3) (0.5) 1.5 (0.2) 12.24 24,146.6 10.2 1.4 4.4 Bahrain 1,392.15 0.5 (0.4) (4.0) (2.4) 0.52 21,769.7 9.1 0.9 5.1 Source: Bloomberg, Qatar Stock Exchange, Tadawul, Muscat Securities Exchange, Dubai Financial Market and Zawya (** TTM; * Value traded ($ mn) do not include special trades, if any) 12,000 12,050 12,100 12,150 12,200 12,250 9:30 10:00 10:30 11:00 11:30 12:00 12:30 13:00

- 2. Page 2 of 6 Qatar Market Commentary The QSE Index gained 1.3% to close at 12,192.2. The Real Estate and Consumer Goods & Services indices led the gains. The index rose on the back of buying support from non-Qatari shareholders despite selling pressure from Qatari and GCC shareholders. Al Meera Consumer Goods and Salam International Investment were the top gainers, rising 4.8% and 4.5%, respectively. Among the top losers, Dlala Brokerage & Investments Holding Co. fell 6.0%, while Zad Holding Co. was down 2.2%. Volume of shares traded on Monday rose by 164.8% to 18.3mn from 6.9mn on Sunday. Further, as compared to the 30-day moving average of 8.3mn, volume for the day was 121.2% higher. Barwa Real Estate Co. and Salam International Investment Co. were the most active stocks, contributing 17.2% and 12.9% to the total volume respectively. Source: Qatar Stock Exchange (* as a % of traded value) Ratings, Earnings and Global Economic Data Ratings Updates Company Agency Market Type* Old Rating New Rating Rating Change Outlook Outlook Change QNB Group (QNBK) Fitch Qatar LT IDR/ST IDR/VR/SR/SRF AA-/F1+/a/1/AA- AA-/F1+/a/1/AA- – Stable – Commercial Bank of Qatar (CBQK) Fitch Qatar LT IDR/ST IDR/VR/SR/SRF A+/F1/bbb/1/A+ A+/F1/bbb/1/A+ – Stable – Qatar Islamic Bank (QIBK) Fitch Qatar LT IDR/ST IDR/VR/SR/SRF A+/F1/bbb/1/A+ A+/F1/bbb/1/A+ – Stable – Doha Bank (DHBK) Fitch Qatar LT IDR/ST IDR/VR/SR/SRF A+/F1/bbb/1/A+ A+/F1/bbb/1/A+ – Stable – Qatar International Islamic Bank (QIIK) Fitch Qatar LT IDR/ST IDR/VR/SR/SRF A+/F1/bb+/1/A+ A+/F1/bb+/1/A+ – Stable – Al Khalij Commercial Bank (KCBK) Fitch Qatar LT IDR/ST IDR/VR/SR/SRF A+/F1/bbb-/1/A+ A+/F1/bbb-/1/A+ – Stable – Ahli Bank (ABQK) Fitch Qatar LT IDR/ST IDR/VR/SR/SRF A+/F1/bbb-/1/A+ A+/F1/bbb-/1/A+ – Stable – Source: News reports (* LT – Long Term, ST – Short Term, FSR – Financial Strength Rating, FCR – Foreign Currency Rating, LCR – Local Currency Rating, IDR – Issuer Default Rating, SR – Support Rating, LC – Local Currency, Viability Rating – VR, Support Rating Floor – SRF) Earnings Releases Company Market Currency Revenue (mn) 1Q2015 % Change YoY Operating Profit (mn) 1Q2015 % Change YoY Net Profit (mn) 1Q2015 % Change YoY Agthia Group Abu Dhabi AED 434.9 11.5% 57.1 18.0% 59.2 21.6% Ooredoo Kuwait Kuwait KD 174.3 -4.6% – – 2.2 -88.9% Muscat National Holding Co. (MNH) Oman OMR 4.1 -2.4% – – 0.3 NA Shell Oman Marketing Co. (SOMC) Oman OMR 80.2 -20.6% – – 2.6 -2.6% Construction Materials Industries & Contracting (CMI) Oman OMR 0.7 18.6% – – 0.0 NA Oman National Investment Corporation Holding (ONIC) Oman OMR 3.7 -15.2% – – 1.3 -47.7% BMMI Bahrain BHD 22.8 -12.0% 2.6 6.2% 3.0 1.6% Source: Company data, DFM, ADX, MSM Global Economic Data Date Market Source Indicator Period Actual Consensus Previous 04/27 US Markit Markit US Composite PMI April 57.4 – 59.2 04/27 US Markit Markit US Services PMI April 57.8 58.8 59.2 04/27 Germany Destatis Import Price Index MoM March 1.00% 0.40% 1.40% 04/27 Germany Destatis Import Price Index YoY March -1.40% -2.00% -3.00% 04/27 UK CBI CBI Trends Total Orders April 1.0 4.0 0.0 04/27 UK CBI CBI Trends Selling Prices April -3.0 2.0 4.0 04/27 UK CBI CBI Business Optimism April 3.0 19.0 15.0 04/27 China NBS Industrial Profits YoY March -0.40% – – Source: Bloomberg (s.a. = seasonally adjusted; n.s.a. = non-seasonally adjusted; w.d.a. = working day adjusted) Overall Activity Buy %* Sell %* Net (QR) Qatari 61.54% 69.10% (54,453,782.11) GCC 5.13% 5.95% (5,889,891.20) Non-Qatari 33.34% 24.95% 60,343,673.31

- 3. Page 3 of 6 News Qatar QNNS net profit edges up YoY to QR364.5mn in 1Q2015 – Milaha reported a net income of QR364.5mn; in-line with our estimate of QR370.3mn (variation of 1.6%). Net income moved up by 4.3% YoY (59.6% QoQ) to QR364.5mn in 1Q2015 on the back of robust core earnings. The company’s operating revenues grew 12.4% YoY to QR785.7mn, while operating profit grew by 2.1% YoY to QR279.2mn. Milaha’s core segments – maritime & logistics; gas & petrochemical as well as offshore – improved their combined bottom-line by 69.8% YoY. The continued strong growth in trade volumes, driven by the ramp-up in project activity in Qatar, resulted in a 25% increase in revenue and a 174.9% increase in net profit for Milaha Maritime & Logistics. Gas & Petrochemical segment’s revenue jumped 39% and net profit rose by 45.1%, on the back of robust performance of its fully owned and operated product tanker and gas carriers as well as higher VLGC rates relative to 1Q2014. In addition, the segment benefited from the full-year effect of 19 harbor vessels, some of which were received through mid-2014. Further, Milaha Offshore fared significantly well, driven by the steep decline in oil prices and the cutbacks on capital spending by oil majors globally. However, Milaha Capital was negatively impacted by the volatility in Qatar’s equities market in 1Q2015, with its net income dropping by 30.7%. (QNBFS Research, Gulf- Times.com) QIGD reveals QR63mn net profit in 1Q2015 – Qatari Investors Group (QIGD) posted a net profit of QR63mn in 1Q2015 as compared to QR58.6mn in 1Q2014. The EPS amounted to QR0.51 in 1Q2015 versus QR0.47 in 1Q2014. (QSE) Fitch affirms 6 Qatari Banks at 'A+'; Affirms QNBK at 'AA-' – Fitch Ratings has affirmed the Long-term Issuer Default Ratings (LT IDR) of Commercial Bank of Qatar (CBQK), Doha Bank (DHBK), Qatar Islamic Bank (QIBK), Al Khalij Commercial Bank (KCBK) , Qatar International Islamic Bank (QIIK) and Ahli Bank (ABQK) at 'A+'. Fitch has also affirmed QNB Group’s (QNBK) LT IDR at 'AA-'. The outlooks on all the LT IDRs are Stable. (Reuters) IHGS BoD meets on May 4 to discuss capital increase – Islamic Holding Group’s (IHGS) board of directors (BoD) will meet on May 4, 2015 to discuss the terms, conditions and date of the increase of company’s capital by 50% as well as determine the premium after taking into consideration the assessment of the fair value prepared by KPMG. (QSE) GOIC opens up QR500mn projects in ‘Invest in Qatar 2015’ forum; signs MoU with Manateq – The Gulf Organization for Industrial Consulting (GOIC) has offered investment opportunities worth QR500mn during the launching of the first “Invest in Qatar 2015” held on April 27 in Doha. GOIC Secretary General Abdulaziz bin Hamad al-Ageel said GOIC has prepared a number of investment opportunities in Qatar in promising industrial sectors, notably pharmaceuticals, food, green building materials, recycling, petrochemicals, and aluminum. The total value of these investment opportunities is estimated to be around QR500mn. He further added that these projects would create technical and administrative job opportunities after implementation. Meanwhile, GOIC and special economic zone developer & operator, Manateq, have signed a memorandum of understanding (MoU) to attract “added-value companies” to the country. The MoU will provide Manateq access to GOIC’s data base, which could help identify industrial investment opportunities in key promising industries in Qatar and the Gulf Cooperation Council (GCC) region. (Gulf-Times.com) Qatar to host Meeting of GCC Committee of Planning and Development Undersecretaries – Qatar, represented by the Ministry of Development Planning & Statistics (MDPS), will host the 31st Meeting of the Committee of Undersecretaries and Deputies of Planning & Development Agencies in the Gulf Cooperation Council (GCC) States on April 27 and 28. A proposal to establish a GCC Center for Planning & Development Research will be discussed during the meeting. The undersecretaries will also consider mechanisms for the funding of projects to support small businesses, including mobilization of resources from private institutions. The challenges faced by small businesses in the GCC region will also come under the spotlight. (QSA) South Korea plans to make major investments in Qatar – According to a senior official of the Korean Embassy in Qatar, South Korea is planning to carry out huge investments in Qatar, especially in the energy-intensive downstream industries, aiming to reduce its huge trade deficit with the Gulf state. The trade volume between Qatar and the Republic of Korea stood at $26.63bn in 2014, marginally down as compared to $27bn in 2013. Qatari exports to South Korea in 2014 stood at $25.73bn, while imports totaled $905m with the trade balance highly lopsided in favor of Qatar, largely due to the huge imports of Qatari gas by South Korea. (Peninsula Qatar) International Markit: US services sector growth eases in April – The US services sector expansion eased slightly in April 2015 as the Purchasing Managers Index (PMI) of Markit’s preliminary services sector has slipped to 57.8, from a final reading of 59.2 in March, which has been the highest level since August 2014. The services index's new business component pulled back slightly from March 2015; whereas Markit's April reading of employment at service companies has risen to a 10-month high of 55.4 from 54.0 in March. Further, Markit's composite PMI has dropped to 57.4 in April, from 59.2 in March. Chris Williamson, Chief Economist at Markit, said that the survey suggested an accelerated annual GDP growth to around 3% in 2Q2015, from a quite anemic pace of around 1% in 1Q2015. (Reuters) GTAI: Germany receives €3.2bn foreign investment in 2014 – According to a report by Germany’s economic development agency, Germany Trade & Invest (GTAI), Germany received record-high foreign investments worth €3.2bn in 2014. Foreign investors initiated 1,199 new projects in the country in 2014, which is 20% higher than 2013; the total value of projects has also risen by 18.5% in 2014, from €2.7bn in 2013. China provided the highest number of investors, pushing the US down to the second place. China launched 190 projects in Germany during 2014, 37% higher than 2013. US investors also carried out 168 new projects while Swiss investors have undertaken 130 projects. GTAI also recorded 489 M&A deals conducted by foreign investors. GTAI noted that foreign investment has created a minimum of 16,000 jobs in Germany during 2014. (Reuters) S&P: Large UK banks face £19bn misconduct charges – An international ratings agency, Standard & Poor's (S&P) said that the biggest banks in Britain have faced another £19bn charges over the next two years, in relation to past misconduct. S&P said that Britain's banks and customer-owned lenders had incurred £48bn toward misconduct and litigation charges over the past five years. The ratings agency said that the four biggest banks in the UK – Barclays, HSBC, Lloyds Banking Group and Royal Bank of Scotland, have together accounted for £42bn, which is equivalent to around 7.5% of their revenues. Banks also face

- 4. Page 4 of 6 litigation charges arising from investigations into the alleged rigging of foreign exchange markets and benchmark interest rates as well as probes into breach of anti-money laundering controls. (Reuters) Fitch downgrades Japan’s rating to ‘A’ – Fitch Ratings downgraded Japan's credit rating by one notch to ‘A’, after the government failed to take steps in its FY2015 budget to offset a delay in a sales tax increase. The outlook is stable. Fitch's move follows a similar downgrade by Moody's Investors Service late in 2014, which could pressurize the government to take tough measures through a fiscal discipline plan that is due around June. Fitch said that use of stimulus spending by the government; a disappointing economic growth and concerns over the sustainability of corporate profit growth have negatively influenced Japan’s rating. S&P now has an AA-rating on Japan with a negative outlook. (Reuters) China plans to merge big state firms – The Economic Information Daily has reported that China is likely to reduce the number of its central government-owned conglomerates to 40 through a series of mergers, given that Beijing proposed a plan to overhaul the country's under-performing state sector. The consolidation will take place across the commercial sectors to begin with, especially in competitive industries. The Chinese central government currently owns 112 conglomerates, including 277 public firms that are listed on the Shanghai or Shenzhen stock exchanges, and with a market capitalization of more than $1.6tn. The restructuring plan is critical to President Xi Jinping's effort to enhance the performance of China's lumbering state sector, at a time when Beijing is trying to find the right policy mix to support the world's second-largest economy. (Reuters) Regional YES Bank plans $100mn investment in GCC – India-based YES Bank is planning to invest around $100mn in the GCC region over the next five years. The bank has recently opened its representative office in Abu Dhabi. (GulfBase.com) GPCA: Chemical exports from GCC reach $54.6bn – According to the Gulf Petrochemicals & Chemicals Association (GPCA), with chemical exports in the GCC region reaching $54.6bn, streamlining the supply chain functions will be the key to maintain competitive advantage. As per GPCA, the GCC region exported approximately 80% of its total product portfolio amounting to 66.1mn tons of chemicals to over 80 countries in 2014. The region’s petrochemical industry is forecasted to grow by 6% every year by the end of this decade, producing over 190mn tons of petrochemicals by 2020. Exports will account for a sizable share of this forthcoming capacity. (GulfBase.com) Ma'aden utilizes SR1.8bn of rights issue proceeds – The Saudi Arabian Mining Company (Ma'aden) has utilized SR1.8bn of SR5.6bn from its rights issue proceeds since March 31, 2015. The offering expenses stood at SR23.9mn as compared to the SR21mn stated in the rights issue prospectus due to an increase in advisory fees. Ma'aden has used SR1.26bn and SR509mn from the proceeds to repay the outstanding amounts under its redrawable Murabaha finance facility, which had been temporarily used to fund the costs incurred by Ma'aden Waad Al Shamal Phosphate Company and Ma’aden Bauxite & Alumina Company, respectively. Another SR7mn was used to fund the balance of its equity contribution to the project. The remaining SR3.8bn will be used to complete financing of the company's equity investment in the project. (Tadawul) JLL: KSA hotel market to witness high levels of supply – According to a report by Jones Lang LaSalle (JLL), the hospitality market in Saudi Arabia is expected to witness high influx of new supply over the next three years with many of the previously delayed projects getting completed. This supply increase is likely to add more vacancies and reduce the revenue per available room (RevPAR), which currently stands at $162, moving up 2.5% over the first two months of 2015. However, this impact may be muted by the continued delay of some announced projects. DoubleTree by Hilton was the only hotel delivered during 1Q2015, adding 196 rooms and increasing the total stock to about 10,100 rooms. Major projects expected to be completed in 2015 include Hilton Riyadh Hotel & Residences and Movenpick Hotel in the central business district of Riyadh. (Gulf-Base.com) EY: Islamic banking in KSA set to reach $683bn by 2019 – According to Ernst & Young’s (EY) World Islamic Banking Competitiveness (WIBC) report, the Islamic banking industry in the Saudi Arabia is set to achieve $683bn worth of Shari’ah- compliant assets by 2019. KSA is the largest Islamic banking market in the world, representing 31.7% of the global market share. The first Islamic bank with equity in excess of $10bn is headquartered in KSA. A strong demand from customers, both retail and corporate, has led to significant growth in Islamic banking, resulting in 54% of all financing being Shari’ah- compliant in 2013. Overall, the size of Islamic banking assets in KSA has nearly doubled from 2009-2013. (GulfBase.com) Saudi CMA approves QInvest’s capital reduction – The Saudi Capital Market Authority (Saudi CMA) has approved QInvest Saudi Arabia Company’s request to decrease its capital from SR50mn to SR5mn. (Tadawul) ANB Insurance’s BoD recommends SR175mn capital increase – MetLife AIG ANB Cooperative Insurance Company’s (ANB Insurance) board of directors has recommended a capital increase through a rights issue with a total value of SR175mn. The rights issue is limited to those shareholders who are registered at the close of trading on the day of the extraordinary general assembly, which will be determined later. (Tadawul) iMENA mulls stake sale to raise $100mn – The UAE-based iMENA Holdings’ Founder and Managing Director, Khaldoon Tabaza said the company will raise $100mn through a stake sale in May 2015 and plans to sell shares to the public in 2017. The fundraising involves the sale of a significant minority stake in iMENA to international investors and it will be utilized for expansion in North Africa. iMENA operates online marketplaces, classified, taxi booking and restaurant reservations businesses. (Bloomberg) ADNOC taps Japan’s Inpex to join $22bn oil project – Inpex Corporation of Japan is joining Total SA to develop the main onshore oil deposits in the UAE as Abu Dhabi picks new partners for a $22bn effort to pump crude from its largest fields. Abu Dhabi National Oil Company (ADNOC) picked Inpex from at least 10 bidders to join it and Total in the venture. Inpex agreed to pay ADNOC a signing bonus of about $1.1bn. Japan’s state- backed energy explorer will take a 5% stake in the fields and the concession will give Japan access to crude from the deposits for 40 years, starting from January 1, 2015. (Bloomberg) Dubai textile trade stands at AED16.4bn in 2014 – According to Dubai Customs, the value of the textiles & fabrics trade in Dubai stood at AED16.4bn in 2014, with AED10.14bn in imports, AED1.3bn in exports, and AED4.22bn in re-exports. Dubai Customs said that these results were issued by the department in conjunction with the International Textile Fair. (GulfBase.com) Topaz close to secure $550mn loan – According to sources, Dubai-based Topaz Energy & Marine (Topaz) is close to securing a loan worth at least $550mn to help refinance its

- 5. Page 5 of 6 existing debt and fund new projects. Reportedly, Emirates NBD, First Gulf Bank, Gulf International Bank, HSBC, Noor Bank and Standard Chartered may provide the loan. (Reuters) DP World’s container volume rises to 15mn TEUs in 1Q2015 – DP World’s Chairman, Sultan Ahmed Bin Sulayem said that the port operator handled 15mn TEUs (twenty-foot equivalent units) across its global portfolio of container terminals during 1Q2015, with gross container volumes growing by 4.4%. The quarterly growth was largely driven by a strong performance from Europe, Asia Pacific and UAE terminals. The UAE had another strong quarter handling 3.9mn TEUs, representing a growth of 7.7%. The company’s new developments remain on track with capacity in Rotterdam (Netherlands) and Nhava Sheva (India) due to come on line in 1H2015. This will be followed by the opening of Yarimca (Turkey) and an additional 2mn TEUs of capacity at Jebel Ali in 2H2015, which will take Jebel Ali’s total capacity to 19mn TEUs. (Gulf-Base.com) Phidar Advisory: Strong US dollar continues to erode Dubai property prices – Phidar Advisory in its 1Q2015 Dubai residential research note said that the residential prices in 1Q2015 continued to decline as compared to 4Q2014. Phidar Advisory’s Managing Director, Jesse Downs said that the strong US dollar continued to hit Dubai property prices during 1Q2015, but apartment transaction volumes remain resilient, adding that the market downturn is attracting selective investment. Apartment lease rates decrease a nominal 0.3%, while sale prices decreased 3.9%, pushing yields up to 7.2%. Lease rates for villas decreased 2.4% and sale prices decreased 3%, which pushed yields up to 5.7%. Transaction volumes for the communities tracked by Phidar’s House Price Index were down by half in 1Q2015 as compared to 1Q2014, implying a shift to newer, less established projects and communities. Phidar’s Dubai Real Estate International Demand Index (Reidi) fell significantly in 1Q2015, driven primarily by currency fluctuations, indicating a very low propensity for international real estate investment into Dubai. (GulfBase.com) Italy-based Bulgari to develop Dubai resort with Meraas Holding – Dubai developer Meraas Holding and Italian jeweler, Bulgari are planning to build a luxury resort and residential project on a man-made island off the coast of Dubai as the emirate steps up its expansion as an international tourist destination. The 1.7mn square foot Bulgari Resort and Residences project will feature a 101-room hotel, 165 residential apartments, 15 mansions and eight penthouses and will be completed in 1Q2017. The project will be entirely financed by government-owned Meraas, with Bulgari, acquired by Paris- listed LVMH in 2011, licensing its brand for an undisclosed amount. (Reuters) Agthia Group AGM approves 10% cash dividend – Agthia Group’s annual general meeting (AGM) has approved a 10% cash dividend. (ADX) RAK Ceramics OGM approves 35% cash dividend – RAK Ceramics’ annual ordinary general assembly (OGM) has approved a 35% cash dividend. (ADX) NBQ reports AED102.9mn net profit in 1Q2015 – National Bank of Umm Al-Qaiwain (NBQ) reported a net profit of AED102.9mn in 1Q2015, reflecting an increase of 8% YoY. The bank’s operating income for 1Q2015 stood at AED91.6mn, up 14% YoY. Net interest income rose by 12% YoY. Loans & advances portfolio amounted to AED7.8bn, while customer deposits stood at AED8.4bn. EPS stood at AED0.06 in 1Q2015 versus AED0.05 in 1Q2014. NBQ’s total assets amounted to AED13.47bn at the end of March 31, 2015 as compared to AED13.23bn at the end of December 31, 2014. (ADX) UIS plans to build AED1bn galvanized steel plant – United Iron & Steel (UIS) is planning to build a new galvanized steel production plant worth AED1bn in Abu Dhabi. The new plant will come up on a 126,000 square meter area in the ICAD (Industrial City Abu Dhabi). UIS is aiming to produce up to 250,000 tons of galvanized steel per year for customers in the Middle East, Europe and Africa at its new plant by 4Q2016. UIS is a joint venture between UAE-based Abdul Jalil Group and Saudi-based Safid Group. Al Diyar General Contracting Company which has been signed up as the main civil contractor for the project said that the construction work will be completed in two phases. UIS is a joint venture between UAE-based Abdul Jalil Group and Saudi-based Safid Group. (GulfBase.com) Bloom Properties to build 40,000 housing units in Iraq – Bloom Properties, the real estate arm of the Abu Dhabi-based National Holding company, is planning to build a new town spanning over 20 square kilometer area and with 40,000 housing units distributed among four districts in Iraq. The mixed- use project, which will be funded by an international consortium, is likely to take 10 years for completion. (GulfBase.com) NBK: Kuwait’s resident credit growth improves to KD96mn in February – The National Bank of Kuwait (NBK), in its latest Economic Update said the resident credit growth in Kuwait improved to KD96mn in February 2015, with growth remaining relatively modest at 6.4% YoY. The growth in household borrowing was somewhat weaker than usual, while business credit continued to appear weak despite steady growth. Meanwhile, the money supply expanded as private deposits saw a large boost. Deposit rates stayed stable, though interbank rates moved back up during the month. Household debt was weaker than recent months, with growth easing slightly to 12.3% YoY. Credit to non-bank financials was flat in February 2015, confirming a clear slowdown in the pace of the sector’s deleveraging. The decline in the sector’s debt over last year slowed to 8.1% YoY. (GulfBase.com) Bank Dhofar appoints DGM–Head of Transformation – Bank Dhofar has appointed Osama Fathi Abdallah Al Mansour as the DGM–Head of Transformation. Osama holds a master’s degree in Management and MBA in Financial Management & Marketing. He has 24 years of experience in consultancy, banking and financial services. (MSM) OIC unveils new brand identity – Oman Insurance Company (OIC) has launched its new corporate identity with a new tagline 'Forward Together'. This move will further strengthen OIC’s leadership in the GCC insurance industry. (GulfBase.com) EDB: Bahrain’s GDP grows 4.5% in 2014 – The Bahrain Economic Development Board (EDB), in its latest Bahrain Economic Quarterly (BEQ) report, said the Kingdom's GDP growth reached 4.5% in 2014. Non-oil sectors rose markedly from 3% recorded in 2013 to 4.9% in 2014. Strong growth of 12.5% YoY was reported in the construction sector following the initiation of a number of major infrastructure projects in areas such as road transportation. The report projected that the country’s real GDP growth will be around 4% over the coming two years, despite the challenging macroeconomic environment. (GulfBase.com)

- 6. Contacts Saugata Sarkar Sahbi Kasraoui QNB Financial Services SPC Head of Research Head of HNI Contact Center: (+974) 4476 6666 Tel: (+974) 4476 6534 Tel: (+974) 4476 6544 PO Box 24025 saugata.sarkar@qnbfs.com.qa sahbi.alkasraoui@qnbfs.com.qa Doha, Qatar Disclaimer and Copyright Notice: This publication has been prepared by QNB Financial Services SPC (“QNBFS”) a wholly-owned subsidiary of QNB SAQ (“QNB”). QNBFS is regulated by the Qatar Financial Markets Authority and the Qatar Exchange QNB SAQ is regulated by the Qatar Central Bank. This publication expresses the views and opinions of QNBFS at a given time only. It is not an offer, promotion or recommendation to buy or sell securities or other investments, nor is it intended to constitute legal, tax, accounting, or financial advice. QNBFS accepts no liability whatsoever for any direct or indirect losses arising from use of this report. Any investment decision should depend on the individual circumstances of the investor and be based on specifically engaged investment advice. We therefore strongly advise potential investors to seek independent professional advice before making any investment decision. Although the information in this report has been obtained from sources that QNBFS believes to be reliable, we have not independently verified such information and it may not be accurate or complete. QNBFS does not make any representations or warranties as to the accuracy and completeness of the information it may contain, and declines any liability in that respect. For reports dealing with Technical Analysis, expressed opinions and/or recommendations may be different or contrary to the opinions/recommendations of QNBFS Fundamental Research as a result of depending solely on the historical technical data (price and volume). QNBFS reserves the right to amend the views and opinions expressed in this publication at any time. It may also express viewpoints or make investment decisions that differ significantly from, or even contradict, the views and opinions included in this report. This report may not be reproduced in whole or in part without permission from QNBFS COPYRIGHT: No part of this document may be reproduced without the explicit written permission of QNBFS. Page 6 of 6 Rebased Performance Daily Index Performance Source: Bloomberg Source: Bloomberg Source: Bloomberg Source: Bloomberg (*$ adjusted returns) 80.0 100.0 120.0 140.0 160.0 180.0 200.0 220.0 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 QSE Index S&P Pan Arab S&P GCC (0.1%) 1.3% 0.2% 0.5% (0.3%) 0.2% (0.5%) (1.0%) (0.5%) 0.0% 0.5% 1.0% 1.5% SaudiArabia Qatar Kuwait Bahrain Oman AbuDhabi Dubai Asset/Currency Performance Close ($) 1D% WTD% YTD% Global Indices Performance Close 1D%* WTD%* YTD%* Gold/Ounce 1,201.93 1.9 1.9 1.4 MSCI World Index 1,801.57 0.1 0.1 5.4 Silver/Ounce 16.41 4.3 4.3 4.5 DJ Industrial 18,037.97 (0.2) (0.2) 1.2 Crude Oil (Brent)/Barrel (FM Future) 64.83 (0.7) (0.7) 13.1 S&P 500 2,108.92 (0.4) (0.4) 2.4 Crude Oil (WTI)/Barrel (FM Future) 56.99 (0.3) (0.3) 7.0 NASDAQ 100 5,060.25 (0.6) (0.6) 6.8 Natural Gas (Henry Hub)/MMBtu 2.48 (3.0) (3.0) (17.1) STOXX 600 412.42 1.5 1.5 8.5 LPG Propane (Arab Gulf)/Ton 56.25 (0.9) (0.9) 14.8 DAX 12,039.16 2.4 2.4 10.2 LPG Butane (Arab Gulf)/Ton 63.50 0.4 0.4 1.2 FTSE 100 7,103.98 1.0 1.0 5.9 Euro 1.09 0.2 0.2 (10.0) CAC 40 5,268.91 1.8 1.8 11.2 Yen 119.04 0.0 0.0 (0.6) Nikkei 19,983.32 (0.1) (0.1) 15.0 GBP 1.52 0.3 0.3 (2.2) MSCI EM 1,065.62 0.5 0.5 11.4 CHF 1.05 (0.1) (0.1) 4.1 SHANGHAI SE Composite 4,527.40 2.7 2.7 39.7 AUD 0.79 0.4 0.4 (3.9) HANG SENG 28,433.59 1.3 1.3 20.5 USD Index 96.77 (0.2) (0.2) 7.2 BSE SENSEX 27,176.99 (0.3) (0.3) (1.2) RUB 52.02 2.3 2.3 (14.3) Bovespa 55,534.50 0.2 0.2 1.1 BRL 0.34 1.2 1.2 (9.1) RTS 1,022.78 (1.4) (1.4) 29.3 175.2 143.6 129.7