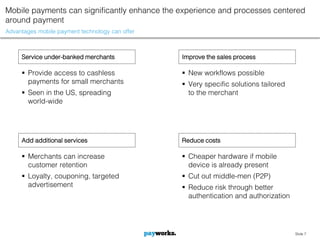

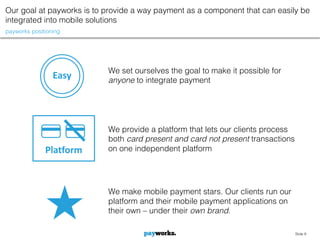

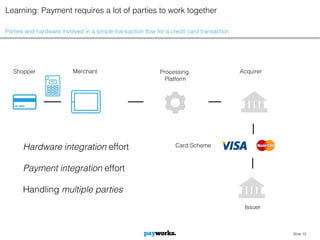

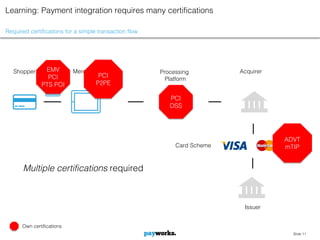

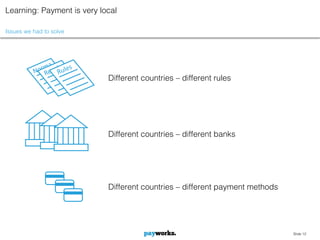

The document discusses mobile payments and provides insights. It notes that current mobile payment solutions do not significantly improve on traditional payment methods in terms of security, availability, risk, and cost. However, mobile payments can enhance the experience and processes around payment by offering services to underbanked merchants, improving sales processes, adding additional services like loyalty programs, and reducing costs. Integrating payments requires coordinating many parties, certifications, and addressing local differences between countries. The goal of payworks is to provide an easy-to-integrate payment platform that allows clients to process card payments on a single independent platform under their own brand.