ING Vyasa Bank Q2FY14 Result: Maintain neutral

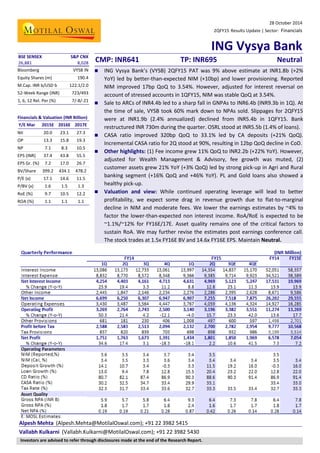

- 1. 28 October 2014 2QFY15 Results Update | Sector: Financials ING Vysya Bank Alpesh Mehta (Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415 Vallabh Kulkarni (Vallabh.Kulkarni@MotilalOswal.com); +91 22 3982 5430 BSE SENSEX S&P CNX CMP: INR641 TP: INR695 Neutral 26,881 8,028 Bloomberg VYSB IN Equity Shares (m) 190.4 M.Cap. INR b/USD b 122.1/2.0 52-Week Range (INR) 723/493 1, 6, 12 Rel. Per (%) 7/-8/-21 Financials & Valuation (INR Billion) Y/E Mar 2015E 2016E 2017E NII 20.0 23.1 27.3 OP 13.3 15.8 19.3 NP 7.1 8.3 10.5 EPS (INR) 37.4 43.8 55.5 EPS Gr. (%) 7.2 17.0 26.7 BV/Share 399.2 434.1 478.2 P/E (x) 17.1 14.6 11.5 P/BV (x) 1.6 1.5 1.3 RoE (%) 9.7 10.5 12.2 ROA (%) 1.1 1.1 1.1 ING Vysya Bank’s (VYSB) 2QFY15 PAT was 9% above estimate at INR1.8b (+2% YoY) led by better-than-expected NIM (+10bp) and lower provisioning. Reported NIM improved 17bp QoQ to 3.54%. However, adjusted for interest reversal on account of stressed accounts in 1QFY15, NIM was stable QoQ at 3.54%. Sale to ARCs of INR4.4b led to a sharp fall in GNPAs to INR6.4b (INR9.3b in 1Q). At the time of sale, VYSB took 60% mark down to NPAs sold. Slippages for 2QFY15 were at INR1.9b (2.4% annualized) declined from INR5.4b in 1QFY15. Bank restructured INR 730m during the quarter. OSRL stood at INR5.5b (1.4% of loans). CASA ratio improved 320bp QoQ to 33.1% led by CA deposits (+21% QoQ). Incremental CASA ratio for 2Q stood at 90%, resulting in 12bp QoQ decline in CoD. Other highlights: (1) Fee income grew 11% QoQ to INR2.2b (+22% YoY). However, adjusted for Wealth Management & Advisory, fee growth was muted, (2) customer assets grew 21% YoY (+3% QoQ) led by strong pick-up in Agri and Rural banking segment (+16% QoQ and +46% YoY). PL and Gold loans also showed a healthy pick-up. Valuation and view: While continued operating leverage will lead to better profitability, we expect some drag in revenue growth due to flat-to-marginal decline in NIM and moderate fees. We lower the earnings estimates by ~4% to factor the lower-than-expected non interest income. RoA/RoE is expected to be ~1.1%/~12% for FY16E/17E. Asset quality remains one of the critical factors to sustain RoA. We may further revise the estimates post earnings conference call. The stock trades at 1.5x FY16E BV and 14.6x FY16E EPS. Maintain Neutral. Investors are advised to refer through disclosures made at the end of the Research Report.

- 2. 28 October 2014 2 ING Vysya Bank Quarterly performance (INR m) Y/E MARCH 2QFY15A 2QFY15E Var. (%) Comments NII 4,969 4,821 3 Reported NIM improved 17bp QoQ % Change (Y-o-Y) 13 9 Other Income 2,286 2,355 -3 Lower than expected ex-fee non-interest income performance Net Income 7,255 7,176 1 Operating Expenses 4,059 3,968 2 Operating Profit 3,196 3,208 0 PPP in-line with estimate % Change (Y-o-Y) 16 16 Other Provisions 497 750 -34 NPA provisions significantly lower than expected Profit before Tax 2,700 2,458 10 Tax Provisions 898 811 11 Net Profit 1,801 1,647 9 Lower provisions to an extent compensated by higher taxes leading to 9% higher PAT % Change (Y-o-Y) 2 -7 Source: MOSL, Company Reported NIM expands 17bp; Strong traction in CASA deposits Reported NIM improved 17bp QoQ to 3.54%. However, adjusted for interest reversal on account of stressed accounts in 1QFY15, NIM was stable QoQ. CASA ratio improved 320bp QoQ to 33.1% led by 21% QoQ growth in CA deposits. Deposit growth during the quarter was mainly driven by CASA deposits, with 90% Incremental CASA ratio in 2QFY15, resulting in 12bp QoQ decline in cost of deposits to 7.28%. SA deposits growth was also strong (+13% QoQ and +19% YoY). Certificate of deposits declined 28% QoQ to INR 39.4b (8.8% of total deposits). Asset quality improves QoQ led by sale to ARCs GNPA declined 32% QoQ to INR 64b led by sale to ARCs of INR 4.4b in 2QFY15. GNPA in % terms stood at 1.6% (2.4% in 1QFY15). NNPA declined to 0.4% (v/s 0.9% in 1QFY15) as PCR improved by ~1000bp QoQ to 74%. Gross slippages for the quarter stood at INR 1.9b (annualized slippage ratio of 2.4%) as compared to INR5.4b in 1QFY15. Of the total gross slippage, ~INR 730m slipped and was sold to ARC in 2QFY15. During the quarter, bank restructured loans of INR 730m and outstanding restructured loan portfolio stood at INR5.5b (1.4% of loans). Slippages from restructured book stood at INR 470m in 2QFY15. Strong growth in Agri and rural segment drives customer assets growth Customer assets grew 3% QoQ and 21% YoY led by strong growth of 16% QoQ and 46% YoY in agri and rural segment (formed 10.2% of overall customer assets as compared to 9.1% in 1QFY15). SME segment which forms 36% of overall customer assets also witnessed robust growth of 20% YoY (+6% QoQ). Consumer banking segment grew 8% YoY (+4% QoQ) led by (1) moderation in mortgage portfolio (+6% YoY and +2.5% QoQ) (2) sequential decline in CV whereas (3) Personal loan grew 20% QoQ and 69% YoY. Wholesale segment declined 3% QoQ (+22% YoY) and now forms 36% of loan book. Adjusted NIM stable QoQ at 3.54% GNPA improved to 1.6% from 2.4% in 1QFY15 Customer assets grew 21% YoY and 3% QoQ

- 3. 28 October 2014 3 ING Vysya Bank Fee income growth picks up led by strong advisory fees Fee income grew 11% QoQ to INR 2.2b (+22% YoY). However, ex-Wealth Management & Advisory fees (+132% YoY), fee income growth was muted. Asset related fee grew 28% YoY (-21%QoQ), Liability related (+11% YoY and -9% QoQ) and forex income declined 22% YoY and 30% QoQ. Trading income declined 21% YoY whereas increased QoQ (low base of INR97m in 4QFY14) to INR215m. Core fee income grew 40% YoY (+10% QoQ) led by healthy growth in Wealth Management & Advisory fees. Other highlights Bank also informed that Mr. Shailendra Bhandari has stepped down from the post of MD & CEO. The bank’s board has proposed the appointment of Mr. Uday Sareen (currently deputy CEO) as MD & CEO of the bank, subject to approval from RBI. VYSB received one-off current account deposits of INR8b towards the end of 2QFY15, which was parked in short term investments, resulting in +13% QoQ investment book growth in 2QFY15. Valuation and view While continued operating leverage will lead to better profitability, we expect some drag in revenue growth due to flat to marginal decline in NIMs and moderate fees. Asset quality has remained one of key aspect of earnings for the bank and has provided boost to RoA (+ve impact of 0.5% over FY10/14). However, continued higher slippages is concerning. We downgrade earnings by ~4% to factor in lower than expected non interest income. RoA/RoE is expected to be ~1.1%/~12% for FY16/17E. Asset quality remains as one of the critical factors for sustenance of RoA’s. We may further revise earnings estimate post earnings conference call. The stock trades at P/BV of 1.5x of FY16E BV of INR434 and 1.3x FY17E BV of INR477. Maintain Neutral. We cut our earnings estimates by 4% to factor in weak non-interest income performance INR B Old Est. Revised Est. % Change FY15 FY16 FY17 FY15 FY16 FY17 FY15 FY16 FY17 NII 19.5 22.5 27.0 20.0 23.1 27.3 2.4 2.6 1.3 Other Income 10.4 12.0 14.1 9.6 11.4 13.5 -8.1 -5.5 -4.5 Total Income 29.9 34.6 41.1 29.6 34.5 40.8 -1.3 -0.2 -0.7 Operating Expenses 16.1 18.6 21.3 16.3 18.7 21.5 0.9 0.9 0.9 Operating Profits 13.8 16.0 19.8 13.3 15.8 19.3 -3.9 -1.6 -2.5 Provisions 2.8 3.2 4.0 2.7 3.4 4.2 -5.2 3.6 3.3 PBT 11.0 12.8 15.8 10.6 12.4 15.1 -3.5 -2.9 -4.0 Tax 3.6 4.2 5.2 3.5 4.2 5.1 -2.8 -1.4 -2.5 PAT 7.3 8.6 10.6 7.1 8.3 10.1 -3.9 -3.6 -4.7 Margins (%) 3.3 3.3 3.2 3.4 3.3 3.2 Credit Cost (%) 0.7 0.6 0.6 0.6 0.6 0.6 RoA (%) 1.1 1.2 1.2 1.1 1.1 1.1 RoE (%) 10.1 10.8 12.2 9.7 10.5 11.7 The stock trades at 1.5x FY16E BV of INR434 and 1.3x FY17E BV of INR477.

- 4. 28 October 2014 4 ING Vysya Bank Source: MOSL, Company

- 5. 28 October 2014 5 ING Vysya Bank One year forward P/BV Source: MOSL, Company One year forward P/E Source: MOSL, Company DuPont Analysis: Higher NPA provisioning leading to stable ROA despite operating leverage playing out and fees pick up (%) Y/E March FY06 FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15E FY16E FY17E Net Interest Income 2.99 2.47 2.22 2.26 2.52 2.76 2.81 3.02 3.04 3.09 3.05 2.98 Core Fee Income 0.83 0.98 1.49 1.53 1.20 1.21 1.13 1.01 0.95 1.06 1.09 1.10 Fee to core Income (%) 21.42 24.25 36.40 36.78 27.25 26.48 25.81 22.76 21.00 23.12 23.96 24.63 Core Income 3.82 3.46 3.71 3.80 3.73 3.97 3.94 4.03 4.00 4.15 4.14 4.07 Operating Expenses 3.23 2.80 2.72 2.69 2.46 2.82 2.58 2.50 2.59 2.52 2.47 2.35 Cost to Core Income (%) 84.49 81.07 73.24 70.87 65.96 70.94 65.57 61.96 64.81 60.76 59.65 57.63 Employee cost 1.46 1.26 1.35 1.37 1.30 1.66 1.51 1.47 1.57 1.47 1.44 1.37 Employee to total exp (%) 45.14 45.00 49.61 50.77 53.07 59.03 58.64 58.98 60.46 58.32 58.32 58.32 Others 1.77 1.54 1.37 1.32 1.15 1.15 1.07 1.03 1.02 1.05 1.03 0.98 Core operating Profits 0.59 0.65 0.99 1.11 1.27 1.15 1.36 1.53 1.41 1.63 1.67 1.72 Non Interest income 0.87 1.59 1.87 1.91 1.89 1.80 1.56 1.43 1.50 1.48 1.50 1.47 Trading and others 0.04 0.60 0.38 0.37 0.68 0.59 0.43 0.41 0.55 0.43 0.41 0.38 Operating Profits 0.63 1.26 1.37 1.48 1.95 1.74 1.79 1.95 1.96 2.05 2.08 2.10 Provisions 0.50 0.55 0.25 0.45 0.82 0.42 0.26 0.18 0.26 0.42 0.44 0.45 NPA 0.33 0.39 0.16 0.37 0.70 0.43 0.19 0.17 0.17 0.37 0.39 0.40 Others 0.16 0.16 0.09 0.08 0.12 -0.01 0.08 0.01 0.09 0.05 0.06 0.06 PBT 0.14 0.71 1.12 1.03 1.13 1.33 1.52 1.77 1.70 1.64 1.64 1.65 Tax 0.08 0.21 0.42 0.37 0.39 0.45 0.46 0.57 0.56 0.54 0.55 0.55 Tax Rate (%) 58.77 30.34 37.59 35.93 34.80 34.15 30.25 32.00 32.72 33.25 33.50 33.50 Extra Ordinary 0.00 0.12 0.06 0.00 0.06 0.00 0.00 0.00 0.00 0.00 0.00 0.00 RoA Adjusted 0.06 0.37 0.64 0.66 0.68 0.87 1.06 1.20 1.14 1.09 1.09 1.10 Leverage (x) 19.70 18.97 18.53 19.01 17.22 15.37 13.45 12.12 10.03 8.91 9.66 10.69 RoE 1.11 7.03 11.86 12.50 11.63 13.43 14.27 14.59 11.45 9.73 10.50 11.71 Source: Company, MOSL 1.52.31.40.50.00.51.01.52.02.5 Oct-04Jan-06Apr-07Jul-08Oct-09Jan-11Apr-12Jul-13Oct-14 PB (x)Peak(x)Avg(x)Min(x) 14.928.213.26.7051015202530 Oct-04Jan-06Apr-07Jul-08Oct-09Jan-11Apr-12Jul-13Oct-14 PE (x)Peak(x)Avg(x)Min(x) Negative Earnings Cycle

- 6. 28 October 2014 6 ING Vysya Bank Story in charts Reported NIM improves 17bp QoQ (%) 3.0 3.4 3.5 3.3 3.3 3.5 3.6 3.7 3.6 3.5 3.4 3.7 3.4 3.5 1QFY122QFY123QFY124QFY121QFY132QFY133QFY134QFY131QFY142QFY143QFY144QFY141QFY152QFY15 Source: MOSL, Company Fee income growth higher than expectation 9631,1101,2851,2801,1551,1651,2131,2071,2861,2061,3011,3641,5241,683 1.01.11.21.11.01.01.00.90.90.90.90.91.01.1 1QFY121HFY129MFY12FY121QFY131HFY139MFY13FY131QFY141HFY149MFY14FY141QFY151HFY15 Fee Income (INR b)Fee Income to avg assets (%) Source: MOSL, Company Improvement in loan growth continues 238249263287293300316318330329340358382396 26232322232120111398131620 1QFY121HFY129MFY12FY121QFY131HFY139MFY13FY131QFY141HFY149MFY14FY141QFY151HFY15 Loan (INR b)Growth YoY % Source: MOSL, Company Core CASA improves led by strong traction in CA deposits (%) 33.832.632.633.432.032.831.731.830.232.531.733.430.033.11QFY121HFY129MFY12FY121QFY131HFY139MFY13FY131QFY141HFY149MFY14FY141QFY151HFY15 Source: MOSL, Company Cost-to-Core income ratio stable QoQ (%) 71.4 66.7 62.4 66.1 64.7 63.9 62.2 62.4 61.9 62.2 65.3 73.2 61.2 61.0 1QFY122QFY123QFY124QFY121QFY132QFY133QFY134QFY131QFY142QFY143QFY144QFY141QFY152QFY15 Source: MOSL, Company Asset quality improves QoQ led by higher sale to ARCs 2.2 2.0 2.0 1.9 2.0 1.9 1.8 1.8 1.8 1.7 1.7 1.8 2.4 1.6 0.4 0.3 0.3 0.2 0.2 0.1 0.1 0.0 0.2 0.2 0.2 0.3 0.9 0.4 84 85 85 91 90 93 97 98 89 89 87 84 64 74 1QFY122QFY123QFY124QFY121QFY132QFY133QFY134QFY131QFY142QFY143QFY144QFY141QFY152QFY15 Gross NPA%Net NPA %PCR % Source: MOSL, Company

- 7. 28 October 2014 7 ING Vysya Bank Quarterly Snapshot FY13 FY14 FY15 Variation (%) 1Q 2Q 3Q 4Q 1Q 2Q 3Q 4Q 1Q 2Q QoQ YoY Profit and Loss (INR m) Net Interest Income 3,433 3,688 4,029 4,237 4,254 4,403 4,161 4,713 4,631 4,969 7 13 Other Income 1,710 1,689 1,866 2,004 2,445 1,847 2,146 2,234 2,276 2,286 0 24 Treasury 58 44 145 63 273 -46 237 97 215 45 -79 -198 Exchange Profits 348 354 370 608 555 577 494 617 435 491 13 -15 Recovery 43 15 29 33 246 22 21 77 13 18 38 -18 Fee Income 1,155 1,165 1,213 1,207 1,286 1,206 1,301 1,364 1,524 1,683 10 40 Others 106 111 109 93 85 88 93 79 89 49 -45 -44 Total Income 5,142 5,377 5,895 6,241 6,699 6,250 6,307 6,947 6,907 7,255 5 16 Operating Expenses 2,967 3,100 3,263 3,398 3,430 3,487 3,564 4,447 3,767 4,059 8 16 Employee 1,768 1,823 1,912 2,005 2,025 2,069 2,145 2,796 2,233 2,359 6 14 Others 1,200 1,277 1,351 1,394 1,405 1,418 1,420 1,651 1,534 1,700 11 20 Operating Profits 2,175 2,276 2,633 2,843 3,269 2,764 2,743 2,500 3,140 3,196 2 16 Provisions 267 64 246 336 681 181 230 406 1,008 497 -51 175 PBT 1,908 2,213 2,387 2,507 2,588 2,583 2,513 2,094 2,132 2,700 27 5 Taxes 607 710 764 804 837 820 839 703 698 898 29 10 PAT 1,301 1,502 1,623 1,703 1,751 1,763 1,673 1,391 1,434 1,801 26 2 Asset Quality GNPA 5,880 5,809 5,705 5,702 5,891 5,738 5,827 6,442 9,287 6,358 -32 11 NNPA 564 398 159 91 644 623 731 1,020 3,316 1,652 -50 165 GNPA (%) 2.0 1.9 1.8 1.8 1.8 1.7 1.7 1.8 2.4 1.6 -80 -13 NNPA (%) 0.2 0.1 0.1 0.0 0.2 0.2 0.2 0.3 0.9 0.4 -45 23 PCR (Calculated, %) 90.4 93.1 97.2 98.4 89.1 89.1 87.4 84.2 64.3 74.0 973 -1,512 Ratios (%) Fees to Total Income 22.5 21.7 20.6 19.3 19.2 19.3 20.6 19.6 22.1 23.2 Cost to Core Income 64.7 63.9 62.2 62.4 61.9 62.2 65.3 73.2 61.2 61.0 Tax Rate 31.8 32.1 32.0 32.1 32.3 31.7 33.4 33.6 32.7 33.3 CASA (Reported) 32.0 32.8 31.7 31.8 30.2 32.5 31.7 33.4 30.0 33.1 Loan/Deposit 81.5 83.0 83.8 76.9 80.7 82.1 87.4 86.9 90.3 88.6 -173 651 CAR 13.4 13.0 12.5 13.2 12.8 16.8 16.9 16.8 15.2 14.4 RoA (Reported) 1.1 1.3 1.3 1.3 1.3 1.3 1.2 1.0 1.0 1.2 RoE (Reported) 12.9 14.2 14.7 15.0 14.9 10.4 9.5 7.9 8.0 9.7 Margins (%) - Reported Yield on loans 12.0 11.9 11.8 11.9 11.7 11.7 11.5 11.7 11.5 11.5 3 -18 Cost of deposits 7.5 7.3 7.1 7.1 7.2 7.3 7.3 7.2 7.4 7.3 -12 -1 Margins 3.3 3.5 3.6 3.7 3.6 3.5 3.4 3.7 3.4 3.5 17 8 Balance Sheet (INR B) Loans 293 300 316 318 330 329 340 358 382 396 4 20 Investments 138 135 143 183 166 176 168 167 179 203 13 15 Deposits 359 362 377 413 409 400 390 412 423 447 6 12 CASA Deposits 120 119 119 134 123 130 135 138 126 148 17 13 of which Savings 53 55 54 61 56 61 61 68 64 73 13 19 Current 66 63 65 73 67 69 74 70 62 75 21 8 Borrowings 64 55 64 65 66 66 86 97 100 100 0 53 Total Assets 487 480 507 548 545 554 568 604 616 646 5 17 Franchise Branches (Excl Extn Counters) 527 527 532 542 547 549 551 553 563 573 ATM 446 447 453 500 542 618 628 638 640 635 Source: MOSL, Company

- 8. 28 October 2014 8 ING Vysya Bank Financials: Valuation Matrix60.02RatingCMP McapDividend(INR)(USDb)FY16FY17FY16FY17FY16FY17FY16FY17FY16FY17FY16FY17Yield (%) # ICICIBC*Buy1,60130.8117.8143.611.29.06657702.01.71.91.916.217.11.6HDFCBBuy89535.853.665.816.713.62563063.52.92.02.022.823.41.0AXSBBuy42416.636.743.311.59.82202561.91.71.81.717.918.11.1KMB*Neutral1,08313.948.959.822.218.13223813.42.81.91.914.115.00.1YESBuy6414.458.975.810.98.53283882.01.71.71.719.421.21.3IIBBuy6976.143.354.416.112.82282733.02.51.91.920.521.70.7VYSBNeutral6412.045.455.914.111.54374811.51.31.21.210.812.21.1FBBuy1402.012.915.410.99.1991111.41.31.21.113.614.61.6J&KBKBuy1411.125.228.45.65.01521740.90.81.31.317.617.42.8SIBBuy270.64.35.36.45.230340.90.80.90.915.016.52.6Private Aggregate113.414.812.22.52.1SBIN (cons)*Buy2,65633.0321.0433.87.95.82,3472,7021.10.90.91.014.417.01.5PNBBuy9215.6156.3203.95.94.51,1931,3730.80.70.80.913.915.91.3BOINeutral2722.960.176.04.53.64785450.60.50.50.613.314.82.2BOBNeutral9216.6146.1170.86.35.49781,1090.90.80.80.815.816.42.8CBKBuy3863.081.2107.24.83.66267090.60.50.60.713.616.13.3UNBKBuy2322.440.248.75.84.83303700.70.60.60.712.813.92.3OBCBuy2791.455.673.15.03.85045600.60.50.60.711.513.83.2INBKBuy1651.328.132.05.95.22883120.60.50.60.610.110.72.8CRPBKNeutral3300.961.974.25.34.46877450.50.40.40.49.310.42.5ANDBNeutral780.812.813.46.15.81651740.50.40.40.38.07.93.5IDBINeutral681.814.419.74.73.51571730.40.40.60.79.511.92.3DBNKNeutral630.613.616.84.63.81371500.50.40.50.510.311.73.3Public Aggregate61.47.55.90.90.8HDFC*Buy1,04727.2384617.112.61661924.03.02.52.523.824.81.5LICHFBuy3382.8323910.48.61982291.71.51.41.417.618.41.5DEWHBuy3540.862765.74.63594161.00.91.31.318.419.72.8IHFLBuy3962.464776.25.21571732.52.34.24.131.432.57.2IDFCNeutral1463.7141610.79.41091211.10.92.52.512.513.01.9RECLBuy2894.865774.43.72983571.00.83.43.423.923.63.8POWFBuy2836.259694.84.12953461.00.83.23.121.521.63.7SHTFBuy8913.4901059.88.55146041.71.52.62.818.519.50.9MMFSNeutral2872.7202414.111.91171342.42.12.92.918.519.11.4BAFBuy2,8152.320824513.511.51,1231,3282.52.12.92.820.120.01.2NBFC Aggregate56.311.79.92.21.9*Multiples adj. for value of key ventures/Investments; For ICICI Bank and HDFC Ltd BV is adjusted for investments in subsidiaries# Div Yield based on FY14 declared dividend; UR: Under ReviewEPS (INR)P/E (x)BV (INR)RoA (%)RoE (%)P/BV (x) EPS: MOSL forecast v/s consensus (INR) MOSL Consensus Variation Forecast Forecast (%) FY15 37.4 41.5 -9.8 FY16 43.8 51.6 -15.2 Shareholding pattern (%) Sep-14 Jun-14 Sep-13 Promoter 42.7 42.9 43.4 DII 15.9 15.0 13.6 FII 27.8 28.2 28.9 Others 13.6 14.0 14.1 Stock performance (1-year) 480560640720800Oct-13Jan-14Apr-14Jul-14Oct-14ING Vysya BankSensex -Rebased

- 9. 28 October 2014 9 ING Vysya Bank Financials and valuation Income Statements (INR Billion) Y/E Mar 2014 2015E 2016E 2017E Interest Income 52.1 58.4 67.6 82.4 Interest Expense 34.5 38.4 44.5 55.1 Net Interest Income 17.5 20.0 23.1 27.3 Change (%) 13.9 13.9 15.8 18.1 Non Interest Income 8.7 9.6 11.4 13.5 Net Income 26.2 29.6 34.5 40.8 Change (%) 15.7 12.8 16.7 18.3 Operating Expenses 14.9 16.3 18.7 21.5 Pre Provision Profits 11.3 13.3 15.8 19.3 Change (%) 13.6 17.7 18.9 22.3 Provisions (excl tax) 1.5 2.7 3.4 3.6 PBT 9.8 10.6 12.4 15.7 Tax 3.2 3.5 4.2 5.3 Tax Rate (%) 32.7 33.3 33.5 33.5 Profits for Equity SH 6.6 7.1 8.3 10.5 Change (%) 7.3 7.2 17.0 26.7 Equity Dividend (Incl tax) 1.3 1.4 1.7 2.1 Core PPP* 10.1 12.4 14.7 18.2 Change (%) 10.1 22.9 18.6 24.0 Balance Sheet (INR Billion) Y/E Mar 2014 2015E 2016E 2017E Equity Share Capital 1.9 1.9 1.9 1.9 Reserves & Surplus 68.8 74.4 81.0 89.3 Net Worth 70.7 76.3 82.9 91.2 Deposits 412.2 478.1 592.9 735.1 Change (%) -0.3 16.0 24.0 24.0 of which CASA Dep 137.6 157.6 185.9 219.0 Change (%) 2.4 14.6 17.9 17.8 Borrowings 96.7 106.2 123.2 143.2 Other Liabilities & Prov. 24.6 27.2 31.4 36.2 Total Liabilities 604.1 687.8 830.4 1,005.9 Current Assets 58.3 31.3 36.7 45.1 Investments 167.2 197.3 226.9 260.9 Change (%) -8.5 18.0 15.0 15.0 Loans 358.3 437.1 542.0 672.1 Change (%) 12.8 22.0 24.0 24.0 Fixed Assets 5.2 5.4 5.6 5.7 Other Assets 15.1 16.6 19.1 22.0 Total Assets 604.1 687.8 830.4 1,005.9 Asset Quality (INR Billion) Y/E Mar 2014 2015E 2016E 2017E GNPA 2.6 1.3 1.4 1.3 NNPA 1.0 0.6 0.4 0.1 GNPA Ratio 0.7 0.3 0.3 0.2 NNPA Ratio 0.3 0.1 0.1 0.0 PCR (Excl Tech. write off) 61.2 55.5 68.1 93.7 PCR (Incl Tech. Write off) 84.2 92.3 95.6 99.3 Ratios Y/E Mar 2014 2015E 2016E 2017E Spreads Analysis (%) Avg. Yield-Earning Assets 9.8 9.8 9.6 9.6 Avg. Yield on loans 11.2 10.9 10.4 10.4 Avg. Yield on Investments 8.0 8.0 7.6 7.6 Avg. Cost-Int. Bear. Liab. 7.0 7.0 6.8 6.9 Avg. Cost of Deposits 6.6 6.8 6.5 6.6 Interest Spread 2.8 2.8 2.7 2.7 Net Interest Margin 3.3 3.4 3.3 3.2 Profitability Ratios (%) RoE 11.4 9.7 10.5 12.2 RoA 1.1 1.1 1.1 1.1 Int. Expense/Int.Income 66.3 65.8 65.8 66.8 Fee Income/Net Income 31.0 30.4 30.9 31.4 Non Int. Inc./Net Income 33.1 32.4 33.0 33.1 Efficiency Ratios (%) Cost/Income* 57.0 55.1 54.3 52.8 Empl. Cost/Op. Exps. 60.5 58.3 58.3 58.3 Busi. per Empl. (Rs m) 75.8 79.5 89.6 105.9 NP per Empl. (Rs lac) 0.7 0.7 0.7 0.9 Asset-Liabilty Profile (%) Loans/Deposit Ratio 86.9 91.4 91.4 91.4 CASA Ratio 33.4 33.0 31.4 29.8 Investment/Deposit Ratio 40.6 41.3 38.3 35.5 G-Sec/Investment Ratio 62.8 60.6 65.3 70.4 CAR 16.8 15.8 14.0 12.6 Tier 1 14.6 13.7 12.2 11.0 Valuation Y/E Mar 2014 2015E 2016E 2017E Book Value (INR) 369.5 399.2 434.1 478.2 Change (%) 26.5 8.1 8.7 10.2 Price-BV (x) 1.7 1.6 1.5 1.3 Adjusted BV (INR) 365.7 397.0 432.4 477.9 Price-ABV (x) 1.7 1.6 1.5 1.3 EPS (INR) 34.9 37.4 43.8 55.5 Change (%) -11.9 7.2 17.0 26.7 Price-Earnings (x) 18.3 17.1 14.6 11.5 Dividend Per Share (INR) 6.1 6.5 7.7 9.7 Dividend Yield (%) 0.9 1.0 1.2 1.5

- 10. 28 October 2014 10 ING Vysya Bank N O T E S

- 11. 28 October 2014 11 ING Vysya Bank Disclosures This research report has been prepared by MOSt to provide information about the company(ies) and sector(s), if any, covered in the report and may be distributed by it and/or its affiliated company(ies). This report is for personal information of the select recipient and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or inducement to invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been furnished to you solely for your general information and should not be reproduced or redistributed to any other person in any form. This report does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, investors should consider whether it is suitable for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this material and the income from them may go down as well as up, and investors may realize losses on any investments. Past performance is not a guide for future performance, future returns are not guaranteed and a loss of original capital may occur. MOSt and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We and our affiliates have investment banking and other business relationships with a significant percentage of the companies covered by our Research Department Our research professionals provide important input into our investment banking and other business selection processes. Investors should assume that MOSt and/or its affiliates are seeking or will seek investment banking or other business from the company or companies that are the subject of this material and that the research professionals who were involved in preparing this material may participate in the solicitation of such business. The research professionals responsible for the preparation of this document may interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting market information. Our research professionals are paid in part based on the profitability of MOSt which include earnings from investment banking and other business. MOSt generally prohibits its analysts, persons reporting to analysts, and members of their households from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, MOSt generally prohibits its analysts and persons reporting to analysts from serving as an officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all o the foregoing, among other things, may give rise to real or potential conflicts of interest . MOSt and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions. Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The information contained herein is based on publicly available data or other sources believed to be reliable. Any statements contained in this report attributed to a third party represent MOSt’s interpretation of the data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party. This Report is not intended to be a complete statement or summary of the securities, markets or developments referred to in the document. While we would endeavor to update the information herein on reasonable basis, MOSt and/or its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its contents. MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report. Disclosure of Interest Statement ING VYSYA BANK LTD Analyst ownership of the stock No Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues. Regional Disclosures (outside India) This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions. For U.K. This report is intended for distribution only to persons having professional experience in matters relating to investments as described in Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (referred to as "investment professionals"). This document must not be acted on or relied on by persons who are not investment professionals. Any investment or investment activity to which this document relates is only available to investment professionals and will be engaged in only with such persons. For U.S. Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States. In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein are not available to or intended for U.S. persons. This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S., MOSL has entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this report will have to be executed within the provisions of this chaperoning agreement. The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker-dealer, MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research analyst account. For Singapore Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time. In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited: Anosh Koppikar Kadambari Balachandran Email : anosh.Koppikar@motilaloswal.com Email : kadambari.balachandran@motilaloswal.com Contact : (+65)68189232 Contact : (+65) 68189233 / 65249115 Office Address : 21 (Suite 31),16 Collyer Quay,Singapore 04931 Motilal Oswal Securities Ltd Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025 Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com