Derivatives Report 06 may-2010

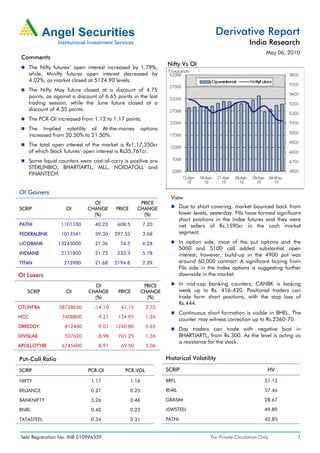

- 1. Derivative Report India Research May 06, 2010 Comments Nifty Vs OI The Nifty futures’ open interest increased by 1.79%, while, Minifty futures open interest decreased by 4.02%, as market closed at 5124.90 levels. The Nifty May future closed at a discount of 4.75 points, as against a discount of 6.65 points in the last trading session, while the June future closed at a discount of 4.35 points. The PCR-OI increased from 1.12 to 1.17 points. The Implied volatility of At-the-money options increased from 20.50% to 21.50%. The total open interest of the market is Rs1,17,350cr of which Stock futures’ open interest is Rs35,761cr. Some liquid counters were cost-of-carry is positive are STERLINBIO, BHARTIARTL, MLL, NOIDATOLL and FINANTECH. OI Gainers View OI PRICE SCRIP OI CHANGE PRICE CHANGE Due to short covering, market bounced back from (%) (%) lower levels, yesterday. FIIs have formed significant short positions in the Index futures and they were PATNI 1101100 40.23 608.5 7.20 net sellers of Rs.1590cr in the cash market FEDERALBNK 1013541 39.30 297.55 3.68 segment. UCOBANK 13245000 27.36 74.5 6.28 In option side, most of the put options and the 5000 and 5100 call added substantial open INDIANB 2131800 21.73 233.3 5.78 interest; however, build-up in the 4900 put was TITAN 273980 21.68 2194.8 2.29 around 60,000 contract. A significant buying from FIIs side in the Index options is suggesting further OI Losers downside in the market. OI PRICE In mid-cap banking counters, CANBK is looking SCRIP OI CHANGE PRICE CHANGE weak up to Rs. 416-420. Positional traders can (%) (%) trade form short positions, with the stop loss of Rs.444. GTLINFRA 58728650 -14.10 41.15 2.75 Continuous short formation is visible in BHEL. The HCC 7408800 -9.21 124.95 1.34 counter may witness correction up to Rs.2360-70. DRREDDY 812400 -9.01 1240.80 0.65 Day traders can trade with negative bias in DIVISLAB 527620 -8.98 701.25 1.36 BHARTIARTL, from Rs.300. As the level is acting as a resistance for the stock. APOLLOTYRE 6745600 -8.91 69.50 5.06 Put-Call Ratio Historical Volatility SCRIP PCR-OI PCR-VOL SCRIP HV NIFTY 1.17 1.16 BRFL 51.12 RELIANCE 0.21 0.25 RNRL 57.46 BANKNIFTY 3.26 0.46 GRASIM 28.67 RNRL 0.40 0.22 JSWSTEEL 49.89 TATASTEEL 0.34 0.31 PATNI 42.85 Sebi Registration No: INB 010996539 For Private Circulation Only 1

- 2. Derivative Report | India Research FII Statistics for 05-May-2010 Turnover on 05-May-2010 Open Interest No. of Turnover Change Detail Buy Sell Net Instrument Contracts (Rs. in cr.) (%) Contracts Value Change (Rs. in cr.) (%) INDEX Index Futures 714820 16977.22 23.60 1748.64 2787.78 (1,039.14) 561658 14357.32 3.61 FUTURES INDEX Stock Futures 615673 20547.58 20.12 6723.57 4039.34 2,684.22 1526431 39086.98 8.38 OPTIONS STOCK Index Options 2126005 54896.68 31.69 2010.77 2009.95 0.82 1000754 29609.26 0.33 FUTURES STOCK Stock Options 105568 3765.28 -5.49 158.59 174.30 (15.72) 30576 985.45 2.25 OPTIONS TOTAL 10641.57 9011.38 1,630.19 3119419 84039.01 4.75 Total 3562066 96186.76 25.71 Nifty Spot = 5124.90 Lot Size = 50 Bull-Call Spreads Bear-Put Spreads Action Strike Price Risk Reward BEP Action Strike Price Risk Reward BEP Buy 5200 69.35 Buy 5100 103.35 35.25 64.75 5235.25 33.30 66.70 5066.70 Sell 5300 34.10 Sell 5000 70.05 Buy 5200 69.35 Buy 5100 103.35 56.15 143.85 5256.15 56.75 143.25 5043.25 Sell 5400 13.20 Sell 4900 46.60 Buy 5300 34.10 Buy 5000 70.05 20.90 79.10 5320.90 23.45 76.55 4976.55 Sell 5400 13.20 Sell 4900 46.60 Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation Nifty Put-Call Analysis For Private Circulation Only Sebi Registration No: INB 010996539 2

- 3. Derivative Report | India Research Strategy Date Scrip Strategy Status 30-04-2010 RELCAPITAL Long Call Ladder Continue 30-04-2010 NAGARFERT Long Call Continue DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and must not be reproduced or redistributed to any other person. Persons into whose possession this document may come are required to observe these restrictions. Opinion expressed is our current opinion as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward- looking statements are not predictions and may be subject to change without notice. Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true and are for general guidance only. While every effort is made to ensure the accuracy and completeness of information contained, the company takes no guarantee and assumes no liability for any errors or omissions of the information. No one can use the information as the basis for any claim, demand or cause of action. Recipients of this material should rely on their own investigations and take their own professional advice. Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Price and value of the investments referred to in this material may go up or down. Past performance is not a guide for future performance. Certain transactions - futures, options and other derivatives as well as non-investment grade securities - involve substantial risks and are not suitable for all investors. Reports based on technical analysis centers on studying charts of a stock's price movement and trading volume, as opposed to focusing on a company's fundamentals and as such, may not match with a report on a company's fundamentals. We do not undertake to advise you as to any change of our views expressed in this document. While we would endeavor to update the information herein on a reasonable basis, Angel Broking, its subsidiaries and associated companies, their directors and employees are under no obligation to update or keep the information current. Also there may be regulatory, compliance, or other reasons that may prevent Angel Broking and affiliates from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. Angel Broking Limited and affiliates, including the analyst who has issued this report, may, on the date of this report, and from time to time, have long or short positions in, and buy or sell the securities of the companies mentioned herein or engage in any other transaction involving such securities and earn brokerage or compensation or act as advisor or have other potential conflict of interest with respect to company/ies mentioned herein or inconsistent with any recommendation and related information and opinions. Angel Broking Limited and affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Sebi Registration No.: INB 010996539 Derivative Research Team derivatives.desk@angeltrade.com For Private Circulation Only Sebi Registration No: INB 010996539 3