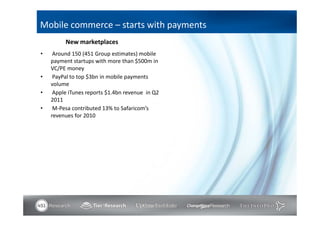

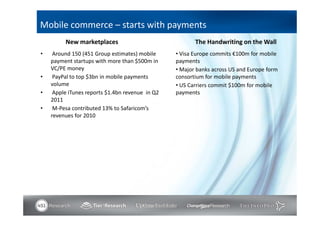

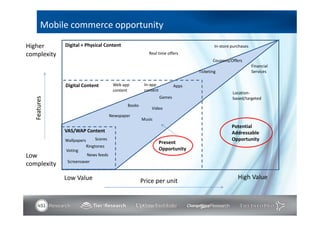

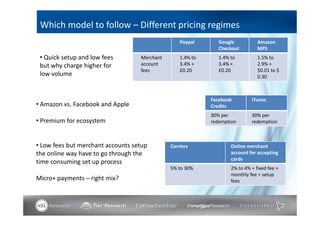

This document summarizes an analyst's presentation on emerging players in the mobile commerce market. It discusses how mobile payments are expanding beyond mobile banking into a wider context, with over 150 startups and new entrants making payments part of their services ecosystems. Examples mentioned include PayPal reaching $3 billion in mobile payments volume, Apple's iTunes generating $1.4 billion in revenue, and M-Pesa contributing 13% of Safaricom's revenues. The presentation also analyzes different business models for mobile payments, emerging players' charging and billing methods, and how mobile advertising is building the ecosystem to support payments.