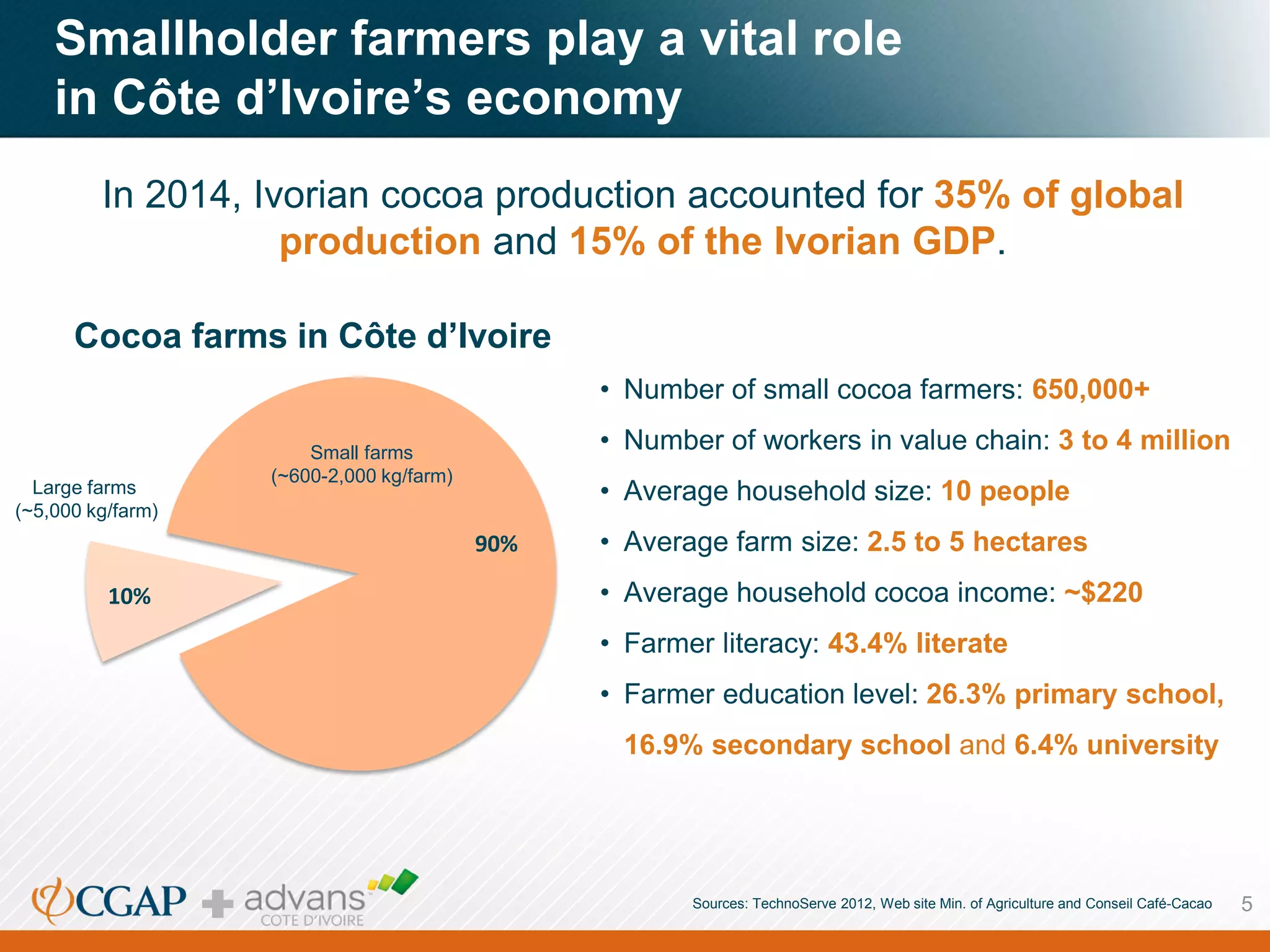

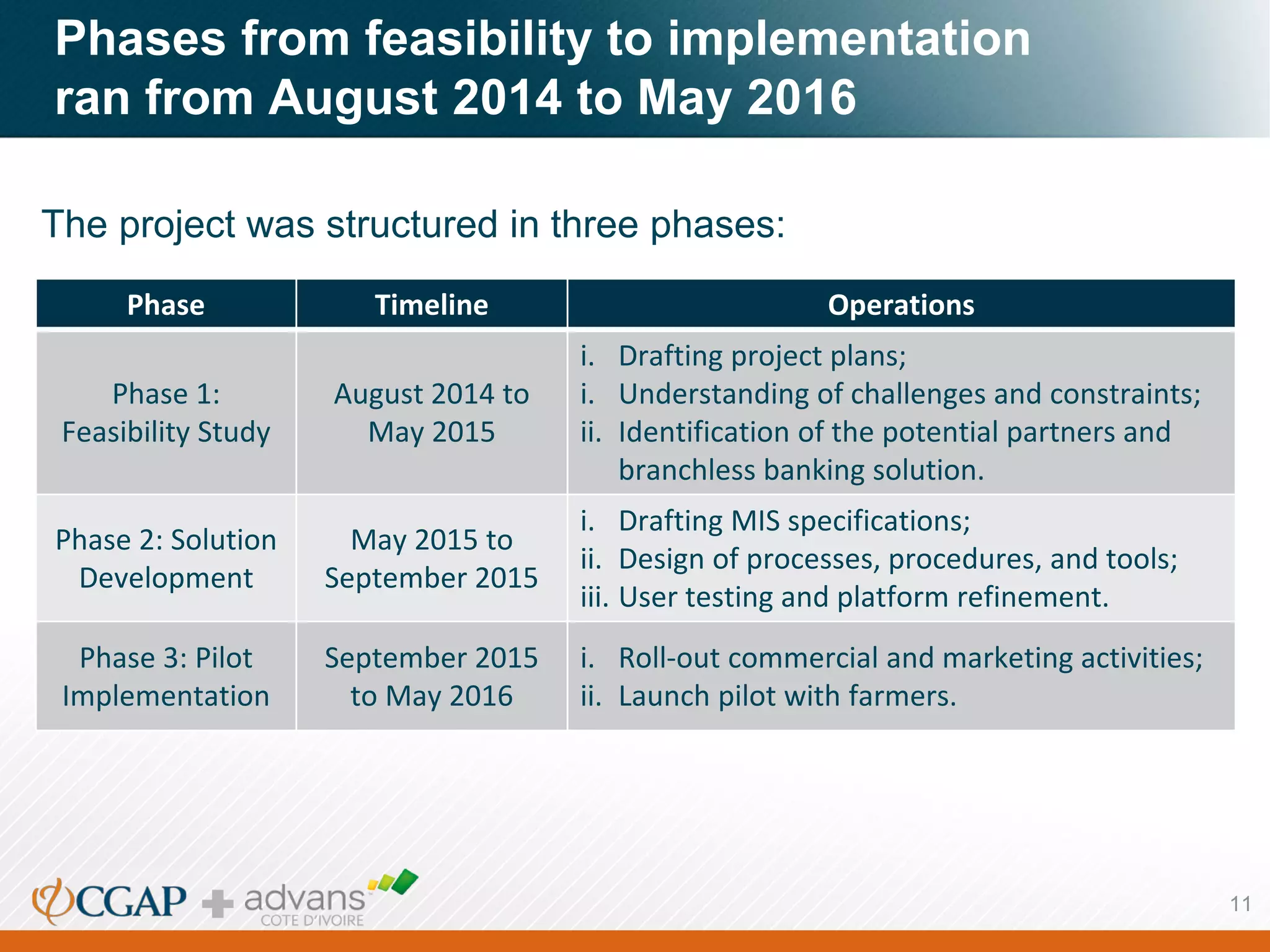

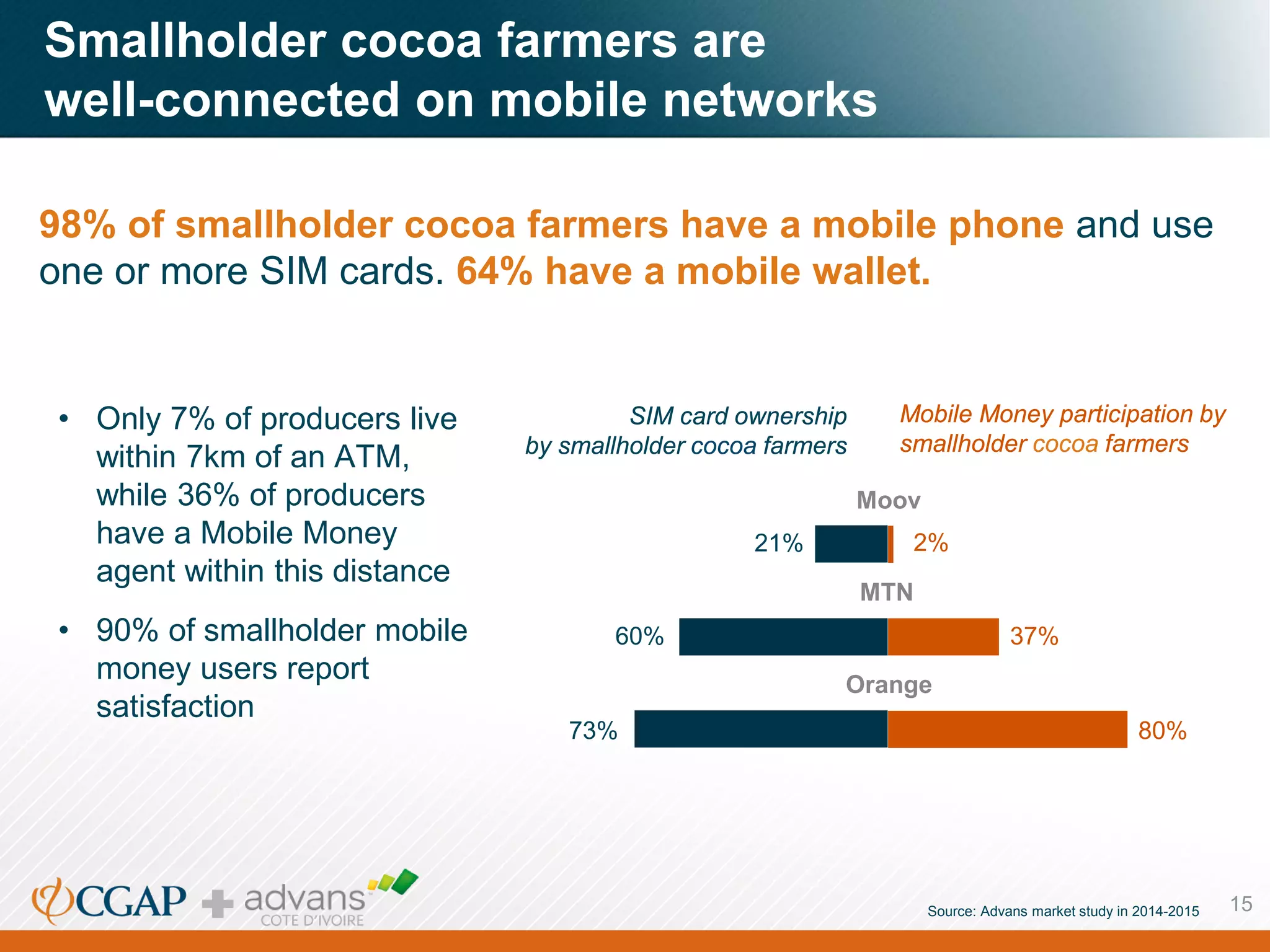

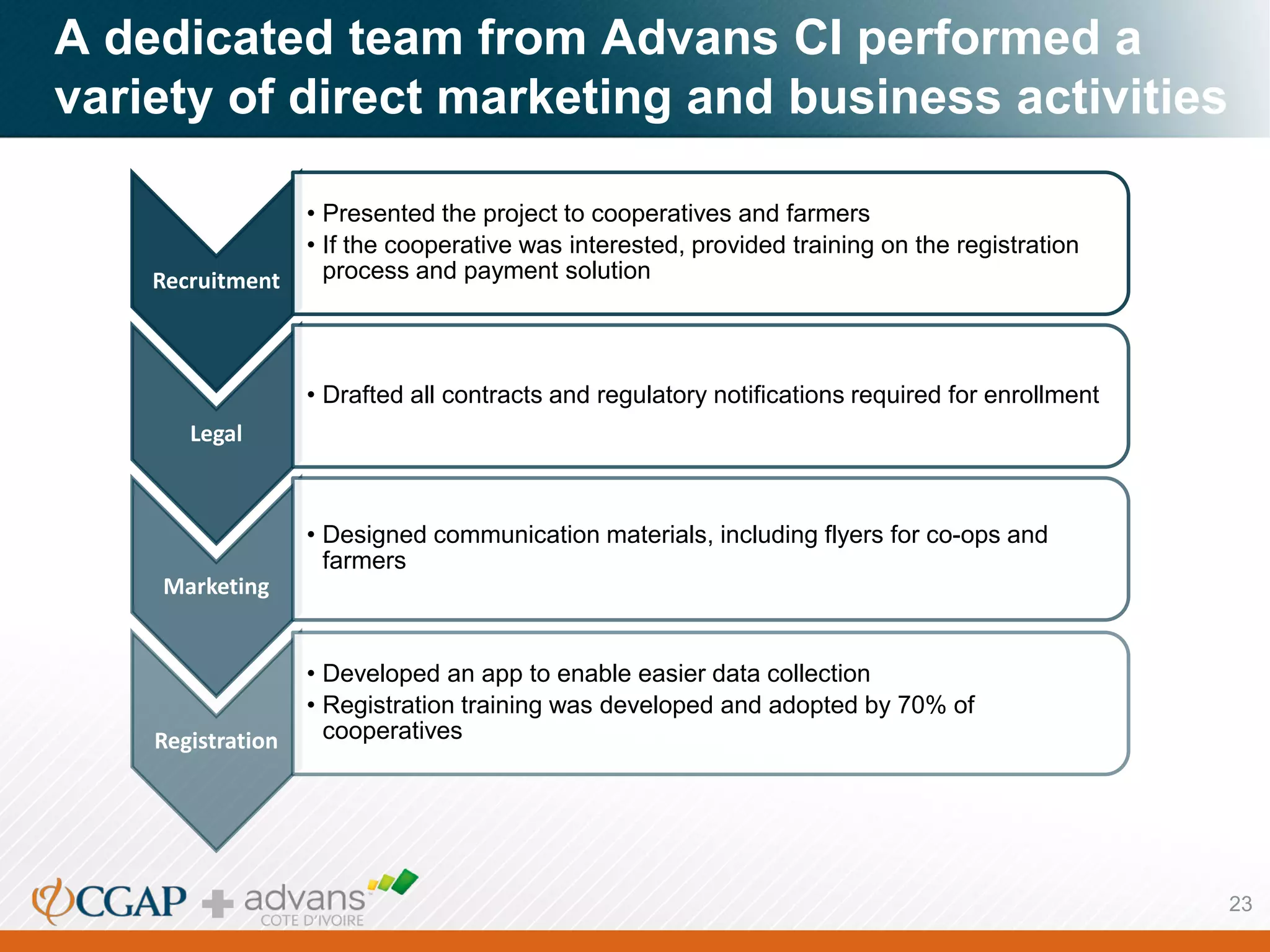

The document summarizes a project by Advans Côte d'Ivoire to develop a digital financial services solution for cocoa farmers in Côte d'Ivoire. It conducted a feasibility study which found farmers and cooperatives were interested in branchless banking. It then developed a USSD-based solution allowing farmers to save a portion of their cocoa payments digitally and withdraw cash. Over 7,000 farmers enrolled, with 2,770 making deposits. Key challenges included lack of USSD aggregators, registration difficulties, and literacy issues. Lessons included the need for training, USSD was essential, adaptive pricing, effective partnerships, and a progressive rollout approach.