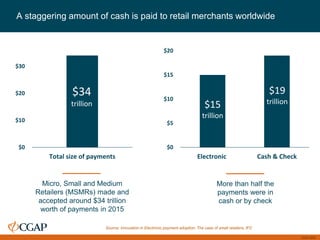

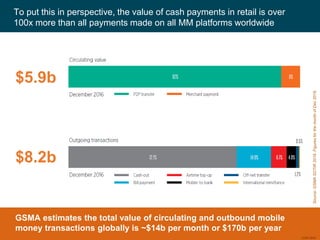

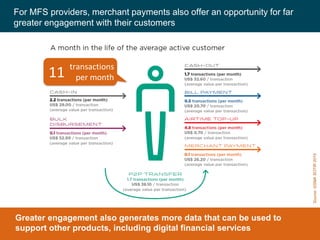

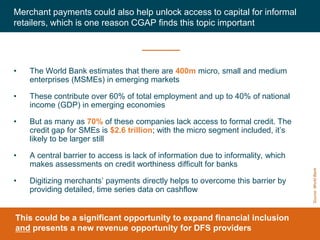

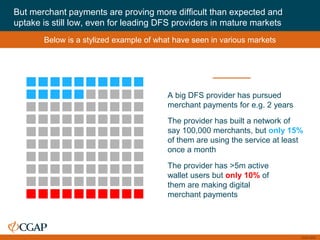

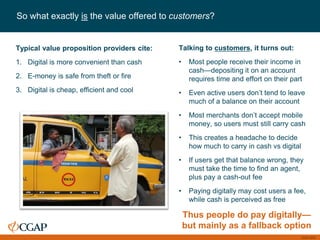

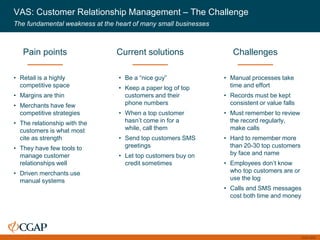

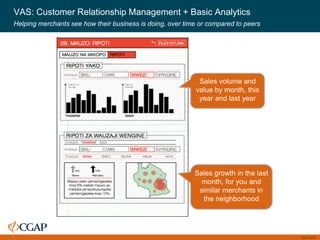

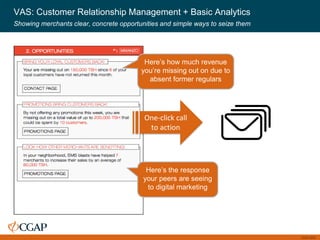

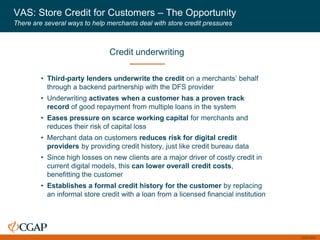

The document discusses the challenges and opportunities in digitizing merchant payments for digital financial service (DFS) providers, highlighting the vast potential of transitioning from cash to digital payments, especially in low and middle-income economies. Despite the potential for increased engagement and access to capital for merchants, the adoption of digital payment solutions remains low due to various barriers including merchant and customer preferences, perceived costs, and a lack of compelling value propositions. It suggests that providing value-added services linked to payments could motivate merchants and consumers to shift towards digital transactions.