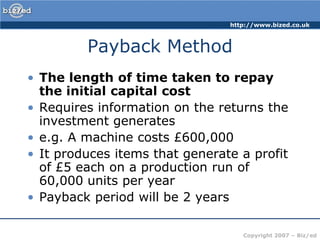

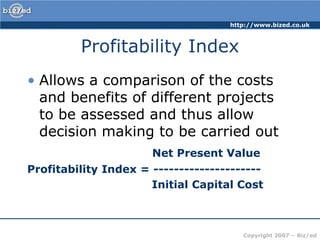

This document discusses various methods used for investment appraisal to assess whether investment projects are worthwhile. It describes payback period, accounting rate of return, internal rate of return, profitability index, and net present value. Net present value discounts future cash flows to account for the time value of money and allows comparison of projects. Internal rate of return identifies the discount rate that results in a net present value of zero. Investment appraisal helps firms evaluate projects and potential returns to determine which investments to make.