Pnb ru2 qfy2011-291010

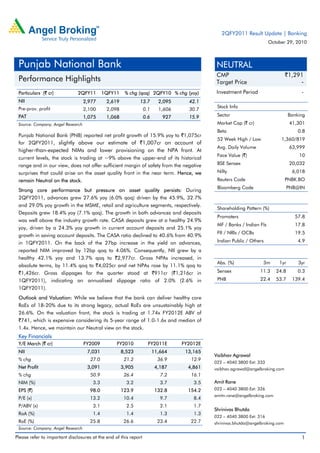

- 1. Please refer to important disclosures at the end of this report 1 Particulars (` cr) 2QFY11 1QFY11 % chg (qoq) 2QFY10 % chg (yoy) NII 2,977 2,619 13.7 2,095 42.1 Pre-prov. profit 2,100 2,098 0.1 1,606 30.7 PAT 1,075 1,068 0.6 927 15.9 Source: Company, Angel Research Punjab National Bank (PNB) reported net profit growth of 15.9% yoy to `1,075cr for 2QFY2011, slightly above our estimate of `1,007cr on account of higher-than-expected NIMs and lower provisioning on the NPA front. At current levels, the stock is trading at ~9% above the upper-end of its historical range and in our view, does not offer sufficient margin of safety from the negative surprises that could arise on the asset quality front in the near term. Hence, we remain Neutral on the stock. Strong core performance but pressure on asset quality persists: During 2QFY2011, advances grew 27.6% yoy (6.0% qoq) driven by the 45.9%, 32.7% and 29.0% yoy growth in the MSME, retail and agriculture segments, respectively. Deposits grew 18.4% yoy (7.1% qoq). The growth in both advances and deposits was well above the industry growth rate. CASA deposits grew at a healthy 24.9% yoy, driven by a 24.3% yoy growth in current account deposits and 25.1% yoy growth in saving account deposits. The CASA ratio declined to 40.6% from 40.9% in 1QFY2011. On the back of the 27bp increase in the yield on advances, reported NIM improved by 12bp qoq to 4.06%. Consequently, NII grew by a healthy 42.1% yoy and 13.7% qoq to `2,977cr. Gross NPAs increased, in absolute terms, by 11.4% qoq to `4,025cr and net NPAs rose by 11.1% qoq to `1,426cr. Gross slippages for the quarter stood at `911cr (`1,216cr in 1QFY2011), indicating an annualised slippage ratio of 2.0% (2.6% in 1QFY2011). Outlook and Valuation: While we believe that the bank can deliver healthy core RoEs of 18-20% due to its strong legacy, actual RoEs are unsustainably high at 26.6%. On the valuation front, the stock is trading at 1.74x FY2012E ABV of `741, which is expensive considering its 5-year range of 1.0-1.6x and median of 1.4x. Hence, we maintain our Neutral view on the stock. Key Financials Y/E March (` cr) FY2009 FY2010 FY2011E FY2012E NII 7,031 8,523 11,664 13,165 % chg 27.0 21.2 36.9 12.9 Net Profit 3,091 3,905 4,187 4,861 % chg 50.9 26.4 7.2 16.1 NIM (%) 3.3 3.2 3.7 3.5 EPS (`) 98.0 123.9 132.8 154.2 P/E (x) 13.2 10.4 9.7 8.4 P/ABV (x) 3.1 2.5 2.1 1.7 RoA (%) 1.4 1.4 1.3 1.3 RoE (%) 25.8 26.6 23.4 22.7 Source: Company, Angel Research NEUTRAL CMP `1,291 Target Price - Investment Period - Stock Info Sector Banking Market Cap (` cr) 41,301 Beta 0.8 52 Week High / Low 1,360/819 Avg. Daily Volume 63,999 Face Value (`) 10 BSE Sensex 20,032 Nifty 6,018 Reuters Code PNBK.BO Bloomberg Code PNB@IN Shareholding Pattern (%) Promoters 57.8 MF / Banks / Indian Fls 17.8 FII / NRIs / OCBs 19.5 Indian Public / Others 4.9 Abs. (%) 3m 1yr 3yr Sensex 11.3 24.8 0.3 PNB 22.4 53.7 139.4 Vaibhav Agrawal 022 – 4040 3800 Ext: 333 vaibhav.agrawal@angelbroking.com Amit Rane 022 – 4040 3800 Ext: 326 amitn.rane@angelbroking.com Shrinivas Bhutda 022 – 4040 3800 Ext: 316 shrinivas.bhutda@angelbroking.com 2QFY2011 Result Update | Banking October 29, 2010 Punjab National Bank Performance Highlights

- 2. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 2 Exhibit 1: 2QFY2011 performance Particulars (` cr) 2QFY11 1QFY11 % chg (qoq) 2QFY10 % chg (yoy) Interest earned 6,455 5,992 7.7 5,407 19.4 Interest expenses 3,479 3,373 3.1 3,312 5.0 NII 2,977 2,619 13.7 2,095 42.1 Non-interest income 718 872 (17.6) 669 7.4 Operating income 3,695 3,490 5.9 2,764 33.7 Operating expenses 1,595 1,392 14.6 1,157 37.8 Pre-prov. profit 2,100 2,098 0.1 1,606 30.7 Provisions & cont. 516 534 (3.4) 216 138.9 PBT 1,584 1,564 1.3 1,390 13.9 Prov. for taxes 510 496 2.8 463 10.0 PAT 1,075 1,068 0.6 927 15.9 EPS (`) 34.1 33.9 0.6 29.4 15.9 Cost-to-income ratio (%) 43.2 39.9 41.9 Effective tax rate (%) 32.2 31.7 33.3 Net NPA (%) 0.7 0.7 0.1 Source: Company, Angel Research Exhibit 2: 2QFY2011 Actual v/s Angel estimates Particulars (` cr) Actual Estimates Var. (%) NII 2,977 2,721 9.4 Non-interest income 718 767 (6.4) Operating income 3,695 3,489 5.9 Operating expenses 1,595 1,349 18.2 Pre-prov. profit 2,100 2,140 (1.9) Provisions & cont. 516 615 (16.1) PBT 1,584 1,525 3.9 Prov. for taxes 510 519 (1.7) PAT 1,075 1,007 6.8 Source: Company, Angel Research

- 3. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 3 Strong advances and deposits growth yoy as well as sequentially During 2QFY2011, advances increased by 27.6% yoy (6.0% qoq) to `2,08,764cr, driven by the 45.9%, 32.7% and 29.0% yoy growth in the MSME, retail and agriculture segments, respectively. Deposits grew 18.4% yoy (7.1% qoq) to `2,73,394cr in 2QFY2011. The growth in both advances and deposits was well above the industry growth rate. CASA deposits grew at a healthy 24.9% yoy, driven by a 24.3% yoy growth in current account deposits and 25.1% yoy growth in saving account deposits. However, as sequentially the term deposits grew at a faster rate (7.6%) than CASA deposits (6.3%), the CASA ratio declined to 40.6% (from 40.9% in 1QFY2011), which was nevertheless strong being above 40% levels. Exhibit 3: MSME and Retail witness strong traction Particulars (` cr) 2QFY11 1QFY11 % chg (qoq) 2QFY10 % chg (yoy) Agri 32,274 30,240 6.7 25,009 29.0 Retail 22,596 19,442 16.2 17,033 32.7 MSME 23,472 20,090 16.8 16,090 45.9 Medium & Large Corporates 72,657 74,146 (2.0) 58,789 23.6 Comm. Real Estate 9,870 10,767 (8.3) 10,570 (6.6) Services & Others 36,644 32,184 13.9 29,911 22.5 Domestic non-food credit 197,513 186,869 5.7 157,402 25.5 Source: Company, Angel Research Exhibit 4: Strong business growth Source: Company, Angel Research Exhibit 5: Domestic non-food advances break-up Source: Company, Angel Research 71.8 73.8 72.1 70.9 72.8 74.8 77.1 76.4 64.0 68.0 72.0 76.0 80.0 - 100,000 200,000 300,000 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 Deposits (` cr) Advances (` cr) CD ratio (%, RHS) Agri 16% Retail 11% MSME 12% Medium & Large Corporates 37% Comm. Real Estate 5% Services & Others 19%

- 4. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 4 Exhibit 6: CASA ratio - strong above 40% Source: Company, Angel Research NIMs high but likely to come down, going forward During the quarter, the yield on advances increased by 27bp sequentially to 10.55%, and the cost of deposits declined by 6bp sequentially to 4.96%. As a result, reported NIMs expanded by 12bp sequentially to 4.06%. The higher yield on advances can be attributed to aggressive lending in MSME (up 16.8% qoq) and retail (up 16.2% qoq) segments. Consequently, NII increased by a healthy 42.1% yoy and 13.7% qoq to `2,977cr. The bank has achieved NIM of 3.99% for 1HFY2011. However, management expects NIM to decline in 2HFY2011because of the pressure on liquidity and need for reviewing the deposit rates to ensure enough mobilisation of deposits to fund the credit growth. For the full year, management expects NIM to be much above its earlier guidance of 3.5%. Exhibit 7: Trend in quarterly reported NIM Source: Company, Angel Research Healthy core non-interest income The non-interest income increased 7.4% yoy to `718cr, despite a 74.7% reduction in treasury gains. Non-interest income, excluding treasury gains, gained a healthy 31.1% yoy to `680cr. Recoveries from written-off accounts grew by a robust 154.3% yoy to `89cr. 37.4 38.8 38.3 38.5 39.5 40.8 40.9 40.6 30.0 32.0 34.0 36.0 38.0 40.0 42.0 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 3.13 3.74 3.59 3.33 3.24 3.50 3.64 3.99 3.94 4.06 0.00 1.00 2.00 3.00 4.00 5.00 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 (%)

- 5. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 5 Exhibit 8: Non-interest income break-up Particulars (` cr) 2QFY11 1QFY11 % chg (qoq) 2QFY10 % chg (yoy) Commission and Brokerage 474 496 (4.4) 381 24.4 Treasury 38 121 (68.6) 150 (74.7) Forex 30 95 (68.2) 55 (45.0) Recoveries 89 76 17.1 35 154.3 Others 87 84 4.2 48 81.3 Total 718 872 (17.6) 669 7.4 Source: Company, Angel Research Asset quality pressures persist PNB’s gross NPAs increased, in absolute terms, by 11.4% qoq to `4,025cr and net NPAs rose by 11.1% qoq to `1,426cr. The gross slippages for the quarter stood at `911cr (`1,216cr in 1QFY2011), indicating an annualised slippage ratio of 2.0% (2.6% in 1QFY2011). During the quarter, the bank classified its additional exposure of ~`200cr to Zoom Developers, taking the total exposure classified as NPA to ~`415cr. The gross NPA ratio deteriorated to 1.9% (as against 1.8% in 1QFY2011). The net NPA ratio remained stable at 0.7%. The bank’s provision coverage ratio including technical write-offs stood at 77.1% (77.6% in 1QFY2011 and 91.1% in 2QFY2010). The bank has cumulatively restructured `13,545cr of its loans till date (6.5% of loans, 68.2% of the net worth). The bank additionally restructured `539cr of loans during the quarter. Till date, `1,195cr worth of loans have slipped into NPAs from the restructured accounts (8.8% of the total restructured advances), of which `157 slipped during the current quarter. Management has indicated a broad range of 10-15% as expected slippages from the restructured accounts. Exhibit 9: Trend in asset quality Source: Company, Angel Research, Note: NPA coverage excluding tech. write-offs till 4QFY2010 The bank made provisions of `359cr towards the NPAs in 2QFY2011, compared to `548cr in 1QFY2011 and `56cr in 2QFY2010. Provision for investments stood at `65cr, compared to `83cr in 2QFY2010. 40.0 55.0 70.0 85.0 100.0 - 900 1,800 2,700 3,600 4,500 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 Gross NPAs (` cr) Net NPAs (` cr) Provision coverage (%, RHS)

- 6. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 6 Exhibit 10: Break-up of provisions Particulars (` cr) 2QFY11 1QFY11 % chg (qoq) 2QFY10 % chg (yoy) NPA 359 548 (34.5) 56 541.1 Standard Assets 38 40 (5.0) 74 (48.6) Investments 65 14 364.3 83 (21.7) Others 54 (68) - 3 1,719.2 Total 516 534 (3.4) 216 138.9 Source: Company, Angel Research Operating costs rise due to employee benefits provisions Operating expenses increased by a substantial 14.6% qoq and 37.8% yoy driven by the 53.0% yoy rise in employee costs and 12.1% yoy increase in other operating expenses. The increase in employee expenses was attributable to the provisions (~`250cr) made on account of gratuity (`125cr) and second pension option (`125cr) during the quarter. In the 1HFY2011, the bank has provided `250cr for gratuity and `250cr for second pension option liability. Similar provisions are expected for the 2HFY011. On account of strong increase in employee costs, the cost-to-income ratio deteriorated to 43.2% (from 39.9% in 1QFY2011 and 41.9% in 2QFY2010). We have increased the operating expenses estimates by 11.3% for FY2011. Exhibit 11: Trend in productivity Source: Company, Angel Research Comfortable capital adequacy The bank’s CAR stood at a healthy 12.6% at the end of 2QFY2011, with a tier-I ratio of 8.0%. Tier-I capital constituted 63.5% of the bank’s CAR. Including the 1HFY2011profit, CAR would have improved to 13.6% with tier-I of 9.0%. 644 690 789 801 908 728 833 653 995 1,113 48.3 42.4 38.0 42.5 44.6 41.9 40.6 32.0 39.9 43.2 25.0 30.0 35.0 40.0 45.0 50.0 - 300 600 900 1,200 1,500 1,800 1QFY09 2QFY09 3QFY09 4QFY09 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 Staff exps (` cr) Other opex (` cr) Cost-to-income ratio (%, RHS)

- 7. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 7 Exhibit 12: Comfortable capital adequacy Source: Company, Angel Research Investment Arguments Relatively higher YoA could lead to higher deterioration in asset quality PNB has cumulatively restructured `13,545cr worth of loans till date (6.5% of loans, 68.2% of the net worth), which is higher than the industry standards. In our view, the bank’s strategy of high growth in advances at relatively high yields could contribute to relatively higher deterioration in asset quality and NIM compression going forward. Strong CASA legacy, but losing market share PNB has a structural advantage of having a high CASA ratio of 40.6%, which is driven by strong rural and semi-urban presence, especially in North India (total of 4,707 branches and 2,910 ATMs). That said, the bank is losing market share like most other PSBs on account of slow branch expansion and competition from the private banks - savings market share was down by 50bp to 7.1% during FY2007-10. Expensive valuations While we believe the bank can deliver healthy core RoEs of 18-20% due to its strong legacy, actual RoEs are unsustainably high at 26.6%. In our view, super- normal RoEs cannot be sustainably earned through higher-than-sector average risk-adjusted yield on assets and tend to decline in the subsequent years either through an increase in NPA costs or decline in yields. The stock is trading at 1.74x FY2012E ABV of `741, ~9% above the upper-end of its historical range (5-year range of 1.0-1.6x and median of 1.4x) and in our view does not offer sufficient margin of safety from the negative surprises that could arise on the asset quality front in the near term. Hence, we maintain a Neutral rating on the stock. 9.1 9.4 9.3 9.2 8.7 8.0 5.4 5.3 5.3 5.0 5.1 4.6 - 4.0 8.0 12.0 16.0 1QFY10 2QFY10 3QFY10 4QFY10 1QFY11 2QFY11 Tier-I CAR Tier-II CAR(%)

- 8. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 8 Exhibit 13: Key assumptions Particulars (%) Earlier estimates Revised estimates FY2011E FY2012E FY2011E FY2012E Credit growth 22.0 18.0 22.0 18.0 Deposit growth 19.0 18.0 19.0 18.0 CASA ratio 40.2 39.4 40.2 39.4 NIM 3.5 3.3 3.7 3.5 Other income growth (10.3) 14.5 (13.4) 13.6 Growth in staff expenses 17.0 19.0 37.0 15.0 Growth in other expenses 13.0 19.0 13.0 15.0 Slippages 2.3 2.0 2.3 2.0 Coverage ratio 75.0 75.0 75.0 75.0 Treasury gain/(loss) (% of investments) 0.1 0.1 0.1 0.1 Source: Company, Angel Research Exhibit 14: Change in estimates Particulars (` cr) FY2011 FY2012 Earlier estimates Revised estimates % chg Earlier estimates Revised estimates % chg NII 11,003 11,664 6.0 12,391 13,165 6.3 Non-interest income 3,197 3,087 (3.5) 3,662 3,508 (4.2) Operating income 14,200 14,751 3.9 16,052 16,673 3.9 Operating expenses 5,506 6,130 11.3 6,552 7,050 7.6 Pre-prov. profit 8,695 8,621 (0.9) 9,500 9,623 1.3 Provisions & cont. 2,277 2,277 - 2,258 2,258 - PBT 6,417 6,344 (1.2) 7,242 7,365 1.7 Prov. for taxes 2,182 2,157 (1.2) 2,462 2,504 1.7 PAT 4,236 4,187 (1.2) 4,780 4,861 1.7 Source: Company, Angel Research Exhibit 15: P/ABV band Source: Company, Angel Research 0 200 400 600 800 1000 1200 1400 1600 May-02 Dec-02 Jul-03 Feb-04 Sep-04 Apr-05 Nov-05 Jun-06 Jan-07 Aug-07 Mar-08 Oct-08 May-09 Dec-09 Jul-10 Feb-11Price (`) 0.25x 0.65x 1.05x 1.45x 1.85x

- 9. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 9 Exhibit 16: Recommendation summary Company Reco CMP (`) Tgt. price (`) Upside (%) FY2012E P/ABV (x) FY2012E Tgt P/ABV (x) FY2012E P/E (x) FY10-12E EPS CAGR (%) FY2012E RoA (%) FY2012E RoE (%) AxisBk Buy 1,467 1,705 16.3 2.8 3.2 14.1 29.6 1.6 21.1 FedBk Accumulate 471 512 8.6 1.4 1.5 9.9 32.6 1.4 14.8 HDFCBk Accumulate 2,278 2,510 10.2 3.6 4.0 19.2 35.7 1.7 20.4 ICICIBk* Buy 1,162 1,335 15.0 2.4 2.6 19.1 29.7 1.4 15.6 SIB Neutral 28 - - 1.7 - 9.6 18.0 1.0 17.8 YesBk Accumulate 359 413 14.9 2.8 3.2 16.5 24.4 1.2 18.2 BOI Accumulate 486 510 5.0 1.5 1.6 8.0 35.2 0.9 19.8 CorpBk Neutral 749 - - 1.4 - 7.2 12.5 1.0 20.1 DenaBk Accumulate 136 150 9.6 1.2 1.3 6.4 9.2 0.8 19.8 IndBk Accumulate 292 324 10.8 1.4 1.5 7.1 8.4 1.3 21.1 IOB Buy 160 186 16.5 1.1 1.3 8.3 22.0 0.6 14.3 OBC Neutral 499 - - 1.3 - 7.5 21.6 0.9 18.1 PNB Neutral 1,291 - - 1.7 - 8.4 11.6 1.3 22.7 SBI* Accumulate 3,151 3,556 12.8 2.3 2.6 13.8 24.0 1.1 19.2 UcoBk Neutral 126 - - 1.2 - 5.4 12.0 0.8 24.9 UnionBk Accumulate 378 403 6.6 1.6 1.7 8.0 7.2 1.0 21.0 Source: Angel Research; Note: *Target multiples=SOTP target price/ABV (including subsidiaries)

- 10. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 10 Income statement Y/E March (` cr) FY06 FY07 FY08 FY09 FY10 FY11E FY12E NII 4,667 5,515 5,534 7,031 8,523 11,664 13,165 - YoY Growth (%) 16.5 18.2 0.4 27.0 21.2 36.9 12.9 Other Income 1,521 1,730 1,998 2,920 3,565 3,087 3,508 - YoY Growth (%) (18.0) 13.8 15.4 46.2 22.1 (13.4) 13.6 Operating Income 6,187 7,245 7,532 9,951 12,088 14,751 16,673 - YoY Growth (%) 5.6 17.1 4.0 32.1 21.5 22.0 13.0 Operating Expenses 3,023 3,326 3,525 4,206 4,762 6,130 7,050 - YoY Growth (%) 1.6 10.0 6.0 19.3 13.2 28.7 15.0 Pre - Provision Profit 3,164 3,919 4,006 5,744 7,326 8,621 9,623 - YoY Growth (%) 9.6 23.8 2.2 43.4 27.5 17.7 11.6 Prov. & Cont. 1,130 1,751 710 981 1,424 2,277 2,258 - YoY Growth (%) 34.7 54.9 (59.4) 38.1 45.1 59.9 (0.8) Profit Before Tax 2,034 2,168 3,296 4,763 5,903 6,344 7,365 - YoY Growth (%) (0.6) 6.6 52.0 44.5 23.9 7.5 16.1 Prov. for Taxation 595 628 1,247 1,673 1,997 2,157 2,504 - as a % of PBT 29.2 29.0 37.8 35.1 33.8 34.0 34.0 PAT 1,439 1,540 2,049 3,091 3,905 4,187 4,861 - YoY Growth (%) 2.1 7.0 33.0 50.9 26.4 7.2 16.1 Balance sheet Y/E March (` cr) FY06 FY07 FY08 FY09 FY10 FY11E FY12E Share Capital 315 315 315 315 315 315 315 Reserves & Surplus 9,061 10,120 12,003 14,338 17,408 20,711 24,540 Deposits 119,685 139,860 166,457 209,761 249,330 296,702 350,109 - Growth (%) 16.0 16.9 19.0 26.0 18.9 19.0 18.0 Borrowings 6,687 1,949 5,447 4,374 8,572 10,201 12,037 Tier 2 Capital 1,935 3,695 6,165 8,085 10,690 13,042 15,390 Other Liab. & Prov. 7,584 6,484 8,633 10,045 10,318 12,022 14,140 Total Liabilities 145,267 162,423 199,020 246,919 296,633 352,993 416,532 Cash Balances 23,395 12,372 15,258 17,058 18,328 20,769 26,258 Bank Balances 1,397 3,273 3,573 4,355 5,146 6,124 7,226 Investments 41,055 45,190 53,992 63,385 77,724 88,024 102,221 Advances 74,627 96,597 119,502 154,703 186,601 227,653 268,631 - Growth (%) 23.5 29.4 23.7 29.5 20.6 22.0 18.0 Fixed Assets 1,030 1,010 2,316 2,397 2,513 2,901 3,321 Other Assets 3,763 3,981 4,381 5,020 6,320 7,521 8,875 Total Assets 145,267 162,423 199,020 246,919 296,633 352,993 416,532 - Growth (%) 15.0 11.8 22.5 24.1 20.1 19.0 18.0

- 11. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 11 Ratio analysis Y/E March FY06 FY07 FY08 FY09 FY10 FY11E FY12E Profitability ratios (%) NIMs 3.6 3.7 3.2 3.3 3.2 3.7 3.5 Cost to Income Ratio 48.9 45.9 46.8 42.3 39.4 41.6 42.3 RoA 1.1 1.0 1.1 1.4 1.4 1.3 1.3 RoE 17.0 16.0 19.6 25.8 26.6 23.4 22.7 B/S ratios (%) CASA Ratio 49.0 46.2 43.0 38.8 40.8 40.2 39.4 Credit/Deposit Ratio 62.4 69.1 71.8 73.8 74.8 76.7 76.7 CAR 12.0 12.3 13.0 11.7 13.0 13.4 13.5 - Tier I 10.1 8.9 8.5 7.5 8.4 8.4 8.5 Asset Quality (%) Gross NPAs 4.0 3.4 2.7 1.6 1.7 2.8 3.4 Net NPAs 0.3 0.8 0.6 0.2 0.5 1.0 1.1 Slippages 1.4 2.7 2.0 1.4 1.8 2.3 2.0 Loan Loss Prov./Avg. Assets 0.2 0.4 0.2 0.4 0.4 0.6 0.5 Provision Coverage 93.3 78.6 77.3 89.5 81.2 75.0 75.0 Per Share Data (`) EPS 45.6 48.8 65.0 98.0 123.9 132.8 154.2 ABVPS 287.8 321.6 342.0 416.7 509.1 619.5 741.0 DPS 9.0 10.0 13.0 20.0 22.0 24.0 28.0 Valuation Ratios PER (x) 28.3 26.4 19.9 13.2 10.4 9.7 8.4 P/ABVPS (x) 4.5 4.0 3.8 3.1 2.5 2.1 1.7 Dividend Yield 0.7 0.8 1.0 1.5 1.7 1.9 2.2 DuPont Analysis (%) NII 3.4 3.6 3.1 3.2 3.1 3.6 3.4 (-) Prov. Exp. 0.8 1.1 0.4 0.4 0.5 0.7 0.6 Adj. NII 2.6 2.4 2.7 2.7 2.6 2.9 2.8 Treasury 0.3 0.2 0.2 0.3 0.3 0.0 0.0 Int. Sens. Inc. 2.9 2.7 2.9 3.0 2.9 2.9 2.9 Other Inc. 0.8 0.9 0.9 1.0 1.0 0.9 0.9 Op. Inc. 3.7 3.6 3.8 4.0 3.9 3.8 3.7 Opex 2.2 2.2 2.0 1.9 1.8 1.9 1.8 PBT 1.5 1.4 1.8 2.1 2.2 2.0 1.9 Taxes 0.4 0.4 0.7 0.8 0.7 0.7 0.7 RoA 1.1 1.0 1.1 1.4 1.4 1.3 1.3 Leverage (x) 16.0 16.0 17.3 18.6 18.5 18.2 17.9 RoE 17.0 16.0 19.6 25.8 26.6 23.4 22.7

- 12. Punjab National Bank | 2QFY2011 Result Update October 29, 2010 12 Research Team Tel: 022 - 4040 3800 E-mail: research@angeltrade.com Website: www.angeltrade.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement Punjab National Bank 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock Yes 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors. Ratings (Returns): Buy (> 15%) Accumulate (5% to 15%) Neutral (-5 to 5%) Reduce (-5% to 15%) Sell (< -15%)