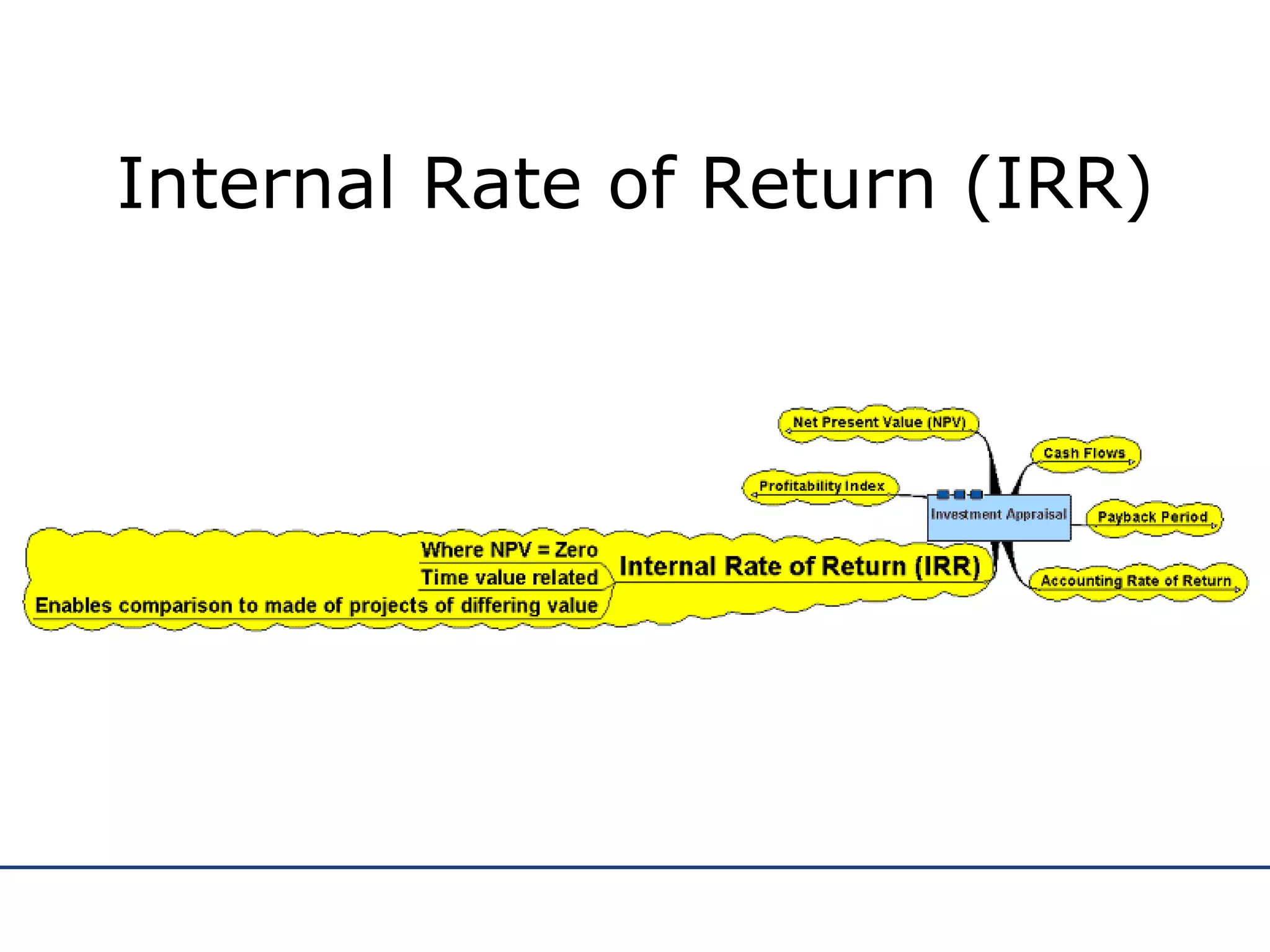

Investment appraisal is a means of assessing whether an investment project is worthwhile. It involves analyzing factors such as payback period, accounting rate of return, internal rate of return, profitability index, and net present value. Net present value discounts future cash flows to account for the time value of money and allows comparison of investments. Firms use these techniques to evaluate potential investments and determine which projects to pursue.