Embed presentation

Downloaded 14 times

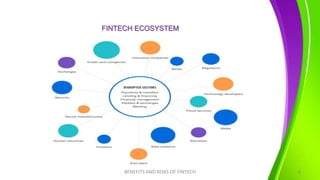

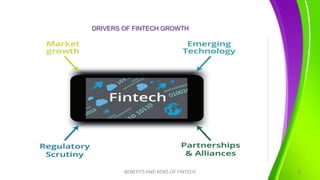

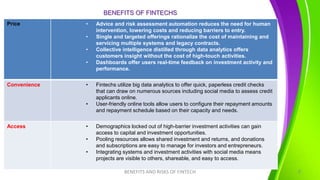

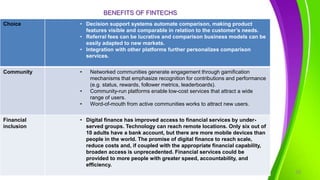

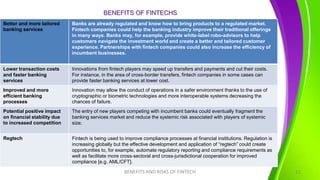

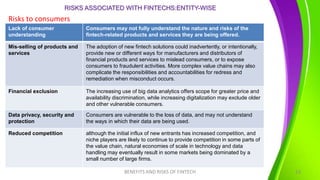

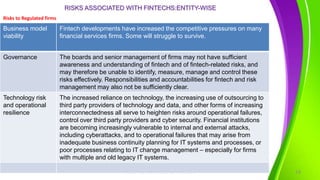

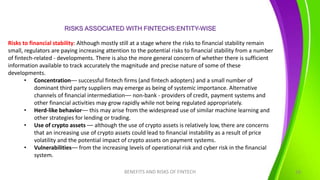

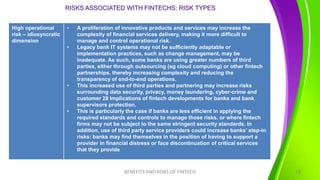

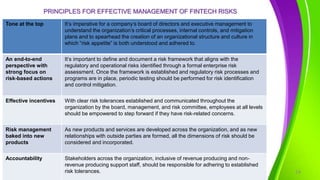

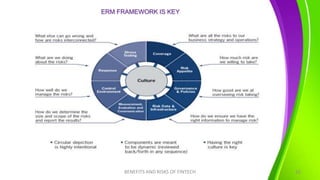

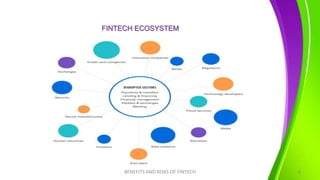

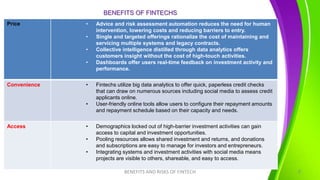

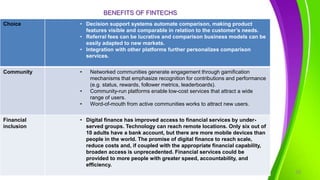

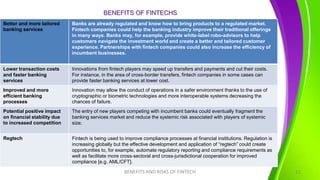

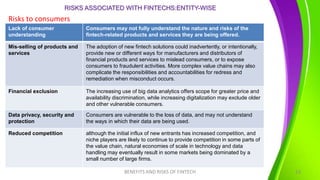

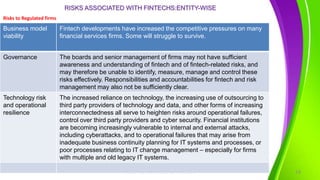

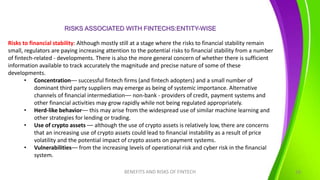

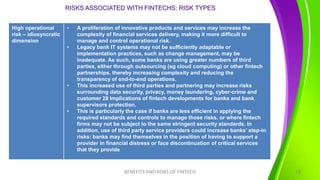

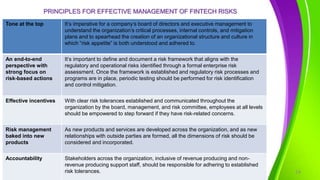

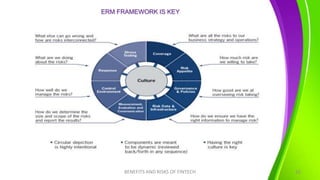

The document outlines the benefits and risks associated with fintech, emphasizing its role in transforming financial services through technology and innovation. Benefits include improved access, lower costs, and enhanced efficiency, while risks encompass consumer misunderstanding, data privacy concerns, and potential financial instability. It highlights the importance of effective risk management and regulatory compliance as fintech continues to evolve.